AUGUST 2020

To learn more about the immediate impact of the COVID-19 crisis on the Asia Pacific real estate property markets, we invite you to read a brief update by Asia Pacific’s Director of Research, Glyn Nelson. This report will be distributed intermittently over the following months as the COVID-19 situation evolves and we monitor its impact, real or potential.

Summer peak

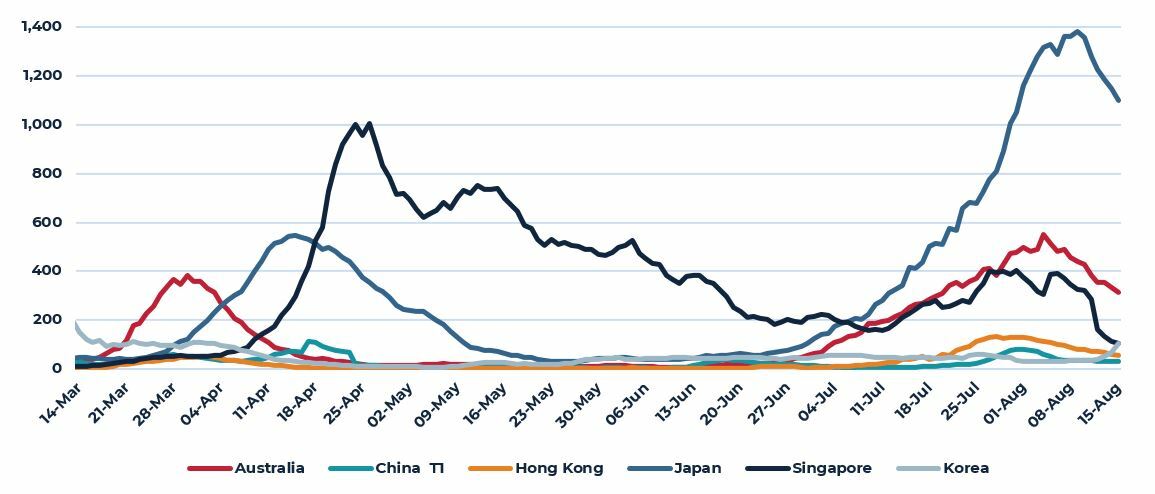

After addressing the emergence of COVID-19 during the first quarter, new case numbers were low and stable in most countries during May and June. However, during July there were new outbreaks in several Asia Pacific countries. The most prominent was in Japan where new case numbers have spread from Tokyo to other large population centers. Melbourne, Australia, has also found itself in the middle of an outbreak. By mid-August the curves in Japan, Australia, Hong Kong and Singapore look to have all peaked.

Governments are dealing with the reemergence of the virus differently this time. The focus is to suppress the spread while at the same time allowing as much of the economy and business / consumer activity to continue. While different country-by-country, this balance of a health response and keeping the operation of the economy as normal as possible is a key commonality. International travel for all but the most essential activity is effectively non-existent, and forecasts are for it to remain low through 2021 with a full recovery not expected until after that. Low levels of cross border may be a drag to the recovery, but it may also create new opportunities through the adoption of new technology solutions.

COVID-19 NEW CASES SEVEN-DAY MOVING AVERAGE

MAR to AUG 2020

Source: AEW Research, Johns Hopkins University Center for Systems Science and Engineering

On-going economic recovery

- Expectations are for H2 2020 to be better than H1 as most economies in the region are progressing towards normality

- The shape of the recovery across the various market will differ, based on the reemergence of cases and the subsequent government response. On a quarter-on-quarter basis, expect checkered growth in the near-term, due to the uneven nature of the recovery

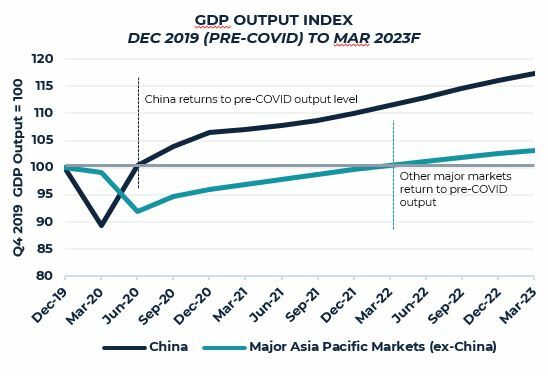

- Loss of output will be apparent for several quarters: For most of the major Asia Pacific markets, economic output is expected to return to pre-COVID levels by early 2022. China is a bright spot where output levels have passed pre-COVID levels as of Q2 2020.

CHINA’S ECONOMIC RECOVERY IS A BRIGHT SPOT

Source: ANREV

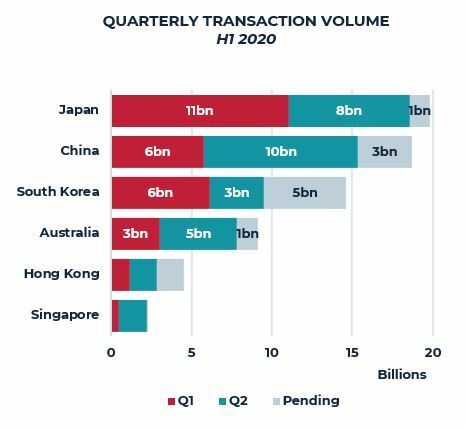

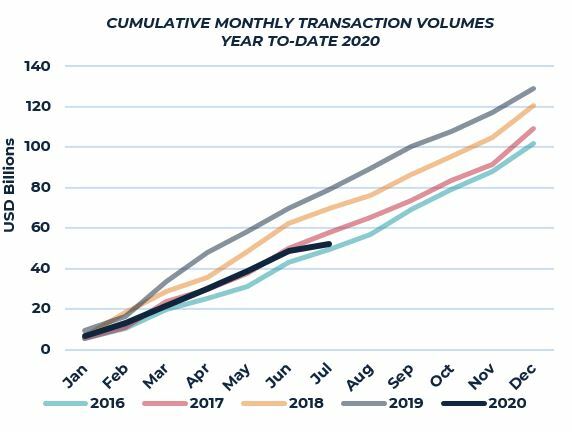

Transaction volume improves, but remains low

- Investment sentiment is improving with a resumption in business activity, but hindering a stronger recovery are factors like widespread travel restrictions and wide bid ask spread between buyers and sellers

- Headline income-producing transaction activity across all Asia Pacific markets was down 34% in the H1 2020 year-on-year. Volumes in Q2 were supported by portfolio sales, some of which was due to M&A activity

- China outperformed in Q2 as the country's recovery builds. On a USD basis it was the most active market in the region, and on a deal count basis, it showed more transactions than previous years for the same time period

- At a sector level, investors are prioritizing more defensive and resilient asset classes such as logistics and multifamily; interest in retail and hotels has receded

- Prices are generally stable across real estate, although yield expansion was visible in some market–sectors; Hong Kong strata retail, as well as Australia sub-regional and regional malls

Q2 INVESTMENT VOLUMES REMAIN MUTED

Source: ANREV

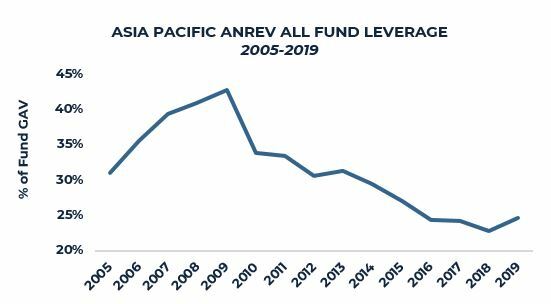

Distress deals are limited as leverage is moderate

- Average leverage levels among Asia Pacific real estate funds are substantially lower than during the lead-up to the Global Financial Crisis (GFC) of 2008/9

- ANREV data shows fund leverage peaked at 43% in 2009, but has averaged only 24% in the past four years. This low use of leverage is despite interest rates and the cost of debt financing being held very low over the same time period

- Generally debt has been used more prudently, with banks and fund managers taking efforts to ensure debt is better structured with more downside protection

- As a result, fund managers today generally have better capacity to sustain issues that could arise in portfolios - resulting in a few distress sales compared to the GFC period

LEVERAGE HAS BEEN RESTRAINED LEADING UP TO 2020

Source: ANREV

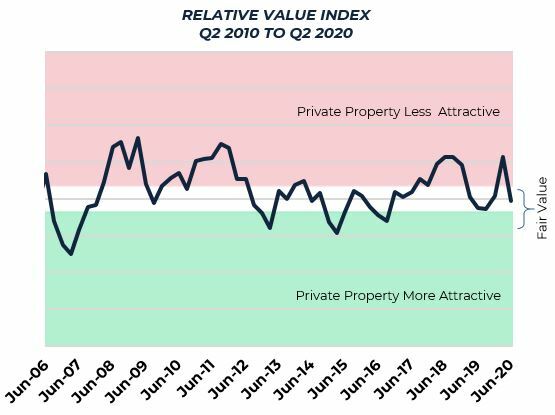

Relative value of private property

- As central banks have kept a loose monetary policy stance for several years (even prior to the pandemic), real estate yields in the region have tightened to historic lows

- In this low yield environment, it’s increasingly important to assess the relative value of private property to see if it offers sufficiently attractive returns

- AEW’s proprietary Relative Value Index (RVI) evaluates the attractiveness of private property versus other asset classes – bonds, stocks and REITs

- The analysis indicates that private property in Asia Pacific is generally fairly valued when compared to the three asset classes. On a market level, Singapore and Australia present the best value for private property as of Q2

- Reflecting this, investors continue to display a healthy appetite for private real estate. Stable income and attractive yield spread to bonds are cited as the key motivations

PRIVATE PROPERTY IS FAIRLY VALUED TODAY

Conclusion

- Asia Pacific’s recovery profile will be choppy as new cases resurface across the region and governments take necessary steps to limit the spread

- It has become clear transaction volumes in the region will be slower then last year, but should be on par with levels seen in 2016/17. Pricing of some sectors of real estate has been affected by the disruption of normal activity, but price reduction is still not widespread

- It has been suggested vendors are holding back assets that would have been put into the market under more normal conditions. If confidence returns soon, some of these may come to market to be traded before year’s end

- Outside of retail and hospitality, we have seen minimal distress, a contrast to the circumstances in the GFC. This is because investors today have managed debt levels and structured financing to protect on the downside

- Investment sentiment into private real estate still holds as it compares attractively to other asset classes

VOLUMES IN 2020 SHOULD END ON-PAR WITH 2016/7 LEVELS

Notes:

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW.