Update on Real Estate Markets and Where they are Going

During 2020, the investment climate was impacted by twin storms, a global economic recession and uncertainty from an unprecedented pandemic. While this made investing challenging for a short period, the climate has now shifted. The first half of 2021 showed how the recovery took hold and the region progressed. As we close out the balance of the year, much of the Asia Pacific region continues to move on and beyond. Looking out several more years, the real estate markets are poised to continue to outperform due to three main capital market themes that will continue to drive returns, as laid out in Figure 1. None of these capital market trends should be a surprise to seasoned investors, but they remain fundamental to the outlook.

FIGURE 1

THREE KEY CAPITAL MARKET THEMES

Source: AEW Research and Strategy

This paper will start with a brief look back at the recent past to set the scene for what is to come. It will then look at what’s next and take a deeper look at the key trends and investment themes in each of the major real estate sectors. The paper builds towards the conclusion that while the pandemic accelerated many trends, the market outlook is supportive and provides the base for investors to link specific opportunities together to build portfolio outperformance.

How Did We Get Here?

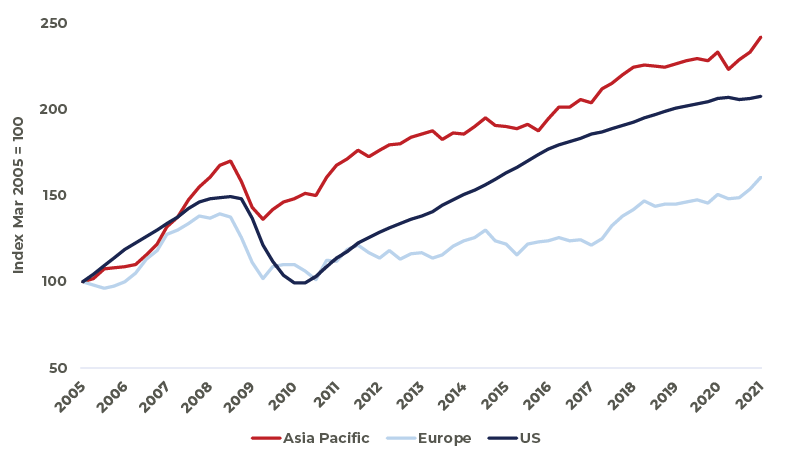

Asia Pacific real estate markets went into the pandemic on a solid footing. This meant the recovery had good foundations to build upon. Figure 2 shows the region’s strong total return profile over the 2005 to 2021 period which includes the 2009 Global Financial Crisis (GFC) and 2020 COVID-19 pandemic. There were many market features producing this performance.

At the end of 2019, ahead of the pandemic dominated 2020, office was the star sector. Vacancy rates were low, and corporate occupier demand was strong. The shift of investment sentiment towards logistics was gradually underway and some investors were making defensive allocations to sectors like Japan multifamily. Retail was bifurcated between good operating performance for grocery-anchored centers and challenging conditions for larger discretionary centers competing with online sales growth.

FIGURE 2

GLOBAL TOTAL RETURN INDEX, 2005 TO 2021

Source: Global Real Estate Fund Index (GREFI)

Prior to the pandemic there were several questions about late cycle investing and concerns that pricing was overly stretched. History has shown that a byproduct of downcycles is they can often help to remove any imbalances that may have formed. While capital values have been surprisingly resilient given the circumstances over the past year or so, there has been the opportunity for the market to rethink pricing expectations.

Examples of stress were evident, but they were not widespread. At the same time some corporates have looked to release value stored in real estate through sale and leaseback activity. We’ve seen examples of this in Australia, Japan and China.

What’s Next?

Allocations drive most of the long-term return of a real estate portfolio historically1, through relative weighting in strong or weak sectors of the market. Looking forward, the big question influencing allocation is ‘where are we in the macro property cycle?’. Are the markets at the beginning of another multi-year growth period or is something else in order?

In order to look for an answer, we will use the three key capital market themes to investigate what’s ahead in the cycle.

Yields in the region are attractive

There are several signs today that suggest the markets could continue to grow for many more years.

Leading the list is real estate’s positive yield spread over the risk-free and corporate bond alternatives, see Figure 3 for the spread of the average property yield over government bonds. With growing portfolio values and higher real estate allocations, global multi-asset investors will build on their real estate investments through either direct deals or commitments to funds or managers.

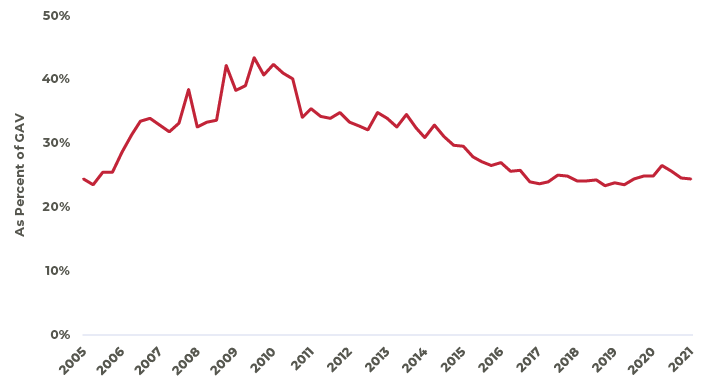

FIGURE 3

ASIA PACIFIC, PROPERTY YIELD SPREAD TO 10-YEAR GOVERNMENT BOND, 2005 TO 2021

Source: JLL, PMA, Oxford Economics

Target allocations have now increased to 10.9%2, posting seven consecutive years of annual increases. Asia Pacific institutions have the widest spread between their target and actual allocations at 400 basis points3. It is AEW’s view the weight of capital chasing a limited set of assets will only increase.

Low Short Rates to Continue

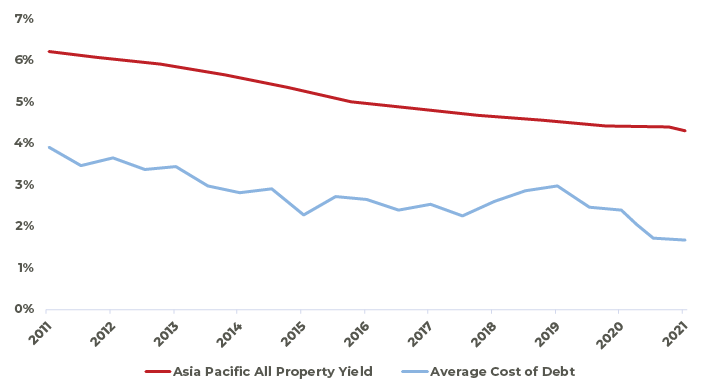

At the other end of the yield curve, the average cost of debt has reduced as base interest rates fell, supporting leveraged returns, see Figure 4. Looking forward this will remain in place as the ‘lower-for-longer’ environment is projected to continue. Central Banks have their policies set about as accommodatively as they can be. With modest medium-term inflation projections4, banks will likely keep the short end of the curve low, even if they were to gently raise policy rates as part of a normalization program.

FIGURE 4

ASIA PACIFIC ALL PROPERTY YIELD AND COST OF DEBT FINANCING, 2011 TO 2021

Source: PMA, JLL, AEW Research

Notes: simple average of Australia, Singapore, Hong Kong, Korea and Japan

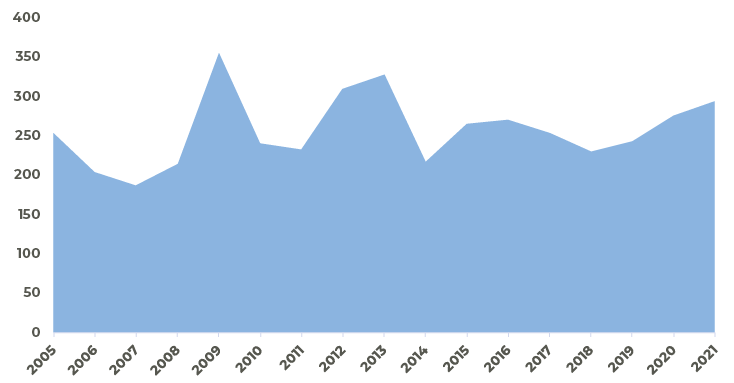

Alongside this, it is interesting to note the use of leverage has been contained in recent years, despite its low cost (Figure 5). This speaks to an improved borrowing discipline compared to pre-GFC years by both investors and lenders as well as the successful effects of macroprudential rules in some countries to limit systemic risk.

FIGURE 5

AVERAGE GEARING LEVELS OF ASIA PACIFIC FUNDS, 2005 TO 2021

Source: ANREV

Economic Expansion is the Foundation for NOI growth

The final reason for expecting an extended firming of pricing in the region is continued economic expansion. Current forecasts have Asia Pacific’s GDP growing by 21% in the 2020 to 2024 period and 43% in the full 2020 decade. This growth will have significant implications - creating tens of millions of jobs, expanding the middle class’s income and wealth, and also generating considerable occupier demand for institutional commercial space. This will create a better balance between tenant and landlords, reducing incentives and vacancy and generating rental growth. NOI growth is built off these fundamentals.

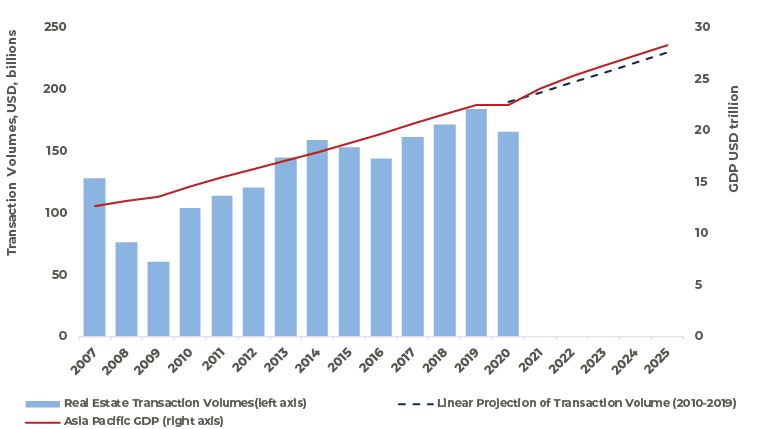

As a result, a much more active transaction market is anticipated. Higher allocations and favorable financing conditions along with economic growth expanding occupier demand will create a much more active capital market. Figure 6 shows the direction transaction activity could head by showing the close relationship between GDP and property market liquidity. As a check, a linear projection of transaction volumes shows a similar path as the GDP forecast indicates.

FIGURE 6

COMMERCIAL INCOME-PRODUCING REAL ESTATE TRANSACTION ACTIVITY AND GDP, 2007 TO 2025

Source: Oxford Economics, Real Capital Analytics, AEW Research

Sectoral Dive

Click on box to skip to content

Office – entering an upswing with more options available

In the near-term there are several supportive factors for the office sector. By mid-2021 employment in many countries is already close to, or has surpassed pre-pandemic levels (Australia, China, South Korea). There have also been several encouraging signs in the form of positive leasing inquiry and site inspection growth, suggesting a weight of occupier demand ready to be released.

Today’s higher-than-average vacancy and incentives make many markets tenant favorable. The rental recovery trajectory will be determined by each market’s supply cycle.

Use Singapore as an example of an early recovery. CBD vacancy peaked at slightly higher than the ten-year average in June 2021 and the five-year net supply outlook is 35% lower than the past five-year period. As a result, rents will start to rise again from late 2021 and growth will continue through to the mid-2020s.

Work-From-Home in Asia Pacific

AEW does not expect voluntary WFH to be a significant feature in the Asia Pacific region. There are household composition and cultural factors against the idea taking hold, including small apartment sizes and multi-generation households.

There is also a preference by employees to be in the office with 60%1 saying they felt more productive there. Similarly, 77% of senior management encourage or require employees to work in the office2.

Asia Pacific has spent billions on critical transport infrastructure which means most cities have very efficient and effective public transport networks, making it easy to get to office districts.

At AEW, while we expect voluntary WFH to be more common than before COVID in some markets, we do not see it affecting occupier demand for office space in a meaningful way over the next several years. Offsetting any demand contraction from WFH practices are likely de-densification trends and service sector employment growth (more than 55 million jobs over the 2021 to 2025 period).

1 JLL Worker Preference Barometer survey July 2021

2 CBRE Asia Pacific Occupier Survey July 2021

In contrast, office markets like Hong Kong and Tokyo have vacancy rates increasing with a lot of supply on the horizon. Current projections have rents continuing to be flat or falling through 2022 at least.

Worldwide many questions are being asked about work-from-home (WFH) and the role of office space in the future. These are great conversations to have and show the responsiveness of the industry to changing client needs. We highlight here the many reasons WFH is not expected to be a significant feature in the Asia Pacific region.

Lastly, capital interest in the office sector is evolving. Where it was once tall towers in CBDs, institutional investors are expanding to include business parks, medical office, industrial office, as well as suburban or metro markets. This wider set of office-based assets illustrates the next phase forward in the region’s maturity. They also represent underlying trends like the growth of the life sciences industry, improving portfolio diversification by targeting local firms in suburban locations as well as demographic trends. These non-CBD locations are of more interest to global institutional investors due to sustained transport infrastructure investment by cities improving commuter access as well as enhanced urban design, better streetscapes and improved retail amenity. Combined they improved the institutional nature of these districts.

Residential – expanding universe presenting opportunities

Residential assets are often the most stable due to their necessity characteristics. Japan’s multifamily sector has shown this key characteristic during both the GFC and 2020’s COVID pandemic. During the GFC Japan multifamily rents fell only half as much as office rents5. More recently despite domestic migration patterns being disrupted, occupancy has been consistent in the mid-90% range.

Other key attributes attracting a significant amount of domestic and foreign capital include an expectation of a return to net positive migration flows to major cities, an increase in one- or two-person households (most migrants are single or childless couples) and declining construction of for-rent apartments. All these favorable fundamentals are built on top of an environment where the propensity to rent is high and rental levels are fairly affordable.

Other parts of the residential sector require a longer investment timeframe. For example, student housing in Australia will start to recover when borders open, allowing foreign students to return. This could be as early as 2022, but it will take some time before the sector shows a meaningful recovery in income and values. In Japan, senior housing represents an opportunity to secure a residential asset with a long corporate master lease at a yield premium to multifamily. It would suit investors looking to add long, secure income to their Asia Pacific portfolio.

There are two emerging multifamily sectors forming in China and Australia. While different from each other in many ways, they represent an increase in the opportunity set for investors wanting to target income-producing residential assets in addition to what’s available in Japan. Access is currently through a creation strategy. In the case of China, it is typical to redevelop existing stock (change of use) into multifamily properties while in Australia they tend to be purpose-built communities.

There are two emerging multifamily sectors forming in China and Australia. While different from each other in many ways, they represent an increase in the opportunity set for investors wanting to target income-producing residential assets in addition to what’s available in Japan. Access is currently through a creation strategy. In the case of China, it is typical to redevelop existing stock (change of use) into multifamily properties while in Australia they tend to be purpose-built communities.

Lastly, parts of the residential sector such as Australia and China multifamily as well as potentially senior housing in Japan or student housing in Australia, are structured with an important operational component. Controlling the vertical operations associated with these assets can bring benefits with respect to sourcing, in addition to providing the management services for the communities, from leasing and facility management through to ongoing repairs and maintenance. Investors may also benefit from a more efficient fee structure versus a traditional joint venture, as well as ownership in a scalable business or platform, overseen by a fiduciary, with future and highly aligned growth prospects.

Industrial & Logistics – outperformance to continue

Structural tailwinds will propel this sector forward for several more years. Strong levels of demand will ensure that the supply in the pipeline is absorbed. With vacancy remaining low, it is likely that rents will grow faster than historical trends. E-commerce tenants are proving to be less price sensitive and more willing to accept higher rents for space that fit their requirements. This is perhaps because of the industry’s rapid expansion, but also because of the lack of modern logistics facilities in many cities.

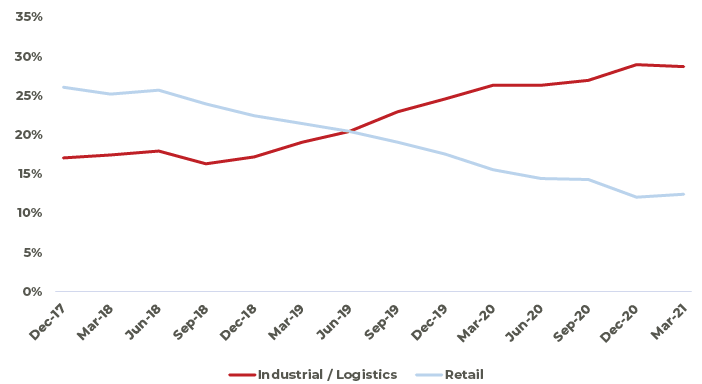

By one estimate, USD 12 billion has been raised for logistics in the Asia Pacific region during 20206. More will be raised in 2021. Repricing in the sector has been a key theme over the past year or so, and expectations are there is further to go. In some cases, yields have reduced below office as investors increase their portfolio allocations to the sector (see Figure 7). Where once investors targeted Asia Pacific consumption growth through shopping centers, they now target the same trend through logistics facilities.

By one estimate, USD 12 billion has been raised for logistics in the Asia Pacific region during 20206. More will be raised in 2021. Repricing in the sector has been a key theme over the past year or so, and expectations are there is further to go. In some cases, yields have reduced below office as investors increase their portfolio allocations to the sector (see Figure 7). Where once investors targeted Asia Pacific consumption growth through shopping centers, they now target the same trend through logistics facilities.

FIGURE 7

ASIA PACIFIC ODCE ALLOCATIONS TO INDUSTRIAL/LOGISTICS AND RETAIL SECTORS, 2017 TO 2021

Source: ANREV

The industrial and logistics sector will continue to be preferred by many investors. In all likelihood, it will become the second most traded income-producing asset class behind office, overtaking retail. As it continues to expand and mature, the region can look to examples of upgrading and repurposing from the U.S. as a possible new investment theme. New construction will continue but as prime land becomes less available, renewal options will have to be evaluated.

Looking ahead, AEW anticipates industrial total returns to lead the way. This is due in large part to 2021’s outstanding capital value growth. But even in the 2022 to 2024 period, the sector is projected to outperform.

Retail – coming out stronger?

Retail has had a very challenging operating environment over the past several years due to competition from online alternatives, and more recently disruption from the pandemic. Positively, the region benefits from not being overly built with malls and high consumption growth. There will continue to be a place for malls in new consumer buying patterns. For example, investors have shown confidence in grocery-anchored, suburban malls – a defensive theme that has been around for many years. These types of assets typically have limited department store and specialty store exposure which carry higher tenant covenant risk. Without these, grocery-anchored malls offer better income certainty.

When the region reopens, retail will benefit from the return of international travel, pent up demand for services, as well as the higher potential spending power due to accumulated savings. Retail investing in Asia Pacific tends to be concentrated in dense urban cities which will be among the first to benefit from a post-pandemic world. Investors will need to decide if they want to seek discretionary, necessity or a mix of both types of spending patterns as they navigate the next several years.

When the region reopens, retail will benefit from the return of international travel, pent up demand for services, as well as the higher potential spending power due to accumulated savings. Retail investing in Asia Pacific tends to be concentrated in dense urban cities which will be among the first to benefit from a post-pandemic world. Investors will need to decide if they want to seek discretionary, necessity or a mix of both types of spending patterns as they navigate the next several years.

Successful future malls will need to be highly responsive to their catchments, balancing the tenant mix appropriately. Owners will need to ensure continued capital expenditure programs keep the environment enticing and efficient – shoppers need a reason to go to malls and the experience needs to be enjoyable. Further, customers are becoming more decerning with their spend. Owners will also need to upgrade systems to ensure appropriate ESG ratings are met as malls tend to be more highly visible to local communities when compared to office towers.

Lastly, it will be interesting to observe what happens to mall income. Prior to the pandemic many landlords were accepting higher proportions of turnover rent. Will they be as keen to accept non-fixed rate rent going forward? Income may need to be diversified with more focus on promotion space, advertising revenue and possible alternative uses for parts of the mall. We have seen examples of malls repositioning space for office use (usually in the form of coworking) and there could be transitions to last mile facilities like in the case of dark stores which proved effective early in the pandemic. This is in addition to the experience transition already underway.

Conclusion

The pandemic accelerated many preexisting trends and created a few new ones. AEW believes, post-pandemic investing will look more diversified than in the years leading up to it – be it geographically, by sector or thematically.

With supportive capital market metrics and a highly active investor base, there will be increased competition for good opportunities across the risk spectrum. Long, solid income is being well priced by core capital. At the same time, return seeking investors are finding many opportunities to secure assets with a value creation strategy.

At the market level, the AEW Risk-Adjusted Return Model indicates most of the region will provide better than required returns, with investments paying for market risks. At the asset level, outperformance is available, but likely needing multiple favorable attributes to achieve it.

As we move post-pandemic and learn to live with an endemic COVID-19, there are multiple opportunities in the Asia Pacific property markets. The right path forward is identifying these and steering portfolios to take advantage of them.

1 Real Estate Asset Selection Mattered — Especially in a Crisis. MSCI, May 14 2020

2 2020 Institutional Real Estate Allocations Monitor

3 2020 Institutional Real Estate Allocations Monitor

4 Average Asia Pacific CPI inflation is 2% p.a. in the 2021 to 2025 period

5 Source is The Association of Real Estate Securitization ARES Japan Property Index rental series. Rental decline measured using highest and lowest rent during the 2008 to 2012 period.

6 Logistics Asia-Pacific: ‘We have years to run with this’. By Florence Chong July / August 2021, IPE Real Assets

For more information, please contact:

GLYN NELSON

Director, Head of Research & Strategy, Asia Pacific

glyn.nelson@aew.com

+65.6303.9016

HANNA SAFDAR

Assistant Director, Research & Strategy, Asia Pacific

hanna.safdar@aew.com

+65.6303.9014

ANNA CHEW

Associate Director, Investor Relations, Asia Pacific

anna.chew@aew.com

+852.2107.3511

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW.