“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.” – Warren Buffett

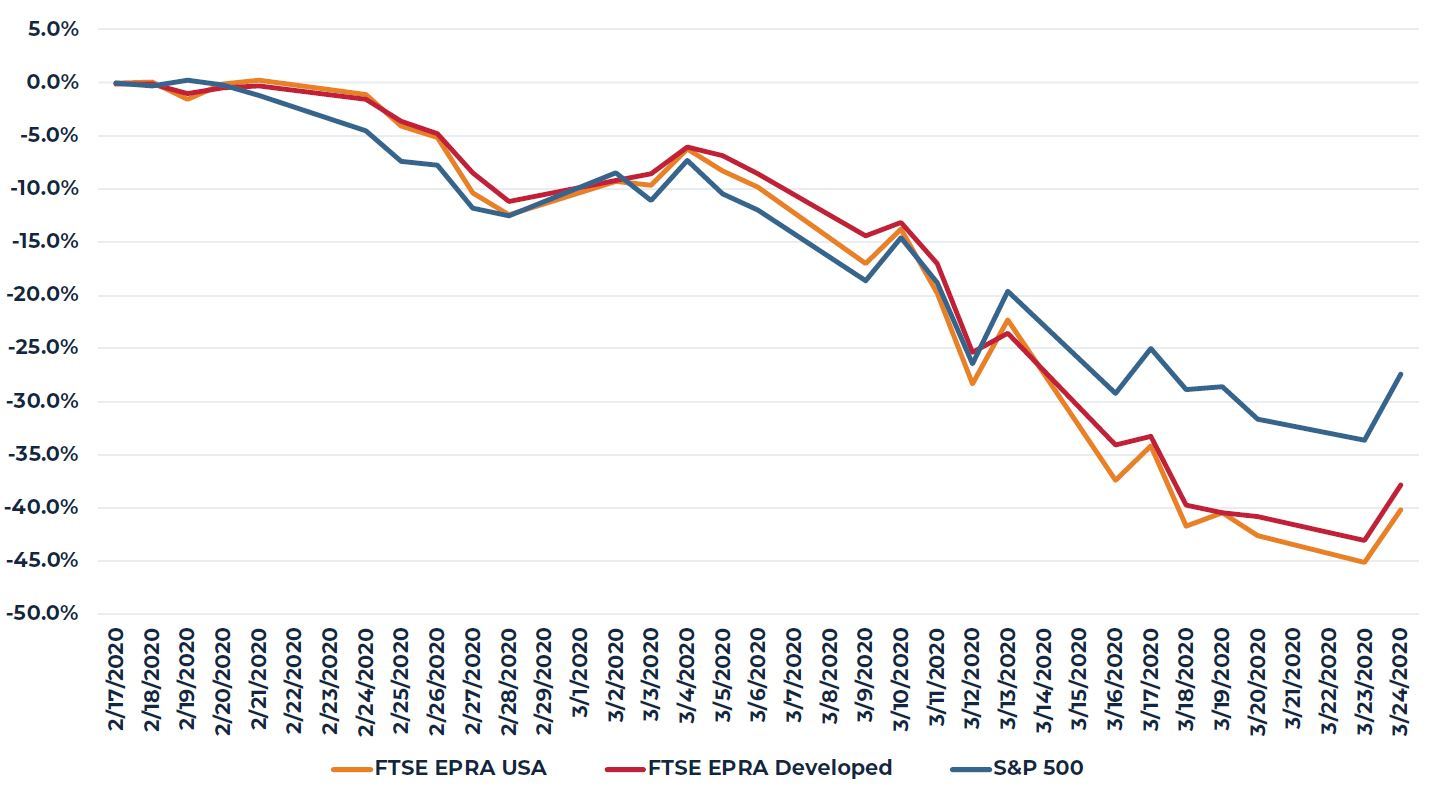

It has been a month since the high watermark for listed real estate securities and other equities, and a week since the dam broke. Listed real estate has suffered even more than the broad market, especially in the past few days as public life began to shut down in the wake of the COVID-19 outbreak. Hotels are empty, many malls and restaurants are shuttered, and most of us are working out of our homes rather than at our offices. Even after the March 24 rally, both U.S. and global listed real estate markets are down roughly 40% from their February peaks.

FIGURE 1

DRAWDOWNS SINCE FEBRUARY 14

Source: FTSE EPRA Nareit USA Index, FTSE EPRA Nareit Developed Index, Moodys S&P 500

This pandemic has been difficult for all of us. At AEW, we have no special claim at predicting where the economy will stand in the next three to six months, or even a year. What we can predict is we can expect more strain before we hit the bottom. That said, investors with a medium- to long-term horizon, and the necessary intestinal fortitude have historically locked in very attractive returns by investing during these broad market declines. The following data explores this historical track-record for both U.S. and global real estate investors.1

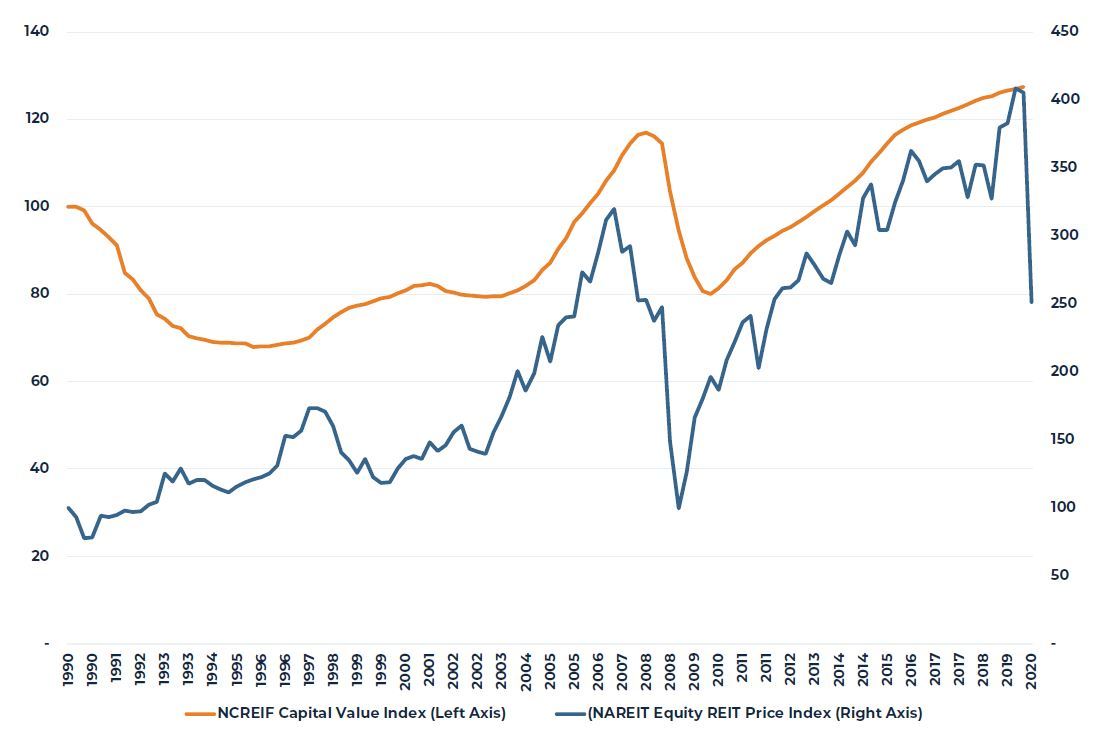

U.S. Listed Real Estate

The U.S. listed real estate market has had several major downcycles since it began to mature in the early 1990s, but none have come on as suddenly as the one we are suffering through now. Here’s how the drawdown above looks on a 30 year timeframe.2

FIGURE 2

U.S. LISTED REAL ESTATE DRAWDOWNS

(January 1, 1990-March 24, 2020)

Source: FTSE EPRA Nareit USA Index

Public and private real estate run with similar cycles, though the private cycle has more built in lags as it typically takes a few quarters for appraisals to catch up with the changes in outlook that the REIT market reacts to on a daily basis. Over time, they move similarly, especially since the REIT market matured and became a significant part of the real estate capital markets in the mid-to-late 1990s. (Note that the scales are different because NCREIF property returns are unlevered.)

FIGURE 3

PUBLIC VS. PRIVATE PRICE MOVEMENTS

(Index=100 in 1990 Q1)

Source: NCREIF, NAREIT

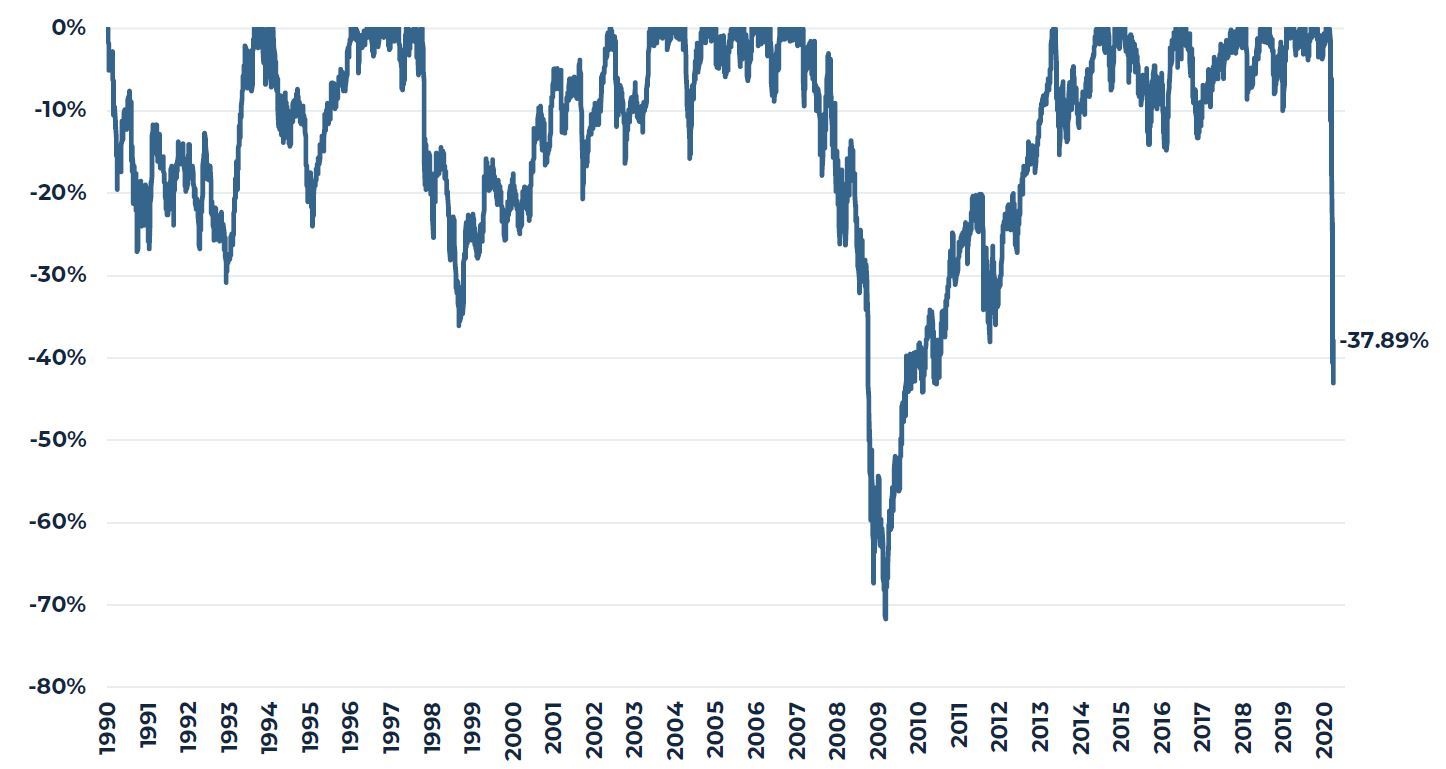

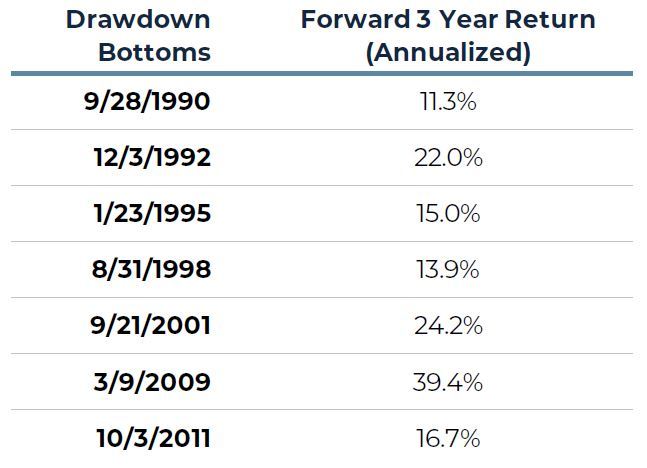

To examine the medium-to long-term returns that might be available to investors willing to venture into the REIT market today, we calculated forward returns from each of the distinct market bottoms with more than a 20% drawdown since 1990. As shown below, investors who put money to work near the bottoms were amply rewarded.

TABLE 1

FTSE EPRA USA THREE YEAR FORWARD TOTAL RETURNS AFTER RETURNS AFTER MARKET DECLINES GREATER THAN 20%

Source: FTSE, Factset, AEW Research

Global Listed Real Estate

The story is not materially different for global property. This section repeats the above analysis for the FTSE EPRA NAREIT Developed index which invests in income-producing real estate in developed markets around the world. As shown in Figure 4, the global listed real estate market has not been immune to the current drawdown and has seen a decline much like that seen in the U.S.

FIGURE 4

GLOBAL LISTED REAL ESTATE DRAWDOWNS IN DEVELOPED MARKETS

(January 1, 1990-March 24, 2020)

Source: FTSE EPRA Nareit Developed Index

Table 2 shows three year forward returns from the bottom of the larger drawdowns since 1990.

TABLE 2

FTSE EPRA DEVELOPED THREE YEAR FORWARD TOTAL RETURNS AFTER MARKET DECLINES GREATER THAN 20%

Source: FTSE, Factset, AEW Research

Here too, investors who allocated to global listed real estate during the deepest drawdowns saw impressive returns. While the post-drawdown bounces have not been quite as large as in the U.S. universe, the global listed real estate does have useful diversification characteristics – since 1990, the annualized standard deviation for daily returns of the FTSE EPRA Developed index is 16.1% versus 24.1% for the FTSE EPRA U.S. index.

Conclusion

The current environment is unprecedented, and like everyone else we are unable to say when we will be able to emerge from our bunkers and resume normal life. This cycle could look different than the Global Financial Crisis over which many of the steepest past drawdowns occurred. Nevertheless, we will emerge. In the meantime, the above evidence suggests that the current discounts in the market may be an attractive entry point for investors with a medium-to-long-term horizon. Listed real estate is much better positioned to weather a protracted downturn than it was in 2008, with lower leverage and laddered maturities and many management teams who have survived a deep downturn before. We are confident that the sector will survive and eventually thrive.

1 This analysis was inspired by “What Happens After the Stock Market Falls”, by Michael Batnick, March 15, 2020. It is available here: https://theirrelevantinvestor.com/2020/03/15/what-happens-after-the-stock-market-falls/.

2 The FTSE EPRA NAREIT USA index was used because daily data is available back to January 1, 1990. Results should not be materially different for any of the major U.S. REIT indices. These are total returns in U.S. dollars.

This material is intended for information purposes only. It does not constitute investment advice or a recommendation. The information and opinions presented in this material have been prepared internally and/or obtained from sources which AEW believes to be reliable, however AEW does not guarantee the accuracy, adequacy, or completeness of such information. Opinions expressed reflect prevailing market conditions at the time this material was completed and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW.