Investing for a New Era

Asia Pacific Presents a Varied Picture

- Between July and November 2023, soft-landing expectations remained intact; higher interest rates incrementally dampened growth and reduced inflationary readings, in line with central banks intentions.

- The notion of higher for longer is likely to eventuate and investors are preparing for a new era of investing.

- Still, risks continue to build, impacting investor confidence, fundraising environment and deal making activity.

- Recession warning indicators are flashing amber, such as rising unemployment, the narrowing spread between the 2-and 10-year U.S. treasuries (USTs), meanwhile evidence of commercial bank losses in the U.S. through the bond market rout and property loans are starting to surface, adding further weight to instability. Hard to ignore as well are the ongoing conflicts with intensifying discord, which is keeping cautionary sentiment elevated.

- Outside the obvious global risks, Asia Pacific presents a varied economic landscape. We believe growth opportunities will not be widespread, but available in pockets and it will be up to managers to align with those growth factors for beta enhancing strategies.

- By H1 2024, some of our monitored markets might see slight monetary loosening, possibly benefiting debt markets, while Japan is expected to gradually normalize, after more than seven years of negative interest rate policy (NIRP).

Capital Markets Remain Quiet, Expect Protracted Repricing

- With varying expectations on interest rate positions going forward, bid-ask spreads between buyers and sellers remain wide.

- Few transactions at the USD100m and over category have concluded this year, and there are several sales campaigns that have stalled or failed across multiple markets and sectors.

- Overall transaction volumes (including alternative sectors such as hotels, seniors housing and student accommodation) are around USD96 billion year-to-October 2023, 30% lower than the same period last year. Anticipating a tepid last quarter of the year, it is likely that we will see investment volumes for the year reach around USD 123 to 125 billion - a 13-year low, similar to volumes last seen in 2010.

- While most markets have experienced declines, Japan and Singapore stand out on better performance, particularly when assessed in local currency. Japan remains the most liquid market while in Singapore, the ex-office sectors have seen healthy activity.

- Despite still limited transaction evidence year-to-date, valuers have been begun to make downward adjustment to values. However, this is being done to a much milder extent than initially anticipated, indicating a protracted repricing cycle.

Growth Momentum, Cyclical Opportunities and Value Propositions

- Despite higher for longer, opportunities exist in acquiring discounted assets today and selling in the future as rates decline to long-term averages.

- Asia Pacific continues to benefit from its early-stage growth position in key sectors such as living (and related alternatives) as well as new economy offshoots from the industrial and logistics sector e.g. cold storage, data centers etc. Many of these markets are underserved or dealing with supply constraints, which is exacerbating rent cycles and increasing income growth potential.

- Meanwhile, specific office markets offer cyclical investment opportunities, and an assessment of the retail sector, particularly in Australia, suggests favorable value propositions.

- Beyond 2024, return in income growth and potential for cap rate compression is likely supporting a better total return outlook, averaging 7% p.a. over 2024 to 2027.

RECESSION PROBABILITIES NEXT 12 MONTHS

Source: Bloomberg, as of Oct 2023

ASIA PACIFIC INVESTMENT VOLUMES

2012 TO OCTOBER 2023

Source: AEW Research, JLL, PMA, Real Capital Analytics, as of Oct 2023

Hopes for Loosening as Growth Stumbles

Asia Pacific Economy Remains Fragile, but Unique Growth Drivers Exist

- The global economy avoiding a recession in 2023 is a forgone conclusion, but still uncertainty lingers for the year ahead. Optimism is tempered by the fact that interest rates are at their highest levels in the last decade, while ongoing conflicts present further risks.

- Economic conditions vary across our monitored markets. Export-oriented economies like Singapore and South Korea have the weakest growth in 2023, while Australia has held up better due to strong population growth and infrastructure spending.

- Japan has benefited from tourism uptrend and auto exports but by Q3, a slowdown in stockpiling and private demand has started to drag on growth.

- Meanwhile, Hong Kong is finally expanding after years of weakness (but today still stands far below its pre-2019 economic output).

- China’s year-to-date recovery has been uneven and patchy as its economic composition slowly shifts away from housing and exports to other high-value manufacturing sources. Latest housing and fiscal stimulus, introduced in October and November 2023, could give a further lift to growth.

- Aside from the differences by country, there will be a cyclical recovery to take advantage of as we move forward into the next three to four years as well as several unique growth features that will continue to support expansion across key sectors of the commercial property market.

Consumption Slowdown, but Tourism Remains Healthy

- Business investment, hiring sentiment and consumption have moderated over the year, in line with expectations. Hiring outlook is down year-on-year across most markets as employers cite economic instability.

- Retail sales have also declined in the last several months across Australia, Singapore and South Korea, showing a reduced spending appetite. A paradox, however, is the larger appetite for travel spending today as compared to pre-pandemic levels. This is evident in healthy tourism numbers across several markets, especially in North Asia, and as China continues to recover, we expect tourism figures in surrounding markets to improve.

Monetary Policy Expectations Are Diverse

- Future monetary policy actions will be a balancing act in managing 1) inflation;, 2) domestic growth; 3) capital outflows; and 4) potential currency instability.

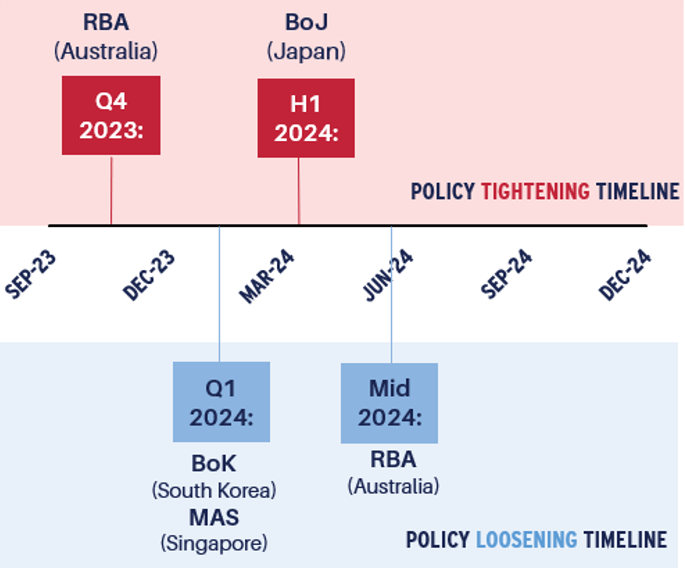

- Inflation is trending down but remains most stubborn in Australia. Consensus outlook points to Singapore and South Korea to take the first step in loosening while the RBA in Australia is likely to delay rate cuts to the second half of 2024.

- Meanwhile the BoJ in Japan could move away from negative interest rate policy as early as January 2024. This comes on the heels of the BoJ calling a de facto end to Yield Curve Control at their 31 October 2023 meeting.

- Despite expected rate cuts in 2024, these will probably be limited, and rates should stay 150 - 200 bps above past 10-year averages.

- Outside of Japan, the balance of probabilities for sustained local currency appreciation against the USD remain low, especially if the Fed stays rigid on holding rates for a protracted period.

ASIA PACIFIC GDP GROWTH

2023 TO 2025

Source: Oxford Economics, Bloomberg & AEW Research, as of end October 2023

MONETARY POLICY MOVEMENT EXPECTATIONS

AS OF SEP 2023

Source: Oxford Economics, Bloomberg & AEW Research, as of end October 2023

The Challenge Opportunity Spectrum

Office

Leasing Sentiment Turns Weaker in Q3, Flight to Quality Strongest in Australia

Leasing conditions have weakened across most markets; average net demand in Q3 was 1.6 million square feet down 20% quarter-on-quarter. Unsurprisingly, near-term rental forecasts in Greater China and Singapore were downgraded, however we believe the recovery in the latter should come through by mid-2024. Cost-consciousness remains a prevailing sentiment, but Australia’s east coast markets stand out as the most bifurcated with a strong flight-to-quality trend. Some markets continue to move against the grain – such as Seoul and Brisbane where effective rent growth forecasts have been upgraded. Conditions in Tokyo are also turning more positive, as pre-leasing in new construction picks up, leading to a slight improvement in vacancy rate expectations by end 2023.

Better Prospects in Asia Pacific, Opportunity as Global Capital Rebalances Out of Sector

Several markets are currently facing rent and valuation downturns due to supply imbalances and weak economic sentiment. However, the medium-term outlook for offices in the Asia Pacific region is more favorable than Western counterparts. Utilization rates are higher, and WFH (ex-Australia), is limited. Our analysis of local dynamics also points to upcoming cyclical improvements in Singapore and Sydney. Despite these positive indicators, global investors seem inclined to reduce their exposure to the sector, including better performing markets. Investment volume across target cities was just USD34 billion year-to-October 2023, reflecting a 40% decline from the same period last year. Investors with a deeper understanding and appreciation of local dynamics may find attractive opportunities ahead as more quality assets are put up for sale.

Logistics

Markets in a Diverse Position

The most landlord favorable conditions today exist in Australia’s eastern seaboard markets and Singapore, where vacancy is close to 0%, re-leasing spreads are in the double digits and pre-leasing in upcoming supply is active. In North Asia, overbuilding has been a concern – however this is moderating in Greater Seoul due to delays and cancellations while in Japan, supply is disproportionately concentrated in the inland markets where landlords are offering larger rent reductions or incentives to revive occupancy.

Investor Interest Strong in Markets With Positive Yield Spreads

Investor interest in the sector remains strong, especially as capital gets redirected away from offices. In Singapore and Japan, investor activity is up, showing year-on-year increases of 40% and 64%, respectively. These markets benefit from positive yield spreads, and the influx of capital has led to a slight compression in yields. Conversely, in Australia and Greater Seoul, yields have risen by 70 to 150 basis points from their peak levels. This increase in yields occurred as transaction volumes have declined by over 50% compared to the same period last year.

Retail

Consumer Sentiment Turns Cloudy, Investment Activity Mixed

The outlook for discretionary retail is turning cloudy as higher interest rates and inflation have eaten into consumer spending. At the property level however, positive conditions are becoming evident as a larger proportion of leases are reverting positively as they are rolled off from COVID-years subsidies. Today, the sector presents a great value proposition, especially in Australia and Hong Kong high-street, where the sector has repriced the most from peak levels.

Given elevated financing costs, liquidity for large shopping malls remain fairly tight, except for Singapore where some large operators have reshuffled their portfolios. In Australia, large institutional investors are net sellers today as they manage their gearing levels, and smaller private capital have emerged as the main buyers.

Residential

Strong Migration and Immigration Support Demand, Robust Cross-Border Appetite

In Japan, migration patterns have already returned to pre-pandemic levels, supporting multifamily demand in the major cities. Meanwhile, in Australia, extremely strong overseas net migration, low vacancy rates and housing affordability is exacerbating pent-up demand conditions for all kinds of rental housing (BTR, student accommodation, co-living). Both markets are exhibiting strong occupier fundamentals, and the supply shortage today is providing further upside to rental growth story in the near-term.

Office

Australia: Bright Spots and Potential Rental Upside, Repricing Extends to 2024

- Leasing prospects today are strongest in Brisbane, where rental growth forecasts for the year have been upgraded to 16.0% in 2023, while in Sydney, stock withdrawals and rezoning of office sites for alternative use present a potential for rental upside in the medium-term (2025/6) for prime grade offices.

- Transaction markets in the >USD100m category have been limited year-to-date, but despite the lack of evidence, valuers are starting to make downward adjustments. The re-pricing cycle could extend to end 2024, with declines ranging from 20 to 30%. Secondary grade assets will be on the deeper end of declines.

Singapore: Market Remains Quiet, Potential Rebound in 2024

- Leasing and investments are in a period of low activity. Rent forecasts for 2023 have been downgraded due to economic weakness, but beyond 2024, there is potential for a decent recovery at net supply drops 70% below the past 10-year historical average.

- There are approximately 15 sales campaigns on the market today; some are active, while most have stalled. Sales of non-core assets outside the markets are starting to come through in October 2023 and could be important in understanding pricing in the market.

Hong Kong: Rent Downgrades, Distressed Sales or Bank Repossession Likely

- Rent growth forecasts have been revised down to reflect weak demand from mainland China while supply due in Q4 2023 on Hong Kong Island will add to vacancy, causing downward pressure on rents. Office rents are around 30% below their peak in June 2019 and office prices are estimated to be 25% lower.

- A growing pool of asset managers are looking to dispose their assets as rising interest rates break debt covenants and wipe out income return. Asking prices for these assets are touted at 15 to 20% below market. With limited investment interest in the market today, several of these assets could be repossessed by the bank.

China: Weak Leasing and Investment Markets

- Despite the return to normal business operations, leasing demand has not improved. Occupiers are cautious about relocating or expanding, and vacancy rates are rising due to widespread construction. Landlords are offering significant rent reductions and incentives as cost-consciousness prevails.

- While many assets are available for sale, bid-ask spreads are wide, making transactions challenging. Offshore buyers are scarce, while interested domestic parties face lengthy and slow procedures, lasting anywhere between 9 to 12 months.

South Korea: Positive Occupier Market Conditions Supports Pricing

- The leasing market remains in a solid position and limited supply in the next three years in the three core markets will support rental growth. Leases are reverting 15 to 20% higher over the next two years, presenting strong income growth potential.

- South Korea’s office market has defied expectations of downward price pressure. Riding on the strength of the occupier market, some recent transactions are reflecting record high pricing.

Japan: Supply Risks Controlled With Moderate Tenant Demand

- Recovering demand has mitigated the impact of 2023’s surge in completions. Better pre-leasing and limited supply in 2024 hint at potential rent recovery. However, a subsequent increase in supply in 2025 is expected to keep vacancy rates above historical averages throughout the forecast period and rental weakness is likely to continue.

- Investment volumes in Tokyo have come down, but ostensibly held up better than other markets. We expect investors to continue to be selective on assets, Grade B is likely to see more liquidity as the number of Grade A offices for sale are limited.

OFFICE RENT INDEX

2022=100

Source: AEW Research, JLL, Q3 2023

Logistics

Australia: East Coast Markets are Undersupplied, Pricing is Mixed

- New construction peaks in 2023/24 are being met with slower demand compared to six months ago, however constricted vacancy is keeping markets extremely landlord favorable. Pre-lease for 2024’s supply is >60% and rental growth is expected to continue in 2024.

- Investment activity improved in H2 2023 but still lacks depth on account of higher interest rates. Short WALE assets remain in high demand and due to extremely positive releasing spreads (exceeding 50% in some cases), which have mitigated valuation risks. Conversely, long WALE assets have seen value declines, ranging from 10 to 12%.

Singapore: Favorable Occupier Conditions, More Investors Target the Sector

- Demand for prime facilities remains strong, leading to full occupancy and limited options for 3PLs looking to expand. Rental growth of 14% expected in 2023, with projections of 3% to 5% growth in 2024 and 2025.

- The sector continues to be actively traded driven by attractive yield spreads (to cost of debt) and the favorable rental outlook.

Hong Kong: Vacancy Remains Low, but Demand Headwinds Increase

- While warehouse vacancy remains low, rents may level off and face potential declines in 2024. Cold storage expansion, active in 2021, is now weakening, with operators returning space to the market. In contrast, the self-storage sector is experiencing growth with expanding operators.

- Liquidity is restricted, and the market mainly sees smaller transactions - over 60% of year-to-date deals were of values less than USD 10 million. There were only three enbloc deals transacted since Jan 2023 (of value USD 50M and above), with no cross-border buyers. New-economy conversion plays (to data centers, cold-storage, or self-storage) remain interesting, but interest rates would probably need to fall by 50 to 100 bps to reignite interest.

South Korea: On-Going Supply Delays, Markets Re-Price

- Demand year-to-date is positive, and e-commerce groups are resuming expansion after a 9-month slowdown. Cold remains oversupplied, especially in the West submarket, but this is contrast to dry, which is just 10% vacant and continues to see rent increases. Ongoing construction delays are lowering supply risks and giving the market time to absorb new completions. There is a potential for a stabilization of overall vacancy by H2 2024.

- Debt costs have lowered in the last six months, but investment activity remains limited. Transaction yields held a wide range, but in general have expanded by 70 to 120 bps since peak pricing in 2022. There are other institutional investors closely monitoring the sector again due to quicker-than-expected supply reduction and potential rental recovery as well as for distressed development deals.

Japan: More Favorable Conditions in Inner-City Submarkets

- Occupier conditions are bifurcated by location. Near-city areas with good port access see limited construction and rent increases, while farther inland markets face heavy leasing competition with large new construction.

- Capital continues to flow in due to appealing yield spreads, with 2023 transactions already exceeding historical annual averages.

LOGISTICS RENT INDEX

2022=100

Source: JLL, as of Q3 2023

Retail

Australia: Retail Sales Strong Up to Q4, Positive Yield Spreads

- Inflation and rising interest rates have had their intended impact on consumer spending. Real retail sales have declined q-o-q in Q1 and Q2 2023, and only registered a marginal increase in Q3 of 0.2% q-o-q. At the same time, consumer confidence surveys continue to indicate cautionary spending.

- As the economy slows and discretionary spending tracks lower, demand for specialty store space is likely to reduce and rents come under pressure. In this scenario, leasing spreads which are mildly positive today (around 2 to 3%), should flatten out in 2024.

- Despite the near-term headwinds, various capital sources are showing interest in the sector, especially given the value proposition for the asset class and potential for recovery alongside healthy population growth. Private domestics remain the most dominant purchasers.

- Yields are expected to soften between 15 to 50 bps over the next 12 months with assets with larger discretionary components on the large end.

Singapore: Rents Recovery Continues in 2023

- Major landlords are now seeing positive reversions of around 3-5%, rebounding from COVID lows and subsidy reductions. This is backed by increased foot traffic and sales compared to a year ago, but inflation and economic uncertainty might moderate these improvements.

- In 2023, the investment market witnessed significant transactions involving wealthy domestic and offshore families as well as REITs, with pricing staying fairly consistent so far.

Hong Kong: Tourism-Led Recovery, but Focus on Services

- After years of weakness, there has been a comeback in retail leasing. Retail sales were up 10% y-o-y in Sep 2023, boosting retailer confidence and supporting expansion. High-street shops are benefiting with rents up around 10% year-to-date, although still 40% below pre-COVID levels.

- Hong Kong’s retail market has historically been supported by tourism spenders from mainland China, but this has altered since 2019. Spending by day-trippers from China is down 48% from 2018 and a larger proportion of their spending outlays are on services (i.e. hotels and restaurants) versus goods. Less spending power by Chinese means retailers of luxury goods will not recover to pre-2019 levels soon. Instead, shops that offer “retailtainment”, wellness and experiential offerings are likely to do better.

- Domestic, non-institutional investors continue to comprise the bulk of capital interested in the sector, especially for high-street shops where there is good value.

RETAIL RENT INDEX

2022=100

Source: JLL, as of Q3 2023

Multifamily

Japan: Healthy Demand, Rent Growth to Support Capital Value Growth

- Migration patterns have already returned to pre-pandemic levels, supporting the demand in major cities. Leasing conditions, especially in inner-city areas, have improved substantially compared to one year ago, and there is a resurgence in demand for smaller-sized units in areas easily accessible to CBD locations.

- Several institutional landlords are noting significant rent growth at tenant turnover, particularly within Tokyo CBD locations. Wage growth, which is finally evident in Japan, will further support rental increases.

- Capital remains interested in the sector, and yields are expected to remain stable. Rental growth in the near-term will contribute to capital value increases.

MULTIFAMILY RENT INDEX

2022=100

Source: PMA, as of Oct 2023

For more information, please contact:

GLYN NELSON

Managing Director, Head of Research and Strategy, Asia Pacific

glyn.nelson@aew.com

+65.6303.9016

HANNA SAFDAR

Assistant Director, Research and Strategy, Asia Pacific

hanna.safdar@aew.com

+65.6303.9014

JAY STRUZZIERY, CFA®

Head of Investor Relations

jay.struzziery@aew.com

+1.617.261.9326

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW. There is no assurance that any prediction, projection or forecast will be realized.