JUNE 2020

RE-OPENING, RECOVERY AND REAL ESTATE

As summer begins, the nation’s economy and property markets continue to move from the crisis phase of the current cycle into the re-opening and recovery phase; but heightened uncertainty remains firmly in place. With respect to the pandemic itself, the most important indicator, the number of COVID-19 related deaths, continue to decrease despite recently accelerating numbers of new infections. And while a resurgence of new infections is undesirable, an increase in cases can be expected as re-openings unfold around the world.

We are beginning to see the true extent of the economic damage that has occurred, as well as the geographic variation of its impacts, as more data becomes available. Unprecedented government spending support has clearly helped ameliorate the economic impact of the pandemic, but as we fast approach July, an end to some of this support will end leading to the concern of what may happen next. Will employers keep paying their employees? Will tenants continue to pay rent? Will properties continue to cover debt service payments? These are just a few of the many questions on investors’ minds in this extraordinary and rapidly changing pandemic environment. What is clear is that transaction volumes will be slow to return to pre-pandemic levels as long as uncertainty persists. We continue to believe that the first threshold issue for businesses, households and investors remains the degree to which schools – primary, secondary, colleges and universities – restart in the fall. The social and economic consequences of a continuation of remote learning are profound. To large extent, remote working has worked, but remote learning has not. Without a return to normal for most of the nation’s vast education system, it seems unlikely that anything resembling a pre-pandemic norm will take place.

RISING CASE COUNTS, BUT NOT DEATHS

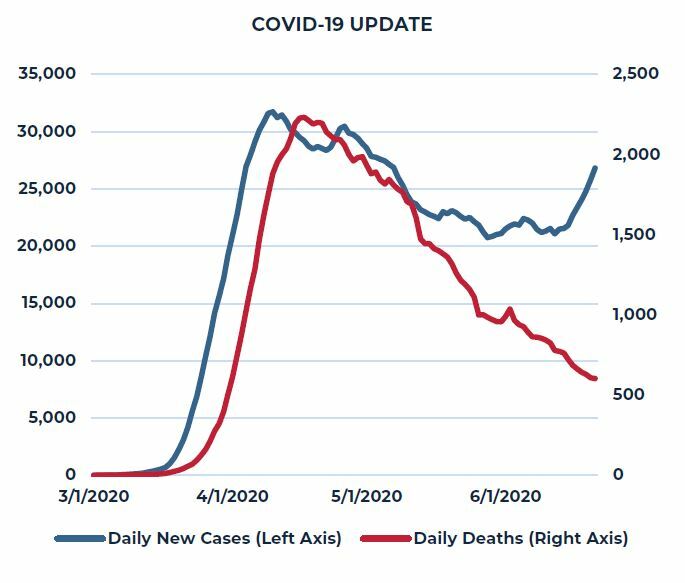

New confirmed cases of coronavirus infection declined steadily from mid-April until mid-May as most state and local governments imposed some form of economic shut down and social isolation. From mid-May to mid-June, daily new cases remained fairly steady averaging approximately 22,000 per day. Over this period, in particular, the relationship between newly reported cases and newly reported deaths decoupled with deaths continuing to plunge as new cases held steady. Since mid-June, daily new cases have begun to re-accelerate with significant upturns across many of the states that re-opened sooner and more rapidly such as Florida, Arizona and Texas. In addition, there are those states that have been largely on an upward trajectory since March such as California and North Carolina. Unlike the onset of the pandemic, the resurgence of new cases seems concentrated on younger patients largely due to the greater likelihood of this age-group venturing out to re-opened bars, restaurants and other venues.

GEOGRAPHIC IMPACT

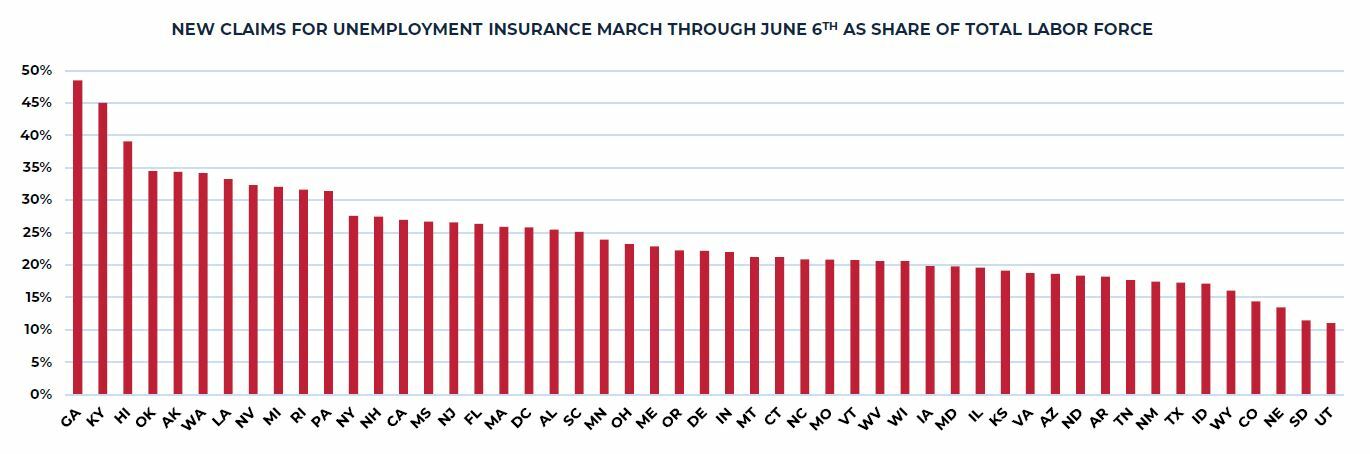

Over the three month period from the middle of March to the middle of June, more than 45 million Americans filed an initial claim for unemployment insurance, roughly 28% of the nation’s nearly 165 million person labor force. Geographically, the surge in unemployment has varied greatly. Obviously, the hardest hit states in absolute terms are states which are home to the dense gateway markets such as New York, Massachusetts, Illinois and California where the initial virus outbreak was greatest. When adjusted for the size of the labor force, however, a different picture emerges with states such as Georgia, Kentucky and Hawaii bearing the brunt of rising unemployment.

Source: Department of Labor

THE PACE OF RE-OPENING AND RECOVERY

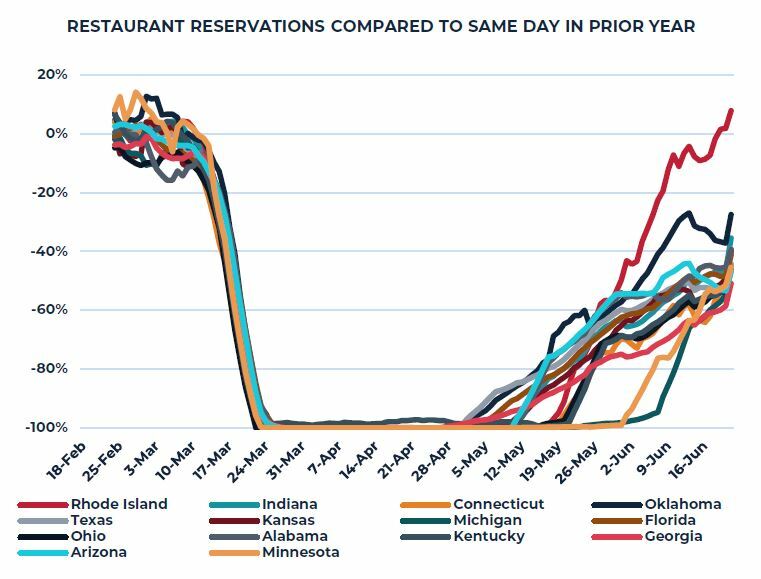

In contrast to the financial crisis period, there are a great number of data sources available to monitor the pace of economic recovery in both real time and geospatially. One very simple metric that captures a great deal of information regarding consumer sentiment and coronavirus concern are reservations for in-person dining. Simply put, consumers need to feel financially able to dine out, as well psychologically comfortable being amongst others while participating in a non-essential activity. Overall, these measures confirm a narrative of early and faster re-openings in the Southeast and Southwest states as in a number of Midwest and Plains states. Interestingly, Rhode Island and Connecticut, neighbors of the hard hit Northeast areas of New York and Massachusetts are also among the more rapidly recovering restaurant states. Indeed, Rhode Island has been leading the pack for several weeks.

Source: Chatham Financial

LOOKING AHEAD

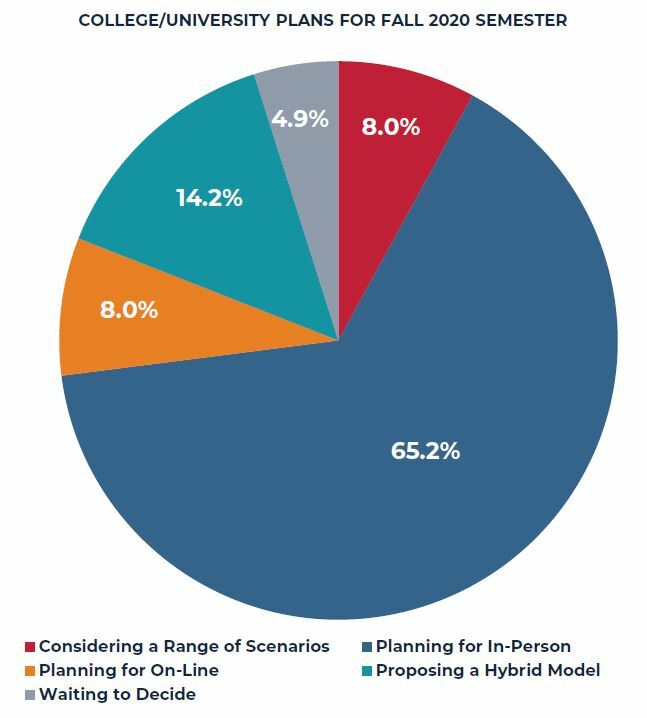

Economic data over the past several weeks have been encouraging. The May employment report showed an unexpected surge in total employment of more than 2.5 million and new weekly claims for unemployment insurance, while still elevated, continuing to trend downward. While all of this is encouraging, it in no way guarantees a rapid return to full employment. Most state governments are just beginning to report significant budget shortfalls related to the pernicious economic effects of the pandemic. Left unchecked by additional financial support from Congress, many states will be forced to close their budget gaps by cutting spending and employment. This same dynamic is already beginning to surface in hospital systems that were forced to reduce non-COVID treatments and elective surgeries, as well colleges and university systems. Indeed, we continue to believe the threshold issue for the current economic recovery is the degree to which primary and secondary school systems resume in the fall, and the degree to which colleges and universities return to campus. Currently, approximately two-thirds of colleges and universities have announced plans for an in-person/on-campus fall semester. While these decisions are not connected in any specific way to primary and secondary school decisions, it is difficult to see a continued robust economic recovery without most schools returning to the classroom.

Source: The Chronicle of Higher Education

IMPACT ON PROPERTY TRANSACTION MARKETS

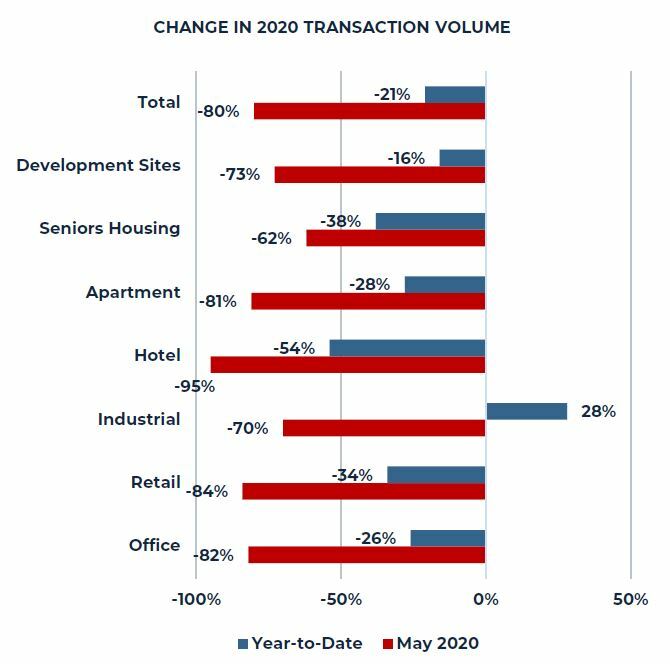

Not only did the pandemic result in the rapid shutdown of most direct economic activity over the past three months, it also had a significant negative impact on the ability of property investors to transact. Recent data from RCA suggests the total transaction volume in May was down roughly 80% from the prior year with hotel transactions down nearly 100%. On a year-to-date basis, the COVID-19 impact on transactions is more muted with total transactions down slightly more than 21% from the same five-month period in 2019, with hotels again showing the greatest impact being down more than 50%. Industrial properties continue to be one of the rare positive outliers in all of this with year-to-date transaction volume for industrial properties still running nearly 30% above the 2019 level despite a 70% year-over-year decline in May. Of course, this abrupt seizure of transactions clouds visibility into price discovery and the potential impact on property valuations. For its part, the PREA 2020 Q2 Consensus Survey suggests investors expect virtually no price appreciation across the NCREIF universe over the next five years with modest gains in industrial and apartment properties being largely offset by declines in retail and office property valuations.

Source: RCA, May 2020

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW.