Coworking entered the real estate industry only a short time ago and has clearly made a lasting impact. The new take on an old model is creating an enduring disruption. It is clear occupiers find the key value proposition coworking operators offer, a flexible, community-based workspace, a compelling option. Coworking firms have challenged how the real estate industry has traditionally operated, and as coworking operators extend their business models, the more the industry will need to address and respond to this evolution.

This paper outlines what coworking is and how its demand for real estate in the Asia Pacific region has evolved. It then reviews the business model shift operators have taken to target corporate users and the industry’s response to the continued growth of the coworking industry; outlines key factors to consider when adding coworking to your portfolio; and lastly, explores future trends.

Background

Coworking entered the Asia Pacific real estate market and rapidly changed the landscape. However, what is it? While there is no one-size-fits-all, the common coworking experience is the provision of a ‘cool’ working environment with a strong ‘hospitality feel’. Operators differentiate themselves from traditional serviced offices by emphasizing community, lifestyle, social interaction and wellness. They prioritize the provision of amenities including front-desk services, free food and beverage, wellness and fitness services, back-end support such as IT or human resources, as well as access to insurance, legal and travel services.

A key difference with traditional office occupying arrangements is that coworking operators sell memberships, in an extremely flexible manner. Commitments by occupiers can be short or long-term, for a single seat or at the enterprise level.

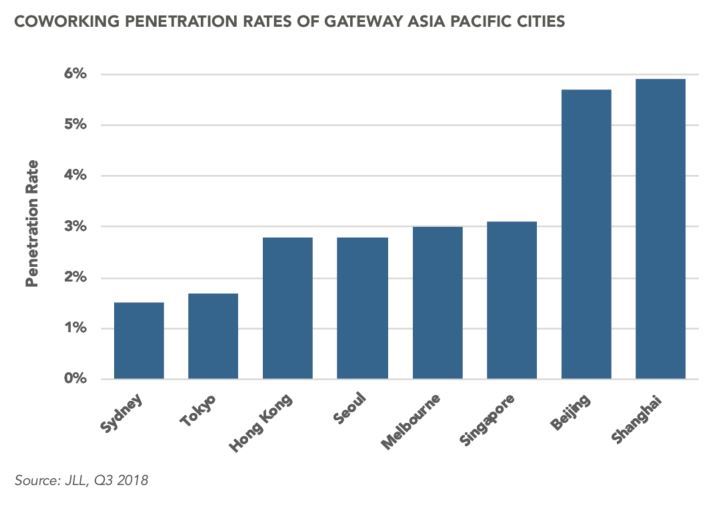

Earlier in the year WeWork took over J.P. Morgan Chase & Co. as the largest occupier of office space in New York and, as we understand, is now the largest occupier of for-lease space in Shanghai, China. In the Asia Pacific region, penetration rates (coworking share of total Grade A office stock) are on average 2.9% for the major gateway markets. While there is a wide variation of these types of estimates, they do suggest coworking in several Asia Pacific cities is behind other global gateway cities. In markets with low vacancy and limited new construction, operators have found their expansion plans constrained. The low penetration rates and announced plans by operators suggest over the next few years these rates could rise.

Demographics are part of the explanation of why coworking has grown as strongly as it has. In Asia Pacific, millennials, born between 1980 and 2000, now make up the largest part of the workforce, about a quarter, and their share will continue to grow. A survey1 of millennial work preferences in Asia Pacific highlights the importance that millennials place on their office environment, with 71% saying they would be willing to give up benefits like location and travel time for better office design. They also value flexibility, with more than 60% saying this was a strong preference. Also, millennials report a strong desire for amenities and wellness, features that coworking operators prioritize.

Evolution of Coworking as an Occupier

There has been an interesting evolution of the coworking industry’s real estate preference. The type of space taken up by operators has changed over the few years they have been active in the Asia Pacific region. Initially operators were targeting Grade B office buildings, attracted by the lower cost base and, often, trendier space. This fit in well with their brand and member base, which was typically freelancers and startups. Operators continue to show a preference for character space with some taking space in shopping centers (JustCo, Marina Square, Singapore), converted warehouses (WeWork at 100 Harris, Sydney), or even in non-CBD locations such as Campfire in Wong Chuk Hang, Hong Kong.

However, more recently there has been a shift towards Grade A office space. Operators are broadening their membership model to target medium- to large-sized corporates. As a result, they have taken up more Grade A office space and even preleased space in upcoming new office developments. For example, JustCo has 80,000 square feet at the recently completed Marina One in Singapore. This is in addition to 50,000 square feet at the redeveloped UIC building2. Around a year ago, WeWork leased about 290,000 square feet in the recently completed China Overseas International Center in Shanghai, taking up the entire building. Coworking has now evolved to be a significant part of the Grade A, institutional real estate market in the Asia Pacific region.

The New Target

Coworking grew out of the gig economy and freelance work, but has now left those roots behind. The current focus is on scalability, by targeting corporate users. Corporates will provide an additional and more stable membership base for operators. The shift should help to solidify the business model, de-risking from the current short-term, single member base that requires constant, and costly, sourcing in a competitive marketplace. In addition, corporates will sign longer agreements than memberships sold to individuals, improving the asset-liability mismatch in the initial business model.

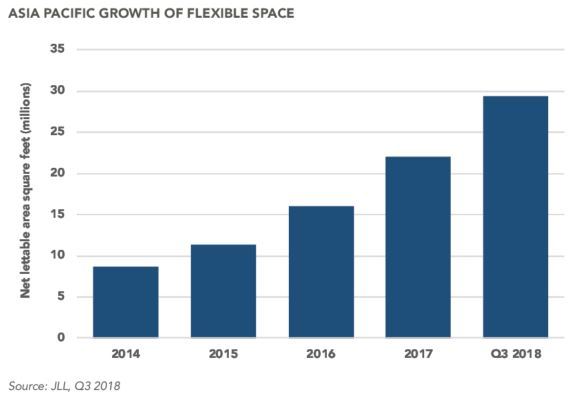

In reaction to the sustained demand for their service, growth has been rapid in the last several years with the number of operators more than doubling from 2014 to Q3 2018 and the total stock managed by them tripling3. As a result, the industry is highly fragmented with hundreds of operators, often with a single city or country focus.

As the industry matures, the growth in the number of operators is likely to abate. Moreover, with the long tail of the industry, M&A activity is expected to continue which, along with natural attrition, will likely have the effect of reducing the overall number of operators over the medium-term. Fragmentation has also led to a high level of price competition among operators, and consolidation may help to improve this and lead to more profitability.

The growth in the space occupied by the industry is expected to continue, albeit at slower rates, due, in part, to higher base effects. The success operators have at attracting corporate users will no doubt have a large impact on their footprint several years out from now.

If operators are able to retain their key value proposition, flexible access to a high-quality service, it seems reasonable to accept there will be a level of sustained demand for their service. Small- to medium-sized firms will be able to look to coworking operators to provide them with a space and services that they would not be able to afford on their own.

For large firms, coworking provides a number of different options. Initially corporates in Asia Pacific looked for coworking to house project teams, typically in the tech-related fields. More recently, many are inquiring if coworking operators can provide cross-market solutions, for either mobile staff or at the enterprise level. There is also the option for corporates to use coworking on a temporary basis, to house staff during renovation or as transition space. There are also initial signs of corporates investigating using operator platforms to provide their full regional or global real estate requirements via an outsourcing arrangement.

AEW has had conversations with industry participants and observers that suggest corporates see a future for flexible space and coworking. Feedback has included comments suggesting some occupiers are seriously evaluating if and how to use flexible space in their portfolio, including coworking sites. Initial responses plan for a portfolio centered on a core of traditionally leased space and anticipate the use of flexible space in the form of coworking or another model, as required for growth or project work.

Industry Response

So far, coworking operators referenced in this report refer to third-party providers. The largest, most well-known of these is WeWork, but other cross-border operators in the Asia Pacific region include Ucommune and JustCo. Many of these operators have substantial equity funding support from very large investors including Softbank, GIC, J.P. Morgan, T. Rowe Price, Goldman Sachs and Hony Capital. The amount and top-tier nature of equity supporting the industry lends a degree of validation for the business model, the management team and the industry’s future.

Beyond this group of independent operators, many landlords of stabilized office portfolios have made the decision to develop their own coworking brand, operating it within their portfolio. This can be seen as the replicate model. In Australia, both Dexus and The GPT Group have set up their own coworking-style facilities. Dexus has extended their Dexus Place program, which provides meeting room facilities, by establishing SuiteX, a pilot site with flexible suites. The GPT Group has set up its own Space&Co that will cater to both their existing customer base and new clients.

Other long-term office landlords have partnered with independent operators, such as the linkup between CDL and Chinese coworking operator Distrii in Singapore. Another example is the launch by CapitaLand of a core-flex model. This concept is to provide flex, or coworking style space, in their portfolio through a partnership with coworking operator, The Work Project, in which CapitaLand has a 50% stake.

Doing a Deal That Co-works

After some initial apprehension, there has been an increase in the acceptance of coworking operators as a tenant. Many investors with vacancy have targeted coworking operators as the industry represents a source of new expansion demand and usually involves large space requirements. Flexible space accounted for about 15% of total leasing volume in Asia Pacific in H1 2018, an increase on 5% of volume early in 2017. The average lease size by flexible space operators has been reported to be about 30,000 square feet currently. AEW understands the typical coworking lease agreement has similar building blocks across the world. Many are long-term with upfront incentive/fitout contributions.

When finalizing a lease with a coworking operator there is an evaluation of three broad themes: income, security and costs. Income is simply the rental payments being agreed upon. Recently, some operators are asking for an alignment of interest by requesting low initial rents with fixed escalations or variable rental payments linked to income performance of the site. Security reflects the creditworthiness of the contracting entity and refers to the amount of deposit or the corporate guarantee to the lease. Costs refer to the upfront incentives, fitout contributions and rent-free periods. Commonly there is a trade-off among these categories. For example, a final agreement may include a larger than usual contribution to fitout, which is countered with a longer than typical lease with fixed escalations and corporate guarantee.

In constructing a real estate portfolio, AEW believes exposure to coworking should, like all tenants, be diversified. By making certain a portfolio’s coworking component is spread across multiple cities and by working with only the most creditworthy operators, a portfolio’s exposure to the industry’s uncertainties can be minimized. At the same time, investors are able to tap an industry with expansion demand. Other positives of doing a coworking deal include their long leases adding to the portfolio weighted average lease expiry (WALE) and the high-density utilization of coworking space leading to associated retail opportunities.

Back to the Future

Serviced office is nothing new, but coworking operators significantly updated and refreshed the offering. They brought a new approach to a traditional model and built on the Active Based Workplace movement already underway.

As we have highlighted earlier in the report, AEW anticipates several coworking trends in the future. However, we make this assumption with the full knowledge that predicting the outcome of this industry is perilous. The fragmented industry will continue to consolidate. M&A activity should persist and there is no doubt some coworking sites will close. The operator focus on corporate users will help to de-risk the business model by improving the asset-liability mismatch and providing scalability. The adoption of management agreements has been slow, but coworking operators will continue to look to monetize some of the in-house capability they have developed.

For instance, many coworking operators have built up substantial in-house interior design and fit-out expertise by designing their own sites, and have in fact, started to provide this know-how as a service. For example, in the U.S. the We Company (renamed WeWork) is offering design and fit-out construction services to businesses. While we have yet to see this service offered in the Asia Pacific region, it may be another way operators will diversify.

AEW expects multi-national coworking operators to be able to offer the most compelling package to MNC’s. Other operators will look to target individuals and SME’s at the city or country level. This group will also include niche coworking sites focused on industry-specific members, e.g. medical or the creative industries.

Investors focused on total return should consider coworking operators as tenants in their buildings, but with the full evaluation of the income, costs and security of the agreement. Landlords with long-hold portfolios are expected to continue to follow the market and provide house-branded services.

Because the coworking industry is so new, the model has yet to be tested during a full real estate cycle, including a demand-led downturn. Some analysts point to the asset-liability mismatch as a key risk factor. How coworking will perform during a demand contraction is a key question.

Lastly, analysis from the U.S. has indicated a cap rate premium for buildings sold with a small amount of coworking and a discount for a large share of coworking. It remains to be seen if this is an embedded market trend or something that changes over time as investors become more comfortable with coworking. In the Asia Pacific region, there has not been enough sales activity with coworking occupiers to determine an industry trend yet. A recent initial analysis with a small sample suggested a sale with a coworking tenant attracted no meaningful premium or discount. This is consistent with AEW’s view of recent transactions involving coworking occupiers.

Conclusion

There is little doubt coworking as a concept is here to stay. The product and service provided is highly attractive to an array of users. AEW believes more and more corporates will opt to include flexible space in their real estate portfolio. If third-party coworking operators are able to secure corporate demand, this will create a level of sustained demand and aid in de-risking the business model. The rapid expansion of the industry will likely see the long tail shorten through natural attrition and M&A. Some coworking sites will prove highly successful, others less so. AEW anticipates the real estate industry as a whole will continue to react to the rapid growth of the coworking industry. Coworking operators are both partners and competitors to the traditional real estate industry and they are here to stay.

The information and opinions presented in this research piece have been prepared internally and/or obtained from sources which AEW believes to be reliable; however, AEW does not guarantee the accuracy, adequacy, or completeness of such information.

1Asia Pacific Millennials: Shaping the Future of Real Estate. CBRE. 2016.

2https://www.mingtiandi.com/rea...

3JLL estimate as of Q3 2018