Investment Vehicles Page

North America

U.S. Core Strategy

Diversified, core real estate strategy with the goal of targeting institutional-quality multifamily, retail, office and industrial properties in well-located markets throughout the U.S. with a goal to provide preservation of capital, stable income and modest appreciation over the long-term.

Learn More

North America

U.S. Core Strategy

Strategy

Core Strategies

Sectors

Industrial,

Multifamily,

Office,

Retail

Inception

2007

The core strategy in the U.S. sources, closes and manages investments in the four primary property types (industrial, multifamily, office and retail) in major U.S. metropolitan markets.

Asia Pacific

Asia Pacific Core Strategy

Diversified, long-hold, core real estate strategy with the goal of targeting institutional quality assets across the Asia Pacific region in sectors, vintage and investment size with the goal to provide preservation of capital, stable income and modest appreciation over the long-term.

Learn More

Asia Pacific

Asia Pacific Core Strategy

Strategy

Core Strategies

Sectors

Logistics,

Multifamily,

Office

Inception

2020

The core strategy sources, closes and manages investments in the primary property types in well-located, urban, growing middle-class markets throughout Asia Pacific.

Europe

Europe Core Strategy

Diversified, open-ended core strategy with the goal of targeting institutional quality assets in major metropoles and regional cities in Europe to build a modern, future-proof and well diversified portfolio providing an attractive and stable income return over the long-term, whilst incorporating a responsible investment philosophy.

Learn More

Europe

Europe Core Strategy

Strategy

Core Strategies

Sectors

Logistics,

Office,

Health Care,

Living,

Life Sciences

Diversified, open-ended core strategy with the goal of targeting institutional quality assets in major metropoles and regional cities in Europe to build a modern, future-proof and well diversified portfolio providing an attractive and stable income return over the long-term, whilst incorporating a responsible investment philosophy.

AEW has been investing in European Core Strategies for over 20 years.

Europe

Logistics Strategy

European logistics platform includes Grade A logistics parks in key locations across the main logistics hubs in Continental Europe.

Learn More

Europe

Logistics Strategy

Strategy

Core Strategies

Sectors

Logistics

Inception

1999

The European real estate logistics strategy includes Grade A logistics parks in key locations across the main logistics hubs in Continental Europe. Both existing assets and new logistics parks are developed into core assets with a network of preferred development partners. The strategy focuses on logistics hotspots in Continental Europe targeting Germany, the Netherlands, France, Italy, Spain and selected markets in Central Europe.

North America

Core Plus/Value-Add Strategy

AEW’s value-add investment strategy focuses on growth and income and seeks to take advantage of the re-balancing of America's demography and the real estate investment opportunities that will follow in its wake.

Learn More

North America

Core Plus/Value-Add Strategy

Strategy

Core Plus & Value-Add Strategies

Sectors

Industrial,

Multifamily,

Office,

Retail

Inception

2004

The core plus & value-add investment strategy is a growth and income strategy that seeks to take advantage of the re-balancing of America's demography and the real estate investment opportunities that will follow in its wake. The core plus & value-add investment strategy seeks to provide investors with an attractive return, comprised of current cash distributions and appreciation potential through re-positioning and other active management strategies.

Asia Pacific

Asia Core Plus/Value-Add Strategy

AEW’s Asia-Pacific core-plus/value-add real estate strategy focuses primarily on high-growth gateway cities in the Asia Pacific region targeting real estate investment opportunities where strong economic fundamentals foster an attractive investment environment.

Learn More

Asia Pacific

Asia Core Plus/Value-Add Strategy

Strategy

Core Plus & Value-Add Strategies

Sectors

Office,

Residential,

Retail

Inception

2006

AEW’s Asia Pacific core plus/value-add real estate strategy focuses on investments in office, residential and retail properties primarily in high-growth gateway cities across the Asia Pacific region. The strategies seek to add value through redevelopment, repositioning, re-leasing or recapitalization in order to provide both current income and appreciation potential.

Europe

AEW Value-Add Strategy

The European real estate value-add strategy seeks to create value through asset repositioning, renovation, new capital structures and other active management strategies.

Learn More

Europe

AEW Value-Add Strategy

Strategy

Core Plus & Value-Add Strategies

Sectors

Logistics,

Office,

Retail,

Living,

Data Centres

AEW’s Pan-European real estate value-add strategy seeks to create value through asset repositioning, renovation, new capital structures and other active management strategies. The strategy targets assets across the main property types (logistics, office, living, retail and data centres) in both primary and secondary European markets.

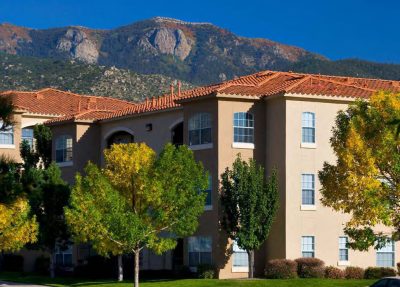

North America

Seniors Housing Strategy

AEW’s core plus/value-add seniors housing real estate strategy involves joint ventures with experienced, operationally-astute seniors housing operators (public and private) in primary and secondary metropolitan markets in the U.S.

Learn More

North America

Seniors Housing Strategy

Strategy

Core Plus & Value-Add Strategies

Sectors

Memory Care,

Assisted Living,

Independent Living,

Age-Restricted

Inception

2007

AEW’s Seniors Housing Strategy targets opportunities for acquisition, development and select repositioning primarily in the memory care, assistant living, independent living and age-restricted sectors of the seniors housing market. The general focus is on assets in major metropolitan markets in the U.S. that exhibit strong underlying income demographics for both seniors and their adult children, as well as favorable supply/demand characteristics.

North America

Opportunistic Strategy

AEW’s opportunistic real estate investment strategy seeks to identify and capitalize on emerging investment trends before they become fully-appreciated by the broader market.

Learn More

North America

Opportunistic Strategy

Strategy

Opportunistic Strategies

Sectors

Industrial,

Multifamily,

Office,

Retail

Inception

1988

AEW’s opportunistic real estate strategy seeks to identify and capitalize on emerging investment trends before they become fully-appreciated by the broader market, and to capitalize on them.

North America

Diversified Strategy

The North America diversified real estate equity securities strategy is designed with the goal to provide exposure to the major sectors of the real estate market from REITS and other publicly-traded real estate companies in North America.

Learn More

North America

Diversified Strategy

Strategy

Real Estate Securities Strategies

Inception

1995

AEW’s North American diversified real estate equity securities strategy is designed with the goal to provide broad exposure to all major sectors of the public real estate market in North America, with the objective of achieving strong risk-adjusted returns. The diversified strategy typically includes 30-35 core positions.

Europe

Diversified Strategy

AEW’s European diversified real estate equity securities strategy is designed with the goal to provide broad exposure to the major sectors of the real estate market from REITS and other publicly-traded real estate companies in Europe.

Learn More

Europe

Diversified Strategy

Strategy

Real Estate Securities Strategies

Inception

2005

AEW’s European diversified real estate equity securities strategy is designed with the goal to provide broad exposure to all major sectors of the public real estate market in Europe, with the objective of achieving strong risk-adjusted returns. The diversified strategy typically includes 30-35 core positions.

Asia Pacific

Diversified Strategy

AEW’s Asia Pacific diversified real estate equity securities strategy is designed with the goal to provide broad exposure to the major sectors of the real estate market from REITS and other publicly-traded real estate companies in the Asia Pacific region.

Learn More

Asia Pacific

Diversified Strategy

Strategy

Real Estate Securities Strategies

Inception

2005

AEW’s Asia Pacific diversified real estate equity securities strategy is designed with the goal to provide broad exposure to all major sectors of the public real estate market in the Asia pacific region, with the objective of achieving strong risk-adjusted returns. The diversified strategy typically includes 30-35 core positions.

Global

Global Strategy

AEW’s global real estate equity securities strategy is designed with the goal to provide broad exposure to all major sectors of the public property markets throughout North America, Europe and Asia Pacific with the objective of achieving above-average income and long-term capital growth.

Learn More

Global

Global Strategy

Strategy

Real Estate Securities Strategies

Inception

2005

AEW’s global real estate equity securities strategy is designed with the goal to provide broad exposure to all major sectors of the public property markets throughout North America, Europe and Asia Pacific with the objective of achieving above-average income and long-term capital growth. The strategy typically includes 90-140 positions selected from our universe of approximately 280 REITs and other publicly traded real estate companies worldwide.

Global

Global Focused Strategy

AEW’s global focused strategy seeks targeted exposure to the global real estate equity securities market.

Learn More

Global

Global Focused Strategy

Strategy

Real Estate Securities Strategies

The global focused strategy is designed to seek more targeted exposure to the global real estate equity securities market, typically holding between 40-50 securities. The global focused strategy holds more concentrated positions in companies that present value opportunities, thereby seeking to provide above average income and long-term growth of capital.

Europe

Absolute Return Strategy

Real estate equity securities strategy offering dynamic long and short positions in European securities.

Learn More

Europe

Absolute Return Strategy

Strategy

Real Estate Securities Strategies

The absolute return real estate equity securities strategy offers dynamic long and short position in European real estate securities with the goal to show positive returns in both up and down markets. The typical number of positions is between 10 and 40 (5-20 long and 0-20 short).

North America

U.S. Income Strategy

Real estate equity securities strategy designed to offer enhanced income and risk-adjusted total returns through a disciplined value approach based on bottom-up security selection of primarily REIT preferred securities.

Learn More

North America

U.S. Income Strategy

Strategy

Real Estate Securities Strategies

The U.S. income REIT strategy is designed to offer enhanced income and risk-adjusted total returns through a disciplined value approach based on bottom-up security selection of primarily REIT preferred securities. Security selection is made with a particular emphasis on balance sheet strength; balance sheet strategy; relative evaluation of each security; and catalysts that will lead to the improvement/deterioration in overall credit metrics.

Europe

Europe Senior Debt Strategy

The Europe Senior Debt Strategy targets investments in senior real estate loans across European markets.

Learn More

Europe

Europe Senior Debt Strategy

Strategy

Debt & Capital Markets

Inception

2012

The Europe senior debt real estate strategy targets senior real estate loans supported by core office, retail and logistics assets located in key European markets. The strategy seeks to seize opportunities created by banks’ need to comply with regulation to distribute their real estate loans and create a bond-like cash flow profile on a fully-collateralized basis.

North America

Debt and Capital Markets

AEW is an active buyer, seller and lender for all types of commercial properties throughout North America and select international markets.

Learn More

North America

Debt and Capital Markets

Strategy

Debt & Capital Markets

AEW’s Debt and Capital Markets team provides borrowers with a variety of full stack lending solutions including whole loans, mezzanine debt, and preferred equity. Flexible capital targets both stabilized and transitional properties, including development, across the risk/return spectrum generally in top 25 metropolitan areas in the U.S.

North America

Separate Accounts & Transferred Asset Management

AEW offers separately managed accounts and transferred asset management capabilities in North America to transition, restructure and ultimately sell assets in a manner that is consistent with each client's goals and objectives.

Learn More

North America

Separate Accounts & Transferred Asset Management

Strategy

Separate Accounts & Transferred Assets

Separate Accounts & Transferred Asset Management typically begin with either a new capital allocation or transferred assets and a capital commitment for new investing. Services include transferred asset management, work-out services and customized solutions. A dedicated team that includes acquisitions, portfolio management, asset management and accounting professionals work exclusively on direct equity portfolios.

Europe

Separate Accounts & Transferred Asset Management

AEW offers separately managed accounts and transferred asset management capabilities in Europe to transition, restructure and ultimately sell assets in a manner that is consistent with each client's goals and objectives.

Learn More

Europe

Separate Accounts & Transferred Asset Management

Strategy

Separate Accounts & Transferred Assets

Separate Accounts & Transferred Asset Management typically begin with either a new capital allocation or transferred assets and a capital commitment for new investing. Services include transferred asset management, work-out services and customized solutions. A dedicated team that includes acquisitions, portfolio management, asset management and accounting professionals work exclusively on direct equity portfolios.

Asia Pacific

Separate Accounts & Transferred Asset Management

AEW offers separately managed accounts and transferred asset management capabilities in the Asia Pacific region to transition, restructure and ultimately sell assets in a manner that is consistent with each client's goals and objectives.

Learn More

Asia Pacific

Separate Accounts & Transferred Asset Management

Strategy

Separate Accounts & Transferred Assets

Separate Accounts & Transferred Asset Management typically begin with either a new capital allocation, or transferred assets and a capital commitment for new investing. Services include transferred asset management, work-out services and customized solutions. A dedicated team that includes acquisitions, portfolio management, asset management and accounting professionals work exclusively on direct equity portfolios.

Europe

UK Real Estate Strategies

UK real estate strategies that acquire assets throughout the UK across all property sectors including industrial, logistics, office, residential, retail, senior housing and leisure.

Learn More

Europe

UK Real Estate Strategies

Strategy

Core Strategies

Sectors

Industrial,

Logistics,

Office,

Residential,

Retail,

Senior Housing (Independent Living),

Leisure

Inception

2012

UK real estate strategies that acquire assets across the UK and aim to provide a return from capital appreciation and income over the long-term. The strategies target assets across the main property types (industrial, logistics, office, residential, retail and leisure) in both primary and secondary UK markets.

Europe

Impact Strategy

AEW's Impact Strategy seeks to create bespoke real estate solutions that address the place-based needs of the UK, in collaboration with local authorities, by increasing the provision of real estate with a social use value, while making environmental improvements to the extent possible.

Learn More

Europe

Impact Strategy

Strategy

Core Strategies

Sectors

Leisure,

Assisted Living,

Health Care,

Education,

Key Worker Accommodation

Inception

2023

AEW worked with independent Impact Advisers, The Good Economy, to develop a proprietary Impact Measurement & Management framework for the strategy. AEW's Impact Strategy seeks to create bespoke real estate solutions that address the place-based needs of the UK, in collaboration with local authorities, by increasing the provision of real estate with a social use value, while making environmental improvements to the extent possible.

The strategy targets assets across the living sector (including assisted living and key worker accommodation), care facilities, early years facilities and leisure/community facilities.

Strategy

Sectors

Inception