In October 2020, AEW Research released a report “A Focus on Greater Seoul Logistics”, which covered a very interesting rising opportunity. The paper examined how rapidly changing consumption patterns were increasing occupier demand for logistics space. It also reviewed the favorable property market fundamentals and how developers and investors were reacting.

One year on, this has played out with a far larger upside than first anticipated. As of end June 2021, South Korea’s e-commerce market was estimated to be KRW 176 trillion, about 15% larger than one year prior. The country has already bypassed the U.S. and U.K. in terms of share of online sales and currently has the second highest e-commerce penetration rate globally (after China). As a result, e-commerce firms have expanded their physical presence rapidly, which has led to record high levels of demand for modern logistics space.

Developers responded by supplying much needed, higher quality space to the market. Occupied stock is 1.5 times larger by mid-2021 than two years prior and vacancy rates are low. Looking forward, logistics stock will double in size from 2021 to 2023, deepening the base of institutional quality assets, benefiting both occupiers and investors.

As the market continues to exhibit extremely favorable fundamentals, capital interest is high and investment activity has reached new records in H1 2021. Further, there is a more diverse pool of interested buyers today, indicating a maturing investment environment. Considering the weight of capital and current deal flow, yields will continue to firm through to the end of 2021.

Delivering modern stock to expanding e-com industry

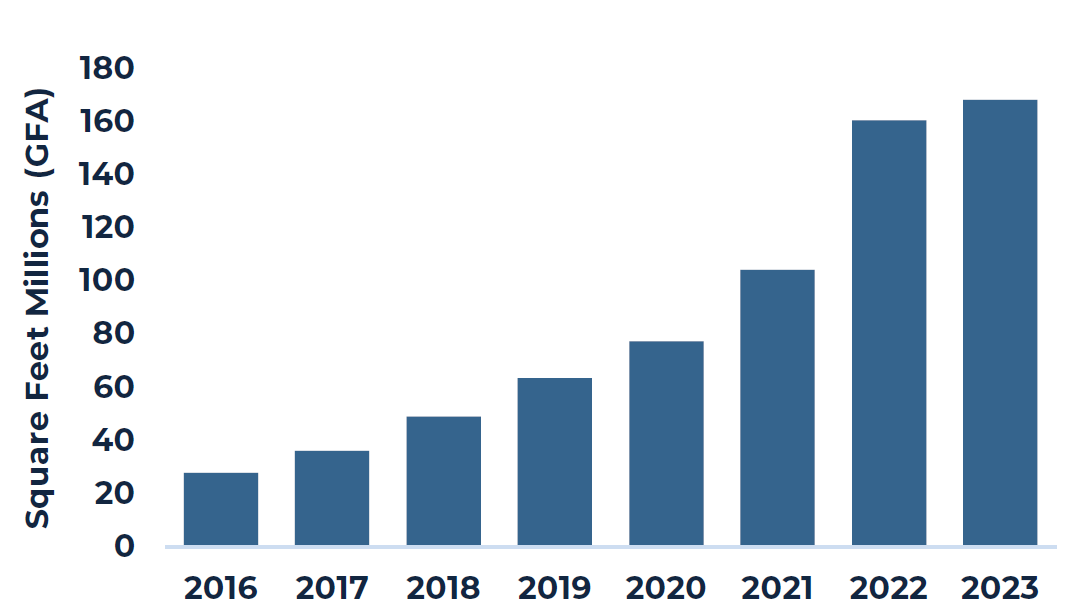

- Prior to the prevalence of online shopping, Greater Seoul’s industrial market was primarily traditional shed-style stock. Developers ramped up construction of modern logistics facilities from 2012, delivering more fit-for-propose space to a growing e-commerce industry.

- By end 2020 Greater Seoul1 had about 77 million square feet of Grade A logistics space -about half the physical size of Tokyo’s.

- By 2023, Greater Seoul will have about 168 million square feet of Grade A logistics stock –two thirds of Tokyo’s. By this stage both markets will be comparable on an online retail revenue (USD) per foot of logistics space basis.

OVERALL GRADE A LOGISTICS STOCK

Source: JLL

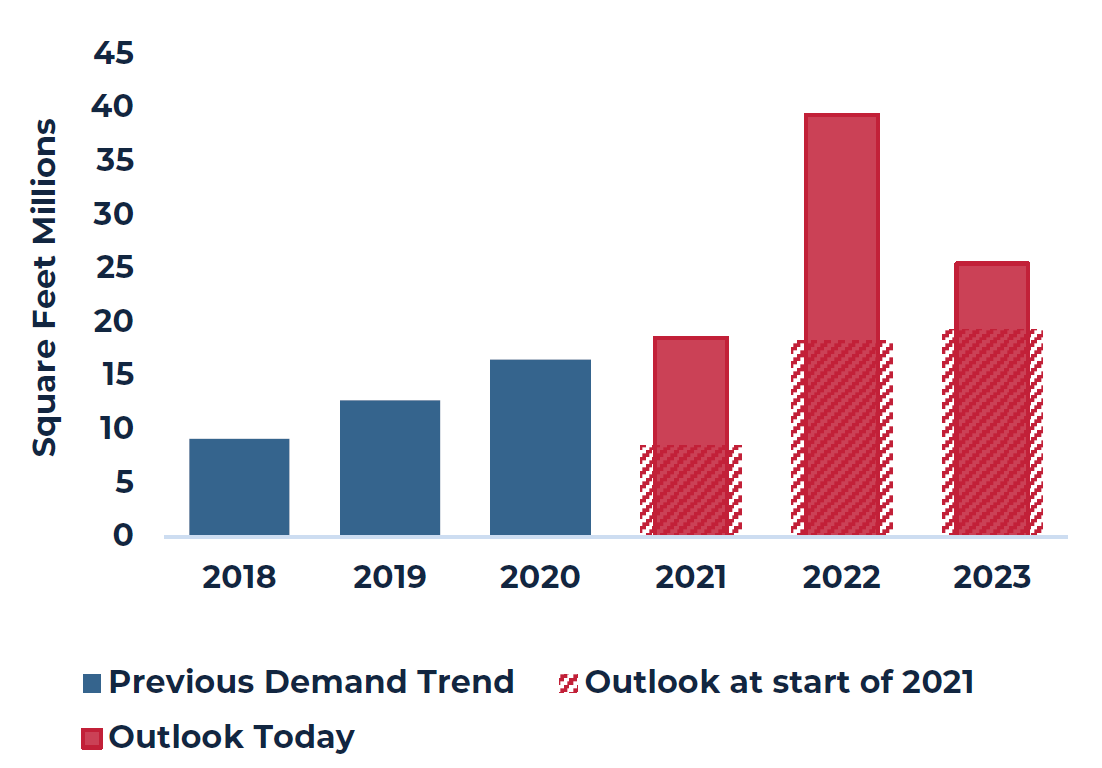

Demand outlook has been revised up

- Net absorption projections doubled mid-year after H1 2021’s take-up came up to 90% of the beginning-of-year forecasts.

- For the three years 2021 to 2023, revised demand will more than double the amount of occupied stock.

- As e-commerce and third-party logistics firms make up about 60% to 70% of occupied logistics stock, the strength of the e-commerce market is the key driver behind demand expansion.

- E-commerce revenue is expected to grow by 22% in the five years ending 2025 and this will translate directly to more demand for logistics space. Currently, e-commerce revenue per capita for South Korea is the highest in the Asia Pacific region.

TAKE-UP OF LOGISTICS SPACE 2018 to 2023F

Source: JLL

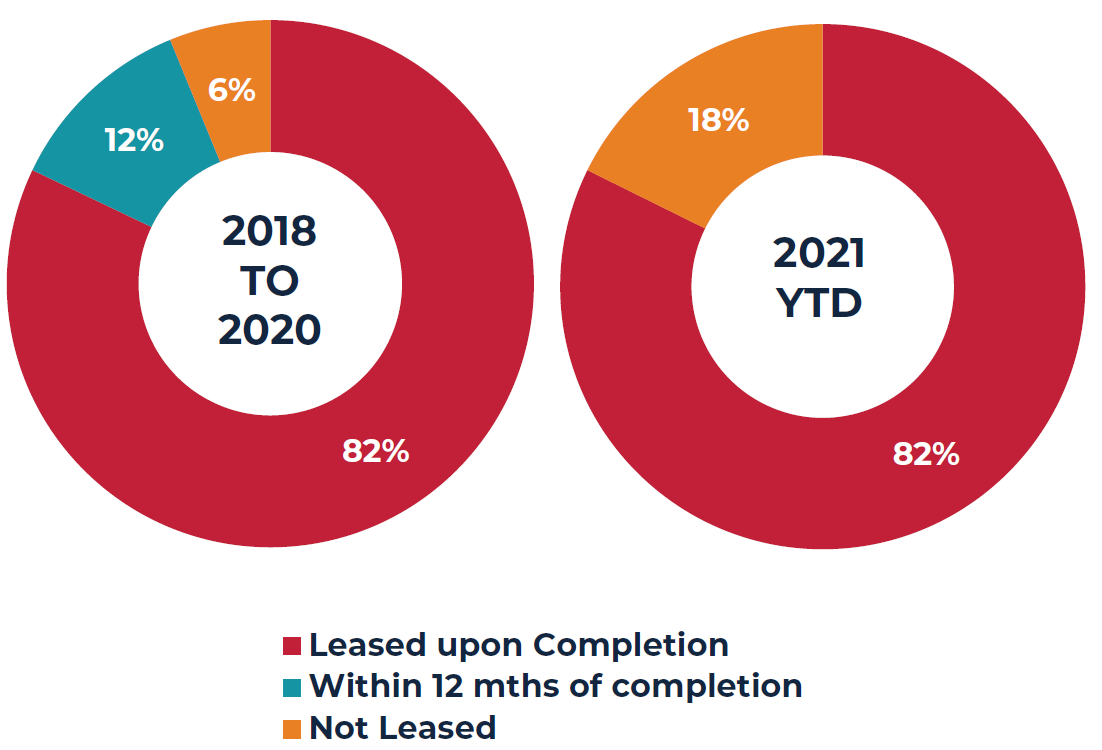

Landlord favorable conditions remain in the near-term

- Supply and demand have kept pace in the last 12 months, meaning vacancy rates have been steady and low.

- A lack of space in existing assets has moved some leasing activity to new builds. Pre-leasing has become a key feature of the market, especially for some of the larger space users requiring future certainty.

- While landlords compete using different leasing strategies, using a sample of buildings that pre-leased in H1 2021, 82% of the space was leased up, consistent with prior years.

- Landlord favorable conditions are expected to persist, supporting an upward rental cycle for the near-term.

SAMPLE OF PRE-LEASING IN LOGISTICS FACILITIES 2018 to 2021

Source: JLL

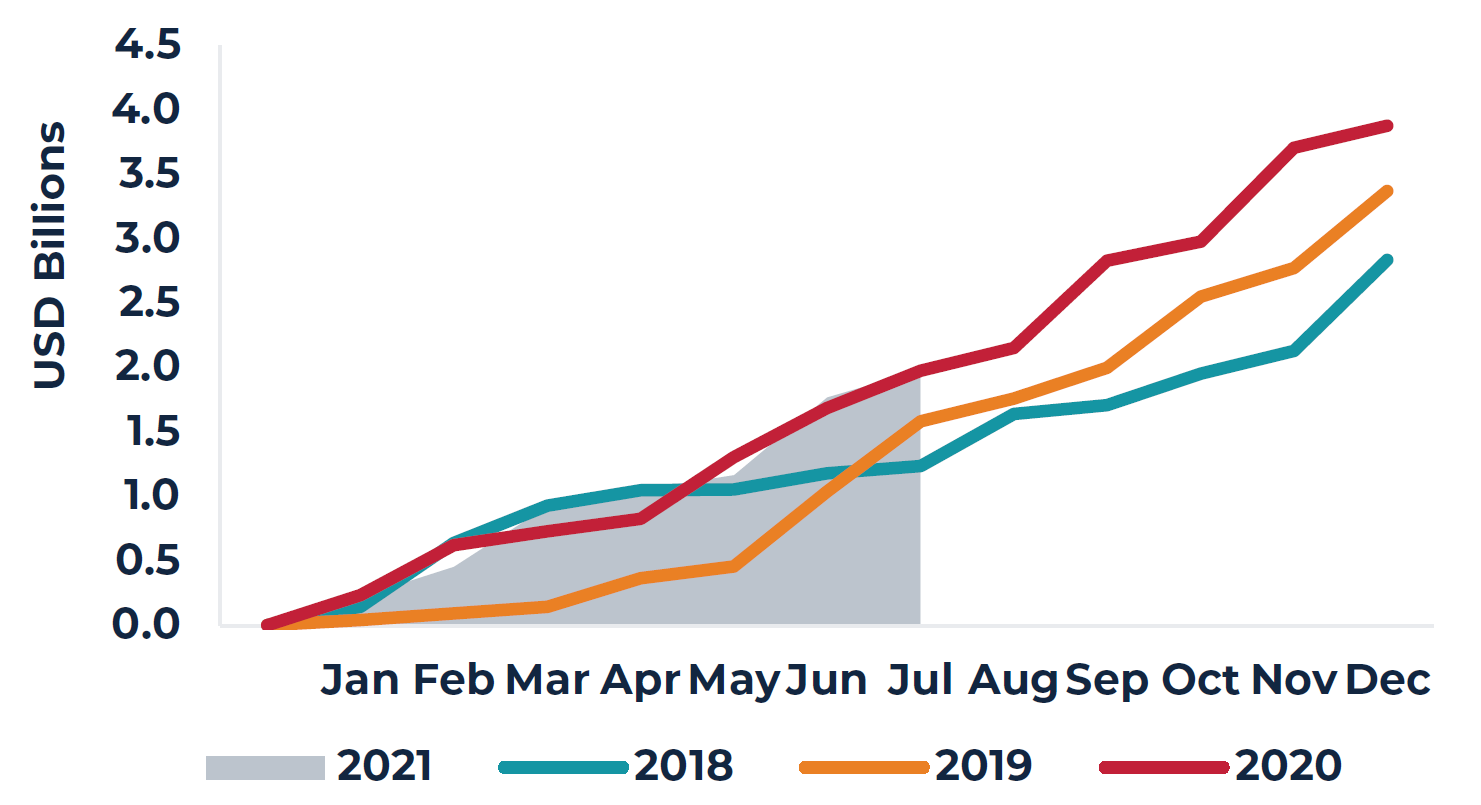

Strong returns drive transaction activity

- Market-driven total returns look attractive on an absolute and relative basis, circa 9% to 11% p.a. from 2021 to 2024.

- AEW’s Total Return Model shows Greater Seoul logistics will be in the top three highest returning markets between 2021 and 2024.

- Capital has responded accordingly and transaction activity for logistics has reached a new high in 2021 with more than USD 2 billion purchased year-to-date.

- Investors have gained comfort through robust leasing activity and as a result, an estimated 15% of deals completed in H1 2021 were “forward funded”, i.e., purchased prior to completion.

INDUSTRIAL/LOGISTICS TRANSACTION ACTIVITY 2018 TO 2021 YTD

Source: Real Capital Analytics

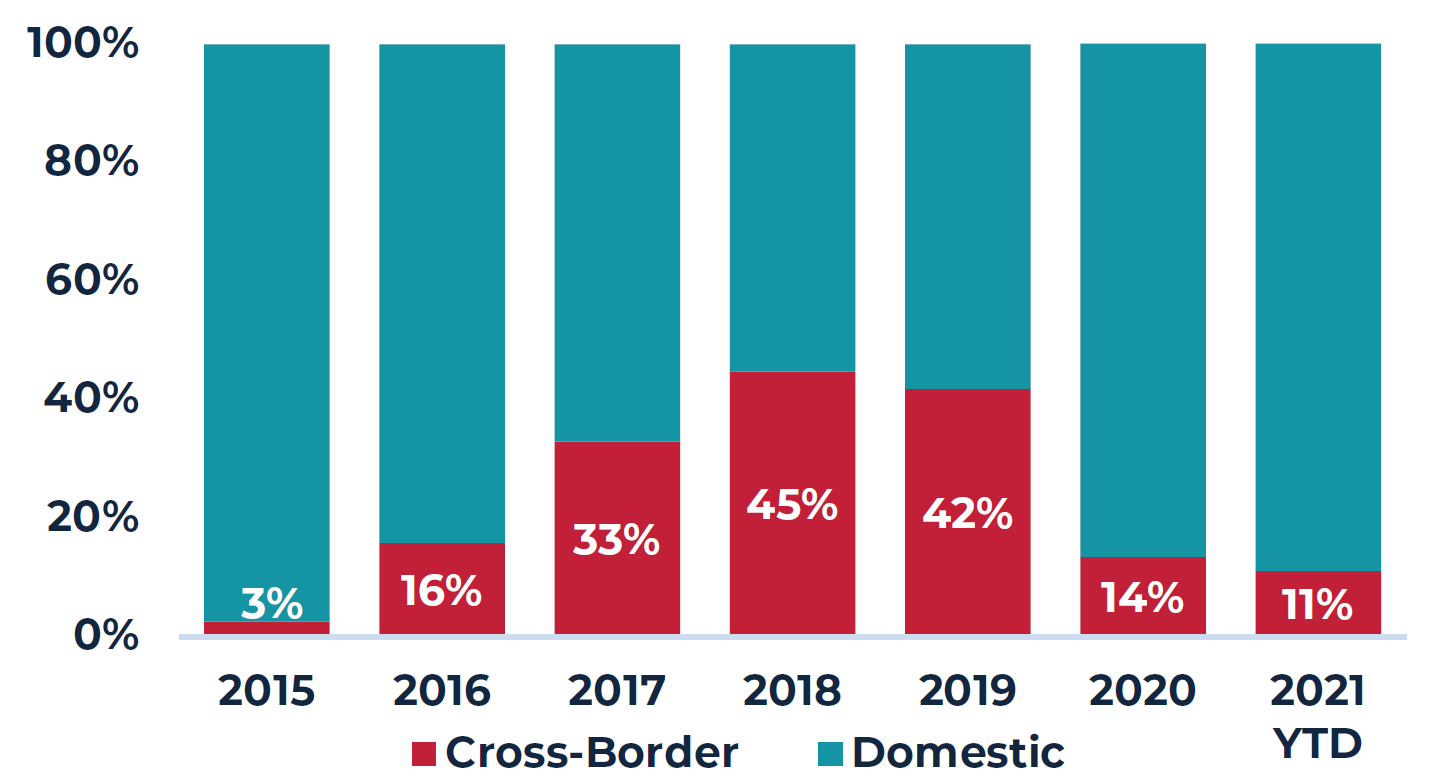

More diverse pool of buyers today

- The share of cross-border participation has increased from 2% to over 40% between 2015 and 2019.

- While international travel limitations in 2020 and 2021 hindered deal flow by foreign investors, there is a large pool of interest from cross-border capital. Their participation indicates the increasing maturity of the sector.

- Anecdotally, for every new asset with an active bid process, the foreign participation is typically 10 to 20%.

TRANSACTION BREAKDOWN BY CAPITAL SOURCE 2015 TO YTD 2021

Source: Real Capital Analytics

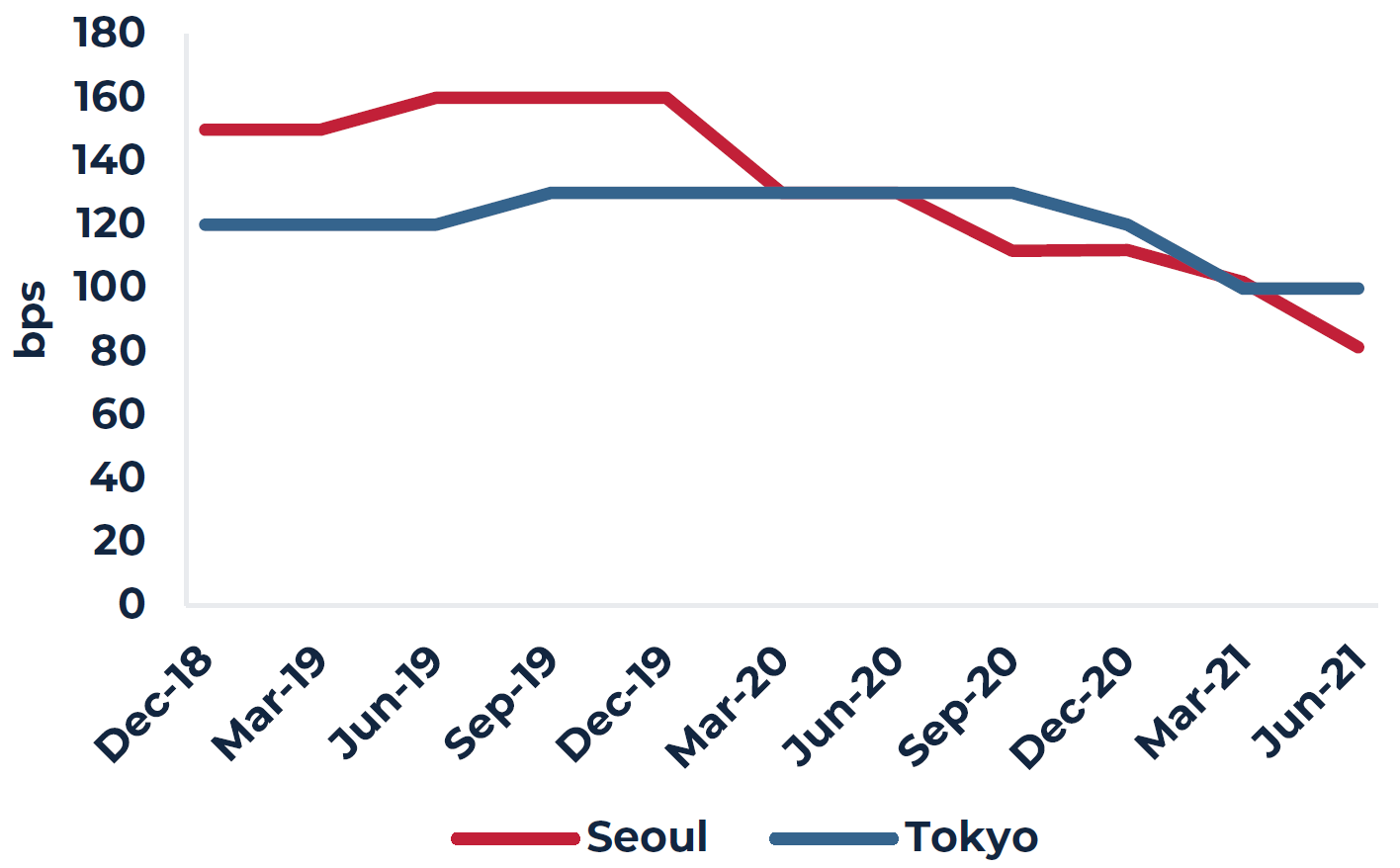

Competition for assets fuels yield compression

- AEW’s Asia Pacific research report released in November 2020 - ‘A Bright Future’, noted there was room for compression in the logistics to office yield spread.

- Consistent with this, between Q2 2020 and Q2 2021 Seoul’s yield spread contracted to be within the 50 to 90 basis point range the report anticipated.

- Considering the weight of capital that continues to want to allocate to the sector and current deal flow, AEW anticipates yields will continue to firm through to the end of 2021.

- Thereafter, investors will become more discerning and yields are unlikely to move much more lower.

YIELD SPREAD, LOGISTICS AND OFFICE 2018 TO 2021

Source: JLL

1 Greater Seoul includes Seoul, Gyeonggido and Incheon, where approximately 50% of South Korea's population live

For more information, please contact:

GLYN NELSON

Director, Head of Research & Strategy, Asia Pacific

glyn.nelson@aew.com

+65.6303.9016

HANNA SAFDAR

Assistant Director, Research & Strategy, Asia Pacific

hanna.safdar@aew.com

+65.6303.9014

ANNA CHEW

Investor Relations, Asia Pacific

anna.chew@aew.com

+852.2107.3511

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW.