Investment Activity Picks-Up Amid Checkered Re-Opening

Multiple Lockdowns Will Not Derail Growth Prospects for the Year

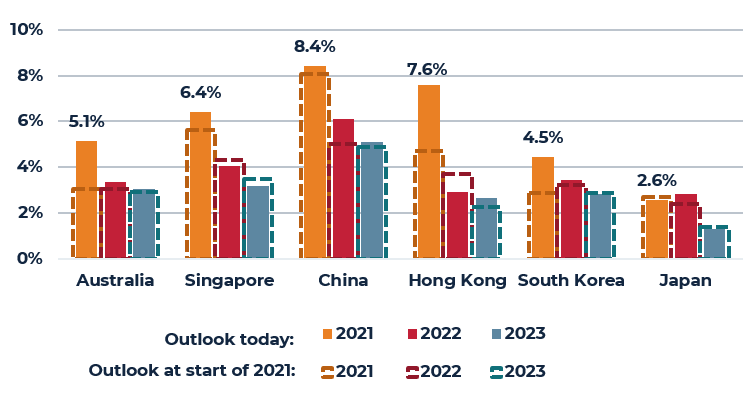

- The re-occurrence of lockdowns across multiple countries and cities in the Asia Pacific region between May and July are not expected to stymie the economic recovery for 2021. In fact, average growth forecasts across major markets in the region have been upgraded – growth in 2021 is now expected to be 5.8% year-on-year, compared to the 5.0% reported in our Q1 Asia Pacific Real Estate Perspective.

- A re-opening in terms of day-to-day movement and travel between select countries is on track for Q4, as the pace of the distribution of the vaccination has increased across developed markets in the region. Most are anticipating herd immunity by Q4 2021.

Investment Momentum Returns with Volumes Up In Most Cities, Cap Rate Compression Continues

- Government bond yields have seen divergent performance. In Australia, Hong Kong and Singapore, yields shifted downward slightly, held flat in Japan, and increased slightly in South Korea.

- Property was strongly sought after in this environment with several large deals transacting in Q2. We note that cross border participation remains below the 2018 to 2019 average, but this is likely to pick up in H2 2021 as vaccination rates improve and travel restrictions ease.

- On average, we expect a forward-looking, four-year total return from 2021 to 2024 of 6.0% to 7.0% p.a. across the major gateway markets. While the logistics sector presents the best near-term risk adjusted returns, much of the capital appreciation for the sector will be realized in 2021, and beyond that, growth levels will normalize. By 2022, an expected recovery in the office rental cycle will make the sector most attractive.

Opportunities for Varied Risk Profiles

- Most favorable leasing conditions are in the logistics sector where demand momentum continues to surprise on the upside. Because of tight vacancy and pent-up demand, pre-leasing is a prominent feature in most logistics markets today.

- We believe repositioning and redevelopment of aged stock is the best route to achieve return in the office sector as it provides some time for the leasing markets to recover. This could involve capex programs to better position the property in the leasing market, ESG upgrades, or expansion of space to achieve higher NLA.

- Challenges are still evident in retail and opportunities will be bottom-up, depending less on market trends and more on catchment/footfall, retail mix and pricing.

ASIA PACIFIC TOTAL RETURNS BY SECTOR

2015 TO 2024F

Source: AEW Research, JLL, PMA

Source: AEW Research, JLL, PMA

Economy: From Recession to Recovery

Checkered Reopenings, Pace of Vaccinations Improve

- Zero case tolerance approach in parts of Asia Pacific has resulted in a checkered reopening across the region.

- Despite many gateway markets managing a resurgence in cases in the months from May to July, the economic recovery is still well underway – growth for monitored markets in the region is expected to average 5.8% in 2021 before returning to a more stabilized level of growth of 3.0% to 3.5% p.a. from 2022 to 2024.

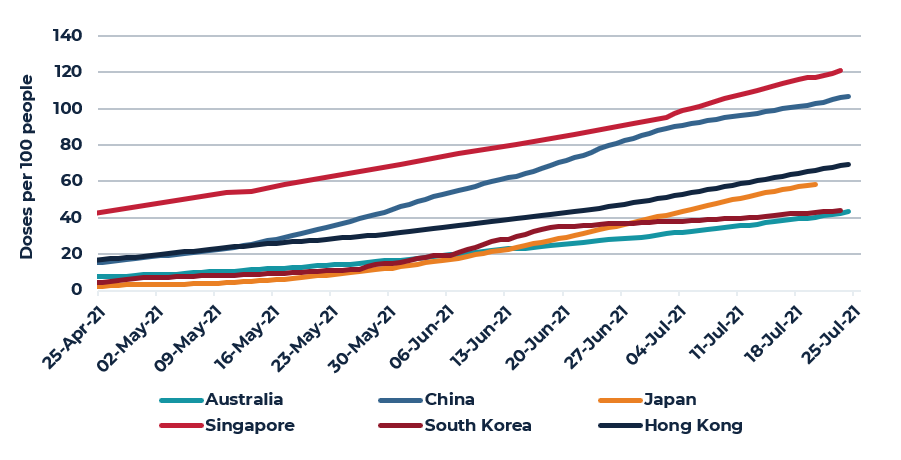

- Vaccine rollout has stepped up in June 2021, prompted by a resurgence of cases in some countries. Singapore and China are currently leading, but Japan, South Korea and Australia have ramped up the number of vaccines given per day. Most of these countries are on track to have more than 80% of their eligible populations inoculated by Q4 2021.

External Sector Rebounds Strongly, Consumption and Labor Markets Improve, Underlying Demand is Healthy

- Most economies are benefiting from a rebound in global trade and for North Asian economies in particular, we are seeing a strong demand for electronics and semi-conductors.

- Domestic demand has also been relatively healthy up to Q2 2021. High frequency indicators across consumption, retail sales and employment numbers have improved, and in Australia, China and South Korea, employment numbers are already close to or have surpassed pre-pandemic levels.

- Fiscal budgets remain expansionary in 2021 to support the economic recovery. Fresh funds directed to support households and businesses could help cushion some of the negative impacts of renewed lockdowns in Q3.

Inflation Risks Are Not An Immediate Concern

- As demand momentum improves, there are concerns about rising inflation and the follow-on central bank reaction. However, high inflation figures are likely to be temporary as the world recovers from its low-base 2020 year. Further, a sizeable output gap in most economies still exists.

- Most central banks in the region have committed to keeping policy rates highly accommodative. In July, the People’s Bank of China (PBOC), who has previously been on a moderate tightening bias, cut the RRR by 50bps, releasing about CNY 1 trillion to support the economic recovery. An exception has been the Bank of Korea (BoK) which has indicated the 25 bps rate hike in H2 2021 to manage fiscal imbalances.

- In the wake of large fiscal stimulus, favorable growth and interest rate differentials between the U.S. and Asia Pacific economies, we could experience some near-term local currency weakness.

GDP OUTLOOK, 2021 TO 2023F

Source: Oxford Economics, Our World in Data (as of 27 July 2021)

Source: Oxford Economics, Our World in Data (as of 27 July 2021)

VACCINATION PROGRESS YTD 2021

Source: Oxford Economics, Our World in Data (as of 27 July 2021)

Property Markets: Recovery Path Being Laid Out

Office

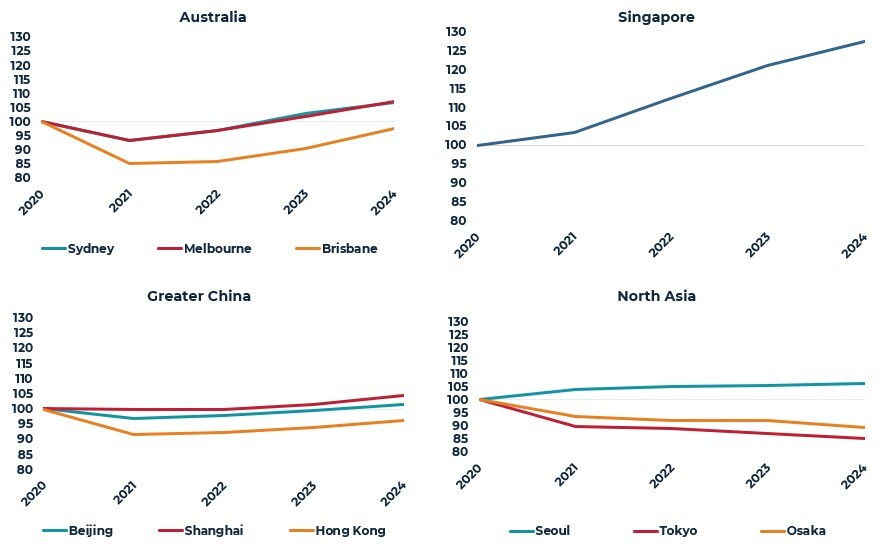

Evidence of pent-up demand in some markets should lead to improved leasing once virus is contained: There is evidence of pent-up demand in the region. Leasing sentiment surveys have indicated leasing conditions improve once the virus is contained, but quickly retreats when restrictions are reinforced. As the region collectively progresses towards vaccination targets and re-opening plans, we expect demand levels to recover strongly by 2022.

WFH impulse will be weaker in Asia, according to latest survey results: Work-from-home (WFH) fatigue is high and as a result, productivity levels have declined in 2021, compared to 2020. Based on JLL’s latest Worker Preference Barometer survey of 1,500 respondents across the Asia Pacific, the appetite for working in the home post-pandemic has decreased, and as a result a larger proportion of people, estimated at 60%, believe they will be more productive in the office.

Uneven office recovery across markets: Despite some setbacks due to renewed lockdowns in Q2 and Q3, Singapore is ahead of other markets on the rent recovery path, with gross rents bottoming out in Q2. Meanwhile, Seoul office has experienced limited impact from the pandemic, with healthy demand pushing up rents. Large supply, vacancy risk and cost-driven leasing decisions are the largest factors delaying the rent recovery in Australia, Greater China and Japan to post 2021/2022. Yet, pockets of outperformance in select submarkets in mainland China are becoming evident.

Logistics

Occupier demand exceeds expectations: As a result of the pandemic and more consumers shifting buying patterns online, e-commerce retailers, traditional retailers and 3PLs continue to increase their demand for modern logistics space. At the same time, growth in grocery sales (both online and offline) as well as additional food and medicine stockpiling has led to strong demand in the food warehousing/cold storage sector. As a result, leasing in the logistics space continues to be extremely active. Limited vacancy means more leases are being “pre-committed” in under-construction assets.

More capital turning to the logistics sector: Due to favorable dynamics on the occupier side, more capital is being re-routed to invest in the logistics sector. The weight of capital and competition for quality assets has resulted in a rapid sharpening of yields in the last 12 months. Australia has seen the sharpest yield compression, estimated at 75 bps, followed by South Korea, at 50 bps. On top of this, de-risked assets with long WALEs and in-built escalations command a significant premium, with recent transactions below 4% cap rate.

Multifamily (Japan)

Return of migration flows into larger cities expected to resume: As urban migration is a socially ingrained practice by Japanese people, there is confidence on the return of migration patterns to larger cities, once movement is less restricted, for either employment opportunities or education. Once migration patterns resume, recovery in leasing demand should follow.

Only mild decreases in rents and occupancy from lower leasing activity: The asset class remains resilient with only mild decreases in rent and occupancy since the onset of COVID-19. Due to the defensive nature of the asset class, investments into Japan multifamily have been elevated since the start of 2020. Deals in Tokyo typically account for 70% of transactions, but strong competition and compressed yields are pushing interest to regional cities where pricing is more attractive.

Retail

Limited activity, but early green shoots in some markets: While consumption and retail sales have improved from their low base in 2020, this has yet to translate to better occupier demand in the retail sector. Rents continue to face downward pressure in several markets with government-imposed restrictions and limited international tourism. Early signs of positivity in leasing markets are coming through in mainland China and Hong Kong where occupiers are taking advantage of depressed rents in the prime malls and high street shops, respectively.

Office

AUSTRALIA: Vacancy and incentives continue to increase till end 2021

- Positive forward-looking indicators (like job vacancies and hiring sentiment) will take a while to translate into healthy occupier demand. Markets are expected to remain tenant favorable and incentives will continue to increase till end 2021.

SINGAPORE: Earliest rental recovery profile in the region

- Demand momentum continued for better quality buildings, despite temporary setbacks in the country’s re-opening plan. The rental downcycle has bottomed in Q2 and the tapering net supply profile beyond 2021 will be supportive to the city’s rental recovery.

- The positive rental outlook should attract more capital interest for the rest of 2021, encouraging further price appreciation. In H1, about $2.5 billion of assets has already transacted.

HONG KONG: More confidence on return of demand from the Mainland

- Cost saving and downsizing remain key themes, but decentralization trends seem to be reducing. There is growing confidence on the return of demand from Mainland China once Hong Kong and Mainland border gates are re-opened.

- The pace of rental decline has moderated, and rents could bottom by early 2022. We expect more institutional investors to enter the market before the anticipated bottoming.

CHINA: Demand rebounds strongly bringing forward the rental recovery

- Shanghai: Leasing conditions have improved further with quarterly take-up in Q2 coming in at the highest level since 2015. As vacancy improves, rents stabilized earlier than expected with some submarkets like Qiantan and Nanjing West Rd outperforming.

- Beijing: A further uptick in leasing activity in Q2 was supported by relocation and expansion of domestic finance and Technology, Media and Telecommunication (TMT) companies. Due to growing demand momentum, vacancy risk is less of a concern. Landlords of more stable projects could start increasing rents in H2 2021.

SOUTH KOREA: Stable conditions, strong underlying investor interest

- Healthy leasing momentum continued into Q2 2021, with interest concentrated in Grade A buildings. Despite elevated vacancy in CBD and YBD submarkets, occupier demand will support steady rental growth in the near-term.

- Mirroring healthy occupier markets, investment markets have been active in 2021 with $5.5 billion invested in H1 2021. The strong competition by domestic capital has resulted in yields compressing by 15 bps in the first six months of the year.

JAPAN: Regional cities hold up better

- With more space cancellations and downsizing reported, vacancy in Tokyo has increased beyond 2%, a level not reached for several years. A rising vacancy environment in the near-term will put downward pressure on rents.

- Regional cities are expected to be more resilient due to manageable vacancy levels and fewer examples of downsizing.

OFFICE RENT INDEX (2020 TO 2024F)

2020=100

Source: JLL, as of Q2 2021

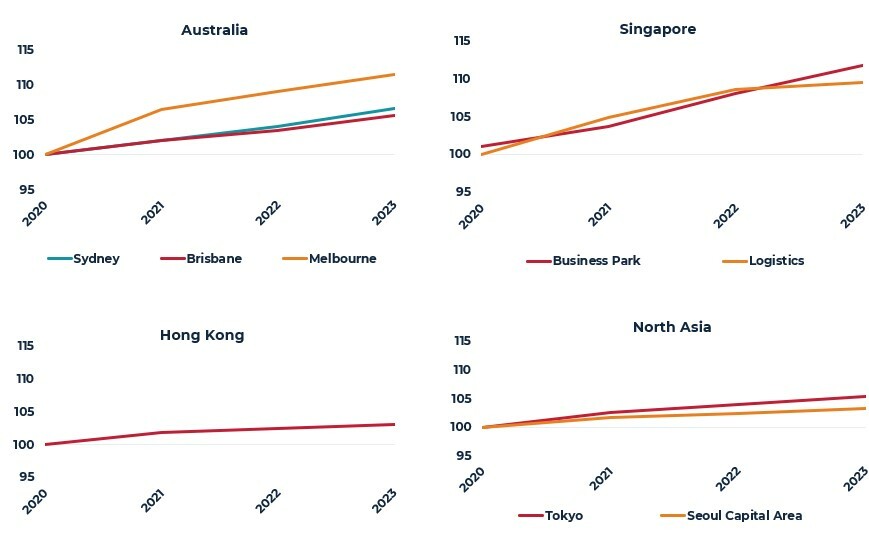

Logistics

AUSTRALIA: Significant repricing justified by stronger forecasted rental growth

- Structural tailwinds continue to drive leasing activity, with demand in H1 2021 coming in at close to double the half yearly average recorded for the past five-years. Rent growth forecasts have been further upgraded to an average 2% to 3% p.a. in the next three years.

- The underlying favorable conditions and capital interest has resulted in significant repricing in the sector, with yields contracting by 75 bps in the past 12 months.

SINGAPORE: Business Parks remain resilient, cold storage to outperform

- Business Park: Resilient segment where demand has expanded due to growth in industries like technology, precision engineering, biomedical manufacturing, as well as research and development. Good investor interest will support yield compression going forward.

- Logistics: Rent and demand trends are bifurcated between specialized and traditional facilities. Cold storage assets expected to outperform, in line with plans to position the country as a hub for the storage, distribution and shipment of vaccines.

HONG KONG: Investment increases as the sector offers good return prospects

- A recovery in trade momentum and local demand has boosted leasing activity in Q2. Rent growth forecasts have been upgraded.

- As the sector has the best near-term growth fundamentals (vs office and retail), liquidity is high at $1.9 billion, tracking ahead of previous years’ volumes. Some enbloc deals are expected to take advantage of the industrial revitalization scheme, reintroduced in 2019.

SOUTH KOREA: More forward-funding opportunities coming to market

- Large supply is being met with strong demand as e-commerce firms expand aggressively and fight for market share. Due to limited vacancy, pre-leasing activity is rampant, lowering concerns over excess supply in the West and South East submarkets.

- Greater Seoul Logistics presents one of the stronger total return forecasts across developed markets in the region, averaging 10.6% p.a. from 2021 to 2024. This strong return outlook is front loaded and driven by extremely strong capital value growth in 2021.

JAPAN: Modern stock limited, still good demand for Grade B facilities

- Strong expansion demand from e-commerce firms and retailers are benefiting from modern or newly constructed assets.

- A large proportion of older stock exists, typically leased to cost-conscious businesses. While rent growth potential is minimal, these assets are affordable on a per square foot basis and some will benefit from value-add upgrades.

LOGISTICS RENT INDEX (2020 TO 2023F)

2020=100

Source: JLL, as of Q2 2021

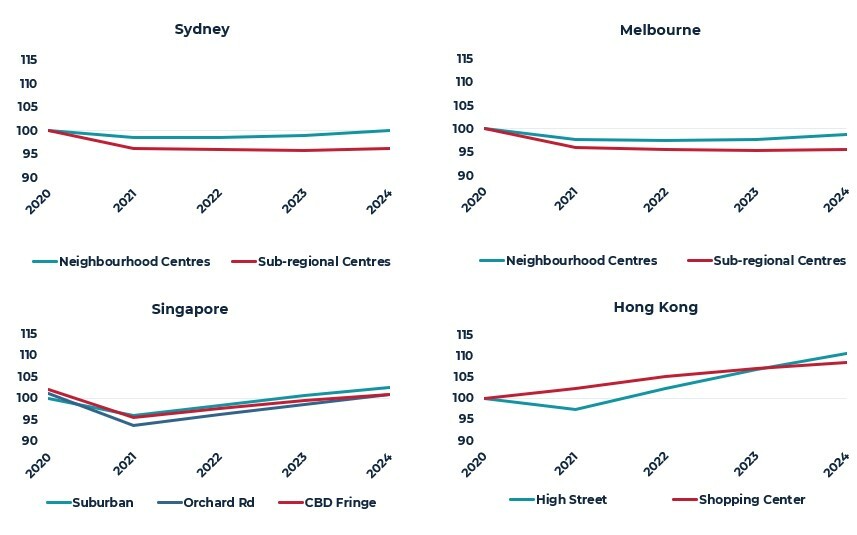

Retail

AUSTRALIA: Capital favors non-discretionary anchored centers

- Rents continue to decline across all major subsectors amid more store closures and bankruptcies.

- Capital favors the non-discretionary anchored centers (neighborhood and large format retail) based on current spending habits and as WFH arrangements persist.

- For discretionary retail exposure, most investors are still sitting on the sidelines due to uncertainty on the structural reset in rents and future occupier demand.

SINGAPORE: Suburban malls hold up, but near-term rental growth is unlikely

- The lack of tourism and default WFH status for the majority of Q2 has continued to pressure rents in the Orchard Road and CBD fringe locations.

- Suburban retail remains attractive, due to stable demand and good customer traffic. Still, value-add or repositioning strategies are preferred as the sector is unlikely to see organic rental growth in the next two years.

HONG KONG: Improving demand in high street

- After almost two years of weak leasing and six years of consistent rental decline, the high street market is seeing demand return. Leasing is driven by local retailers who can secure leases at affordable rates.

- At the strata-end of the market, there has been a strong return in activity, probably due to the combined positive effects of the removal of the Double Stamp Duty (DSD) and some good discounts available.

RETAIL RENT INDEX (2020 TO 2024F)

2020=100

Source: JLL, as of Q2 2021

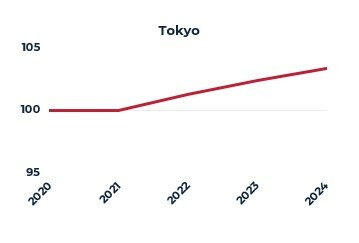

Multifamily

JAPAN: Leasing demand holds up better in regional cities

- Tokyo net migration numbers through to June are below historical trends. The lack of new migrants has put an interim damper on leasing demand.

- Compared to Tokyo, net migration flows in regional cities have been less impacted by COVID-19 and as a result, cities like Yokohama and Osaka have had better leasing momentum in the past 12 months.

- Strong competition and compressed yields in Tokyo have pushed interest to regional cities where pricing is more attractive. Regional cities have yield premiums of about 50 to 100 bps compared to Tokyo.

MULTIFAMILY RENT INDEX (2020 TO 2024F)

2020=100

Source: PMA

For more information, please contact:

GLYN NELSON

Director of Research, Asia Pacific

glyn.nelson@aew.com

+65.6303.9016

HANNA SAFDAR

Research Associate, Asia Pacific

hanna.safdar@aew.com

+65.6303.9014

ANNA CHEW

Investor Relations, Asia Pacific

anna.chew@aew.com

+852.2107.3511

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW.