HOW CAN INVESTORS USE FACTOR INVESTING IN EUROPEAN OFFICES?

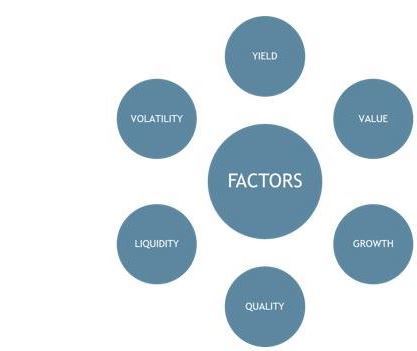

Factor investing is an investment approach successfully used in fixed income and equity investment management. It is based on academic work by Fama & French (1993) among many others. The approach identifies multiple factors that explain excess returns compared to the market portfolio. Initially these factors focused on small caps, value and growth stocks, but then expanded in scope. By identifying the most relevant underlying factors, investors can benefit from market inefficiencies in a rules-based and transparent way. If you consistently select stocks, bonds or sectors whose performance have been driven most by factors delivering excess return, you should beat the market benchmark in the long term. These so-called smart beta strategies use factors such as volatility, liquidity, quality, value, yield and growth. In this report, we apply this factor investing approach to close to 40 European office markets for the first time. We will also compare factor investing to the traditional core and value add investment styles.

FACTORS USED IN FACTOR INVESTING FRAMEWORK

Source: AEW

EXECUTIVE SUMMARY

In this report, we apply our new factor investing approach to close to 40 European office markets for the first time. This framework quantifies factors such as Volatility, Liquidity, Quality, Value, Yield and Growth. A comparison of our factor investing results to the traditional “core” and “value-add” investment styles is also provided.

- Our three steps factor investing framework (1) defines the six most relevant conceptual factors; (2) selects the most appropriate available data series to represent each factor and identifies each market’s exposure to the same factors; and (3) creates a historical total return series based on the top markets per factor for each quarter.

- Our key results for both risk and return across our six different factor office portfolios are as follows:

- Growth and Value outperformed the Universe for the three periods (2003-07, 2008-13 and 2014-18) considered;

- Growth was well ahead of Value in all three periods;

- Quality and Yield performed well in the earlier upcycle of 2003-07 also;

- Low Volatility performed particularly well with low risk and good returns during the down cycle in 2008-13;

- Yield performance suffered especially during the GFC period, compared to the other factor portfolios.

- To put our new factor-based investing results into the context of our traditional core and value-add investment styles, we selected two factors that in our view best fit with these styles. In our view, Quality and Liquidity are the best factors for “core” style investing while Growth and Value fit best with the traditional “value-add” style.

- Surprisingly, we find a consistently higher risk for “core” than “value-add” for each of the three distinct periods. Only in the 2008-13 downturn period did the core office market portfolio show better returns than “value-add”.

READ THE FULL REPORT

The information and opinions presented in this research piece have been prepared internally and/or obtained from sources which AEW believes to be reliable; however, AEW does not guarantee the accuracy, adequacy, or completeness of such information.