WEEK OF APRIL 27

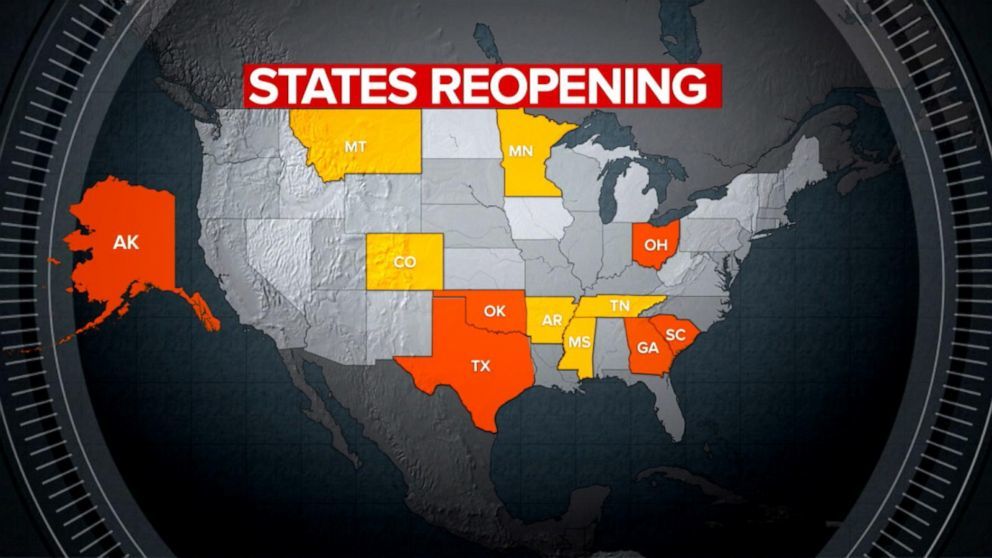

The latest data being released illustrates the immense impact that broad based social distancing has had on wide swathes of the economy. These measures, while unfavorable to the nation’s economy, have largely worked to slow the growth rate of new infections, and have generally kept levels below which most hospital systems are overwhelmed. Overall, new confirmed COVID-19 cases have remained between 25,000 and 30,000 per day for several weeks. Reflecting this, several states, primarily in the South and Midwest, have announced the beginning of gradual easing of social distancing guidelines and re-opening of some businesses while other states, primarily in the Northeast and West Coast, remain under relatively strict social distancing requirements. Moving forward, state-by-state decisions regarding the re-opening of economies will likely produce a wide range of public health and economic outcomes that will both inform and potentially complicate decisions by policy makers and multi-jurisdiction employers.

Source: ABC News

U.S. ENTERING SHARP AND SEVERE RECESSION BUT FOR HOW LONG?

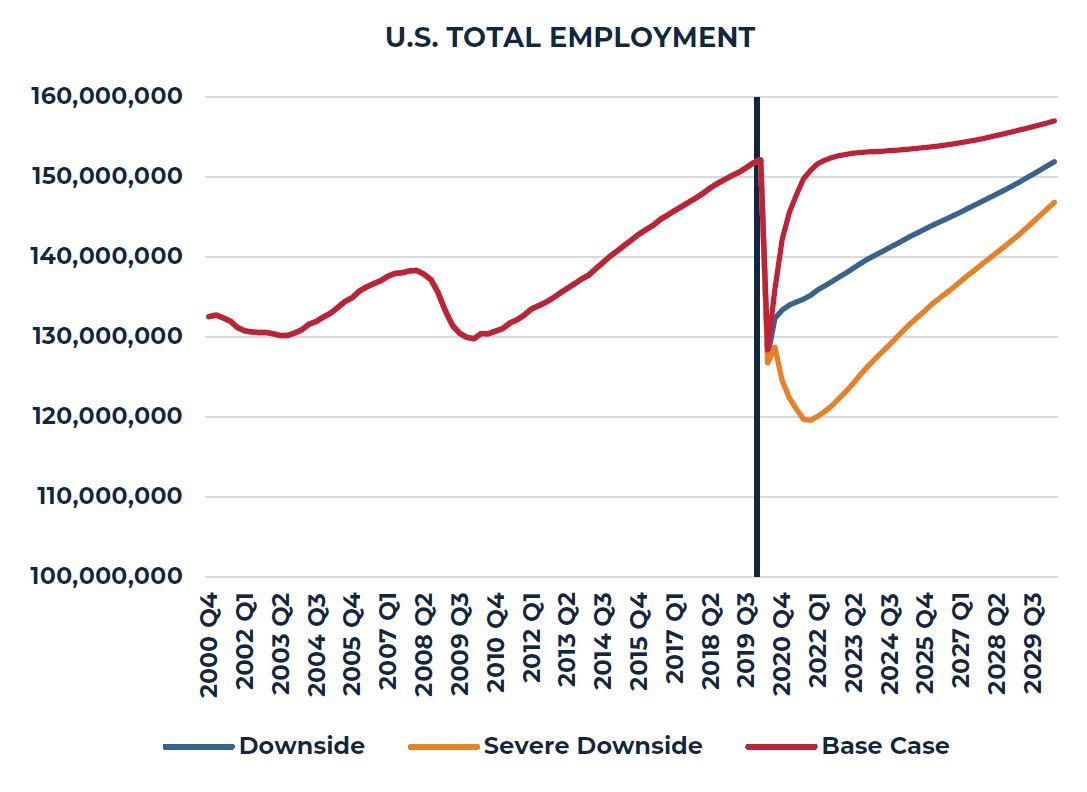

Since mid-March, more than 26 million Americans have filed a new claim for unemployment insurance with more than 6.8 million new claims filed in one week alone. Over the prior 50 years, the highest single week totaled less than 700,000. Current forecasts assume that the U.S. economy will lose 23-25 million jobs in the second quarter. The shape of any recovery following Q2 depends largely on the efficacy of the U.S. public health system to accelerate the slowdown of the virus’ spread, the public’s confidence in this effort, and their resulting willingness to resume some level of economic activity. The best case scenario for the U.S. economy would obviously be a strong V-shaped recovery that assumes well-executed virus containment and rapid resumption of ordinary economic and social activities.

Source: Oxford Economics, CoStar

IMPACT ON PROPERTY FUNDAMENTALS

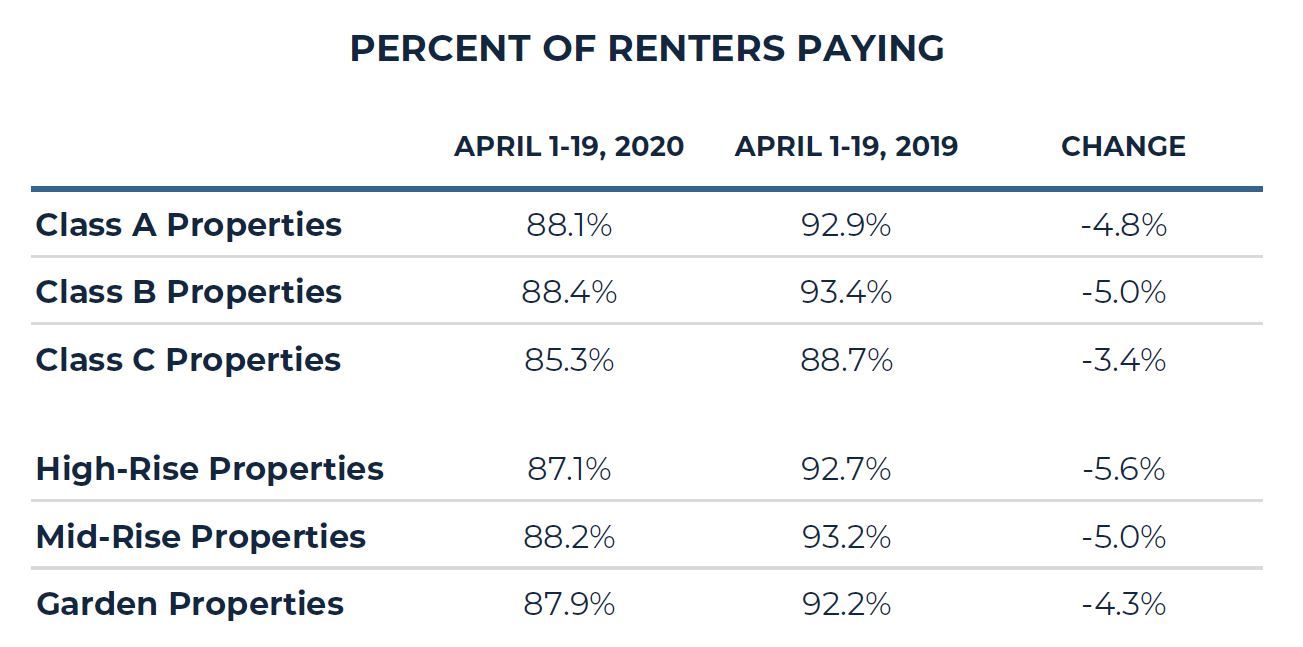

The widespread and severe economic impacts of the COVID-19 pandemic did not erupt in earnest in the U.S. until well into March. As such, the full impact on property markets is just beginning to be revealed. Obviously, the near-term impact on operating fundamentals of properties such as hotels and non-essential retail which are now shuttered will be significant. The effects on other major property types will likely be less severe and more varied. For example, April rent collections in apartment properties, while down compared with the same period last year, was not as dramatic as might have been expected. In part, this might reflect the timing of the surge in unemployment happening largely in the second half of March, as well as, the government’s hastily enacted, large scale cash transfer program to expedite and supplement unemployment compensation.

Source: Real Page

NOI RECESSION OR SOMETHING MORE?

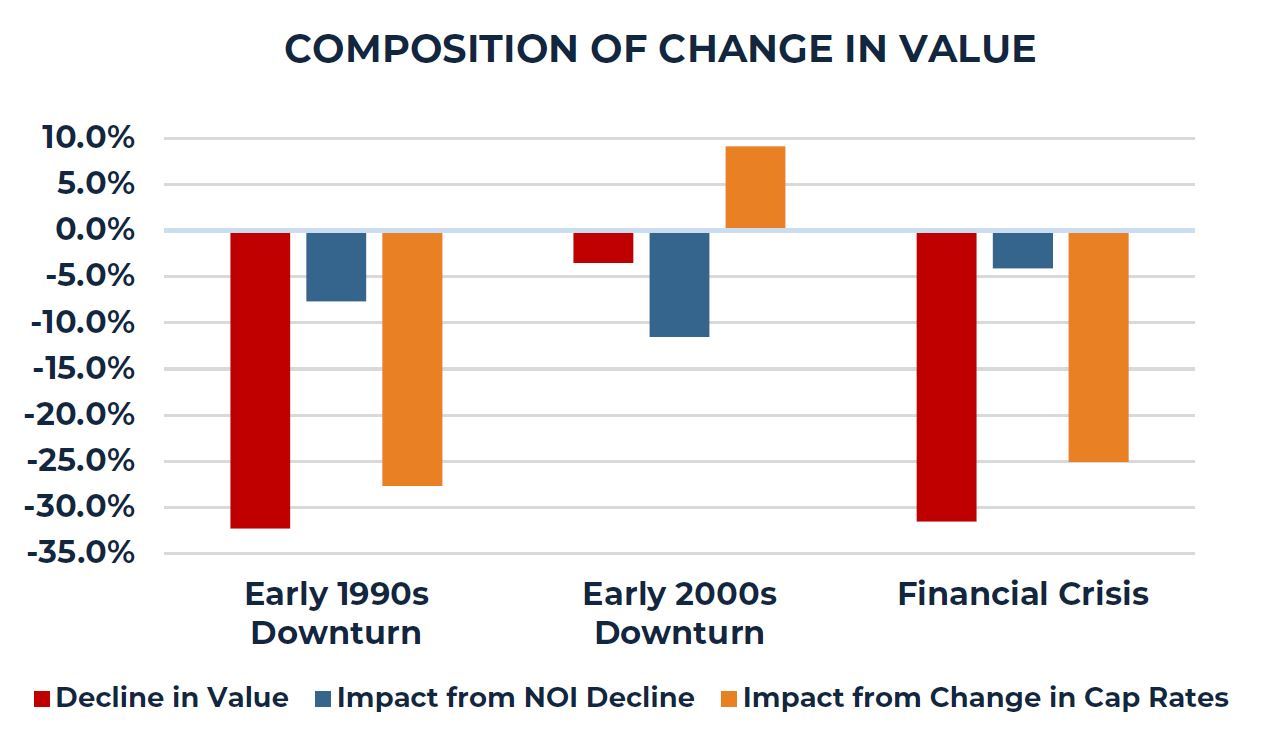

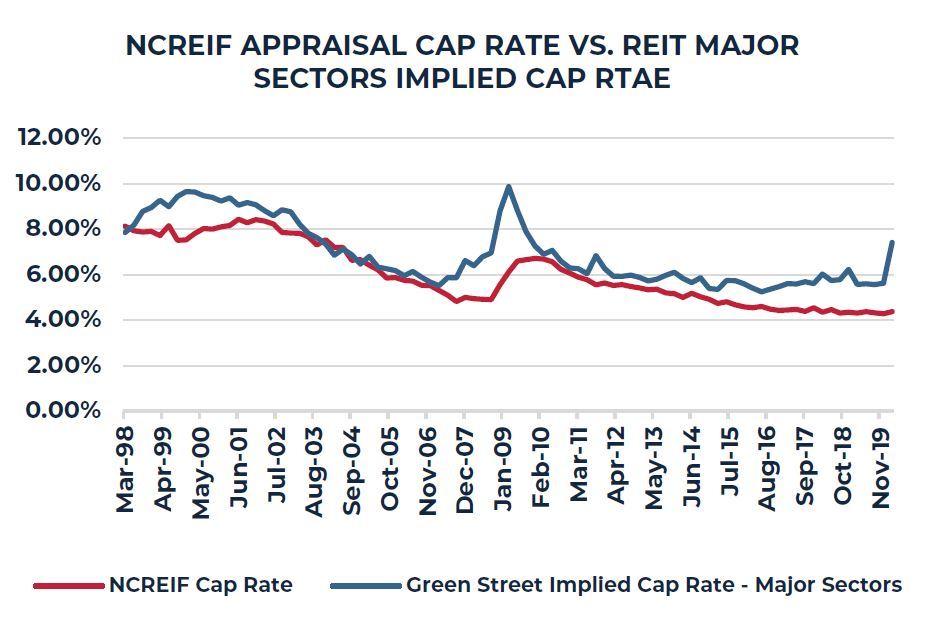

With the rapid increase in unemployment, business closings (temporary and permanent) and supply chain disruptions, 2020 net operating income (NOI) at many properties is simply going to be lower than previously assumed. The degree to which these NOI impairments will be longer lasting is, again, largely a function of the future path of the virus’ spread, and the pace at which parts of the economy re-open. In earlier economic downturns, the “NOI effect” on property value was relatively small. Rather, the capital market effect (i.e. the change in investor required property yields) was a much larger determinant of ultimate change in valuation. With sovereign bond yields near zero across the globe, there seems to be little pressure for property yields to rise significantly.

Source: NCREIF, Green Street

GUIDANCE FROM THE LISTED MARKET?

Much of the Q1 valuation assessment of the direct property market had largely been completed (third party appraisals, etc.) by the time the COVID-19 economic shutdown began in March. Indeed, the NCREIF Property Index recorded almost no change in value for the first quarter. In contrast, the publicly traded equity REIT market suffered a valuation decline of slightly more than 24% in the first quarter, largely concentrated in March. To put this in context, REIT share prices fell more than 70% during the financial crisis with most of the decline happening during the fourth quarter of 2008, and the first quarter of 2009. In contrast, private market valuations adjust less quickly and less severely with the NCREIF capital value index declining 32% between 2008 Q1 and 2010 Q1. Current pricing, captured by the difference in private and public market capitalization rates shows a significant disconnect between the two markets, but not as great as during the financial crisis period.

Source: NCREIF, Green Street

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW.