- On the back of this changing macro-economic outlook, continued political uncertainty around Brexit and disappointing corporate earnings, most European government bond yields have come down over the last six months.

- In addition, current swap market pricing implies that government bond yields will stay lower for longer and not widen as much over the next five years compared to our base case forecasts.

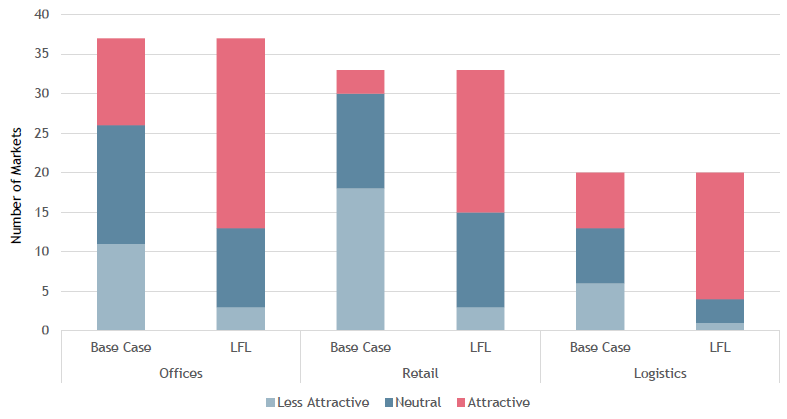

- Based on these recent economic and market trends, we consider a lower-for-longer (LFL) scenario, where we assume that property yields widen in-line with current swap pricing, albeit 41% less quickly than our base case.

- There are two main results. First, with lower spot bond yields, the required rate of returns have come down for both the base case and LFL scenario, using our required and expected rate of return framework as outlined in our Annual Outlook 2019.

- Second, in our LFL scenario 58 of 90 markets are now rated attractive compared to 21 in our base case. This is due to the fact that in the LFL scenario rental growth more easily offsets slower property yield widening compared to the base case.

LOWER FOR LONGER SCENARIO SHIFTS MANY MARKETS INTO ATTRACTIVE CATEGORY

Sources: CBRE, RCA, MSCI, Natixis & AEW Research

The information and opinions presented in this research piece have been prepared internally and/or obtained from sources which AEW believes to be reliable; however, AEW does not guarantee the accuracy, adequacy, or completeness of such information.