Investment Strategy

Operating conditions and the investment outlook in the Asia Pacific region shifted dramatically over the first quarter. The market had severe restrictions imposed on it to bring the public health crisis of COVID-19 under control, and governments and central banks announced very large support packages to offset the costs of these restrictions. The current projections are for a sharp, but short-lived contraction in economic activity, concentrated in the first half of this year, with a resultant recovery in the second half of 2020 and rebound in 2021. The unknown part of this outlook is the effect any COVID-19 re-occurrence may have, and how disruptive that could be.

In this environment, investors will likely seek an entry discount in order to price that increased uncertainty. For the time being, most property sellers are waiting to see how this situation evolves. Their holding power will likely withstand most of the pressure from the occupational markets, and fortunately, banks are being supportive and unlikely to cause any forced sales.

There continues to be a weight of capital in the region as well. For example, private funds have about $84 billion of dry powder to invest, and fund closings continue as 2020 progresses. Investors with return-seeking mandates are expected to act quickly on any reduced priced opportunities. However, travel restrictions that are still in place may complicate due diligence efforts, requiring an increased reliance on virtual solutions where investors lack established relationships with local teams or trusted partners.

In the region, AEW targets investments primarily in the office, logistics and business park sectors. We believe occupier demand for office assets in central locations will be resilient through the current cycle. In the office sector, location and building quality will be key value drivers for buyers. The increased use of online purchasing and parcel delivery during the pandemic has stretched logistics providers, with many looking for expansion space. Business parks that house industries such as technology-related firms, research &development, and media-related businesses are anticipated to benefit from the online consumption shift.

Long-duration income, in the form of weighted average lease expiry (WALE) or rent rolls with major expiries further out than the first year or two of holding, will be preferred. There will need to be a deeper analysis of tenant creditworthiness, as well as, an evaluation of the repayment of any income delayed due to local regulations designed to help businesses during stay-at-home periods.

While operating conditions will continue to be unusual in the first half of the year, the second half of the year could form the base from which a recovery will form if the situation stabilizes.

Economy

The economic outlook has changed dramatically since early 2020 as countries implemented the necessary quarantine and social distancing practices to contain the spread of SARS-CoV-2, and its disease, COVID-191. During the quarter, normal life was severely disrupted, and economic activity was put on pause, affecting supply chains and consumption across multiple industries and sectors, causing major effects on financial markets globally. Revised forecasts by the International Monetary Fund (IMF) in April indicate the global economy will be in a recession in 2020, falling 3.0% year-on-year, followed by a 5.8% rebound by 2021. Similarly, within Asia Pacific, the regional economy is expected to contract by 1.6% in 2020 before an anticipated sharp recovery of 7.7% in 20212.

Asia Pacific is generally ahead of other regions in managing COVID-19. Strict people movement restrictions put in place early have enabled a flattening of cases in China, Korea, Hong Kong and Australia. The economic trade-off from managing the spread of the virus is high, with reports of corporate failures, job losses and credit default risks filtering through. Looking to offset some of these issues are generous support packages by governments and policy makers, which include variations of cash handouts, tax rebates, wage subsidies and access to cheap financing. In addition, labor laws in countries like Korea and Japan make it difficult for companies to dismiss workers, which could help keep jobless rates low.

Today, China serves as a good example of the effectiveness of severe people movement restrictions, with the potential to revert to normal operating conditions relatively swiftly once new case numbers are brought down. High frequency indicators in China such as coal consumption, traffic congestion and housing sales indicates that businesses are running at close to normal levels again. Additionally, March data for industrial value-add, investment and retail sales show the declines are slowing down (after some cities had lockdowns lifted), suggesting a recovery is underway. This has laid out an optimistic trajectory for other countries in the region for when their restrictions are eventually unwound, although the rebound and recovery of Asia Pacific will be tied to an overall improvement in global demand.

Our base case assumes a phased unwinding of restrictions across Asia Pacific from May to August and for global travel to remain restrictive till the end of 2020. Once economic activity resumes to near-normal, we expect a second phase of government spending to support the recovery in 2021, likely through sustained tax cuts, investment in new industry and accelerated infrastructure projects. Monetary policy is expected to remain supportive for years. To date there have been multiple rate cuts across the board in the major Asia Pacific economies, and some central banks (i.e. Reserve Bank of Australia and Bank of Korea) have embarked on their own version of quantitative easing. The risk to this outlook is more COVID-19 outbreaks later in the year that require another round of strict social distancing or people movement restrictions.

As large currency movements are common in times of uncertainly, some central banks have established USD swap facilities with the Federal Reserve. This action has helped calm some weakness in Asian currency markets seen in the first three months on the year. The AUD has appreciated by 13.0% against the USD to-date3 since the swap facility was established on 20 March 2020. As of April 30, the AUD was still the weakest currency to-date (down 6.9%), followed by the KRW and SGD (both down 4.9%). Meanwhile, the CNY has been relatively stable, as the PBOC has worked to maintain the yuan at strong levels, as the expense of competitive devaluation.

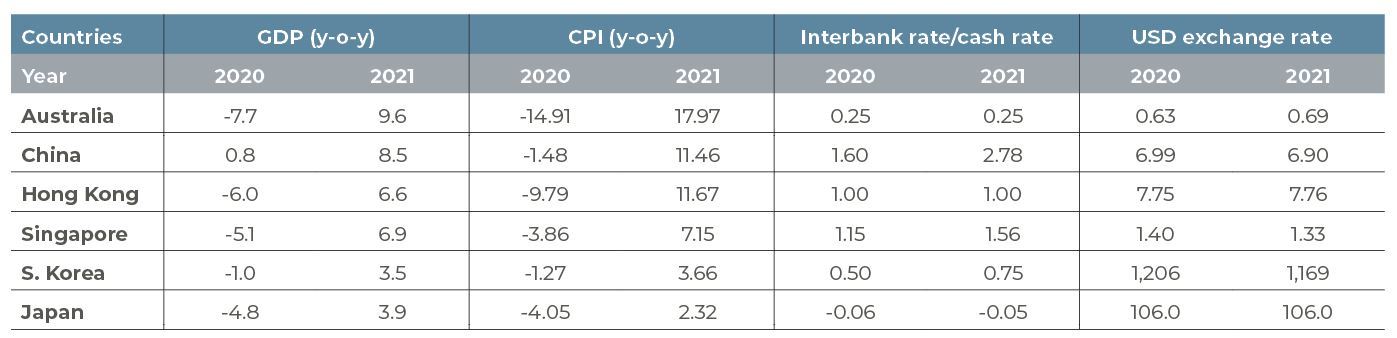

MACROECONOMIC INDICATORS

Source: Oxford Economics, 30 April 2020

Tokyo

Multifamily remains defensive, office demand holds in Q1, but expected to slow

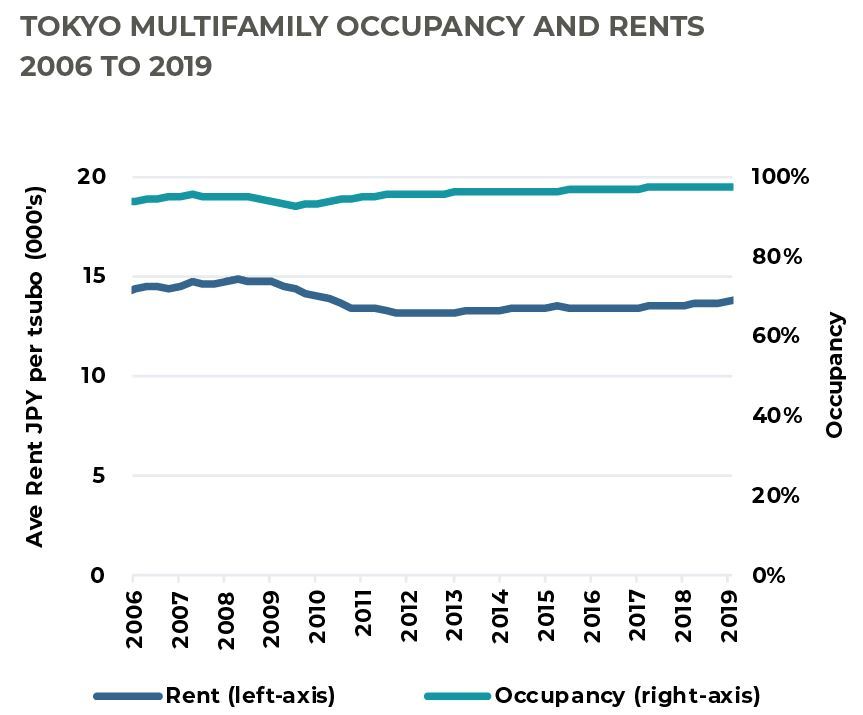

MULTIFAMILY: OCCUPANCIES STABLE AND RENTS INCREASE

The multifamily sector in Japan is recognized for its stability and defensive nature. Drawing on the previous downturn in 2008 as an example, residential occupancy remained steady, while rents underwent only a marginal decline. For Q1 2020, residential rents continued to increase, bringing the year-on-year increase to 5.8% in Tokyo’s 23 Wards. In the Central 5 Wards (with smaller units popular with young adults and foreigners), rents have increased by 5.4% year-on-year.

AEW continues to monitor this sector closely especially under the premise of a slowdown in corporate activity and falling labor demand. Reduced migration to Tokyo may reduce renter demand in the short-term. Further, with residential rents at an all-time high, there could be resistance to further increases.

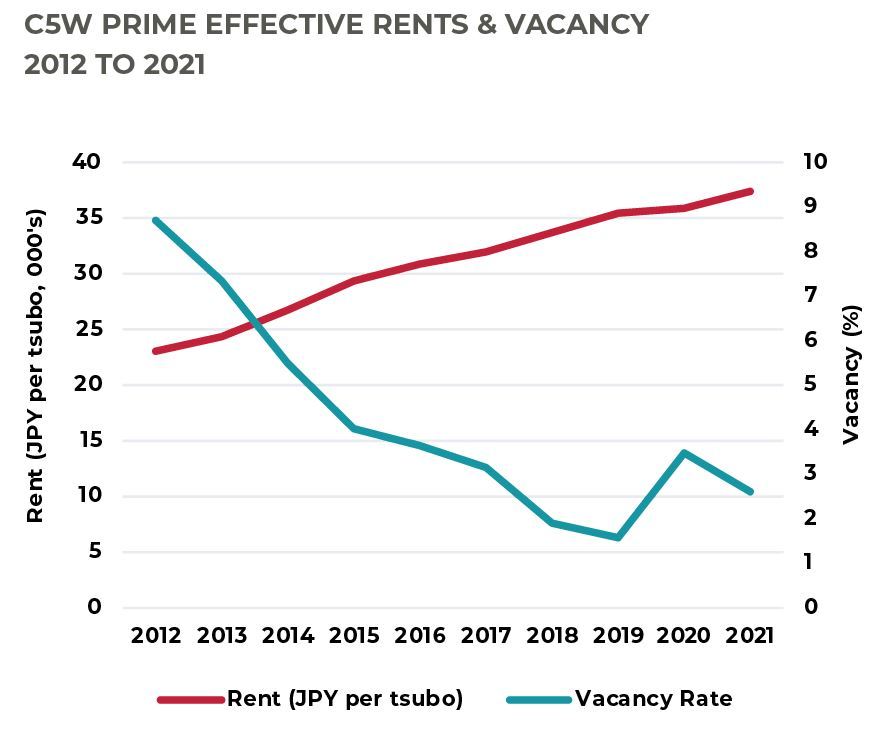

OFFICE: RENTS REMAIN FIRM AS VACANCY TIGHTENS

As of end Q14, office leasing markets in Japan were relatively unaffected by the impact of COVID-19. Office demand in Q1 was similar to levels seen in the same quarter last year. Tenant relocation and renewals continued as planned, aside from a handful of smaller-sized companies that have reduced space requirements. Vacancy remains extremely low in Tokyo and further vacancy tightening was reported at the end of February.

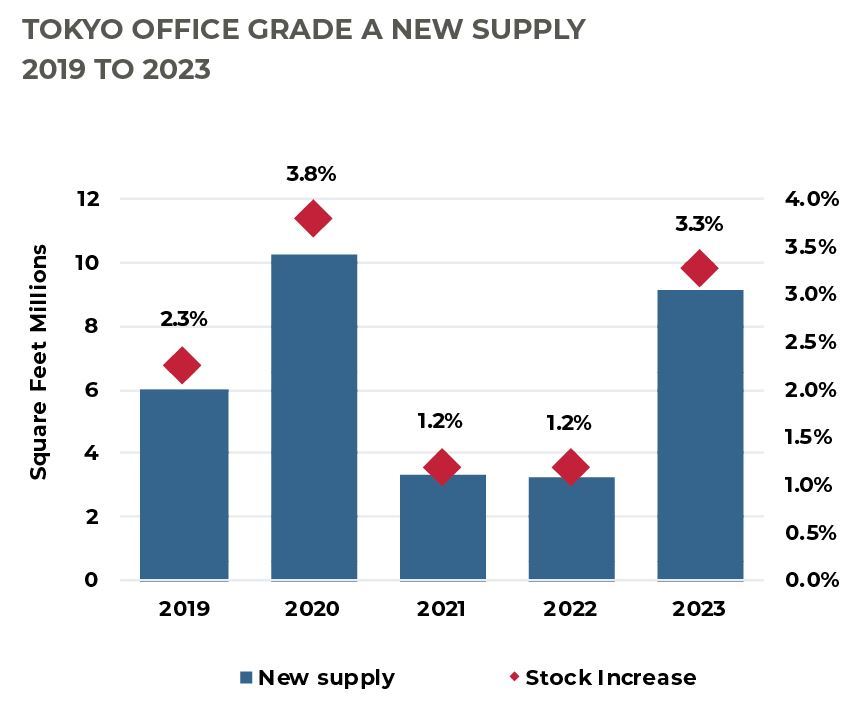

SUPPLY PEAK IN 2020, RENTAL WEAKNESS COULD SET IN H2

The initial optimism in the office leasing market is unlikely to last for the remainder of 2020 as business confidence has been severely impacted since the State of Emergency was declared by the government in early April. Further, new supply is expected to peak in 2020 with about 10.3 million square feet completing. As of writing in late April, AEW understands that about 95% of the new space is committed and tenants intend to take occupation of their space.

We expect landlords to be accommodative in the near-term, supporting the lease-up of the backfill space, with smaller-sized, Grade B buildings expected to see the largest downward rental adjustments in 2020. Beyond this period, however, medium-term supply will only be completed from 2023 to 2024, which means a space shortage could re-surface in the 2021 to 2022 window, giving opportunity for the market to rebalance.

Sources: ARES and PMA, as of March 2020

Seoul

Limited impact on office environment from COVID-19 in Q1, outlook varies by submarket

DEMAND HOLDS IN Q1, OUTLOOK ACROSS SUBMARKETS VARY

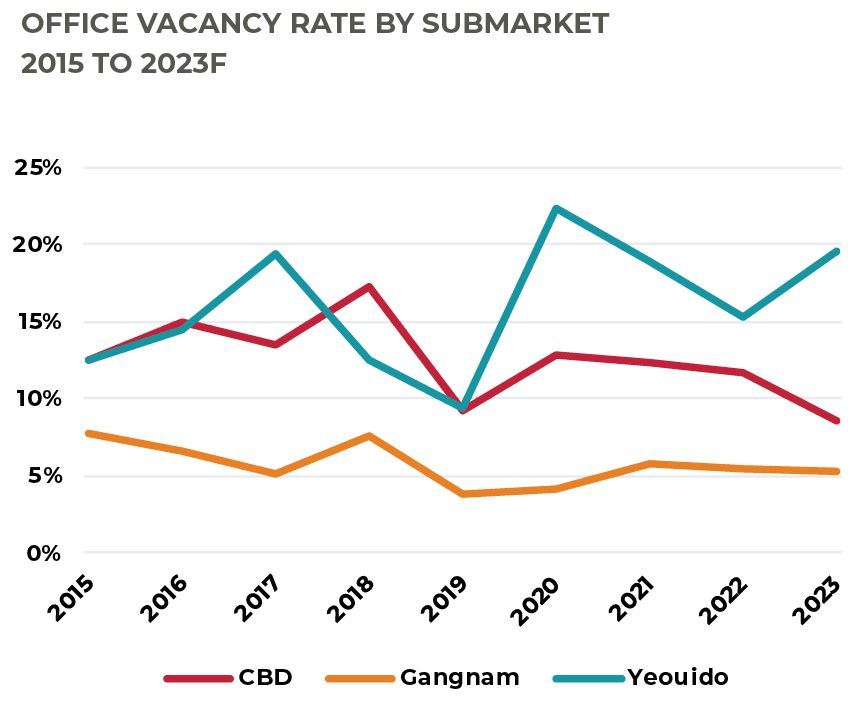

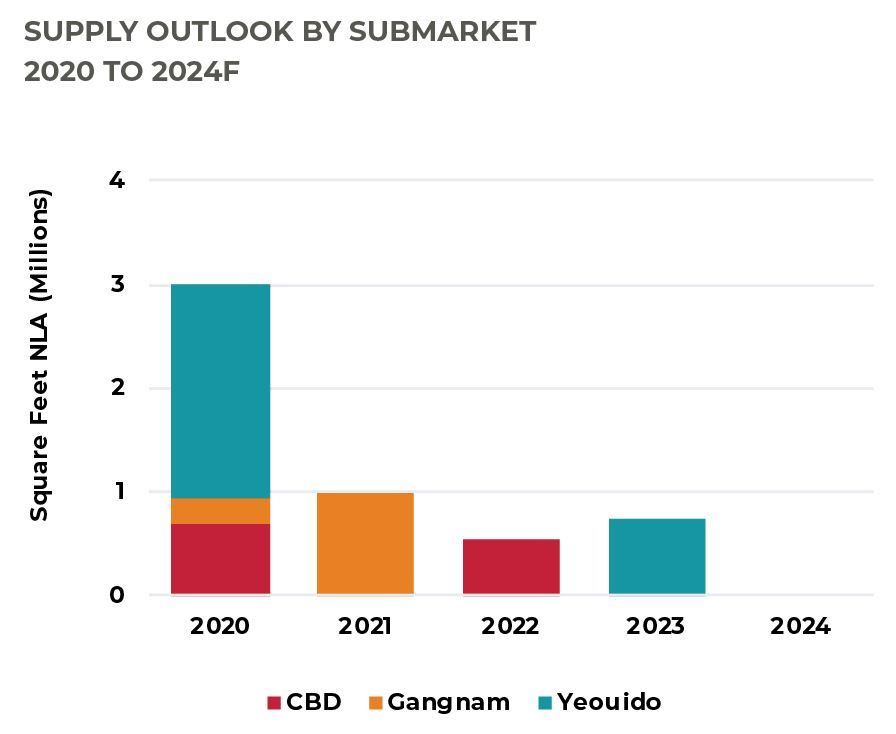

With no widespread lockdown implemented to-date, the day-to-day business environment was left relatively undisturbed in Seoul. This has been reflected in the leasing markets where demand in Q1 was healthy. Net absorption was up in all three submarkets resulting in vacancy rates declining across the board. The outlook across submarkets, however, is mixed due to supply factors and variations in underlying tenant-profile. We expect the technology-dominated Gangnam district to hold up best due to favorable demand and supply trends in 2020 while rental weakness in CBD and YBD could set in as early as Q2 2020.

CBD: DEMAND COULD TAPER IN H2

While leasing figures for Q1 were positive, we expect some weakness to set in over the coming months as industries hard-hit by the COVID-19 disruption (such as tourism, transportation and manufacturing) start to cut costs. Estimates suggest these industries account for 25% of the tenant base in the CBD. Further with new construction, vacancy rates are expected to rise by end-2020. In the CBD, some interruptions to fit-out and refurbishment works could delay the movement of tenants into new premises, and a result, vacancies could remain elevated for some time. Current forecasts suggest rental weakness in the remainder of 2020, before the economic recovery in 2021 supports leasing momentum again.

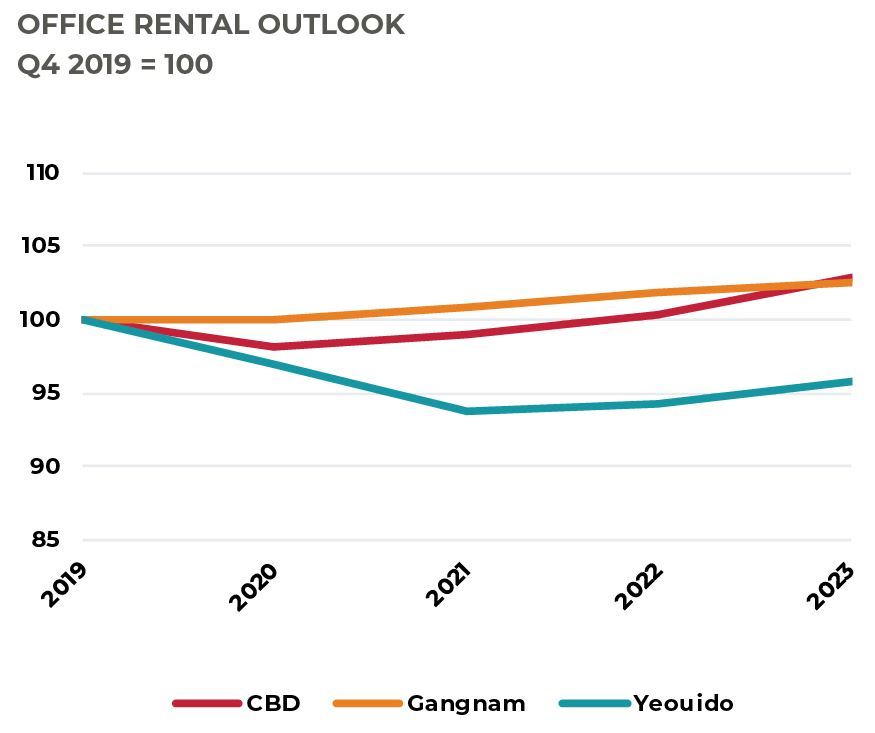

YEOUIDO: SUPPY-LED RENTAL WEAKNESS TILL 2021

The completion of the ParcOne will result in a supply-led rental correction in Yeouido. AEW understands that it could take several years for the market to rebalance, like when International Finance Center Seoul completed. As a result, rental weakness is expected to be protracted, with effective rents declining by a total of 8.5% between 2020 and 2021.

GANGNAM: LANDLORD FAVOURABLE CONDITIONS PERSIST

Limited vacancy and expansion of firms in the Information, Technology and Communication (ITC) industry is expected to continue amidst this period and keep leasing markets in favor of landlords. Brokers on-the-ground have indicated some firms are already enquiring about leasing space in 2021’s supply. Given the still-healthy demand, rents are expected to hold in 2020 for several buildings, with only a handful (those with higher vacancies) experiencing a mild contraction in rents.

Sources: JLL, as of March 2020

China

Stability in some submarkets, large supply impedes rental recovery in others

WEAK Q1 CHINA-WIDE, GRADUAL IMPROVEMENT EXPECTED

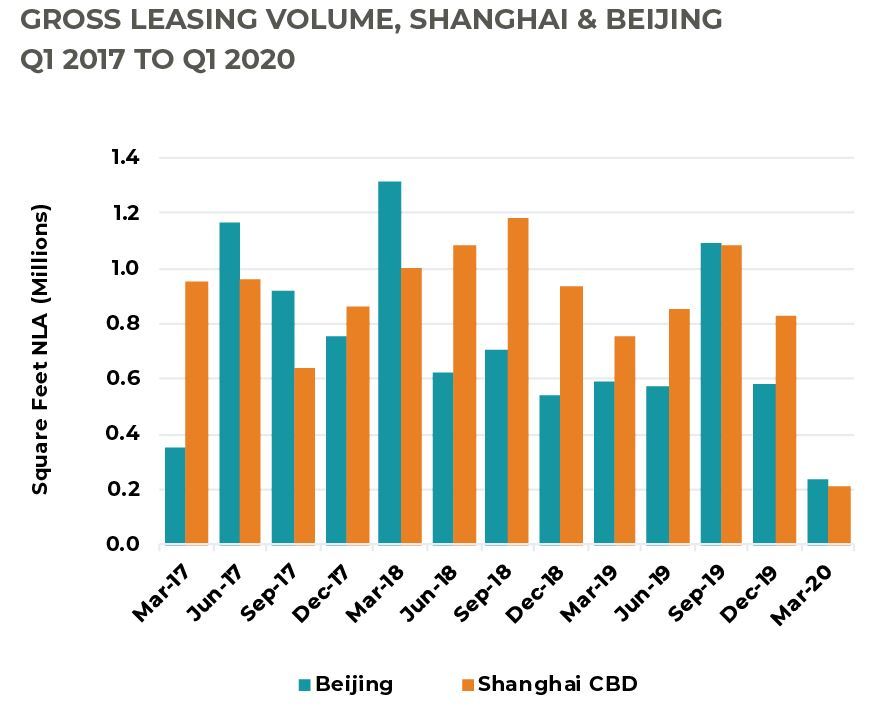

Through the seasonal slowdown of Lunar New Year and subsequent lockdown across China due to COVID-19, office leasing demand was severely impacted in Q1. Tenants generally became conservative on leasing strategies, and where possible, reduced their space requirements. At the same time, landlords were highly flexible in negotiations, offering discounts, larger rent-free incentives or rent deferrals. As life returns to normal in China (lockdown restrictions started to be removed by late March 2020), we expect leasing volumes to gradually improve through the year. Several high supply markets could see construction delays which could help markets rebalance sooner than expected.

SHANGHAI

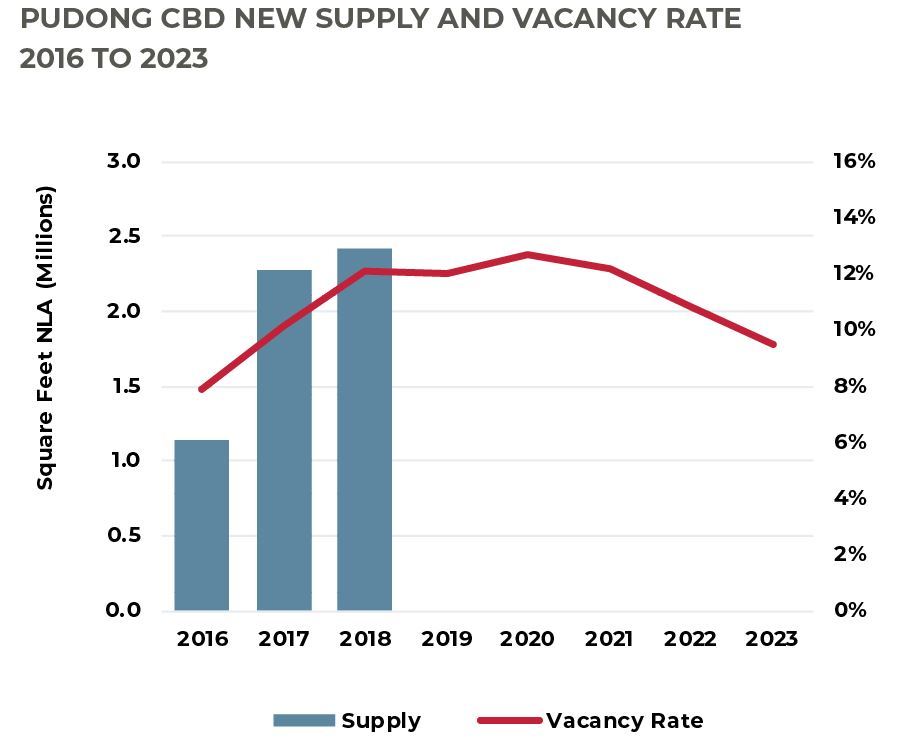

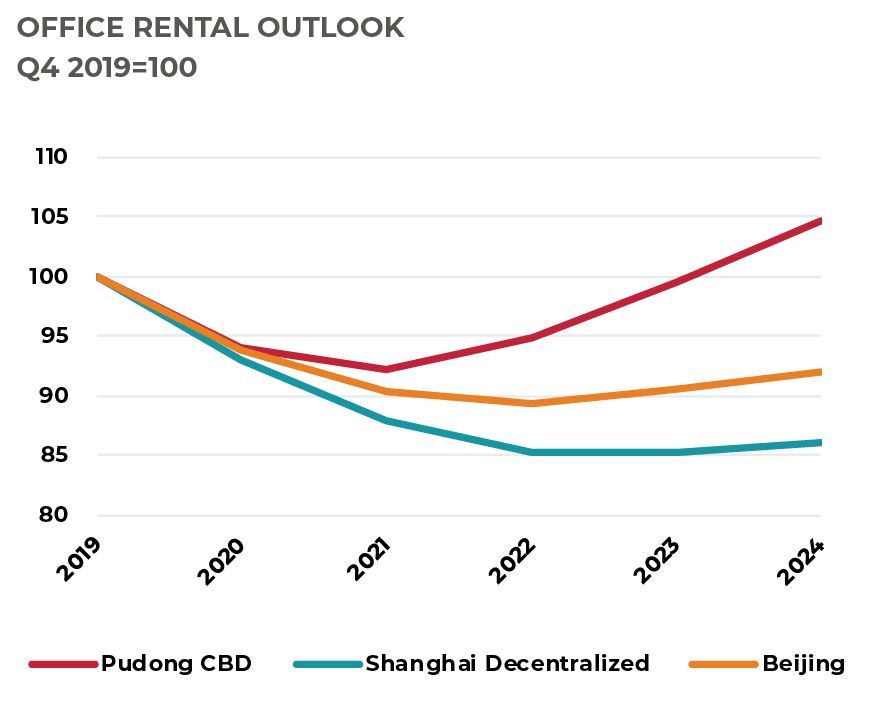

CBD: SHORT-TERM WEAKNESS, FAVOURABLE OUTLOOK

Demand in the CBD was negative 137,000 square feet in Q1, resulting in the vacancy rates increasing slightly to 10.6%. While demand is expected to gradually improve in the coming months, uncertainty in the business environment will keep new demand limited causing vacancy to stay high for some time.

Aside from the near-term challenges, the government has not slowed down its efforts in promoting Shanghai as an international financial hub. On April 1, 2020, all foreign ownership caps on finance firms were removed allowing them to have wholly-owned entities on the mainland, of which several firms took advantage, (i.e. Morgan Stanley, Goldman Sachs). As foreign finance firms grow their presence on the mainland, we expect Liujiazui to benefit as it remains the choice location for firms in the financial sector. Further, no new supply in the market for the next five years will help support the submarket’s rental recovery.

BEIJING

LARGE SUPPLY IN CBD, RENTAL STABILITY IN SOME MARKETS

Leasing transactions were down around 60% from the same period last year and AEW understands several expansion and relocation plans have been delayed. As a result, overall rents declined by 2% in Q1. Still, industries that have stayed resilient through this period are expected to contribute to expansion demand in the coming months. These include gaming, online education and biomedical. Due to the large expected supply in Guomao, where 6.5 million square feet will complete in 2020, overall rental weakness could stay until 2021. Submarkets like East 2nd Ring Road and Finance Street that have low vacancy and historically low volatility should fare better.

Sources: JLL, as of March 2020

Hong Kong

Commercial market downcycle further amplified by COVID-19

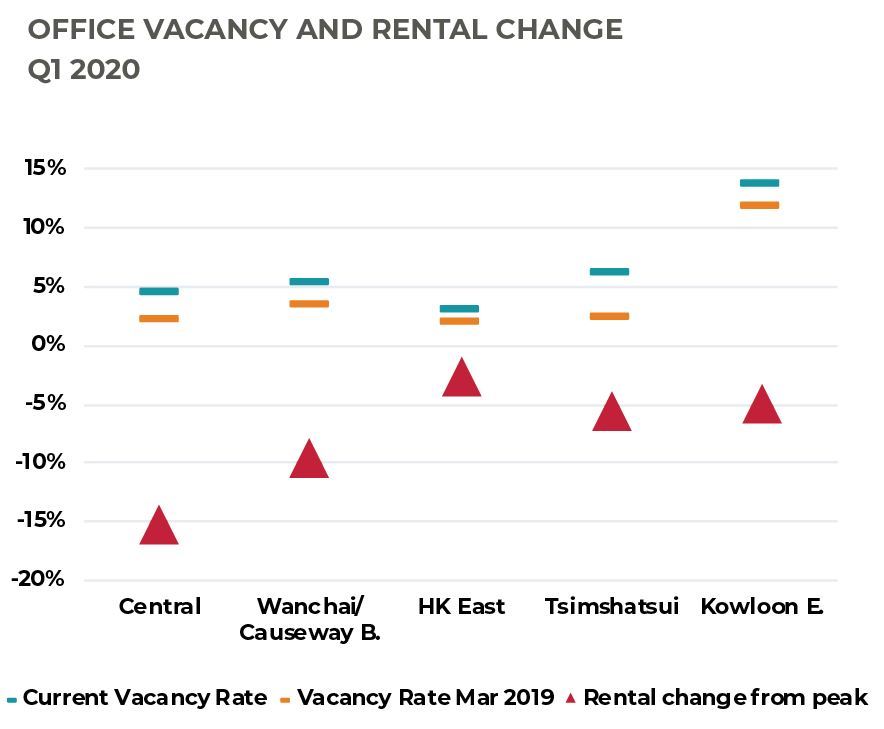

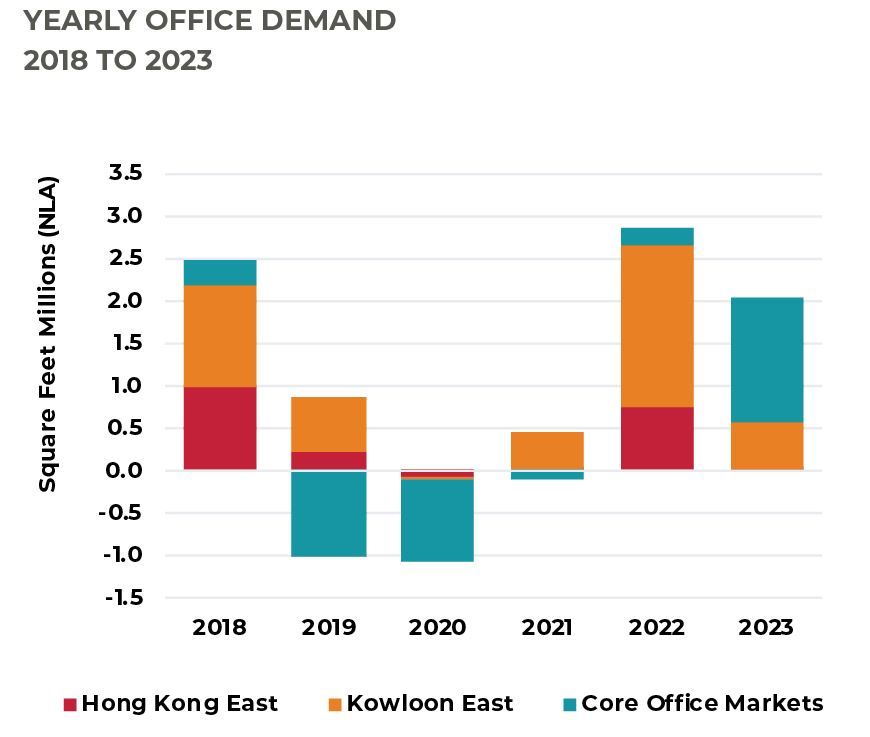

FURTHER PULL BACK IN DEMAND DUE TO DOWNSIZING

Leasing demand in 2019 had already receded from the effects of the trade war, fall in demand from mainland Chinese firms and months of social unrest. The outbreak of the virus has continued to bring leasing volumes down in Q1, this time with the impact extending to the more resilient submarkets like Hong Kong East. New leases that were signed (mostly renewals) were negated by multiple cases of downsizing and surrendering of space, resulting in negative take-up of 743,000 square feet for the quarter. As a result, vacancy levels have increased across the board, with the largest increases in Wanchai/Causeway Bay and Tsim Sha Tsui. The co-working sector has also been negatively impacted. AEW is aware of three leases that a major coworking conglomerate withdrew from in Q1.

RENTAL DECLINE MAGNIFIED, RECOVERY POTENTIAL BY 2022

Rents in Hong Kong further extended their decline in Q1, falling in the quarter by 6% island-wide and about 10% in Central. Rents to-date have fallen by 10% to 15% in the core submarkets since their peak in Q1 2019. The expectation is for the leasing market to continue to be weak for the remainder of year, with further contraction of space expected. By end 2021, rents in Central could have reached HKD83 to 85 per square foot, like levels last seen in 2014.

SOME SMALLER DEALS TRANSACTING AT DISCOUNTS

While there have been limited transactions for large enbloc deals to-date, there has been a noticeable uptick in smaller-sized strata-titled deals on the market, some transacting at discounts of between 10% to 15% from asking price. Buyers are mostly domestics; local families or high net worth individuals.

RETAIL AND TOURISM REPORT LARGEST DECLINES IN Q1

With significant disruption to tourism and consumption-related activities, the tourism and the retail industry have had the largest setbacks. Tourist arrivals fell about 96% year-on-year in February while retail sales volume declined 46% for the same period. Store closures and layoffs are expected to continue through the year, despite major government relief packages. A survey by the Hong Kong Retail Management Association indicated that an estimated 10,400 workers will lose their jobs, while 5,200 stores could close their doors by the end of May 2020. As a result, more leases are being renewed on a short-term basis and at significant discounts (between 40 to 50% lower). Retail yields are being adjusted to reflect the significant alteration to the rental outlook.

Sources: JLL, as of March 2020

Singapore

Disruption to daily-life, short-term income impairment for commercial real estate

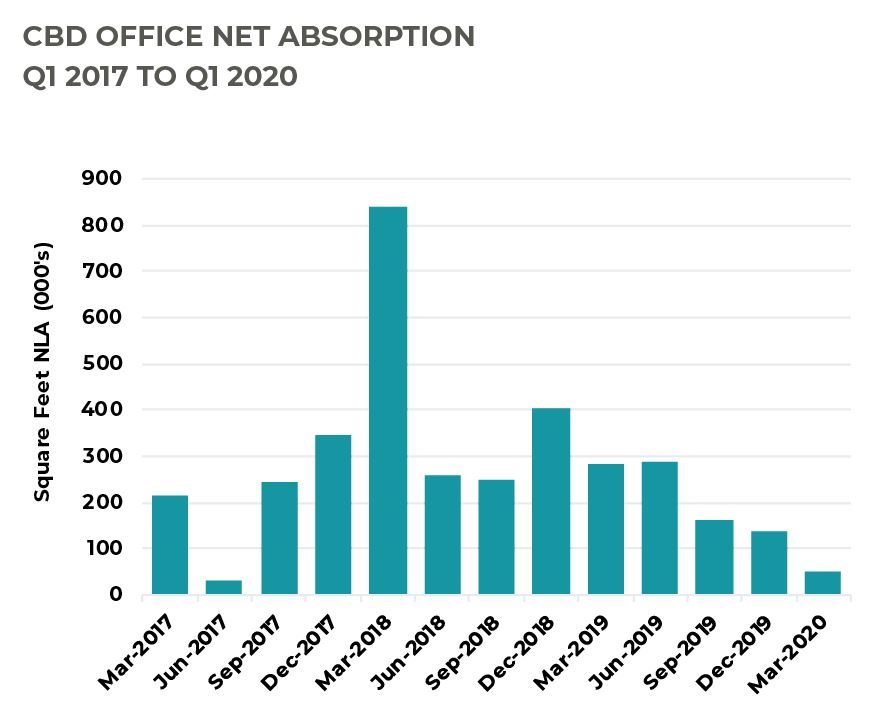

OFFICE DEMAND UNEVEN IN Q1

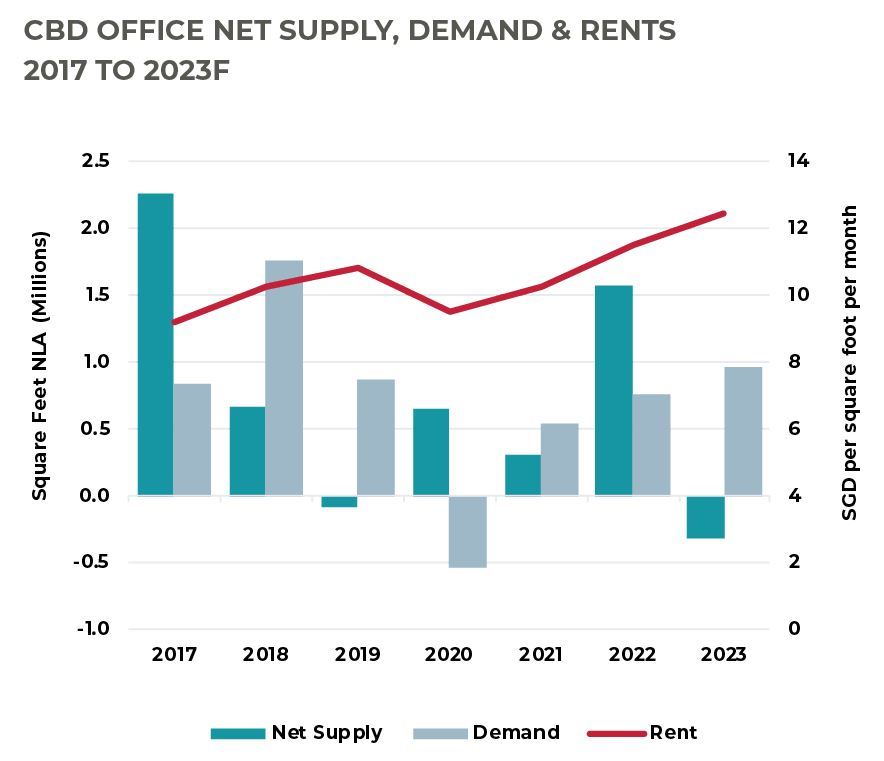

Leasing sentiment fluctuated in the weeks pre- and post Lunar New Year, but generally turned down in March after stricter safe distancing measures were implemented nationwide. Leasing enquiries fell considerably as in-person viewings were avoided. Companies became focused on contingency management, making cost optimization a priority and delaying non-essential business decisions.

SHORT-TERM RENTAL DECLINE, GOVERNMENT SUPPORT

Demand for 2020 is now expected to contract between 350,000 to 500,000 square feet, potentially bringing vacancy up to 7.7% by year-end, slightly above the long-term average of 6.6%. As demand levels fall and landlords offer greater flexibility on leases, we expect office rents to decline by between 12% to 15% in 2020. Behind some of the impact to office rents are newly- legislated government policies requiring landlords to offer rental rebates or deferrals (of up to six months) to tenants. At the same time, property tax rebates are being offered to landlords. Current estimates indicate that about 40% of small-to-medium enterprises and 20% of multi-national companies have applied for these concessions.

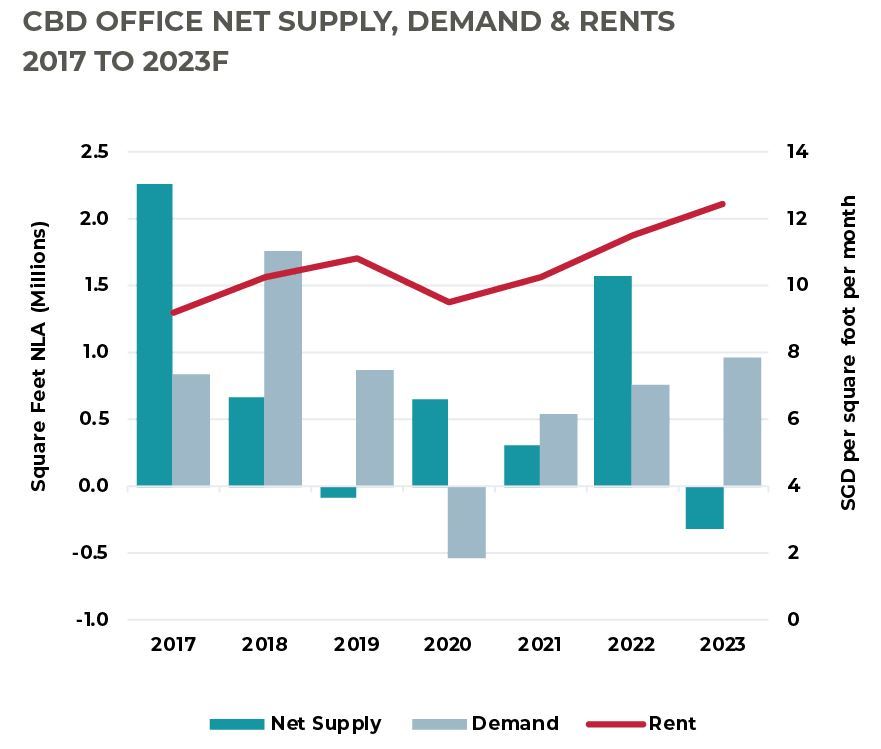

GOOD FUNDAMENTALS TO SUPPORT RECOVERY BY 2021

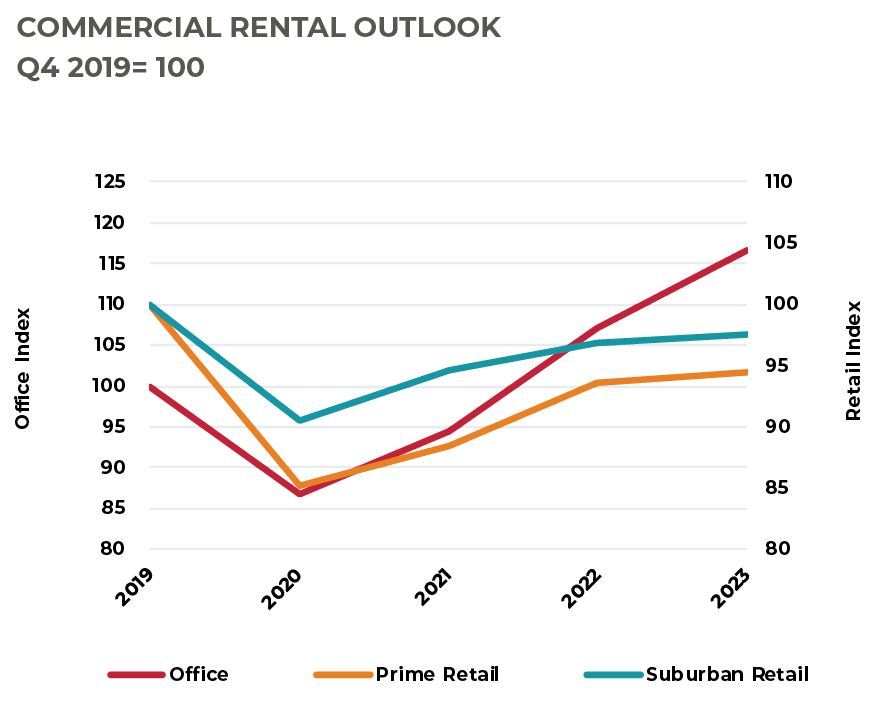

Despite the short-term weakness from COVID-19, medium-term demand-supply fundamentals in the office market remain in favor of landlords. Assuming economic conditions stabilize H2 2020, projections are for a turnaround in office rents as early as H1 2021. Rents could potentially rebound by 13% to 18% recovering lost value by mid-2022. The five-year net supply outlook is in balance with demand levels and will help support a gradual recovery in rents.

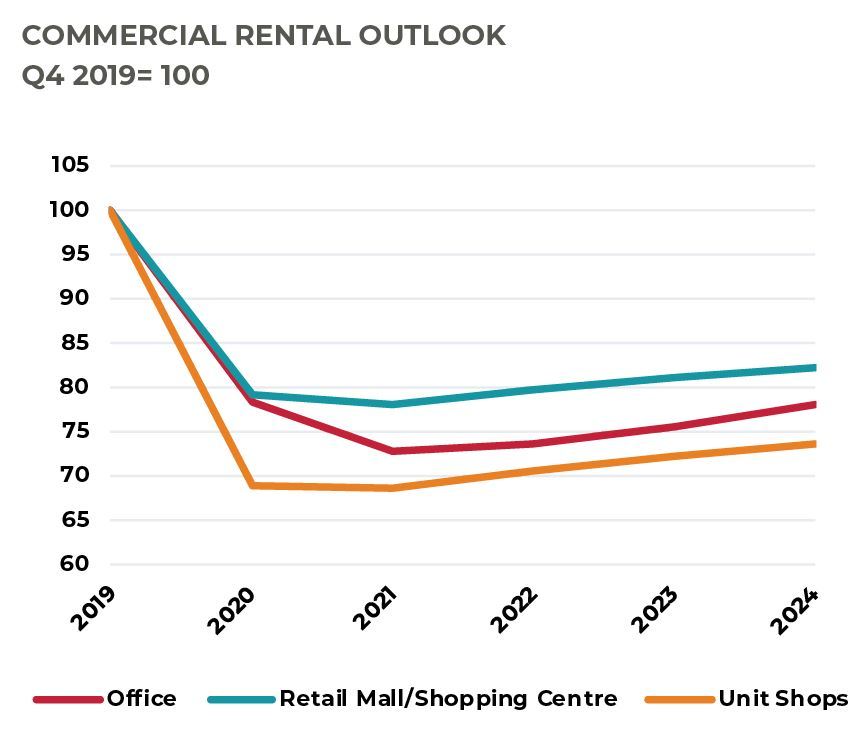

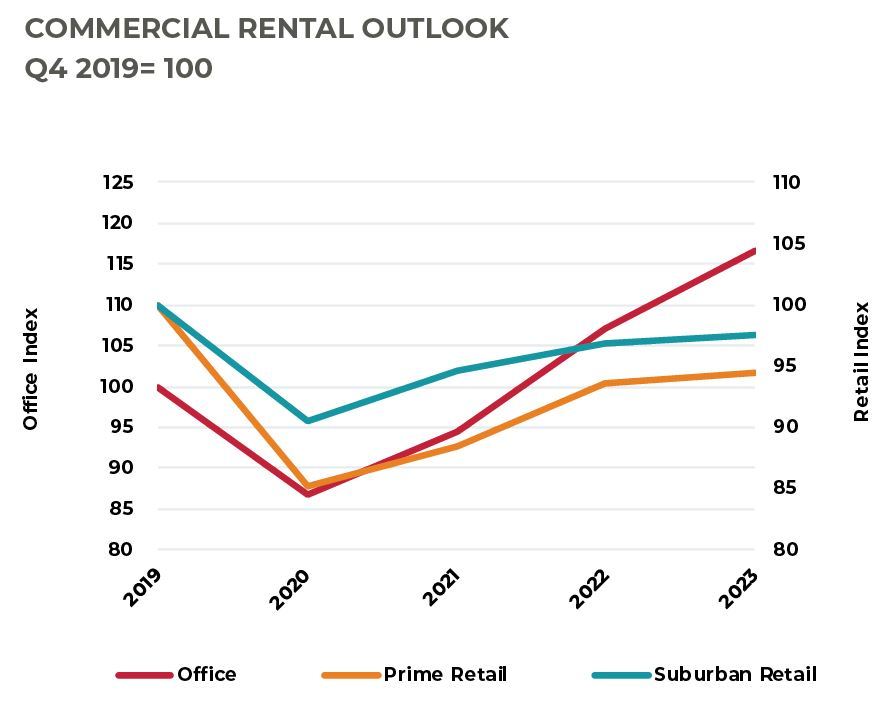

STRUCTURAL WEAKNESS IN RETAIL TO REMAIN PAST COVID-19

The structural weakness in the retail sector has been exacerbated by social distancing and government mandated closures of non- essential businesses. Despite some support by the government to businesses most severely affected, AEW expects many tenant defaults and permanent store closures of smaller businesses as cashflows dry up. Through this period, we expect malls in the city fringe to see larger rental declines of up to 10% versus suburban malls (about 5%) due to spending support from the residential catchment. Post COVID-19, we expect retail rents to stabilize, but it could take years before rents recover to pre-crisis levels.

Sources: JLL, as of March 2020

Singapore

Disruption to daily-life, short-term income impairment for commercial real estate

OFFICE DEMAND UNEVEN IN Q1

Leasing sentiment fluctuated in the weeks pre- and post Lunar New Year, but generally turned down in March after stricter safe distancing measures were implemented nationwide. Leasing enquiries fell considerably as in-person viewings were avoided. Companies became focused on contingency management, making cost optimization a priority and delaying non-essential business decisions.

SHORT-TERM RENTAL DECLINE, GOVERNMENT SUPPORT

Demand for 2020 is now expected to contract between 350,000 to 500,000 square feet, potentially bringing vacancy up to 7.7% by year-end, slightly above the long-term average of 6.6%. As demand levels fall and landlords offer greater flexibility on leases, we expect office rents to decline by between 12% to 15% in 2020. Behind some of the impact to office rents are newly- legislated government policies requiring landlords to offer rental rebates or deferrals (of up to six months) to tenants. At the same time, property tax rebates are being offered to landlords. Current estimates indicate that about 40% of small-to-medium enterprises and 20% of multi-national companies have applied for these concessions.

GOOD FUNDAMENTALS TO SUPPORT RECOVERY BY 2021

Despite the short-term weakness from COVID-19, medium-term demand-supply fundamentals in the office market remain in favor of landlords. Assuming economic conditions stabilize H2 2020, projections are for a turnaround in office rents as early as H1 2021. Rents could potentially rebound by 13% to 18% recovering lost value by mid-2022. The five-year net supply outlook is in balance with demand levels and will help support a gradual recovery in rents.

STRUCTURAL WEAKNESS IN RETAIL TO REMAIN PAST COVID-19

The structural weakness in the retail sector has been exacerbated by social distancing and government mandated closures of non- essential businesses. Despite some support by the government to businesses most severely affected, AEW expects many tenant defaults and permanent store closures of smaller businesses as cashflows dry up. Through this period, we expect malls in the city fringe to see larger rental declines of up to 10% versus suburban malls (about 5%) due to spending support from the residential catchment. Post COVID-19, we expect retail rents to stabilize, but it could take years before rents recover to pre-crisis levels.

Sources: JLL, as of March 2020

Australia

Office demand to fall significantly in 2020, landlords increase incentives to support occupancy

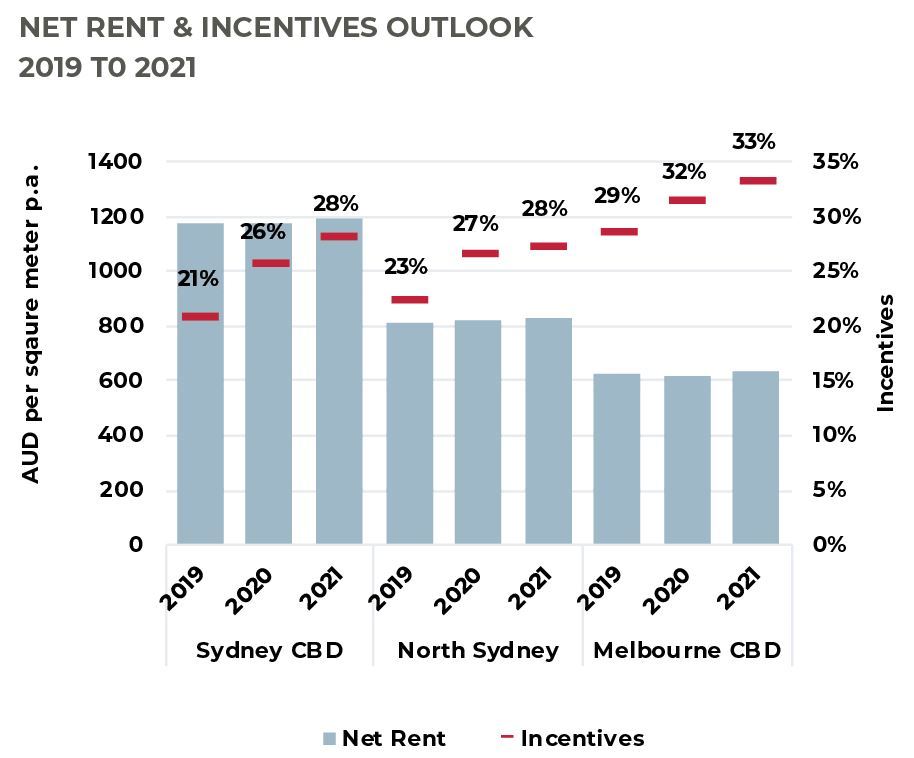

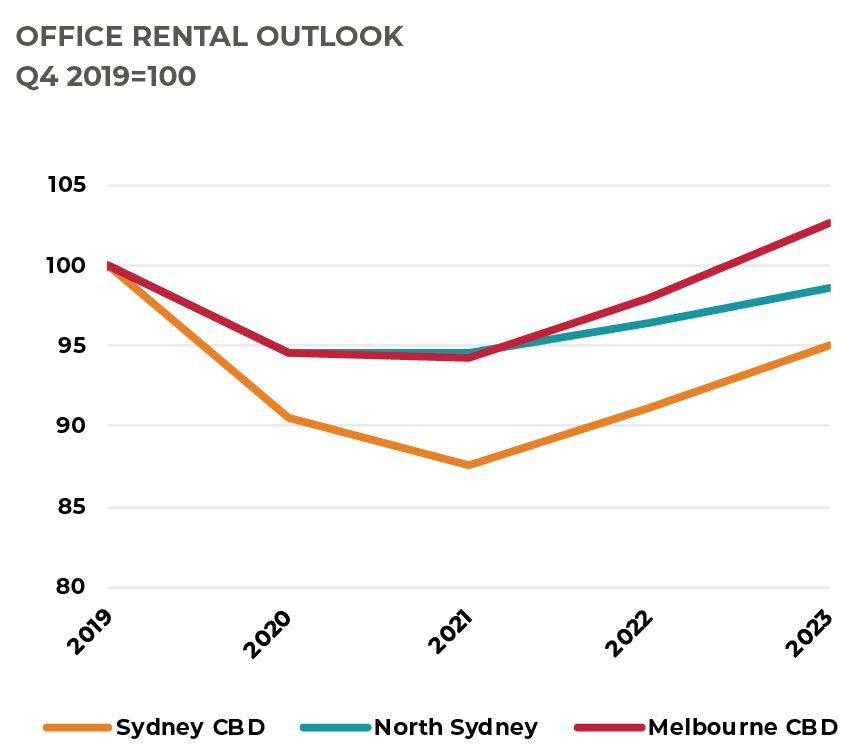

PULL BACK IN OFFICE DEMAND, LANDLORDS FLEXIBLE IN 2020

The impact of COVID-19 on leasing markets became noticeable in mid-March and will continue to affect leasing volumes in Australia for the next year, especially as the nationwide lockdown continues. By end Q1, leasing volumes were generally down 90%, and many tenants had already started asking for short-term renewals (i.e. one to two versus the typical five years) and larger rental discounts. While landlords have generally avoided giving rebates or discounts in Q1, we expect these to become common in coming months in the form of tenant incentives as was the case in previous cyclical downturns.

SYDNEY

INCENTIVE LEVELS TO INCREASE IN 2020

Current low vacancy levels in the CBD will serve as a buffer for the large pull-back in demand that is expected in 2020. Nevertheless, landlords are expected to be flexible on lease terms through this period as they attempt to maintain occupancy. Incentive levels in the CBD are expected to increase by 5 to 10 percentage-points over the course of the year, while net face rents are expected to remain flat.

Future new construction in the CBD (average 1.5 million square feet per annum from 2021 to 2024) will remain a challenge once the economy recovers. However, government efforts to fast track infrastructure projects, and the possible expansion of workplace ratios, should help to create new sources of absorption.

SYDNEY METRO MARKETS TO HOLD UP BETTER

Outside the CBD, smaller commercial precincts generally have clusters of more defensive industries that could result in these markets emerging from the COVID-19 induced downturn better. For example, North Sydney and Pyrmont are technology-rich districts, Macquarie Park holds numerous biomedical and pharmaceutical firms, and Paramatta is predominately government-related. Net effective rents in these markets are expected to decline in 2020 but could recover as early as H1 2021.

MELBOURNE CBD

VACANCY TO RISE IN 2020, IMPACT ON SECONDARY SPACE

New supply in Melbourne’s CBD will peak in 2020 with about 3.5 million square feet of space completing (95% pre-committed). The assumption of the take-up of backfill space was initially positive, but this has since been unwound as new sources of demand have dropped. While prime vacancy levels should be manageable, we expect secondary vacancy to increase by year-end, due to the substantial unleased backfill space. Like Sydney, face rents are expected to hold flat in 2020 while incentives could increase by 5 (prime) to 10 (secondary-grade) percentage-points in 2020.

Sources: JLL, as of March 2020

Capital Markets

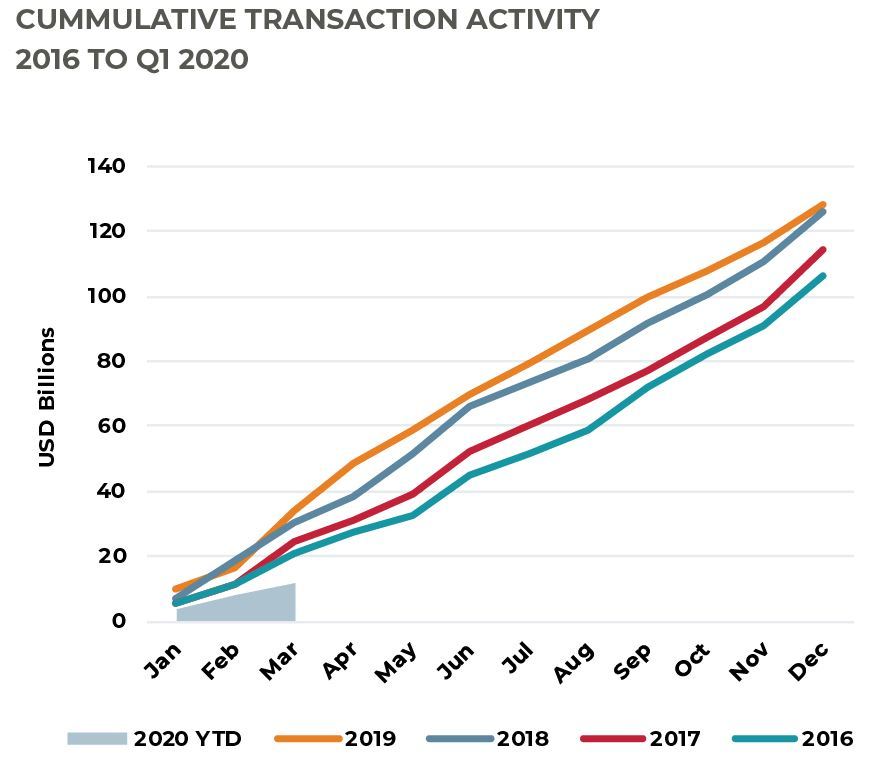

SLOW START TO THE YEAR

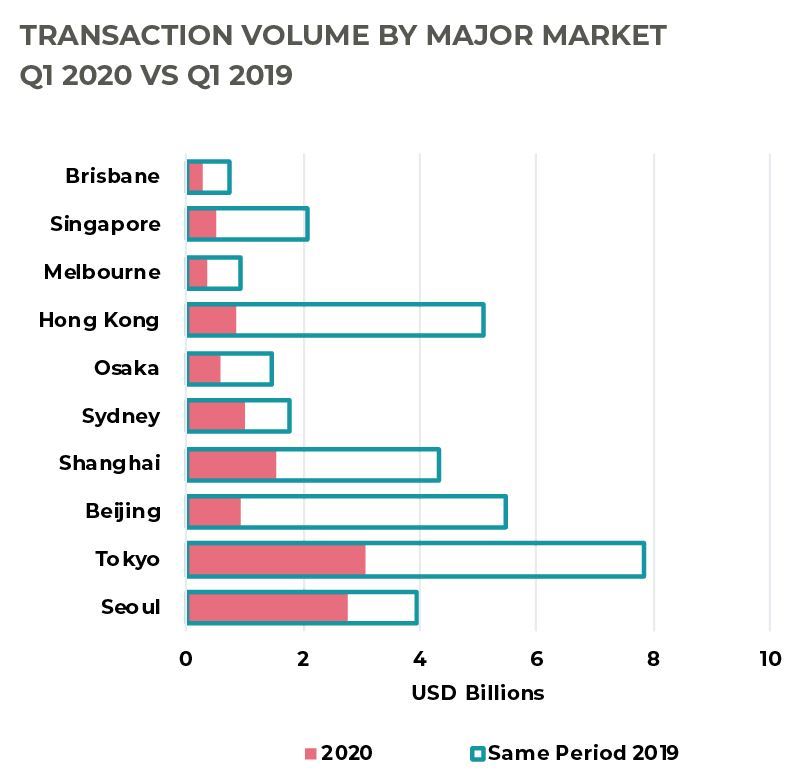

With people movement restrictions in place across several countries and investment decisions generally getting delayed, a drastic slowdown in real estate purchasing activity was expected. Income producing transaction volumes as of the end of March 2020 were down 63% compared to the same period last year for the major Asia Pacific countries. While no market was spared, evidence pointed to relatively healthy levels of activity in Seoul and Tokyo, markets typically dominated by domestic investors. Interestingly as well, even though Seoul recorded a year-on-year decline of 30% in terms of USD volumes, in terms of the number of deals, the decrease was a mere 6%, indicating an affinity for smaller-sized deals during this period of uncertainty.

Despite the slowdown in transaction activity, there were several noteworthy deals announced in Q1 such as LG Twin Towers in Beijing; The Rialto in Melbourne; and Otemachi Park Building in Tokyo. These transactions were already in negotiation for several months, prior to the outbreak of COVID-19.

BUYERS ON THE SIDELINES, DEBT REMAINS AFFORDABLE

Following the weak figures up to March, investment volumes are expected to improve H2 onwards, with parts of Asia Pacific hopefully past the worst of the virus outbreak. Further, there are many eager buyers waiting on the sides with an estimated $84 billion in dry powder from private funds in the region. Looking at larger sized deals (i.e. above $50 million) as of the end of Q1, there were close to 30 deals amounting to $7.3 billion in value that were at the “pending stage”. We expect a large proportion of these to translate to actual deals in the coming quarters.

Debt financing continues to be attractive as central banks across the region lowered base rates and encourage lending. AEW understands while lenders have generally become more stringent for specific sectors like hotels or retail, they remain accommodating on others. Further, sponsors with existing banking relationships and good track records are viewed more favorably.

EXPECT PRICING ADJUSTMENT IN SOME MARKETS

Based on deals concluded in Q1, no major pricing adjustments were noticeable in the primary markets. However, as landlords get more clarity on revised rental income assumptions in the near-term, we could see some downward adjustments in the coming months. In some markets where fundamentals remain solid (i.e. Singapore, Japan), cap rates are expected to hold steady or could even compress as the income impairment is expected to be short-lived, and the market could revert to normal operating conditions by 2021.

Source: RCA, as of Q1 2020

Note: Transaction volumes in charts above include only income producing assets in the following markets: Beijing, Brisbane, Hong Kong, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney and Tokyo

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW.