Onward & Upward

Recovery Gaining Momentum

- Average economic growth forecasts across major markets in the region have been upgraded from the start of 2021(from 4.5% to 5.0%) on the back of supportive macro policies and a recovery in global trade.

- Extension of fiscal support in Japan, South Korea and Hong Kong will be helpful while Singapore and Australia are seeing a smooth transition from stimulus-led to private-sector growth.

Real Estate Remains Attractively Positioned, Expect Transaction Volumes to Pick-Up

- Recent rise in bond yields in Q1 have narrowed property yield spreads, however they remain attractive compared to other asset classes and historical averages.

- On average, we expect forward looking four-year total returns of 6.0% to 7.0% p.a. across the major gateway markets. We see the best near-term, risk-adjusted returns in logistics for most markets as well as Singapore office.

- A rise in transaction volumes in some markets like Singapore and Sydney in Q1 are generally being offset by a year-on-year slowdown in others, like Tokyo and Seoul (albeit from a high base). We expect a more widescale recovery across markets to begin in the coming months as mass vaccinations continue and business confidence improves.

Varied Opportunities Across Sectors

- Defensive and stable returns are still sought after in the residential (multi-family) sector, with continued interest putting downward pressure on yields.

- In logistics, the weight of capital is resulting in prices increasing faster than rents. There is strong demand across the spectrum, including cold chain, which is underprovided for in the region. In South Korea, a good alpha play is conversion from dry to cold to increase net operating income and exit value.

- For office, more certainty is building in the investment thematic as a physical return to work is evident across the major gateway cities in Asia Pacific. Further, new ESG/carbon neutral targets being set are creating opportunities for building upgrades.

- Challenges are still evident in retail, but nascent recovery in demand and price discounts in some markets like Hong Kong (strata) and Australia (sub-regional) are making the sector look interesting.

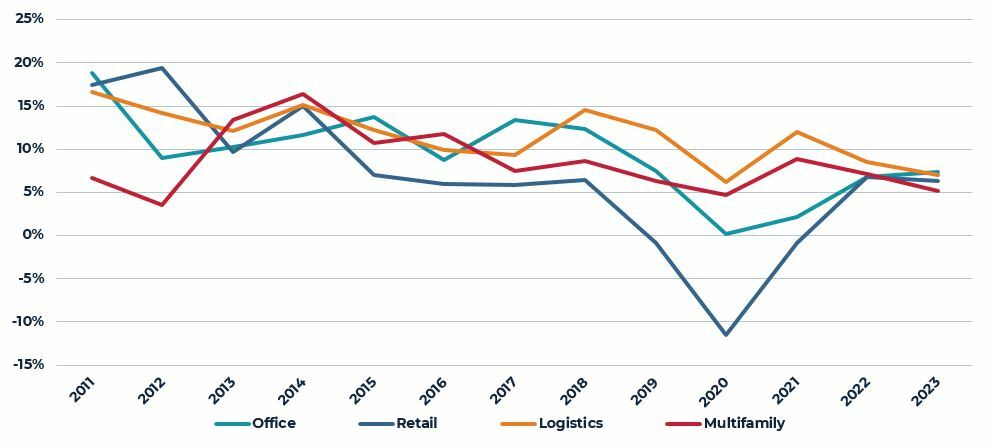

ALL SECTOR TOTAL RETURN OUTLOOK

2011 TO 2023F

Source: AEW Research, JLL, PMA

Economy: Return To Growth, But Risks Remain

Asia Pacific Benefits from Return in Global Trade, but Lags Vaccine Rollout

- GDP forecasts for 2021 have been adjusted upward from the start of the year on the back of recovery in global trade, supportive macro policies, and the momentum behind the vaccine roll out. The largest positive upgrades for 2021 GDP growth were for China, Australia, and Singapore, meanwhile Hong Kong is the only economy with a slight downgrade.

- Business confidence in the region is increasingly positive, with better than expected data on export momentum and labor markets year-to-date. While Japan and South Korea are slightly lagging due to an uptick on COVID-19 case numbers and tightened restrictions in Q1, sequential recovery should gain pace from Q2 and beyond.

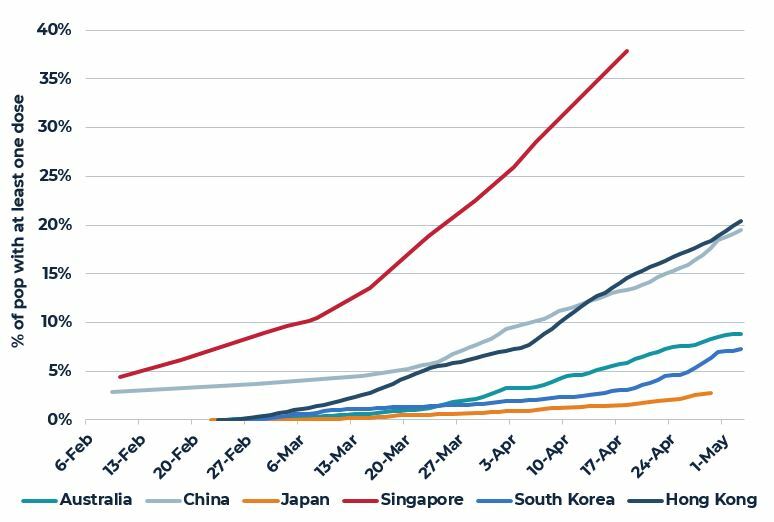

- Vaccine rollout is progressing, but most Asia Pacific markets (except for Singapore) are generally behind the pace of Western countries. As can be expected, the lagging vaccination schedules add downside risks to the improved growth.

Uneven Recovery in Sectors and Labor Markets

- The return to growth will be uneven across sectors, which will filter through to the labor market. There will continue to be labor scarring impact on sectors like retail and hospitality for 2021, while others are expected to recover.

- Office-occupying headcounts are expected to expand from increased growth in the digital economy, medical & pharmaceutical, non-banking finance as well as public administration. Cities or office submarkets that have larger exposure to these sectors such as Macquarie Park in Sydney (for pharmaceutical) or Zhonguancun in Beijing (technology-focused zone) could see a quicker turnaround in demand and a faster rental recovery.

Inflation Risks are Not an Immediate Concern, Possible Local Currency Weakness

- Despite a quick return to growth, inflation is not an immediate concern, especially in the Asia Pacific region where fiscal stimulus has been not as aggressive as its western counterparts. Oil prices have risen slightly due to supply cuts, but these are unlikely to have a major impact.

- In the wake of extraordinary fiscal stimulus and favorable growth and interest rate differentials in the U.S., we could see some local currency weakness in coming months.

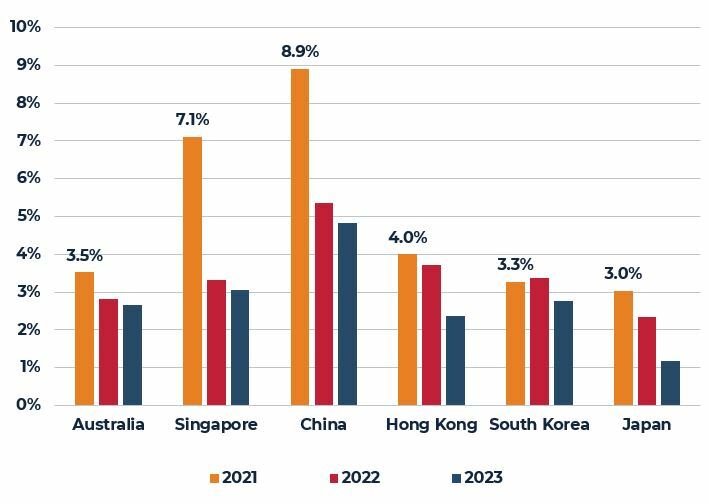

GDP OUTLOOK, 2020 to 2022F

Source: Oxford Economics, Our World in Data (as of 29 April 2021)

VACCINATION PROGRESS YTD 2021

Source: Oxford Economics, Our World in Data (as of 29 April 2021)

Property Markets Rebalancing in 2021

OFFICE

A real return to the office lowers concerns on work-from-home (WFH): Physical occupancy in offices have increased since the start of 2021, supported by government mandated policies, corporate-directives, and employee eagerness to return. There is progressively less concern on WFH being a major detractor of future office demand.

Incentive-driven lease agreements support demand recovery: Across markets, leasing inquiries have generally picked up in Q1, in the range of 30% to 80% from the prior quarter. Incentives (either in the form of rent-free or capex/fit-out allowance) have been offered, even in markets like China, Hong Kong and Japan where it is not standard practice. While this has been helpful in supporting new demand and lease momentum, it will put a strain on NOI achieved in initial years of a lease.

Earliest rent recovery prospects in Singapore, while others would be submarket dependent: Singapore is ahead of other markets on the rent recovery path, with gross rents likely to start increasing by H2 2021. Meanwhile, with little impact from the pandemic, Seoul’s rents are expected to climb steadily going forward. Large supply, vacancy risk and cost-driven leasing decisions are the largest factors delaying the rent recovery in Australia and Greater China to post 2021/2022. Yet, pockets of outperformance in select submarkets are becoming evident.

LOGISTICS

Meaningful supply, but good upgrade demand: Across Australia, Japan and South Korea, new supply in the next two years will be 1.9 times the past five-year average. A significant proportion of this is speculative, but active pre-leasing (which was previously atypical for logistics markets) are abating supply concerns.

Rent growth to accelerate: The logistics market has historically been a low rent growth market, viewed mostly by occupiers as a cost to cut. Today, needs have changed, and occupiers prioritizing better assets to maximize efficiency and allow for organic growth. On an inflation adjusted basis rents had only grown by 0.5% p.a. in the past ten years, but going forward, rents could grow up to 2.0% to 3.0% per annum for new, modern facilities.

Returns to be driven by capital value growth, further yield compression: This weight of capital is boosting prices faster than rents and putting downward pressure on yields. As this sector’s yields continue to compress, we are likely to see logistics and office yields converge in some markets, namely Australia and South Korea. Large portfolio deals in Australia have already transacted at record low yields of sub 4.5%.

MULTIFAMILY (JAPAN)

Return of migration flows in H2 2021 to support leasing demand: While there has been a temporary shift in leasing preferences to outside core areas, at this point, we believe concerns on telecommuting meaningfully impacting residential demand trends are overstated. There is an expectation on the return of net migration into the larger cities during H2 2021, which will support new leasing demand.

Sector still considered resilient: The sector’s proven stability and defensiveness continues to attract capital, with $1.1 billion transacting already in Q1. Yields continue to sharpen, especially for stabilized assets. Some recent deals that take leasing risk, show up to 30 bps difference in entry yield.

RETAIL

Investment activity to return as demand fundamentals improve: Investor interest in retail is building again as consumption fundamentals start to slowly improve. Generally, interest is being driven by private domestic capital, who typically have a lower cost of capital and are more capable of taking some value-add risk to revamp centers and turn them around.

Office

AUSTRALIA: Investors return despite near-term occupier challenges

- Increased vacancy (including sublease) and expectation of more backfill to reach the market in 2021 continue to put upward pressure on leasing incentives. The magnitude of the rental decline has been lowered, but weakness should persist till 2022.

- An increase in transaction activity in Q1 indicates investors are looking beyond the near-term challenges in the occupier markets.

SINGAPORE: Earliest rental recovery profile in the region

- Leasing has improved in Q1 as demand from the technology sector outpaces downsizing across several financial institutions.

- Rent recovery forecasts have been brought forward to reflect better demand conditions and withdrawal of stock.

- Confidence in the market recovery is reflected in investment interest year-to-date.

HONG KONG: Weak fundamentals persist, seeing a return in interest for strata deals

- Cost saving and decentralization remain key themes. Current vacancy levels are highest since 1999 and it could take two-to three-years for the market to absorb. City’s robust IPO pipeline could be a source of new demand, but timing remains uncertain.

- The removal of the Double Stamp Duty in Q4 2020 has brought some renewed interest to the strata-titled market, where there has been a price correction of about 10% to 15% in the last year.

CHINA: Demand rebounds strongly, but supply and vacancy challenges continue

- Shanghai: Improved demand levels, but interest is concentrated in emerging submarkets, where good transport infrastructure, building quality and deep rental discounts continue to attract occupiers.

- Beijing: Solid rebound in leasing activity in Q1 2021, prompted by landlords offering more incentives and lowering rents, especially in markets with elevated vacancy like Guomao. Rents are expected to bottom by year-end.

SOUTH KOREA: Stable conditions, strong underlying investor interest

- Seoul Core Markets: Healthy leasing momentum continued into Q1 2021, with a flight to quality apparent. Expect mild, but steady rental growth outlook in the near-term.

- Transaction volumes in Q1 2021 fell versus the same period last year, but this is expected to be temporary. AEW understands there are several deals in the pipeline yet to close in the coming months.

JAPAN: Rent growth prospects deterred by weak demand and rising vacancy

- Tokyo: Although headline vacancy is low at around 1.9%, the underlying availability rate (including space returned and new supply) is estimated to be closer to 6% or 7%. More lease cancellations are expected in the coming months, especially by MNCs who continue to rationalize space needs. A rising vacancy environment in the near-term will put downward pressure on rents.

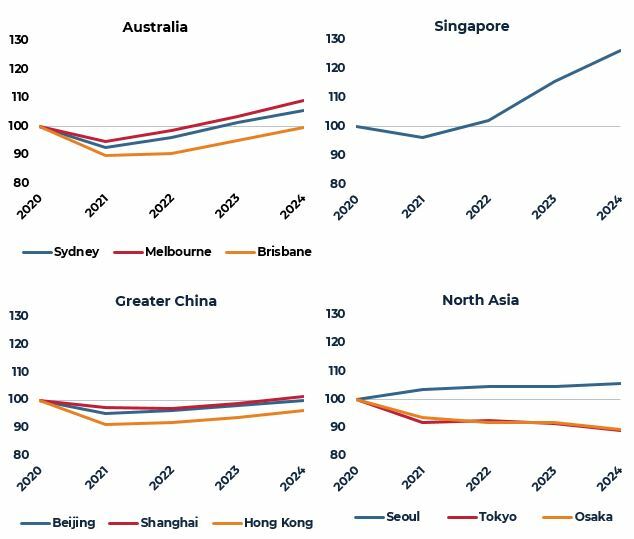

OFFICE RENT INDEX (2020 TO 2024F)

2020=100

Source: AEW Research, JLL

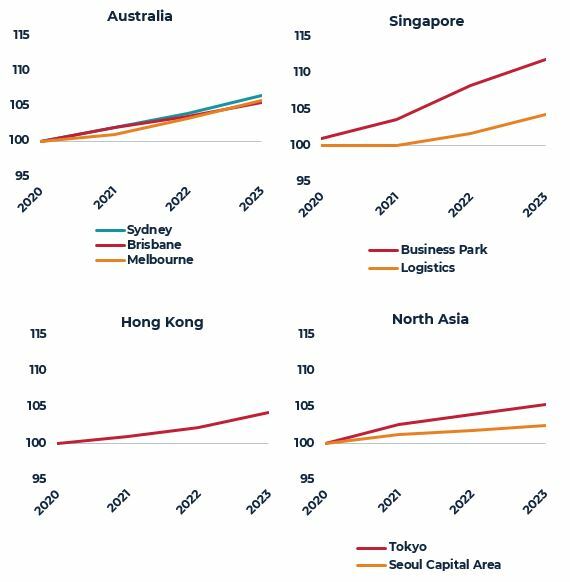

Logistics

AUSTRALIA: Rent forecasts upgraded; recent transaction yields fall to a record-low

- Oversupply concerns have been reduced on the back of leasing strength (by 3PLs, retailers and e-commerce groups) for both completed and under construction assets. Near-term rent forecasts have been upgraded since last quarter.

- Investors are competing for scarce sites on city outskirts, driving down yields to mid-to-low 4.0%s, in some cases lower to the country’s Grade A office towers and shopping centers.

SINGAPORE: Good prospects for specialized facilities, but access remains difficult

- Business Park and Hi-Tech: Resilient segment where demand has expanded due to growth in industries like technology, precision engineering, biomedical manufacturing, as well as research and development.

- Logistics: Rent and demand trends are bifurcated between specialized and traditional facilities. Bright spot on cold storage, in line with plans to position the country as a hub for the storage, distribution and shipment of vaccines.

- Good investor interest, but short ground leases and limited stock for sale are challenges.

HONG KONG: Investor increases as the sector offers good return prospects

- Compared to office and retail, the industrial sector (and the subsectors alternatives like data centers and cold storage) have the best near-term growth fundamentals in the city.

- Capital interest has stepped up in 2021 across both enbloc and strata deals. Some enbloc deals are expected to take advantage of the industrial revitalization scheme, reintroduced in 2019.

SOUTH KOREA: More forward-funding opportunities coming to market

- Large supply is being met with strong demand. Pre-leasing activity has become rampant, lowering concerns over excess supply, especially in the Western regions of Gimpo and Incheon.

- Under the strong demand cycle and solid growth prospects, more forward purchase transactions are being executed. Strong competition means pricing differential between under construction and stabilized deals are quickly narrowing.

JAPAN: Modern stock limited, still good demand for Grade B facilities

- Strong expansion demand from e-commerce firms and retailers are benefiting modern or newly constructed assets.

- Large proportion of older stock exist, typically leased to cost-conscious businesses. While rent growth potential is minimal, these assets would be more affordable and would benefit from value-add upgrades.

LOGISTICS RENT INDEX (2020 TO 2023F)

2020=100

Source: AEW Research, JLL

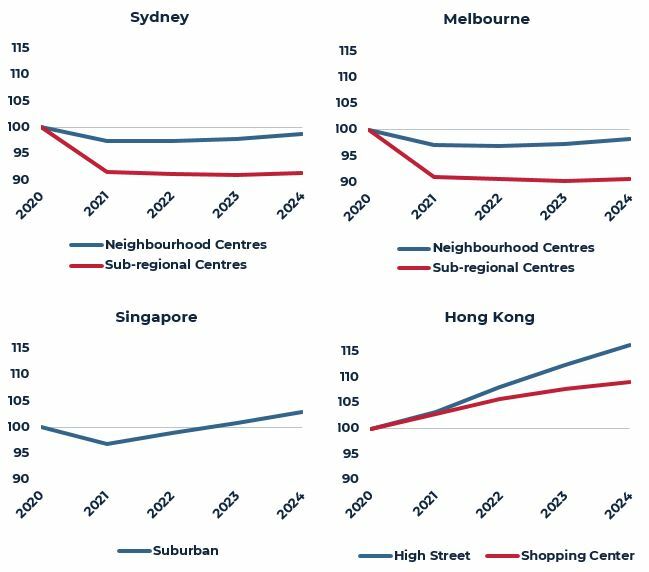

Retail

AUSTRALIA: Private players have renewed interest

- Weak leasing environment for discretionary retail with more store closures and bankruptcies expected after the end of the government wage support in Q1 2021.

- A return in interest from domestic investors who are purchasing from wholesale funds with liquidity requirements.

HONG KONG: Improving fundamentals, investment interest returns for strata retail

- After almost two years of weak leasing, the market is improving slowly, mainly by retailers who cater to local consumption.

- At the strata-end of the market, there has been a return in activity, probably due to the combined positive effects of the removal of the Double Stamp Duty (DSD) and some good discounts available.

SINGAPORE: Suburban malls hold up better

- New code of conduct to be applied to retail leases going forward will tip the balance towards tenants.

- Suburban retail remains attractive, due to stable demand and good customer traffic. Value-add or repositioning strategies are preferred as the sector is unlikely to see organic rental growth in the next two years.

RETAIL RENT INDEX (2020 TO 2024F)

2020=100

Source: AEW Research, JLL

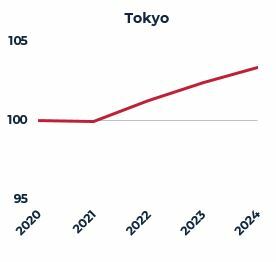

Multifamily

JAPAN: Investor confidence in market resilience

- April migration numbers are being monitored to determine the strength of net population increase in the major cities.

- Some changes in preference of building location and size are expected to be temporary – smaller-sized units still make up the bulk of multifamily stock in Japan and are expected to remain popular.

- Strong investment interest in Q1 2021, despite a rise in COVID-19 case indicate there is good confidence on the future resilience of the market.

MULTIFAMILY RENT INDEX (2020 TO 2024F)

2020=100

Source: AEW Research, JLL

For more information, please contact:

GLYN NELSON

Director of Research, Asia Pacific

glyn.nelson@aew.com

+65.6303.9016

HANNA SAFDAR

Research Associate, Asia Pacific

hanna.safdar@aew.com

+65.6303.9014

ANNA CHEW

Investor Relations, Asia Pacific

anna.chew@aew.com

+852.2107.3511

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW.