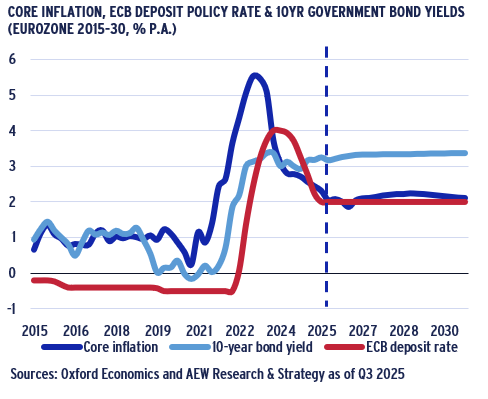

- With inflation now close to central banks’ target levels, financial markets are not expecting any further rate cuts in the Eurozone. Increasing levels of government debt, US trade policy uncertainty and remaining inflation concerns continue to weigh on the bond markets and limit the chances of government bond yields’ tightening.

- Across our 20-country European coverage, base case GDP growth is expected at 1.7% p.a. in 2026-30. Other key macroeconomic drivers, such as business and consumer confidence, unemployment, consumer spending and industrial production are expected to positively drive occupier demand in most European occupier markets.

- Prime rental growth across all property sectors for 2026-30 is projected at 2.2% p.a., with residential at the top spot at 3.2% p.a. Limited supply has kept European vacancy low across most sectors. Even in offices, overall vacancy has passed the peak and the bifurcation between CBD and non-CBD is projected to ease in the future.

- With borrowing costs at accretive levels and the remaining refinancing challenges projected to moderate, the European investment market is recovering. This is supported by the latest 2025 IPE Real Assets Expectations Survey showing a further improvement in sentiment, with offices and retail catching up with the other sectors.

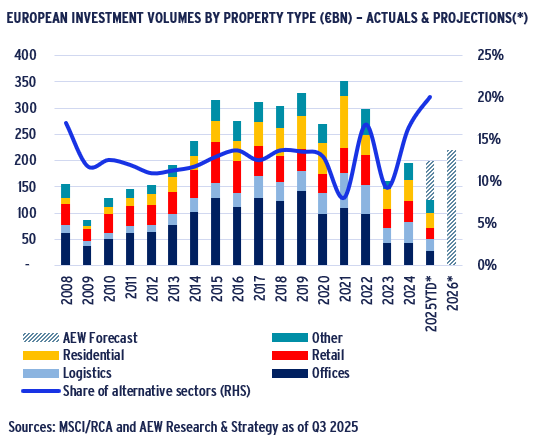

- Against this backdrop of improving fundamentals, 2025 European transaction volumes are projected at €200bn, up from €183bn in 2024. As bid-ask spreads narrow further we expect 2026 volumes at €215-225bn. Alternative sectors have expanded their share and are set for a new record of 20% of 2025 volumes.

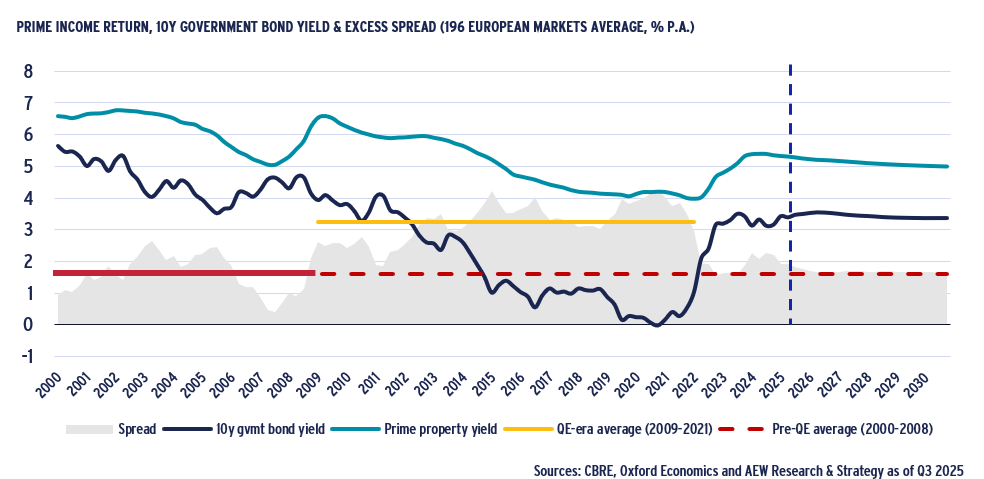

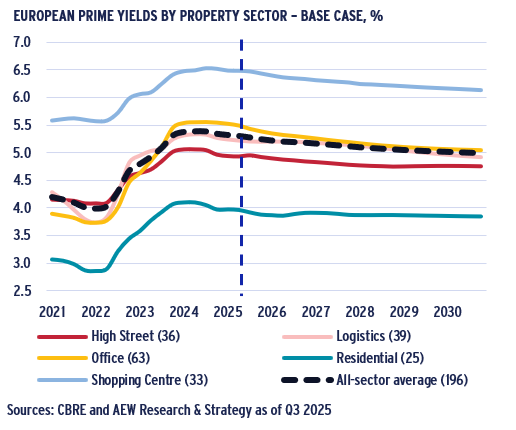

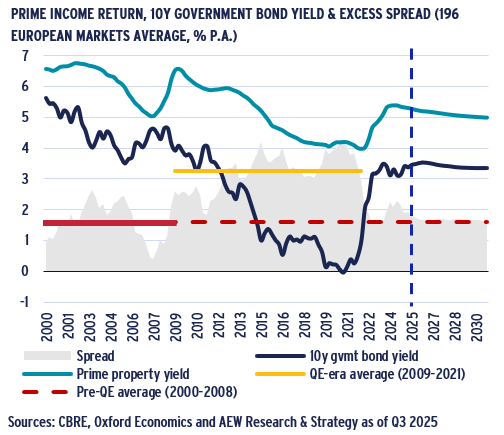

- Solid occupier markets, more widely available debt finance and positive sentiment have already pushed all-sector prime yields in by 10bps since Q2 2024 with a further 30bps tightening projected by 2030. The excess spread between property and bond yields is expected to normalise at historical pre-Quantitative Easing levels.

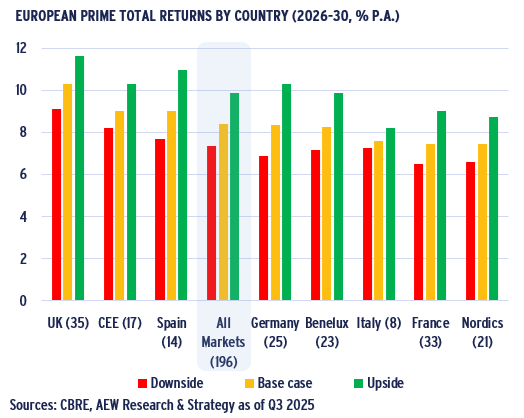

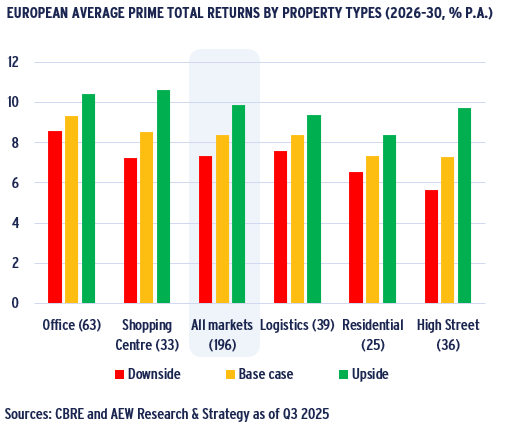

- On the back of repriced current income yields, projected rental growth and modest yield contraction, prime all-sector returns are projected at 8.4% p.a. UK markets are forecasted at 10.3% p.a. -- the top ranked country. Offices are expected to deliver the best returns at 9.3% p.a., followed by shopping centres with returns of 8.6% p.a.

SECTION 1: ECONOMIC BACKDROP – COPING WITH THE NEW NORMAL LEVEL OF UNCERTAINTY

EUROZONE RESILIENCE IN THE FACE OF CHALLENGING NEWS FLOW

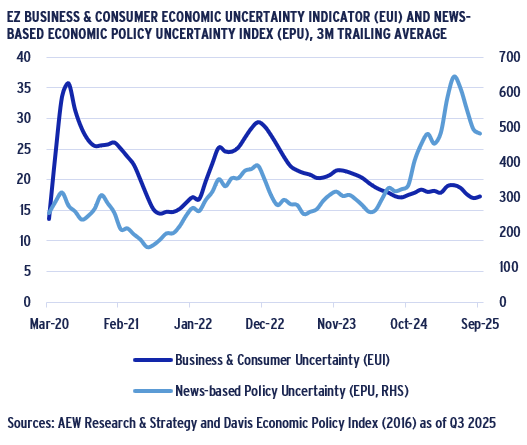

- The post-COVID political winds of change have already led to many changes in trade, fiscal, monetary and other economic policies with more expected to come.

- Uncertainty around these policy changes – as confirmed by the ongoing tariff discussions - has led to increasing concerns from businesses and consumers.

- Already widely followed, the economic policy uncertainty (EPU) news index reflects the level of uncertainty reported by mainstream newspapers across Europe over time.

- EPU increased in 2022 on the back of inflation and rate hikes and peaked in Apr-25 after US tariff announcements.

- In comparison, the uncertainty index (EUI) consistently measures how insecure Eurozone consumers and businesses feel about their financial situation.

- The index shows a strong post-COVID resilience from consumers and businesses in the light of elevated challenging news flow on policies.

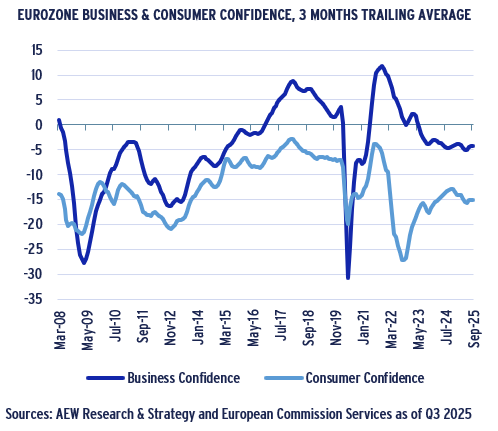

EUROZONE BUSINESS AND CONSUMER CONFIDENCE STABILISE

- Using the European Commission’s Economic Sentiment Indicator, we can compare consumer and business confidence development over time.

- In the long term, business confidence appears to be more volatile, even though the impact from shocks like GFC and COVID are easily identified in both series.

- Business confidence was more affected by COVID lockdowns even if its recovery has been stronger.

- Post-2022 rate hikes dampened both business and consumer confidence, with the cost of living crisis pushing consumer confidence to a record low.

- After the 2022 interest rate hikes, consumers have actively reduced household debts, which has impacted negatively on their discretionary spending in the short term.

- The encouraging relative stabilisation of business confidence confirms resilience in the face of elevated levels of news-based uncertainty.

EUROZONE BONDS PROJECTED TO WIDEN AS PRESSURES REMAIN

- The European Central Bank (ECB) rate hikes from 2022 and 2023 eventually brought inflation down to its stated target of 2% by Q3 2025 across the Eurozone.

- As inflation moderated, it started easing with rate cuts from 2024. However, in line with consensus we do not expect further cuts but note that cuts are still expected in the UK.

- Eurozone government bond yields are expected to widen out by 20bps by 2030, even if national projections vary.

- Required spending on defence and social benefits will increase fiscal deficits and funding needs. This could impact on credit ratings.

- Increasing public debts, trade policy uncertainties and lingering inflation concerns are expected to push yields out.

- Bond yield expectations are also impacted by the planned unwinding of the post-GFC quantitative easing.

ECONOMIC BACKDROP – MODEST GDP GROWTH UNDERPINS REAL ESTATE DEMAND DRIVERS

GDP OUTLOOK UNCHANGED DESPITE TARIFFS

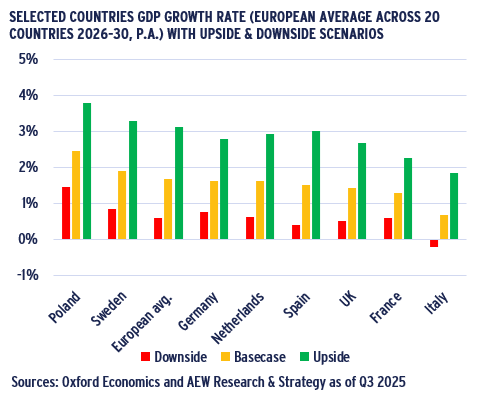

- Our property market models use Oxford Economics’ (OE) forecast of 1.7% GDP p.a. growth for Europe in 2026-30.

- In a part reversal from last year, German GDP growth has started recovering while both the UK and France growth are projected to be slightly slower than our 20-country average.

- Poland and Sweden are projected to have 2026-30 GDP growth well ahead of the European average, while Italy remains the laggard in Europe in terms of GDP growth.

- This post-tariffs growth projection was unchanged from our Mar-25 forecasts and therefore better-than expected as tariffs were feared to have a significant negative impact.

- Despite the limited short-term effect of higher US tariffs on European GDP growth, there might still be longer term impacts on higher inflation, policy rates and bond yields.

- Our downside scenario shows that only Italy - across major economies - is projected to post negative GDP growth.

EMPLOYMENT TRENDS BROADLY SUPPORTIVE OF REAL ESTATE DEMAND

- Given changes in working and shopping habits, it has become more challenging to link the demand for specific types of real estate directly to labour market trends.

- Nevertheless, while the labour market remains robust, employers will be looking to accommodate staff in offices, retail premises and logistics warehouses.

- Unemployment is projected to trend down to 6% across the Eurozone and return to 4% in the UK over the next five years.

- Office employment growth is positive but trending down to zero in the Eurozone and 1.4% p.a. in the UK by 2030. This overall trend is unlikely to impact demand for office in bigger cities.

- In addition, a partial reversal of the COVID-era working from home practices is under way and has started driving down vacancy rates, especially in prime CBD offices

- Finally, these trends highlights the significant demographic challenge that Europe faces from an aging population, lower birth rates and more restricted immigration.

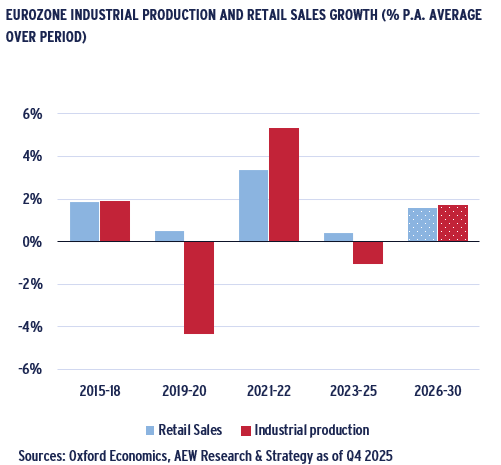

REBOUND IN INDUSTRIAL OUTPUT AND RETAIL SALES PROJECTED

- While Oxford Economics' projections for Eurozone GDP growth remain modest, they are nonetheless positive and indicate an anticipated improvement in economic activity.

- Indeed, 2025 is projected to be a turning point, with cyclical and structural tailwinds anticipated to emerge by 2026.

- After contracting by -1% p.a. in each of the last three years, Eurozone industrial output is projected to regain momentum again in 2026-30 at 1.7% p.a. growth.

- Retail sales projections suggest consumer spending will also recover in 2026-30 as real income growth will pick up with inflation under control.

- 1.6% p.a. retail sales growth is projected for the next five years, nearing the 1.8% p.a. observed during the pre-pandemic period of 2015-18.

- Even if these are not spectacular growth projections, these intermediate drivers will be supportive for both logistics and retailer occupier demand.

SECTION 2: OCCUPIER MARKET – DECREASING VACANCY RATES SUPPORT RENTAL GROWTH

OFFICE VACANCY RATE INCREASES AGAINST TRENDS IN OTHER SECTORS

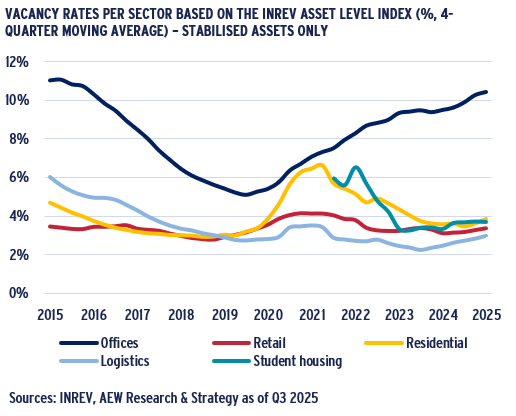

- Vacancy rates across European property sectors have been declining since the pandemic, with the notable exception of offices, as indicated by the INREV Asset Level Index (ALI).

- At 10.4%, the office sector has experienced the largest and most sustained increase in vacancy of any sector post-COVID, excluding assets under (re)development.

- This is still below the peak of 12% recorded in 2015, yet much higher than the 5% vacancy observed prior to the pandemic.

- Other sectors vacancy ranges between 3% and 4% as of 2025.

- Retail vacancy reflects the high quality of assets reported by institutional investors to the ALI index.

- Residential vacancy did record another increase but remains low at 3% compared to the near 7% during COVID lockdowns.

- Student housing vacancy has also started trending up to 3.7% from a record low level of 3.2%.

- The logistics vacancy remains the lowest among our sectors at 3.0%, reflecting a slight increase from the 2.2% in Q4 2023.

PRIME OFFICE RECOVERY TO REDUCE BIFURCATION WITH NON-CBD

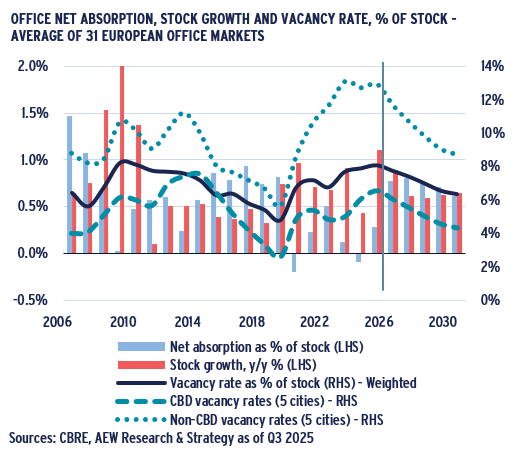

- In the largest 31 European office markets, vacancy rates are projected to reach 8.1% by year-end 2025, an increase of 250 basis points compared to pre-COVID levels in 2019.

- By year-end 2030, vacancy rates are expected to decrease to 6.3%, as new supply is projected to decline due to reduced developers’ profitability, lower asset values and higher construction costs.

- Office demand is projected to recover as COVID-era remote working arrangements are partially reversed, with more firms requiring employees to return to the office.

- Since the COVID lockdowns, a significant bifurcation has emerged between CBD and non-CBD markets. This divergence is clearly illustrated by their vacancy trends.

- Non-CBD vacancy peaked at nearly 13%, while CBD vacancy rates remained below 7% in 2025. Occupiers are struggling to find affordable CBD space, particularly in London and Paris.

- This, in turn, is expected to narrow the gap between CBD and non-CBD vacancy rates over the next five years.

NEW RESIDENTIAL SUPPLY FALLING SHORT OF GOVERNMENT TARGETS

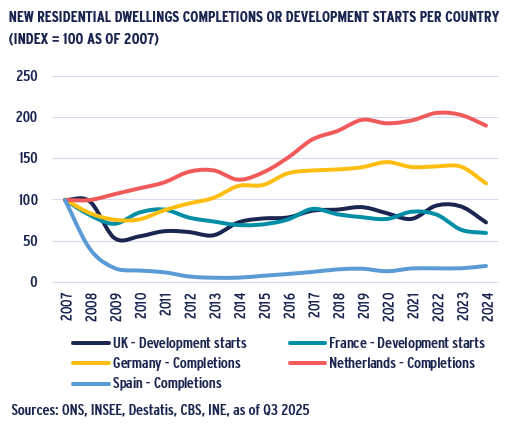

- The new supply of housing in Europe has been limited over the past two decades, as illustrated in the chart.

- In the most extreme case, Spain has remained under 20% of construction completions since the pre-GFC boom.

- Despite a recent decline, at 380,000 p.a. France has built more dwellings since 2007 than any other European country, including Germany (243,000) and the UK (174,000).

- While completions in Germany and the Netherlands have increased post-GFC, they still fall short of government targets.

- 2025 German completions are expected to be as low as 230,000 units compared to a government target of 400,000.

- Private rental availability has decreased in many markets due to fiscal and regulatory changes that have rendered buy-to-let and build-to-rent options less attractive.

- On top of this, a growing number of dwellings are rented out on a short-term basis through platforms such as Airbnb.

OCCUPIER MARKET – HIGHEST RENTAL GROWTH FOR PRIME RESIDENTIAL & OFFICES

LOGISTICS VACANCY PROJECTED TO COME DOWN FROM NEAR 6%

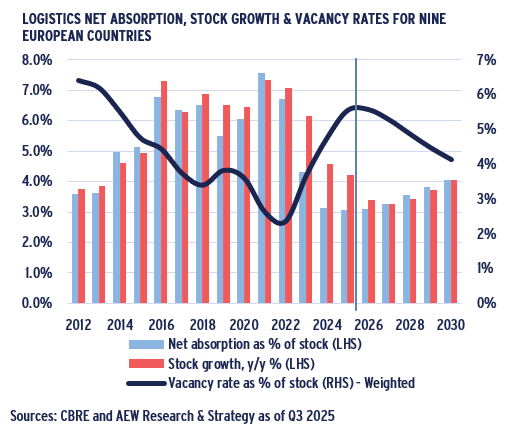

- Logistics developers were able to keep up with the strong increase in net absorption in the 2016-22 period, which was prolonged by the e-commerce Covid-related demand boost during 2021-22.

- As demand returned to more modest pre-2016 levels over the past three years, supply outpaced demand, resulting in an increase in vacancy to 5.5%, up from a low of 2.5% in 2022.

- However, as developers’ profitability was hurt by increased costs and lower values, new supply is projected to reduce.

- Looking ahead, new supply and demand are expected to become more balanced, leading to a gradual decrease in the logistics vacancy rate to 4.1% by 2030.

- With tariffs proving to be less severe than expected, fundamental drivers, e.g. near-shoring manufacturing and higher defense spending, remain favourable for demand.

- The heightened demand for data centres in Europe will serve as an additional positive factor.

VACANCY TRENDS DIVERGE WITH SHOPPING CENTRES EDGING UP

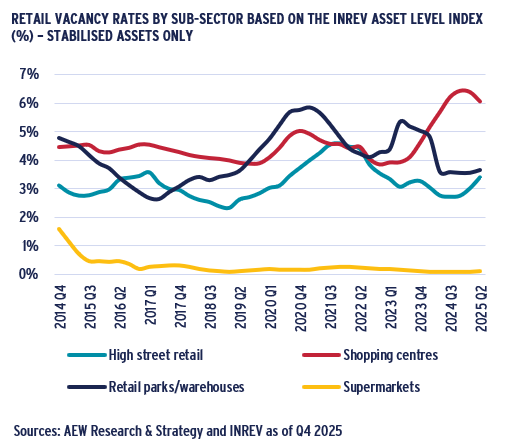

- In the retail sector, more detailed data reveals diverging trends in vacancy rates across various retail sub-sectors.

- Since 2014, reported vacancy rates have remained relatively low, with only minor increases during the COVID period.

- This data reflects a concentration of high-quality assets in a limited number of countries and is not considered fully representative of the European retail markets.

- The vacancy rate for shopping centres reached 6.4% in Q1 2025, up from 4% in Q3 2023, marking its highest level since 2014; however, it has slightly decreased in Q2 2025.

- This is likely due to national retailers reducing their footprint and retaining space only in the most profitable locations.

- On the other hand, vacancy rates for high street retail have increased during the first half of 2025.

- Vacancy for retail warehouses (incl. furniture, DIY, etc.) was reported at 3.7% in Q3 2025, the lowest level since 2014.

- The vacancy rate for multi-tenanted retail parks has been more volatile and higher than that of most other sub-sectors.

PRIME RENT GROWTH PRIMARILY DRIVEN BY LIMITED SUPPLY

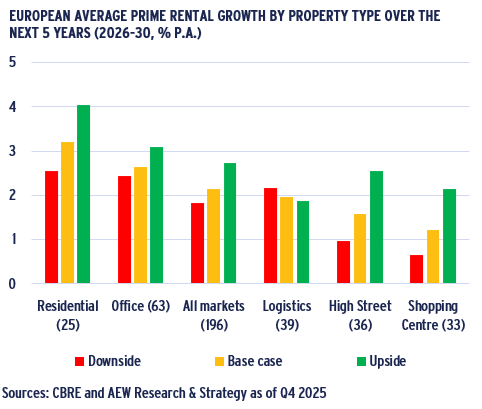

- Our latest base case forecast for prime rental growth across all sectors for the 2026-30 period is projected at 2.2% p.a., an increase from 2.0% anticipated in our Mar-25 base case.

- Again, the residential sector leads our rental outlook, with an average projected growth rate exceeding 3.2% p.a.

- A further downward revision of the supply of new residential units continues to highlight existing shortages.

- Average rental growth is projected at a solid 1.8% p.a. in the downside and 2.7% p.a. in the upside scenario.

- Prime office rents are projected to grow by over 2.6% p.a., securing the second position across sectors.

- The counterintuitive scenario results for the logistics can be explained by the historically stronger relationship between the sector's rental growth and inflation, rather than GDP.

- Shopping centres and high street retail have projected 2026-30 rental growth of 1.6% and 1.2% p.a., respectively.

SECTION 3: ACCRETIVE BORROWING COSTS & EASING REFINANCING CHALLENGE

EUROZONE DEBT COSTS HAVE STABILISED AND REMAIN ACCRETIVE

- Over the past year, average all-in borrowing costs have stabilised at accretive levels below prime yields, particularly in the Eurozone, and less so in the UK.

- Based on the latest data, Eurozone 5-year swap rates have tightened to 2.2% pa from 2.8% over the past four quarters.

- Loan margins have also tightened slightly from 170bps to 160bps since Jun-24.

- As a result, CRE all-in borrowing costs have come down from 5.1% to 3.9% p.a. over the last two years.

- Cross-sector prime yields in the Eurozone as of Sep-25 are estimated at 5.1%, down from 5.2% from Feb-24.

- These recent yield levels still represent a significant increase from the 3.8% prime yields recorded in May 2022, prior to the onset of inflation and interest rate hikes.

- Based on this, CRE debt has remained accretive to the equity as prime yields of 5.1% are 120bps ahead of all-in borrowing costs of 3.9% p.a. as of Sep-25.

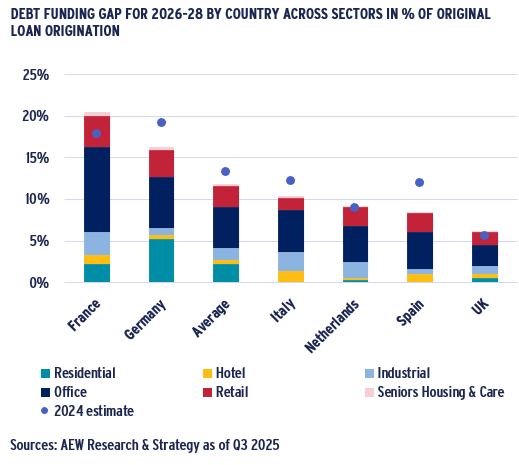

MOST OF €74BN EUROPEAN DEBT FUNDING GAP PROJECTED FOR 2026

- Despite lower borrowing costs, refinancing challenges persist for many European investors, particularly in 2026.

- Our estimate for the European debt funding gap (DFG) for 2026-28 is €74bn, representing an 18% reduction from 2023, indicating that the collective challenge is beginning to ease.

- Office-backed loans constitute 41%, followed by retail loans at 21%, residential loans at 19%, and other categories at 18% of the total DFG for the 2026-28 period.

- Apart from historical reductions and projections of capital values, absolute DFG volumes also reflect historical acquisition and loan origination levels across each sector.

- Therefore, scaling DFG by origination volumes can provide additional insights.

- Based on this, the relative DFG as a percentage of original loan originations across Europe has also eased, decreasing to 12% from 13% a year ago.

FRANCE MOVES AGAINST THE TREND & RANKS TOP FOR RELATIVE DFG

- Despite easing to 12% from 13% a year ago, the change in relative DFG over the last year varies by country.

- France’s €17bn DFG stands out as the highest in Europe at 20% of original loans. With this increase from last year’s 18%, France moves against the overall European easing trend.

- This change is attributed to a more pessimistic outlook on French capital values, particularly in the logistics and office sectors, compared to last year's projections.

- Germany’s €23bn DFG ranks highest in absolute terms but comes second when considered relative to original loans, representing 16% (down from 19% last year).

- The German residential-linked DFG is larger than elsewhere due to the sector's significant share of German deal volumes.

- Italian and Spanish figures have remained below the European average, at 10% and 8%, respectively.

- As before, the UK ranks at the lower end with a DFG of just €11bn, representing 6% of original loan volumes.

SECTION 3: STRONGER CAPITAL RAISING TRIGGERS RECOVERY IN LIQUIDITY

DEAL VOLUMES RECOVER AS SENTIMENT IMPROVES

- Based on Q3 2025 year-to-date volumes of €130bn, we still expect full year 2025 volumes at €200bn and 2026 at €220bn. These are both ahead of the restated 2024 €183bn full-year volumes.

- This liquidity recovery confirms that improved sentiment is bridging the bid-ask spread. In fact, with more widely available debt, liquidity could rebound more than projected.

- However, there are sectors where bid-ask spreads remain a hurdle such as non-CBD offices and other secondary assets.

- As lenders push for refinancings and fund managers facilitate redemptions, transactions proceed at reduced prices compared to many sellers’ original reserve prices.

- As both stock and bond pricings exceed their fundamentals and private credit is starting to show some defaults, property is likely to become more attractive for multi-asset investors.

- Given that the European property markets are in the early stages of recovery, we anticipate that more institutions will increase their long-term allocations to real estate portfolios.

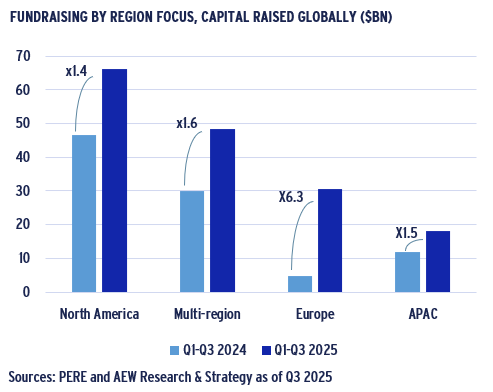

OVERSEAS INVESTORS LOOK AT EUROPE TO DIVERSIFY ALLOCATIONS

- This expectation is supported by the latest PERE data on real estate fundraising by targeted region, which highlights an interesting regional capital rotation on a global scale.

- Capital raised for European real estate has increased an impressive sixfold in the first three quarters of 2025 compared to the same period last year.

- Although North American-targeted fundraising dominates in absolute terms, it has, like APAC, experienced more modest relative fundraising increases over the same period.

- This is likely due to North American and Asian investors re-allocating capital to Europe to geographically diversify their portfolio deliberately at this time of elevated uncertainties.

- We expect a higher levels of liquidity in the European market from an increase in these overseas investors’ allocations, both for core and value-add strategies.

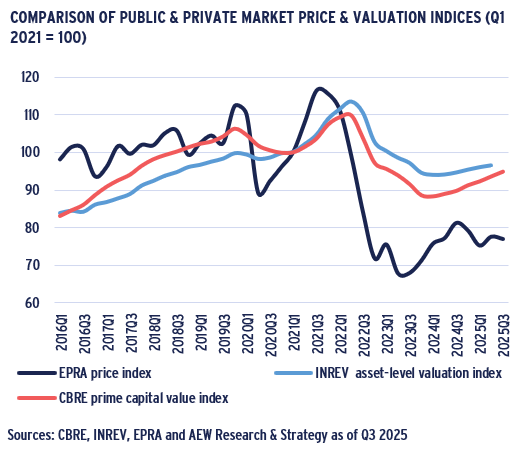

POSITIVE PRIVATE MARKET MOMENTUM UNLIKE PUBLIC MARKETS

- Private market indices have continued their positive momentum despite a recent pause in the recovery of EPRA’s publicly listed property companies (incl. REITs).

- REITs have led valuation indices as they experienced a sharp repricing from 2021 peak, coinciding with the rapid increase in inflation and anticipated interest rate hikes.

- In 2021-23 REIT investors saw a 40% repricing due to heightened debt levels and costs, as well as concerns specific to the office sector.

- With a three-quarter lag, private market indices for prime assets (CBRE) and institutional quality appraisal-based values (INREV ALI), declined by 20% and 17%, respectively.

- Since mid-year 2023, REITs rebounded by 22% to Q3 2025 but have since slipped by 5% to Q3 2025.

- Our two private real estate value indices have started rebounding from Q1 2024 without any reversal.

PROPERTY YIELDS TO TIGHTEN AS EXCESS SPREAD WITH GOVERNMENT BONDS NORMALISES

OFFICE & RETAIL SENTIMENT CATCHING UP WITH RESI & LOGISTICS

- The Sep-Oct-25 IPE Real Assets Expectations Indicator survey confirms that the sentiment among European managers continued to broadly improve.

- The net percentage (%) reflects the difference between the share of managers who believe property values would increase vs decrease over the next 12 months.

- Across all four sectors over 68% of respondents expect a positive capital value increase in the next 12 months, up from 60% in Mar-Apr-25.

- Retail and office-focused manager sentiment is resuming its positive momentum and is approaching the now stabilised high levels for residential and industrial.

- These latest results also confirm that the range of sentiment across sectors has narrowed.

- Past changes in manager sentiment are correlated to actual European transaction volumes, which implies that improved sentiment can be expected to push up volumes in 2025-26.

PRIME YIELD TIGHTENING PROJECTED TO MODERATE FURTHER

- In a change of momentum, prime yields started tightening from their record highs in Q2 2024. This was after higher rates pushed yields up by 135bps over the 2022-24 period.

- Over the last four quarters prime residential yields tightened most of any sector by 14bps, followed closely by high street retail and logistics at 13bps and 12bps, respectively.

- Based on solid occupier market drivers, stable borrowing costs and improved liquidity, prime yields across all sectors are now projected to move in by just over 30bps by 2030.

- Prime office yields are forecasted to tighten by 45bps over the next five years from mid-year 2025, followed by shopping centres and logistics at 35bps and 30bps, respectively.

- Prime office yield tightening is unlikely to lead to lower yields for non-prime offices in the short term. But shortage in prime CBD sub-markets might start pushing secondary rents up.

- Also, further improvement in office investor sentiment and prime rental growth might trigger a broader recovery in the medium term.

EXCESS SPREAD OVER BONDS BACK TO PRE-QE HISTORICAL AVERAGE

- Many income-oriented investors often consider property yields relative to “risk-free” government bonds yields.

- This comparison remains limited in scope as bonds and property have their own risk profile, income characteristics, and potential for appreciation.

- When looking at the data, prime property yields in Europe widened by 140bps, while bond yields widened by 350bps since year-end 2022.

- The current excess spread of property yields over bond yields at 160 bps is projected to remain stable over the next five years.

- It is half the 320bps 2009-21 historical average excess spread. However, that period was unusual as quantitative easing (QE) brought bond yields down to near zero levels.

- The anticipated 2026-30 excess spread is projected in line with the pre-QE historical 2000-08 average of 160bps.

SECTION 3 – PRIME OFFICES AND UK TOP RANKINGS

UK RANKS FIRST IN PROJECTED TOTAL RETURN RANKINGS

- Our base case projections for prime total returns across all sectors for the 2026-30 stand at 8.4% p.a., reflecting a slight increase from 8.2% p.a. in our previous Mar-25 base case.

- UK markets are projected to deliver the highest average total return of 10.3% p.a., which is driven by relatively higher current yields and stronger forecasted yield compression.

- CEE markets are ranked second with a forecast return of 9.1% p.a., driven by high current income yield.

- Spanish markets rank third in our total return projections, driven by higher rental growth relative to many other countries.

- The total returns for the German and Benelux markets are projected to be close to the overall European average, at rates of 8.4% and 8.3% p.a., respectively.

OFFICE REMAINS TOP RANKED SECTOR IN OUR RETURN PROJECTIONS

- Again, prime office markets are projected to have the highest returns of any sector at 9.3% p.a. over the next five years.

- This is driven by robust projected prime rental growth and a larger-than-anticipated repricing in 2024.

- Prime shopping centre markets rank second, with projected returns of 8.6% p.a., supported by their high current yields and improving rental growth forecasts.

- Base case prime logistics returns are aligned with the European all-markets average, projected at 8.4% p.a.

- Our downside and upside scenarios project average returns of 7.4% p.a. and 9.9% p.a. returns across sectors, respectively.

- Our latest return projections are primarily driven by higher current incomes, as yields widened in the recent downcycle, and capital value appreciation from expected rental growth.

- Since projected yield tightening by year-end 2030 is expected to remain limited, capital value growth from this source will likely be modest.

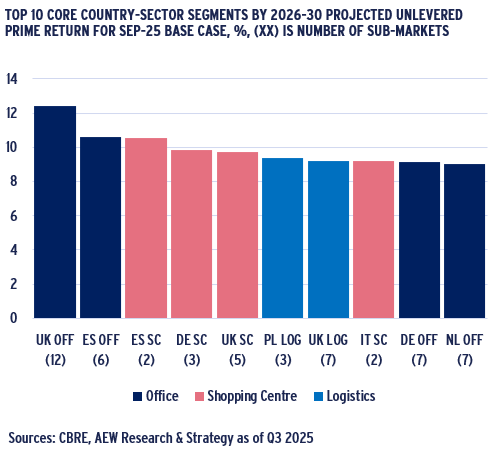

UK OFFICES SHOW HIGHEST RETURN ACROSS SEGMENTS

- If we look at our projected 2026-30 base case returns across countries and sectors, we note that UK offices offer the best returns at 12.4% p.a., followed by Spanish offices at 10.6% p.a.

- Three prime shopping centre markets are next in our ranking: Spanish, German and UK at 10.5% p.a., 9.8% p.a. and 9.7% p.a., respectively. Italian centres at 9.2% p.a. are in eighth place.

- In sixth and seventh position, Polish and UK logistics markets are forecasted at 9.4% p.a. and 9.2% p.a. returns in 2026-30.

- German and Dutch offices round out our top ten segment ranking at 9.2% p.a. and 9.0% p.a. projected 2026-30 returns.

- We observe that no residential, high street retail, or French segments are int the top ten. It is important to note that single-city segments are excluded from this ranking.

- Finally, it is important to note that projected returns do not account for segment-specific risks or borrowing costs, which could affect leveraged returns.

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW. There is no assurance that any prediction, projection or forecast will be realized.