The logistics market in Greater Seoul has grown rapidly in the last few years on the back of a rapid expansion in the e-commerce sector. E-commerce has thrived due to unique features such as the high internet penetration rate as well as a densely populated city area.

While significant investment has already been made into the logistics sector, the scope for more growth is substantial and warrants further attention. Underlying consumer trends will translate into sustained demand for Grade A logistics facilities by e-commerce players, retailers and third-party logistics players (3PLs) in the medium term. At the same time, the limited availability of Grade A stock has led to an undersupplied environment, creating opportunities for investment strategies across the risk/return spectrum.

In this two-part paper, we outline (A) the positive consumption trends and (B) the underlying favorable fundamentals of the Greater Seoul logistics market that continue to encourage significant investment into the sector.

(A) New consumption trends leading to increased demand for Grade A facilities (dry & cold) include:

- Further growth in online sales, including a wider volume and variety of goods

- Larger segments of the population ordering fresh foods and groceries online

- Increasing healthcare and pharmaceutical demands

- Acceleration of e-commerce growth and expansion of inventory due to COVID-19

(B) The favorable fundamentals of the Greater Seoul logistics market include:

- Pent-up demand for Grade A facilities as a result of a large proportion of obsolete stock

- Varying supply trends by submarket could present a favorable rental outlook for some areas

- Increasing demand for cold storage coupled with limited supply should result in upward rental pressure in the near to medium term

These favorable factors are expected to translate to attractive total returns for the sector and should continue to invite significant investment from domestic and cross-border investors in the medium-term.

Part A: Consumption Trends Supporting Increased Demand for Logistics in South Korea

E-COMMERCE MARKET IN SOUTH KOREA

- Rapidly expanding: The market size has grown by 30% p.a. in the last four years (2015 to 2019) from KRW 46.8 trillion to KRW 135 trillion.

- More growth to come: Online sales volume is expected to continue to expand to KRW207 trillion by 2024, representing further growth of 9.0% p.a. for the next five years.

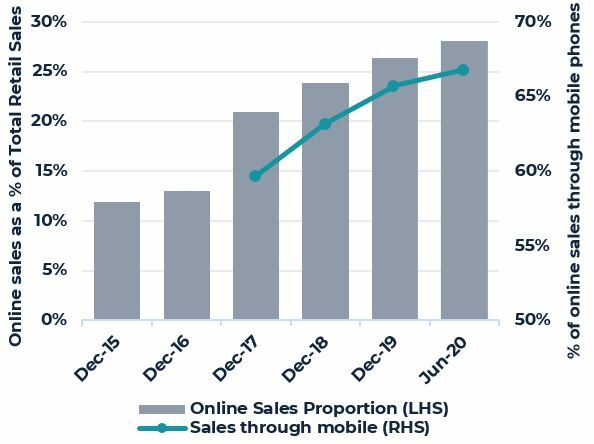

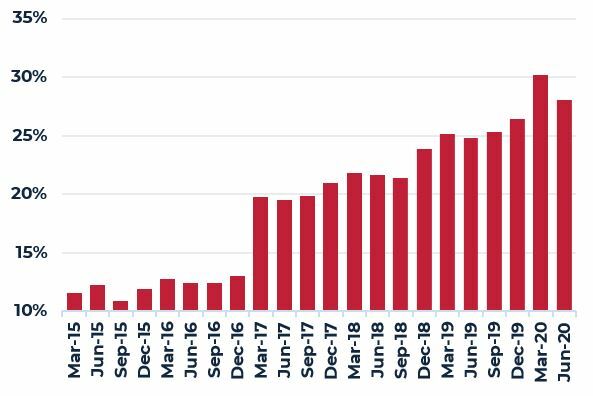

- A leader in the region: Comprising 29% of all retail sales as of June 2020, South Korea has one of the highest e-commerce penetration rates in the Asia Pacific region.

- Significant sales through mobile phones: As an extremely digital country with good broadband access and high-speed connectivity, the high penetration of smartphones is a significant factor behind the growth. The proportion of online sales through mobile phones has increased to 67% as of June 2020, the highest ratio globally.

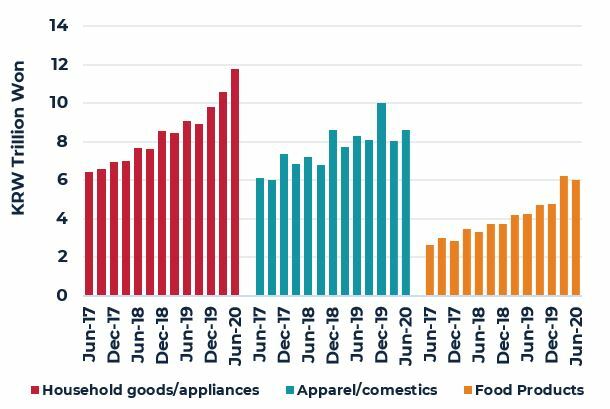

SOME CATEGORIES HAVE GAINED GOOD TRACTION ONLINE

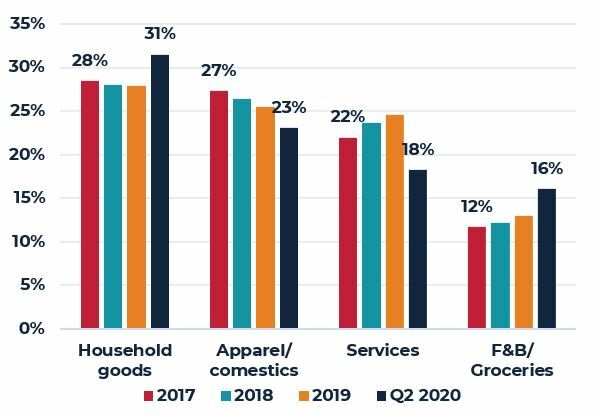

- Initial barriers to online sales have been overcome: Good marketing by large wholesalers/e-commerce platforms, easy return policies and faster shipping options (overnight or same day delivery) has decreased some of the inertia for online shopping. The value of food and beverage (F&B) purchases, home appliances and cosmetics have had the largest growth in online sales since 2017.

- F&B sales online see fastest growth: Expanding the fastest over the past several years was food products which climbed from KRW8.7 trillion in 2017 to KRW14.4 trillion as of December 2019, growing by 1.6 times in overall value. As of June 2020, F&B represented 16% of all online sales.

E-COMMERCE PENETRATION IN SOUTH KOREA 2015 TO JUNE 2020

Source: Statistics Korea, as of Q2 2020

SHARE OF ONLINE RETAIL SALES CATEGORIES 2017 TO Q2 2020

Source: Statistics Korea, as of Q2 2020

CONSUMPTION TRENDS & DEMAND FOR SPECIALIZED LOGISTICS

- Dawn delivery market: Started in 2015, dawn delivery (unique to South Korea) allows grocery and fresh food orders to be placed as late as midnight with deliveries guaranteed to arrive by 7 a.m. the next day, even faster than Amazon’s next-day delivery service, which has a noon cut off time.

- Rapid dawn delivery growth: The dawn delivery market has grown substantially since 2015 when it was valued at around KRW10 billion. By the end of 2019 the market value is estimated to have already reached KRW800 billion.

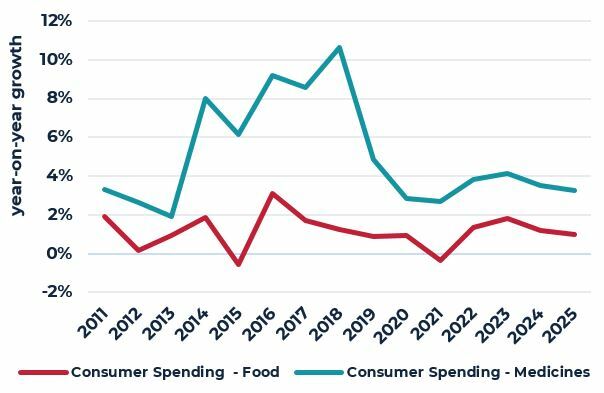

- Healthcare demands: Consumer spending of pharmaceuticals in South Korea is forecasted to grow to KRW 13.3 trillion by 2025, representing 3.5% p.a. growth. Some medications require stringent control of temperature, humidity and sterility, making cold-chain vital for modern storage and transportation solutions.

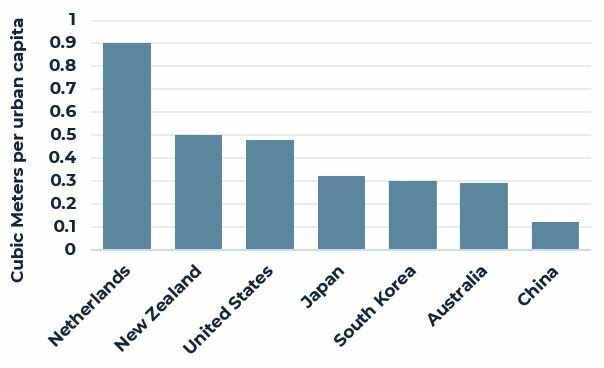

- Increased demand for cold storage facilities: The growth in the dawn delivery and pharmaceutical industry has resulted in a surge in the demand for cold storage facilities. South Korea’s current refrigerated warehouse capacity by urban capita is 0.3 versus 0.5 in the United States (U.S) and 0.9 in the Netherlands (see chart), indicating there is significant room for further growth.

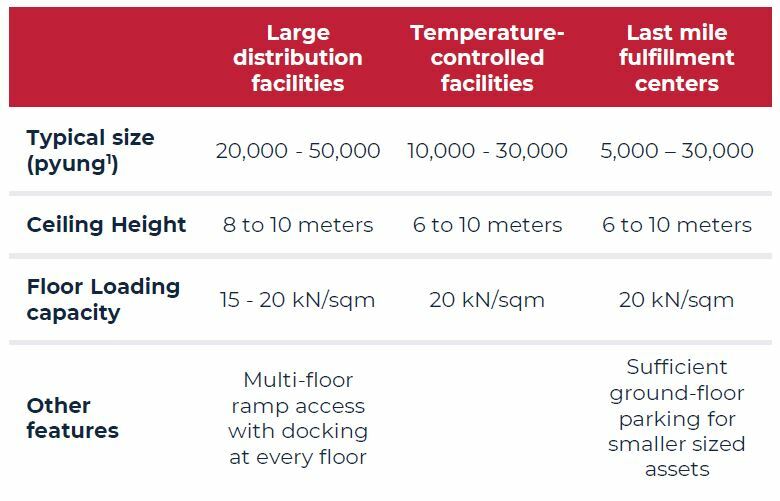

REQUIREMENT FOR GRADE A LOGISTICS FACILITIES

- Optimizing supply chains: The increase in volume and the variety of goods ordered, as well the demand for quicker shipping times and easy return policies has forced retailers and logistics firms to expand and adjust their supply chains.

This has resulted in the increased demand for:

- Larger/modernized distribution facilities: E-commerce players and retailers require larger volumes of space for inventory storage and goods processing.

- Temperature-controlled facilities: For optimal storage of perishable goods or consumables; can be a chilled warehouse for the storage of perishable goods and frozen warehouses for frozen goods.

- Last mile fulfilment centers: Smaller-sized facilities typically located close to urban centers or residential communities to allow for quick handling of deliveries and return of goods.

CONSUMER SPENDING FORECASTS 2011 TO 2025F

Source: Oxford Economics, as of Q2 2020

REFRIGERATED WAREHOUSE CAPACITY PER URBAN CAPITA 2018

Source: Global Cold Chain Alliance

GRADE A LOGISTICS FACILITIES BASIC CRITERIA

Source: AEW Research

Note: 1 pyung = 3.3 square meters = 35.5 square feet

THE IMPACT OF COVID-19

- Immediate surge in online sales: In the quarter ending March 2020 (at the peak of the outbreak) online sales jumped in value by 20%, while offline sales declined by 2.3%. Essential goods like food & beverage, fresh meat and household goods saw the largest increase in demand.

- New buyer groups to stay: Parts of the population (e.g. age groups above 60) that did not shop online before were forced to convert and a large proportion of this demographic are expected to continue even when COVID-19 diminishes.

- Changes in food habits: Consumers will adjust their shopping as they get into the habit of keeping a broader stock of essential products at home. In a survey conducted by Nielsen, 62% of consumers said they will re-prioritize eating at home. Changing consumer preferences toward ready-to-cook meals due to the rising need of convenience will also boost the frozen segment growth. Home meal replacement (HMR) items increased by 11.4% in Q1 2020, whereas general food items increased by 7.5%.

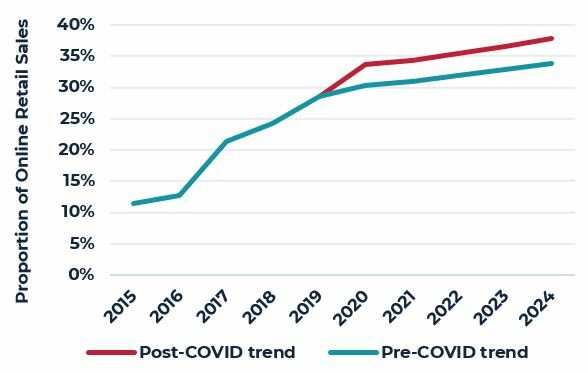

- Acceleration of e-commerce trends: Penetration rates that were forecast by 2024 have been brought forward to 2020/21. The rate of growth for 2020 to 2024 remains unchanged.

- Increased need for safety or back-up stock: A major lesson from COVID-19 for retailers and e-commerce players was a need for safety or reserve stock to meet large swings in consumer demand in the face of another unexpected event. Expansionary demand from existing players has increased as a result of this space requirement. Besides increased demand from retailers, other industries such as healthcare, could increase stockpiling for essential products such as personal protective equipment or medical-related machinery, further increasing the need for logistics space.

SURGE IN ONLINE SALES Q1 2020

MARCH 2015 TO JUNE 2020

Source: Statistics Korea, as of Q2 2020

ONLINE SALES CATEGORIES

Q2 2017 TO Q2 2020

Source: Statistics Korea, as of Q2 2020

FORECAST GROWTH IN E-COMMERCE PENETRATION

2015 TO 2024F

Source: AEW Research, Oxford Economics, PMA

These on-going consumption trends and side effects of COVID-19 positively impact short-and long-term leasing demand for warehouses (dry and cold logistics facilities). The forecast for logistics demand stands better today than it was pre-COVID.

With more consumers shifting online and a larger volume of goods to be sorted, packed and transported, the demand for large scale centers and last mile facilities is expected to increase. Reports from the U.S. generally state that for every USD1.0 billion of new online sales, 1.2 million square feet of new logistics space is required. In particular, the cold storage industry benefits from demand inelasticity, as demand for food or pharmaceuticals will remain, regardless of the economic conditions.

Part B: Favorable Fundamentals for Logistics Investment in Greater Seoul

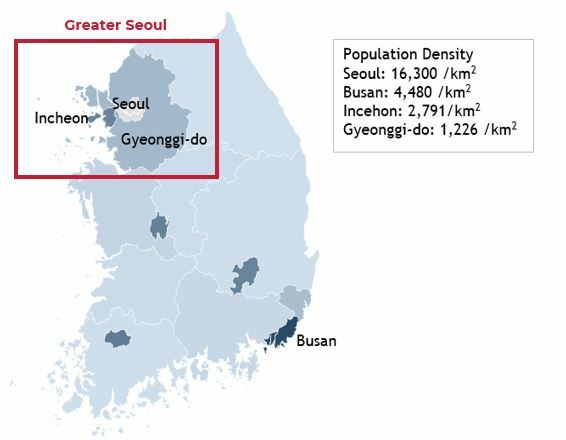

- Densely populated, suitable for e-commerce model: Seoul and Busan are the two main centers of population and economic activity. The logistics stock lies mostly within the Seoul Capital Area or Greater Seoul where an estimated 50% of South Korea’s population live. The region is well connected through an extensive road network, making it highly suitable for an e-commerce model.

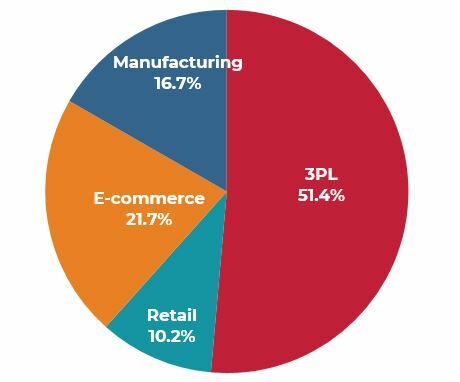

- Leasing driven by e-commerce players: Demand for new, modern and larger facilities has been driven by the growth in e-commerce and upgrading of supply chains. Today, firms linked to the e-commerce supply chain (3PLs, e-commerce players and retailers) make up more than 80% of the total occupied stock in Grade A facilities within Greater Seoul.

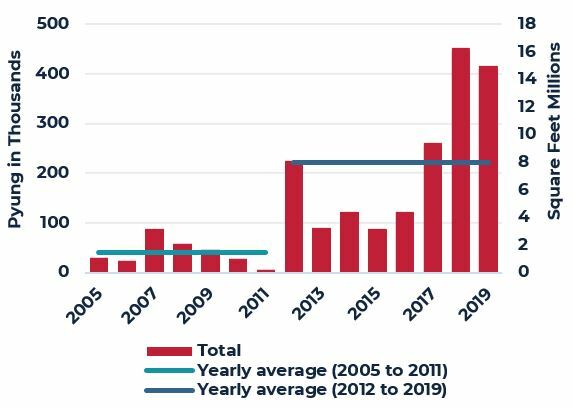

- Ramp-up in supply from 2012, but still undersupplied: Development in the logistics space accelerated from 2012, with new stock added at a rate of 221,000 pyung/p.a. (7.8 million square feet p.a.) in tandem with the growth in the e-commerce market. In general, for every USD1.0 billion increase in online sales, 0.6 million square feet of new warehouse space was provided in Greater Seoul. This falls far below international standards, which estimates 1.2 million square feet of logistics space for every USD 1.0 billion increase in online sales.

- Modern stock is constructed for purpose: Newly delivered stock is built to specifications desirable by e-commerce firms, 3PLs or retailers. At a basic level modern stock has a ceiling height of at least 8 to 10 meters (to allow for a minimum 4-level stack), higher floor loading capacity and an optionality for temperature-controlled compartments. As these requirements become pervasive by end-users, older stock is becoming increasingly obsolete.

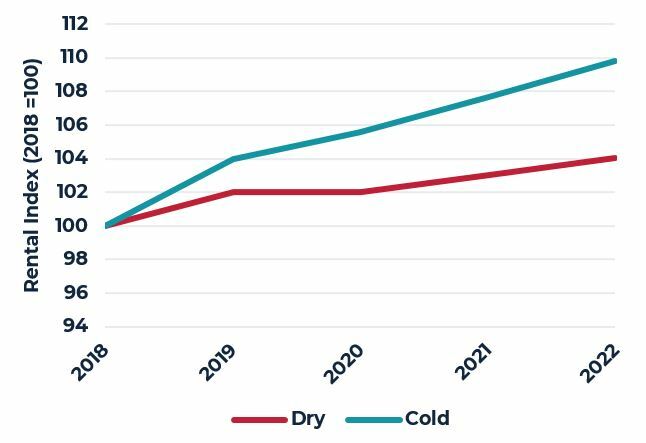

- New supply of cold storage is limited: Pure cold storage facilities within Greater Seoul are rare because of the higher construction costs (1.5 to 2.0 times the cost of dry) and more intensive technical requirements. Instead cold storage space is mostly available in mixed-facilities. Since 2012, it is estimated that only about 25% of the new supply (in terms of area) was for cold storage use.

- Cold Storage rent at a premium: Because of the higher construction and maintenance costs as well as limited availability, cold storage is typically rented out at a 1.5 to 2.0 times premium to dry facilities.

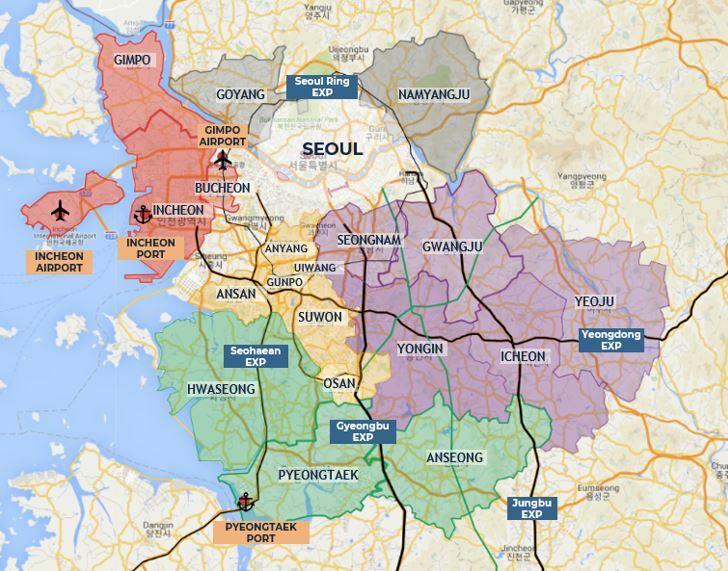

- Differences between submarkets over time: Based on distances from key infrastructure (ports, roads, air terminals), availability of land, as well as proximity to labor and communities, the different submarkets have developed for different needs and at different speeds. This has in turn impacted rental growth and investment fundamentals across each submarket.

MAP OF SOUTH KOREA

Source: Statistics Korea

OCCUPIER BREAKDOWN OF GREATER SEOUL LOGISTICS

AS OF Q2 2020

Source: JLL, as of Q2 2020

NEW SUPPLY OF LIGISTICS CENTERS IN GREATER SEOUL

2005 TO 2019

Source: CBRE, as of June 2020

MAP OF GREATER SEOUL LOGISTICS SUBMARKETS

PENT-UP DEMAND BY E-COMMERCE AND RETAILERS

- Old stock not fit for use: Despite the ramp-up in supply since 2012, a large proportion of current logistics stock is near obsolete. Older facilities are typically not suited for upgrades because of structural issues or land plot restrictions. This is driving a wave of expansionary and relocation demand for more modern, higher specification logistics space.

- Strong leasing activity: Unlike the office market, pre-leasing is a feature of the logistics market because of the strong underlying demand from end users. Well-located new construction is typically 20 to 40% pre-leased prior to completion, or completely leased within three months of completion.

- Nascent growth stage for cold storage: The demand for cold storage facilities is still at the early stages of its growth cycle, and this is expected to expand as the food and pharmaceuticals market grows further. Outside of this, industries like biotechnology, chemicals and semiconductor are also likely to contribute to new demand.

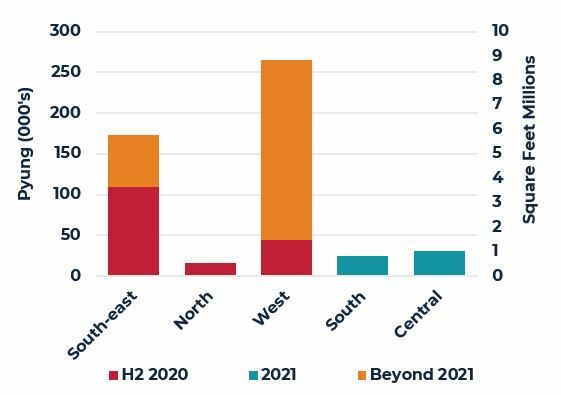

UNEVEN SUPPLY PRESENTS OPPORTUNITIES

- Limited supply in areas close to city centers: Submarkets like Seongnam, Uiwang, Gwacheon, Anyang, Bucheon and Gimpo serve as ideal sites for last mile logistics. Zoning restrictions have limited the extent of industrial construction in some of these areas. This limited supply will support rental growth and land value in the long-term.

- Stabilizing supply in South Eastern markets: The bulk of new supply in the last five years has been concentrated in markets like Yongin, Incheon and Yeoju. Tapering of new supply and declining vacancy in these markets could create some upward rental pressure going forward.

- Possible slowdown in cold storage supply in the medium term: Construction permits for cold storage development are expected to become more stringent due to new Fire and Safety measures at construction sites. As a result, projects that have not begun construction (such as some in the Western markets) could see delays going forward.

RENTAL OUTLOOK

- Two-tiered market: Newer warehouses are likely to see stronger rental growth versus older stock, because of stronger demand fundamentals.

- Cold storage to outperform: Due to attractive dynamics such as strong demand and limited supply, overall rental outlook for cold storage is positive. We expect the rental gap between dry and cold to expand in the next five years.

LOGISTICS PIPELINE SUPPLY BY REGION IN GREATER SEOUL

H2 2020 TO 2021 BEYOND

Source: CBRE, as of Q2 2020

RENTAL DIFFERENCE, DRY VS. COLD BY REGION

AS OF Q2 2020

Source: CBRE, Savills, JLL as of Q2 2020

RENTAL OUTLOOK, DRY VS. COLD

2018 TO 2022F

Source: AEW Research, as of Q2 2020

ATTRACTIVE INVESTMENT QUALITIES

- Highest total returns forecast in the region: Capital is targeting the logistics sector because it continues to offer very attractive income returns, despite yields firming in recent years. Total returns in South Korea logistics are expected to exceed other asset classes (office, retail) and are the most attractive when compared on a sector basis to other developed markets in the region.

- Cold storage facilities are specialized with core features: Cold storage facilities have core like features, longer1 weighted-average lease expiry (WALE), inelastic demand, providing income stability and organic growth. The assets are usually underpinned by longer term leases as tenants typically fund the initial capital outlay for fit-out and are more likely to renew existing leases. For larger tenants, some are even structured as triple net leases (similar to data centers), where the tenant bears all operational and maintenance obligations.

1 Typical lease length for cold storage is 5 – 10 years, versus 2 – 5 years for dry facilities

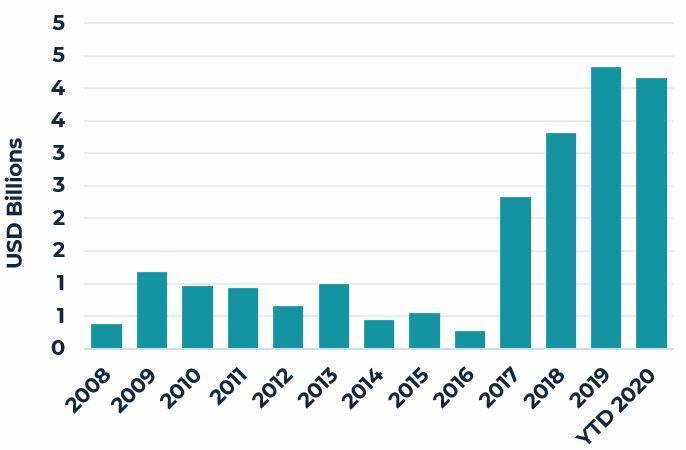

CAPITAL MARKETS

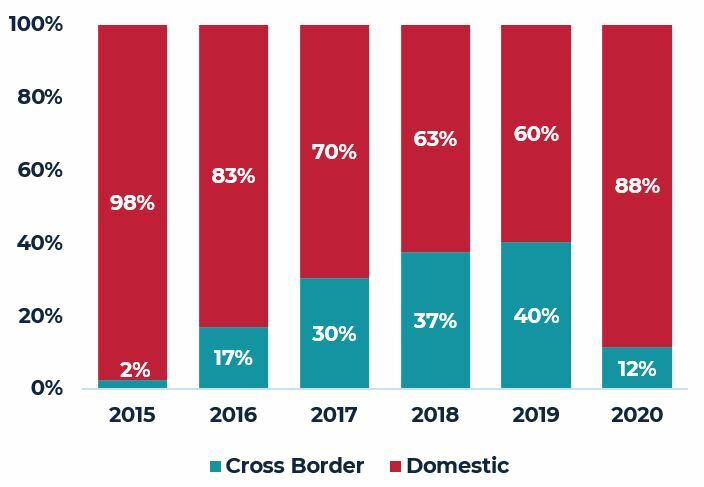

- Increasing volume of tradeable assets: Heavy development investment in the past five years has provided a generation of new institutional quality stock. This has subsequently resulted in a more active market for stabilized income-producing assets. The volume of industrial/logistics transactions was USD 4.3 billion in 2019 and already in 2020 (year-to-August) has almost matched this record.

- Increasing foreign participation: Between 2015 and 2019, the proportion of cross border interest has steadily increased from 3% to 40% of all transactions. In 2020, the proportion likely fell due to travel restrictions which has hindered deal making for groups without teams on the ground. Beyond 2020, we expect the activity from cross-border investors to increase as the country-sector offers good growth fundamentals and offers the one of the best risk adjusted returns for logistics in the developed markets across the region.

LOGISTICS 4-YR (2021 TO 2024) TOTAL RETURNS PER ANNUM

Source: JLL, PMA, AEW Research, as of Q2 2020

TRANSACTION VOLUME FOR LOGISTICS IN S. KOREA

2008 TO YTD 2020

Source: RCA, as of 11 September 2020

CAPITAL SOURCE FOR LOGISTICS INVESTMENTS

2015 TO YTD 2020

Source: RCA, as of 11 September 2020

The underlying fundamentals of the logistics market in Greater Seoul (i.e. lack of modern stock, uneven supply by submarkets and strong pent-up demand) will continue to create opportunities for capital across the risk/return spectrum. As demand for modern, institutional-quality assets remains high, we expect a two-speed rental outlook, with newer, recently-built assets outperforming. Of this, cold-storage assets, could see even stronger growth given the implied supply delays and recent ramp-up in interest by end-users.

A healthy rent growth outlook and expected cap rate compression are helping to form a view of an attractive four-year (2021 to 2024) total return. With this positive outlook, the sector should continue to maintain high levels of liquidity for the near-term.

Please do contact us if you would like to learn more about our analyses of the property markets in the Asia Pacific region:

Authored By:

HANNA SAFDAR

Research Associate, Asia Pacific

hanna.safdar@aew.com

+65.6303.9014

Contact:

GLYN NELSON

Director of Research, Asia Pacific

glyn.nelson@aew.com

+65.6303.9016

ANNA CHEW

Investor Relations, Asia Pacific

anna.chew@aew.com

+852.2107.3511

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW.