EUROPEAN RESIDENTIAL: FINDING A NEW BALANCE

- Prime European residential markets show solid occupancy fundamentals and stabilising investment yields. This is despite the 2022-23 upward shift in interest rates and associated decline in lending. Student housing has also remained a key alternative sub-sector.

- The long-standing shortage of housing has further intensified as higher mortgage rates and a drop in mortgage lending pushed demand for rental housing up, as home ownership became less affordable.

- Positive household formation trends, especially in Europe’s cities also offset the impact of its weak population growth.

- Already limited supply of new housing has been further cut back, in large part due to low developers’ profitability and uncertainty around rent control, EPC and planning regulations.

- Therefore, European prime residential markets are projected to see market rental growth of 2.5% p.a. in 2024-28, ahead of inflation.

- Following the recent interest rate increases, 2023 European investment volumes halved. However, with both inflation, central bank rates and bond yields projected to come down, price expectations of buyers and sellers are likely to re-align and liquidity to return.

- The timing of this re-alignment will be driven in part by the refinancing challenges of legacy debt. In that respect, the residential sector faces a modest 14% relative debt funding gap for 2018-21 loan originations, well below those faced by the retail and office sectors.

- Since 2008, residential has doubled its share in total investment volumes to 20% in 2023 and emerged as a core sector in the overall investment market.

- Based on our latest forecasts, we project prime residential yield compression to start from the second half of 2024. It is projected that prime residential yields may tighten by an average of 40bps by 2028, partly reversing the 130bps yield widening since mid-2022.

- Furthermore, our analysis of student housing markets confirms that this sub-sector benefits from strong demand fundamentals, coupled with investors being able to rely on a single professional operator.

- Student housing yields have proved more resilient to the rise in interest rates than prime residential and other sectors. UK regional university towns and Southern European markets appear to be the most attractive markets for investment into student housing.

HOME OWNERSHIP OUT OF REACH FOR MOST, DESPITE STABILISING MORTGAGE RATES AND HOUSE PRICES

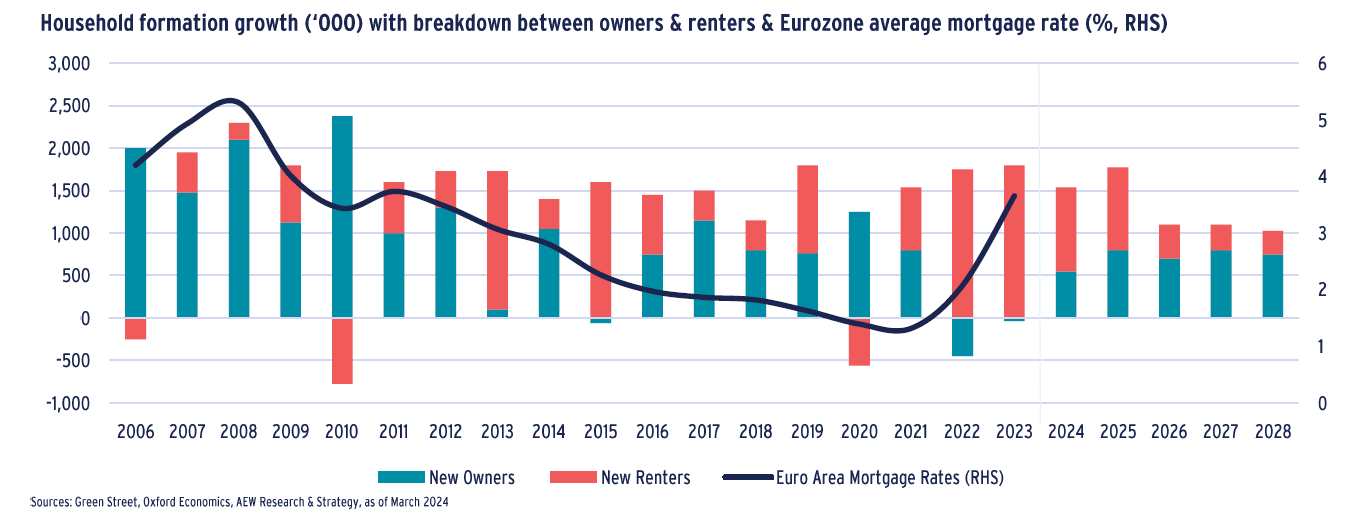

DESPITE STABILISING RATES, RENTING REMAINS MORE AFFORDABLE

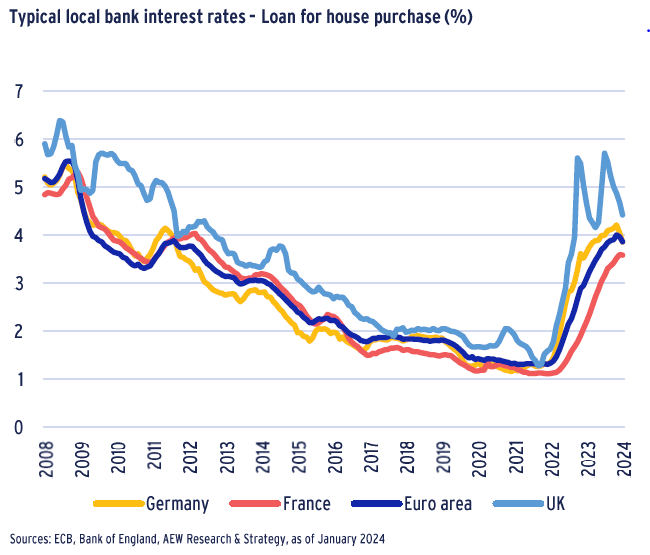

- Average Eurozone mortgage interest rates have risen to just below 4% at the start of 2024, a level not seen since 2012, representing the largest and fastest increase ever recorded.

- Typical Eurozone mortgage rates have risen significantly since the beginning of 2022 after the ECB started hiking its base rates to curb inflation.

- UK mortgage rates are significantly higher than in the Eurozone due in part to higher UK inflation and the Bank of England’s independent monetary policy.

- UK rates rose sharply in the past year with the average quoted rates for a 5-year fixed mortgage at 75% LTV peaking at 5.7% in July-23. However, UK rates have since decreased to 4.4% in Jan-24.

- As more households will be unable to afford a loan for a home purchase in the current lending environment house prices are expected to come down. At the same time, this supports the demand for rental units in the private rented sector.

LOWER MORTGAGE LENDING HAS PUSHED HOUSE PRICES DOWN

- In addition to the rise in interest rates, there has been a decline in lending from banks to finance house purchase, after eight years of steady increase, uninterrupted by the Covid pandemic.

- Data confirms that house price growth and residential mortgage lending volumes are highly correlated.

- The decrease in lending activity has caused house price growth to abruptly decline from 10% in Q1 2022 to -2% in Q3 2023, a modest decrease.

- The recent macroeconomic slowdown and cost of living crisis faced by many households is another contributing factor to house price declines.

- As banks started lending again at the end of 2023, house price growth is almost returning to positive territory in Q4 2023. This rebound is expected to continue in 2024.

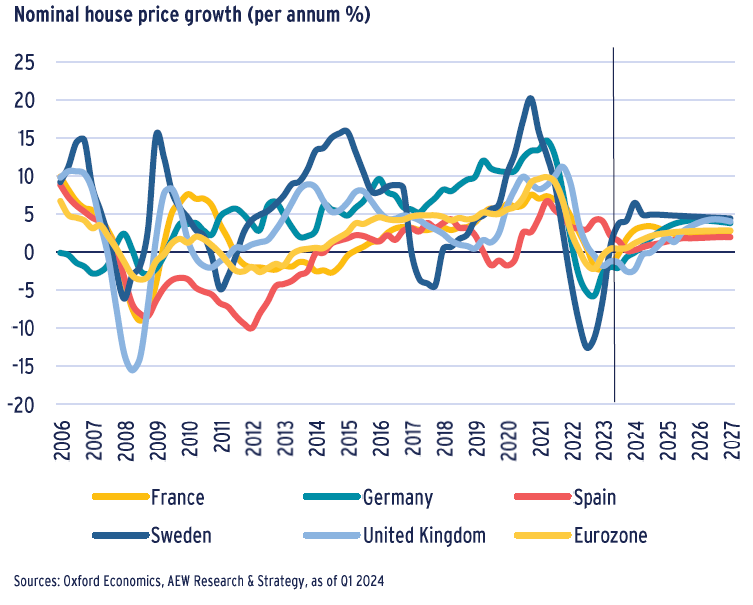

HOUSE PRICES EXPECTED TO RECOVER IN THE COMING YEARS

- The rise in interest rates has led to a sharp slowdown in house price growth from 7% in 2022 to -1% in 2023 on average in the Eurozone.

- There are significant differences between national markets due to structural differences in their mortgage markets.

- Markets with a higher share of mortgages with variable interest rates, such as Sweden, experienced a faster slowdown in house prices with a decline of 10% recorded in 2023.

- With the notable exception of Spain where prices increased by 4%, most European markets experienced a decline in prices in 2023, ranging from -4% in Germany, -3% in the Netherlands to -1% in France. Prices continued to increase by 0.5% in the UK.

- As interest rates stabilise and potentially come down as implied by bond yield pricings, house prices are expected to recover. Oxford Economics projects an increase of 2.4% per annum on average in the Eurozone over the next five years.

TIGHTENED FINANCING CONDITIONS ARE LIMITING NEW SUPPLY AND LEADING HOUSEHOLDS TO RENT FOR LONGER

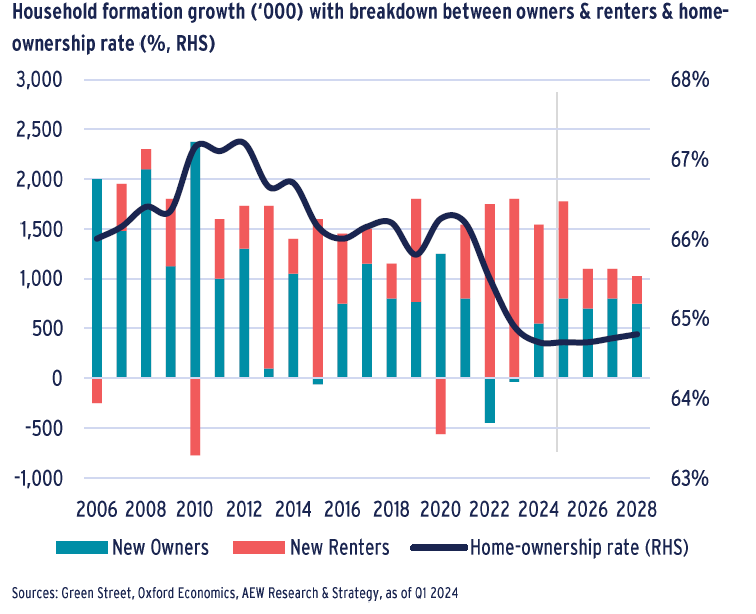

HOUSEHOLDS RENTING FOR LONGER

- The main fundamental driver of housing demand is household formation. While population growth is weak overall in Europe, household growth remains strong, particularly in cities.

- Indeed, the typical household size is decreasing. This results from a later entry into adult life, more fragmented family structures and population ageing.

- As a result of the tightening financing conditions, many households have been unable to secure a mortgage and have remained in rental properties.

- This is highlighted by the breakdown between owning and renting on the chart, highly tilted towards renting in 2022 and 2023. This is expected to remain the case in 2024, with a gradual rebound in home-ownership expected from 2025.

- Nevertheless, going forward the home-ownership rate is expected to remain lower than its historic average, and below 65%, on average in Europe.

LOWER NEW SUPPLY AS DEVELOPERS’ PROFITABILITY SUFFERS

- Despite a recent softening of construction costs, developers continue to struggle with a high cost of capital and lower sales prices making new developments less profitable.

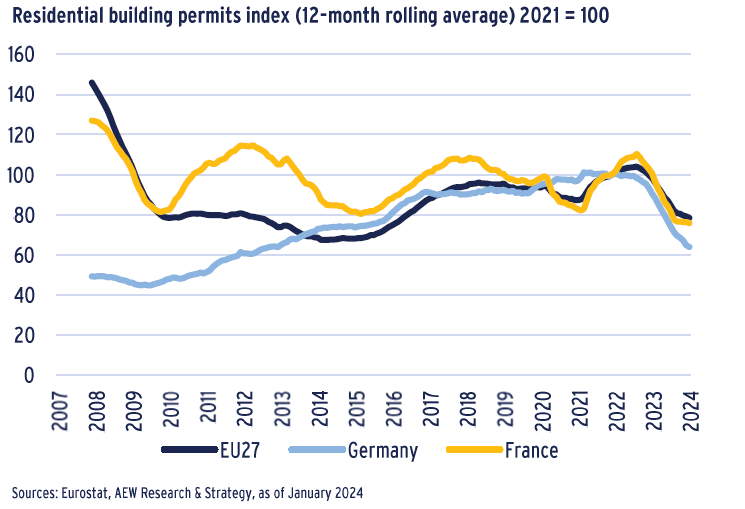

- As a result, the supply pipelines of new housing in the main European markets are shrinking. The number of residential building permits filed in the EU27 – a leading indicator of future developments – fell sharply in 2023.

- These permits might not even translate into new residential developments as many developers are facing financial difficulties, particularly in Germany where the market is more fragmented.

- The supply of new housing is unlikely to recover in the short term. This will make supply in constrained cities even tighter than before, with market rents expected to increase further.

RENTS CONTINUE TO INCREASE AS MARKETS BECOME TIGHTER

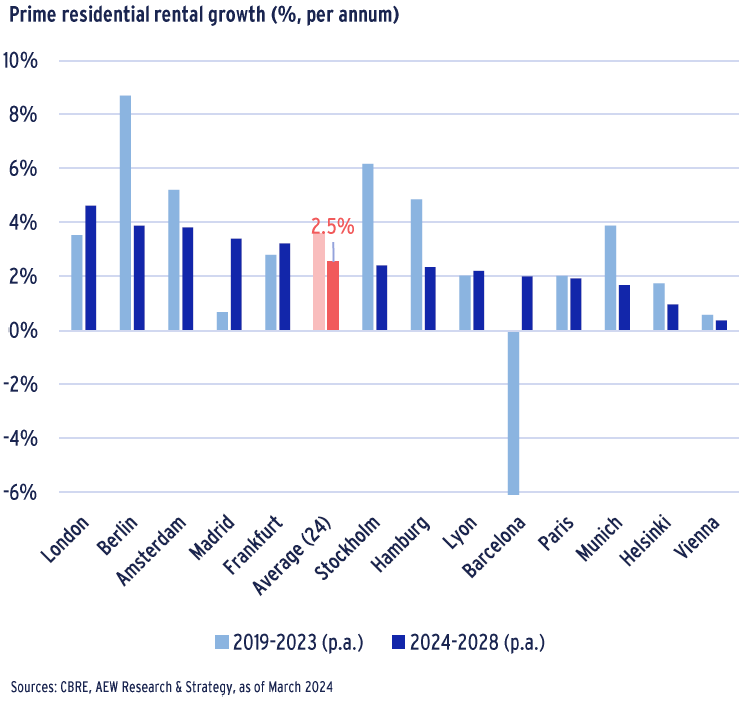

- The long-term supply shortages have become more acute in 2023 in key European cities, driving rental growth (6.3% recorded in 2023).

- Based on our latest projections, we expect 2.5% p.a. average prime residential rental growth for 2024-28, just above projected inflation of 1.9% p.a. on average across the 24 European markets, as the imbalance between demand and supply continues.

- This is less than the 3.6% p.a. prime rental growth recorded over the past five years across our 24 markets coverage, boosted by a strong 2022 and 2023. London, Berlin, Amsterdam and Madrid are expected to outperform the European average.

- Barcelona stands out with negative rental growth due to the introduction of rent control mechanisms. This highlights a trend toward more rental regulation in Europe.

- Across Europe, the lack of supply is exacerbated by environmental regulation preventing energy-inefficient dwellings to be rented and by the upcoming Summer Olympics Games pushing buy-to-let landlords to transfer their properties from long-term to short-term rentals (e.g., Airbnb).

INVESTMENT ACTIVITY HAS NOT RESTARTED YET DESPITE REPRICING

SUBDUED ACTIVITY MASKS DOUBLING OF RESI SHARE SINCE 2008

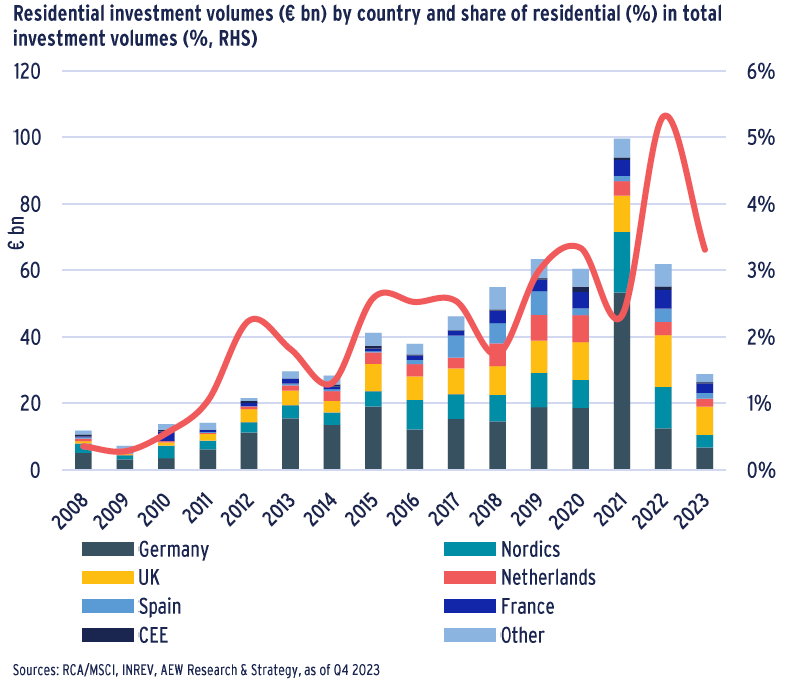

- European residential volumes totaled less than €30bn in 2023, a 53% decrease compared to 2022. A similar decline can be seen in many other sectors of the market.

- Residential transactions remain scarce and were down 45% in the first quarter, thus investors and valuers continue to struggle to gauge values and yields as bid/ask spreads remain high.

- Nevertheless, according to the INREV 2024 Investment Intentions Survey, residential took the first position as preferred investment sector for the first time, ahead of logistics.

- This investor preference can be explained by the relative high stability of cashflows offered and improved liquidity.

- Over the last 15 years, residential has doubled its market share and emerged as a core sector in the overall investment market increasing its share from 8% in 2008 to 20% in 2023.

RESIDENTIAL PRICES STABILISING AFTER 24% DECLINE

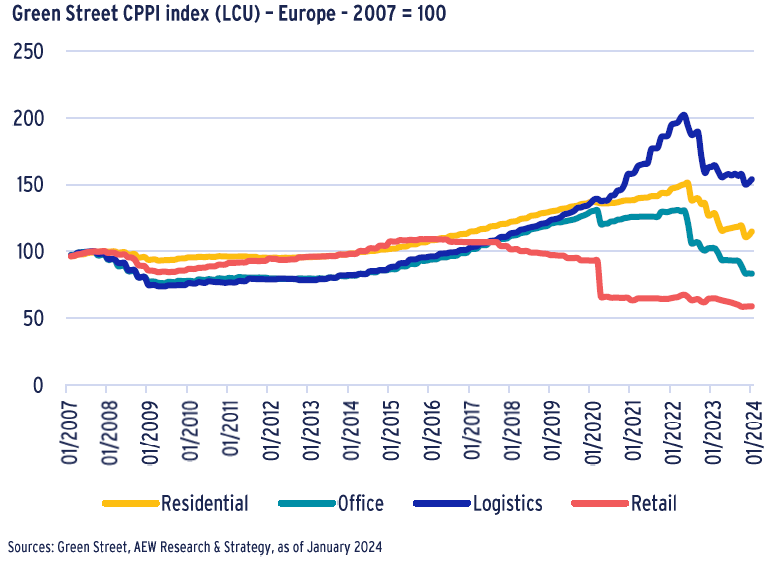

- According to Green Street’s CPPI index, the European residential sector has experienced a significant repricing of 24% since mid-2022 when interest rates started rising.

- This compares to 24% in the logistics sector and 36% for offices.

- As a proxy for private market pricing, the CPPI index is unlevered and captures the prices at which commercial real estate transactions are currently being negotiated and contracted – even if the deal does not complete.

- The latest index update highlights how residential capital values started stabilising at the end of 2023/early 2024.

- It should be noted that the index was launched in 2010. The index was backfilled during the GFC which might underestimate the capital value declines during the 2008-2010 period.

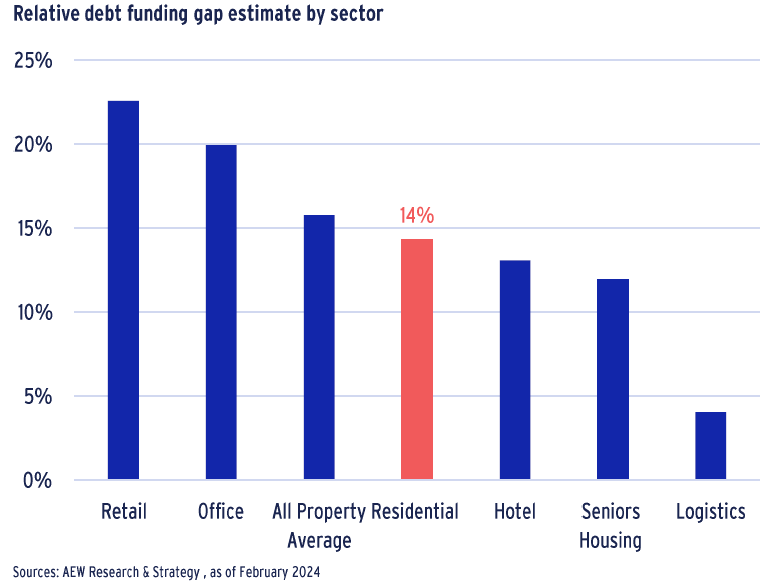

RELATIVE DEBT FUNDING GAP IN RESIDENTIAL BELOW AVERAGE

- Refinancing challenges remain a major headwind for investors. Our estimate of the debt funding gap (DFG) represents the potential shortfall between the originally secured debt and the amount available for refinance at the loan maturity.

- Our estimate is driven by lower collateral value projections as they drive up loan-to-values (LTVs) at refinancing, the additional impact from higher interest rates on interest coverage ratios (ICR) and lower LTV loan origination levels available from lenders.

- Our estimate of the debt funding gap is calculated on a relative and not absolute basis to account for differences in acquisition and debt origination volumes between property sectors.

- Compared to retail and office, residential-backed loans show a lower relative DFG with 14% of 2018-21 originated loan volumes expected to face refinancing issues, compared to 23% for retail and 20% for offices.

RESIDENTIAL YIELDS EXPECTED TO TIGHTEN FROM 2024

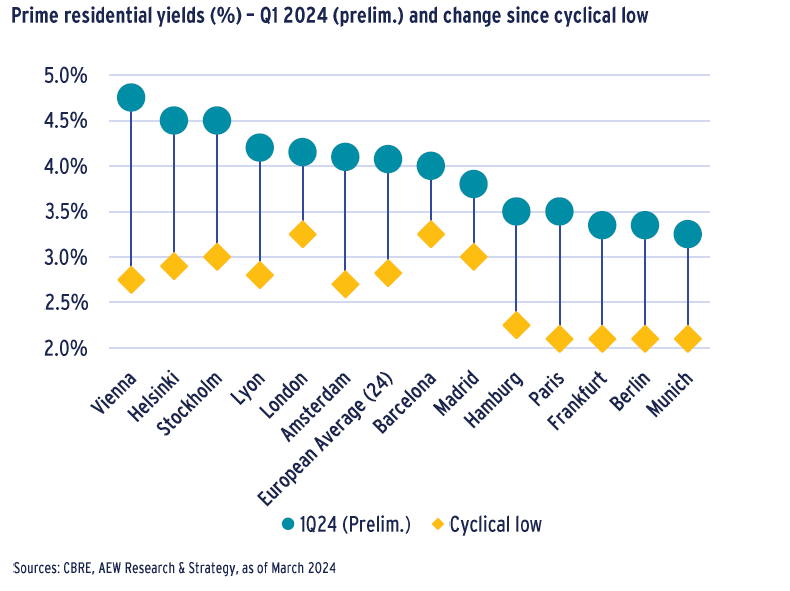

PRIME RESIDENTIAL YIELDS MOVED OUT 130 BPS SINCE MID-2022

- Prime residential yields have moved out by 130bps on average in Europe since their lowest level in H1 2022.

- This prime residential yield widening is consistent with other European property sectors as high inflation triggered a dramatic increase in interest rates from central banks.

- The range of the yield decompression varies from 150bps recorded in Vienna and Stockholm to just 80 bps in the Spanish markets.

- This is in contrast with last year when there was some lag in the yield widening across some markets.

- Prime residential yields stood at 4.10% as of Feb-2024 when considering a 24-market European average, ranging from 3.25% in Munich to 4.8% in Vienna.

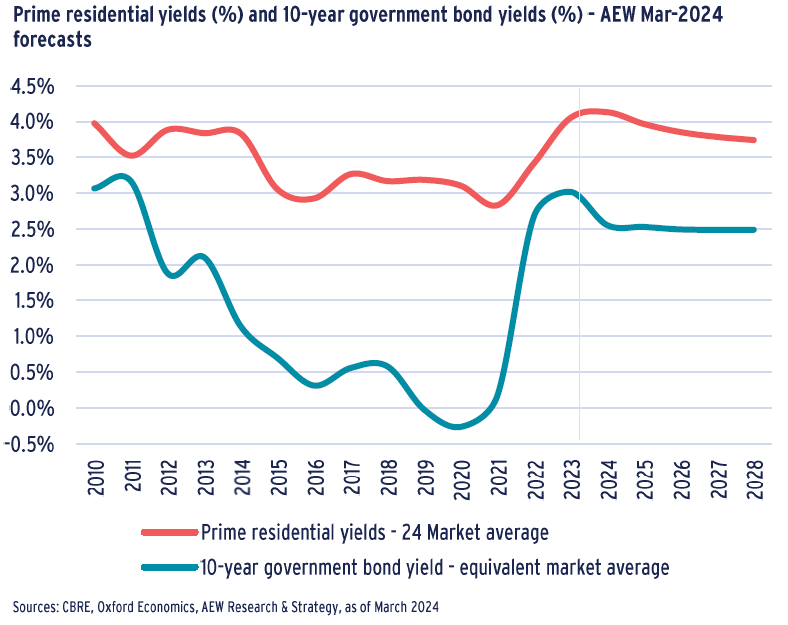

40 BPS YIELD COMPRESSION TO BE EXPECTED IN 2024-28

- Our recently updated prime residential forecasts indicate a 40bps yield compression by 2028 across our 24-market average, after prime residential yields peak at 4.1% in 2024.

- This is a partial reversal the 130bps yield decompression recorded in 2022 and 2023. The implied stability between residential and government bond yields is a result of the 24 different individual market models.

- Most markets seem to have fully repriced with only limited yield expansion expected in H1 2024.

- Our latest yield forecasts reflect the Oxford Economics forecasts on the stabilisation of government bond yields as central banks are expected to decrease their base rates from summer 2024.

- The spread between prime residential yields and government bond yields is expected to average 140bps over the next five years, lower than the average of 240bps over the previous 10 years.

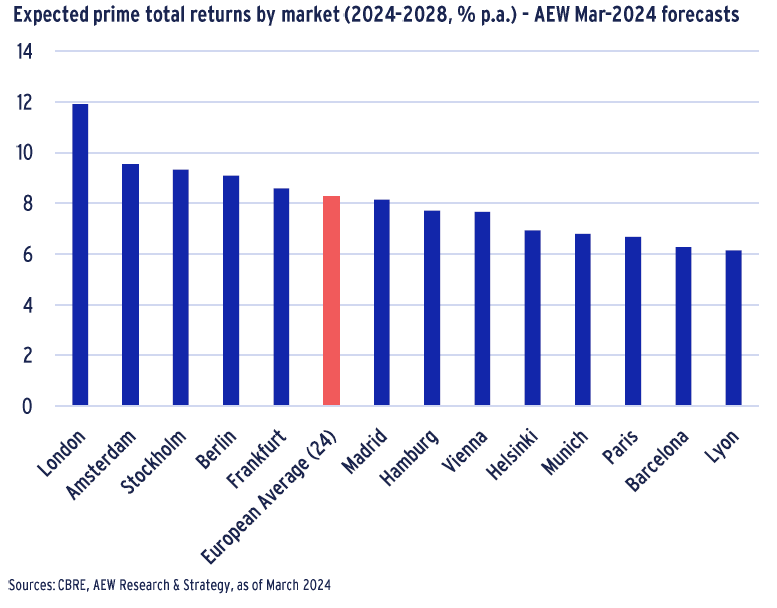

LONDON & AMSTERDAM EXPECTED TO OUTPERFORM

- Our recently updated prime residential forecasts show that total returns are expected to reach 8.3% per annum over the next five years on average across the 24 European markets.

- This is slightly weaker than our Sep-2023 forecast for the same markets and period (8.9% per annum).

- All residential markets should benefit from prime total returns exceeding 6% per annum over the coming 5-year period, assuming an investment in 2024.

- This is mostly driven by the 40bps yield decompression expected from 2024, combined with solid rental growth of 2.5% per annum.

- London and Amsterdam are expected to outperform the European average with 11.9% and 9.5%, respectively.

- By contrast, Barcelona and Lyon are expected to underperform with 6.3% and 6.1%, respectively.

SPECIAL FOCUS: STUDENT HOUSING OPPORTUNITY MOSTLY DRIVEN BY FOREIGN STUDENT AND MATURING OPERATORS

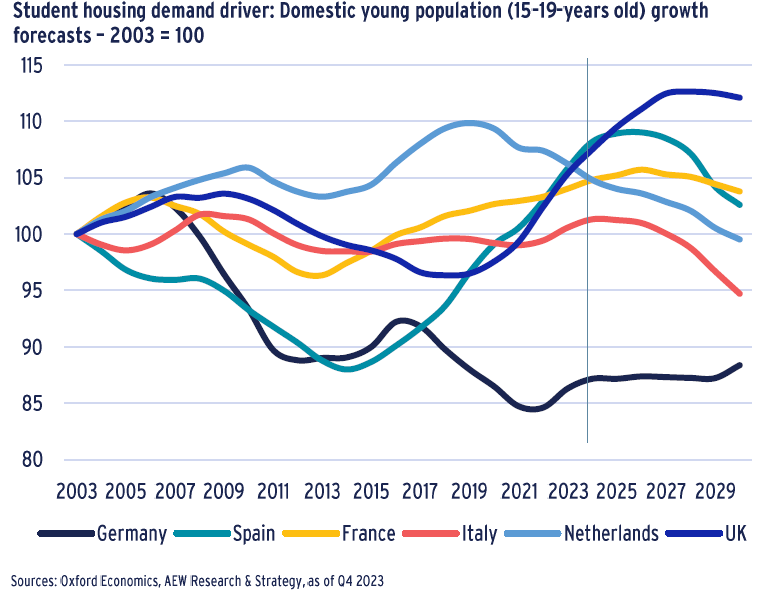

MIXED DEMOGRAPHIC STORY IN AGEING EUROPE

- In ageing Europe, the domestic student-aged population is expected to decrease in most countries going forward.

- This downward trend in future student numbers is most acute in Italy and Spain, but also in the Netherlands, as a result of decreasing fertility rates.

- The UK stands out as the country with the best demographic outlook, with the strongest increase in the young population.

- The student-aged population is expected to remain stable in Germany and France.

- The mixed demographic story is partly offset by the increasing number of foreign students in Europe.

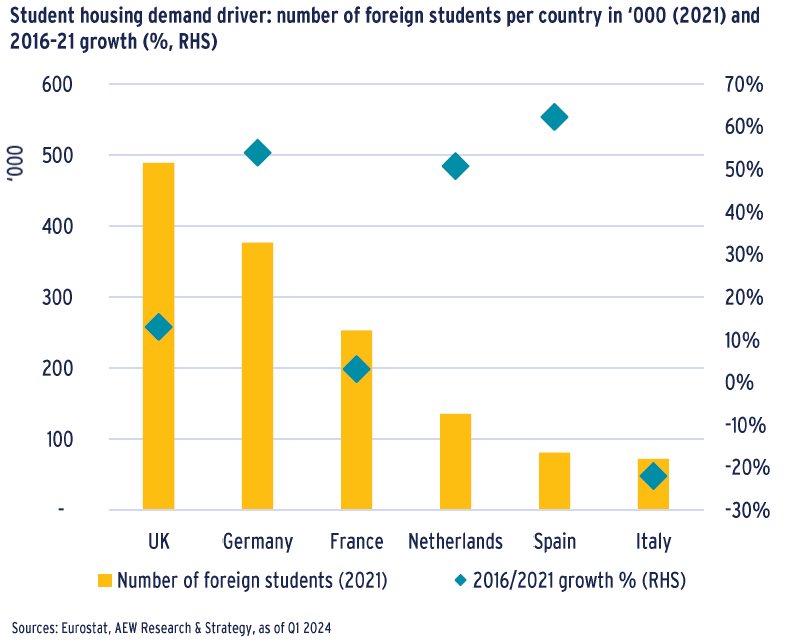

GROWTH IN FOREIGN STUDENTS IS A KEY DEMAND DRIVER

- Foreign students are less likely to rent in the private rental sector due to the complexities associated with a lease contract with a private landlord.

- Purpose-Built Student Accommodation (PBSA) provides a simpler alternative for foreign students, with all-inclusive contracts typically including an internet connection, utilities, access to on-site services and immersion in student community.

- The UK, Germany and France attract the highest number of foreign students in Europe.

- The number of foreign students increased by more than 50% in Spain, Germany and the Netherlands since 2016, driven by the increasing number of English-speaking programmes.

- By contrast, the number of foreign students in the UK and France increased by only 13% and 3% respectively.

- Italy, meanwhile, has seen its number of foreign students fall by 22% in 2021 compared to 2016, potentially due to the more restrictive measures of the Italian government during the COVID-19 pandemic.

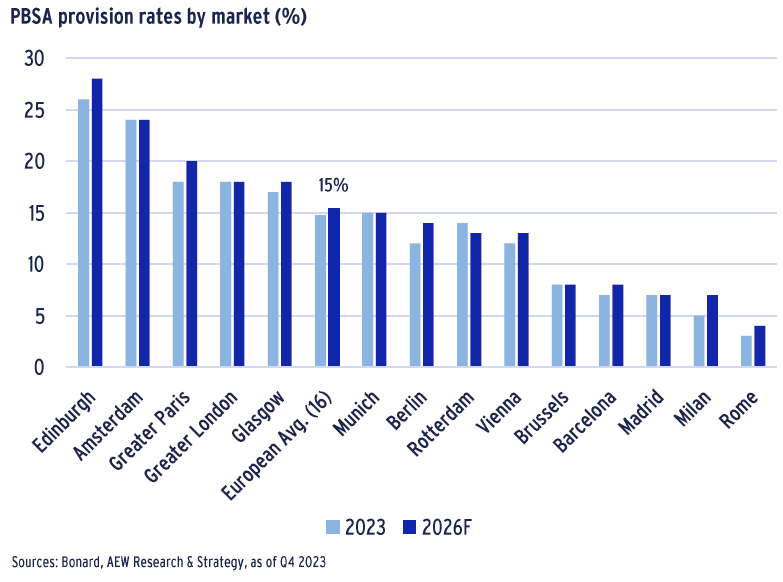

LOWER PBSA PROVISION RATES IN SOUTHERN EUROPE

- The average 15% provision rate is calculated as the ratio between the number of beds available in PBSA and the total number of full-time students in a market.

- The remaining 85% of students live at home or in private rental accommodation.

- Northern European countries have a more mature PBSA sector, with high provision rates, notably in Copenhagen (28%), Edinburgh (26%) and Amsterdam (24%).

- By contrast, cities in Southern Europe, such as Barcelona (7%), Madrid (7%), Milan (5%) and Rome (3%) have lower provision rates. This means there is plenty of room for additional growth in PBSA stock.

- According to Bonard’s forecasts, provision rates are expected to increase everywhere in Europe between now and 2026 as European student housing operators are expanding to meet increasing demand.

SPECIAL FOCUS: STUDENT HOUSING INVESTMENT MARKET SHOWS RESILIENCE

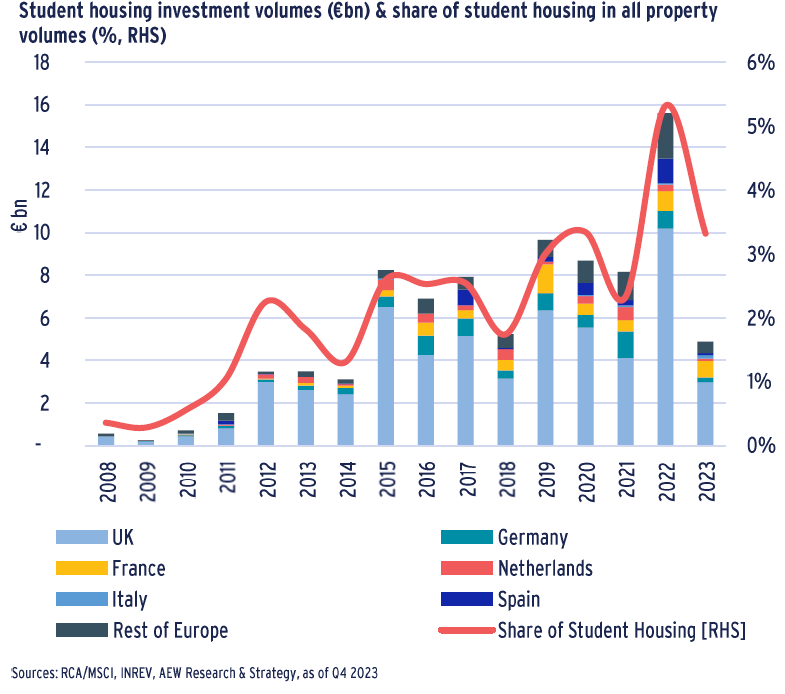

INCREASING INVESTOR APPETITE FOR STUDENT HOUSING

- There is a clear upward trend in the share of the PBSA sector in total property investment volumes in Europe, which exceeded 5% in 2022, from 1% in 2011. This reflects the increasing maturity and liquidity of this residential sub-sector.

- European student housing volumes totaled €4.9bn in 2023, as prices adjusted to the higher interest rates environment. This comes after the 2022 record transaction volumes of €15.6bn.

- According to INREV 2024 Investment Intentions Survey, student housing recorded the biggest increase in terms of investment preference.

- The UK is by far the most liquid investment market, representing 60% of European volumes in 2023, in line with the historical average. France is the second largest market, representing 16% of European volumes.

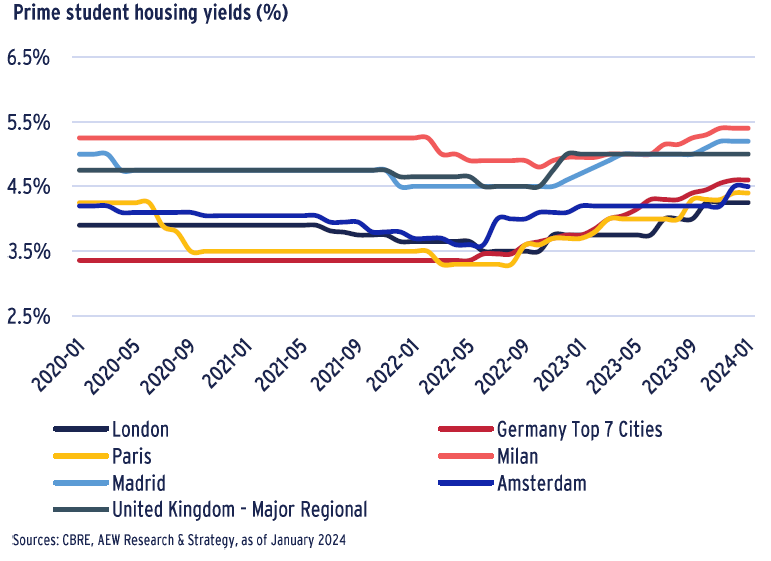

SOUTHERN EUROPEAN PBSA YIELDS STILL OFFER A PREMIUM

- Prime student housing yields have moved out by 85 bps since mid-2022 as a result of rising interest rates, on average across the covered markets.

- Southern European markets such as Milan and Madrid have higher student housing yields. This is consistent with other less liquid Eurozone alternative property markets.

- Additionally, the PBSA sector in these countries have lower maturity compared to the markets in Northern Europe with higher provision rate.

- The excess yields spread is likely to decrease in the coming years as operators are expanding into Spain and Italy and the sector matures.

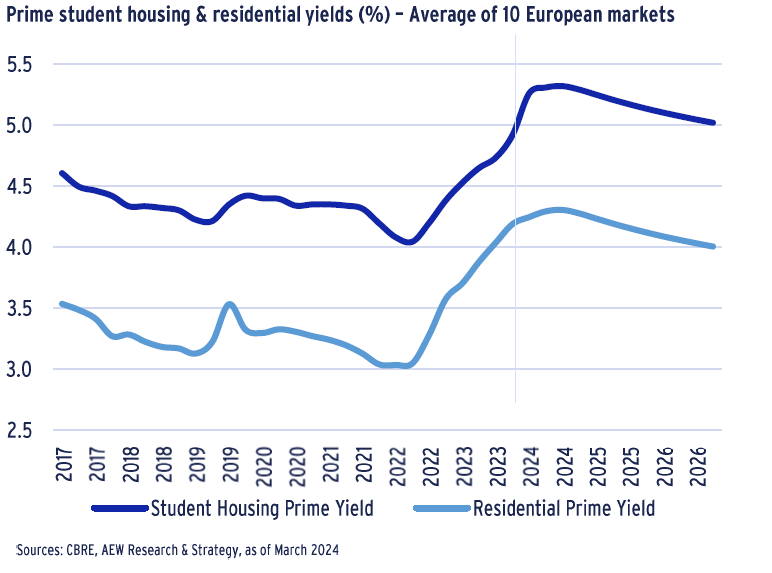

PBSA YIELDS EXPECTED TO COMPRESS BY 30 BPS BY 2026

- Over the past decade, PBSA and residential yields have been compressing significantly as both sectors have become more sought-after by institutional investors as alternative to bonds.

- Prime student housing yields remain higher than prime residential yields (by 100 bps on average), to reflect operational risks.

- Student housing yields currently stand at 5.3% after decompressing by around 120 bps in 2022 and 2023 – in line with prime residential yields.

- Based on the interpolation of our prime residential yield forecasts, student housing yields are expected to move in from 5.3% in 2024 (average of 10 European markets) to 5.0% by the end of 2026, a 30 bps yield compression.

SPECIAL FOCUS: THE UK PBSA MARKET OFFERS OPPORTUNITIES IN REGIONAL UNIVERSITY TOWNS

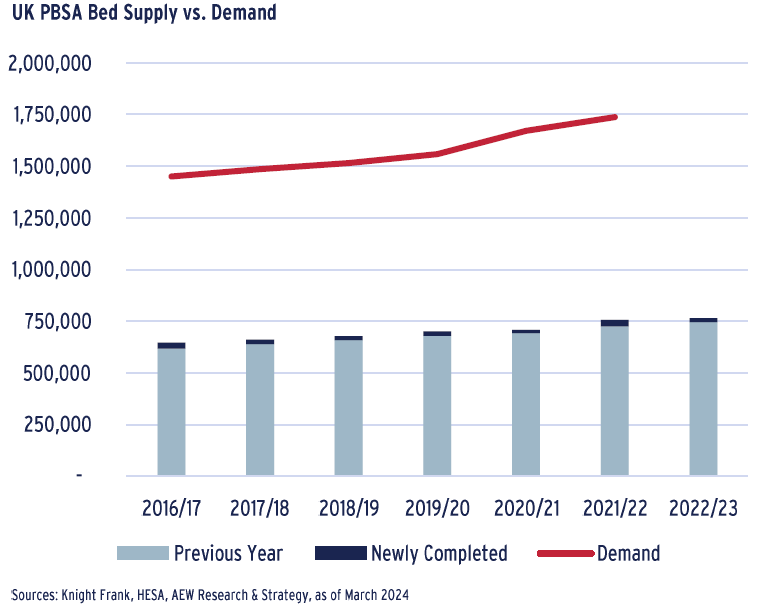

DELIVERY OF BEDS NOT KEEPING UP WITH DEMAND GROWTH

- Demand for UK PBSA exceeded 1.7 million in 2021/22, up 20% from 2016/17. This is largely driven by the increase in international students.

- As a result, demand exceeded supply with only 745,000 beds available in 2021/22 and an additional 20,000 beds added in 2022/23, emphasising a structural supply imbalance.

- The negative Brexit effects on EU student mobility were more than offset by the growth of students from China and India.

- Constraints to new and existing supply include planning, safety, energy efficiency regulations, as well as higher construction and debt costs.

- In parallel, housing in multiple occupation (HMO) stock (e.g. flat sharing), a traditional alternative to PBSA, has been declining as a result of rising interest rates, taxation and licensing restriction on owners, creating a further opportunity for PBSA.

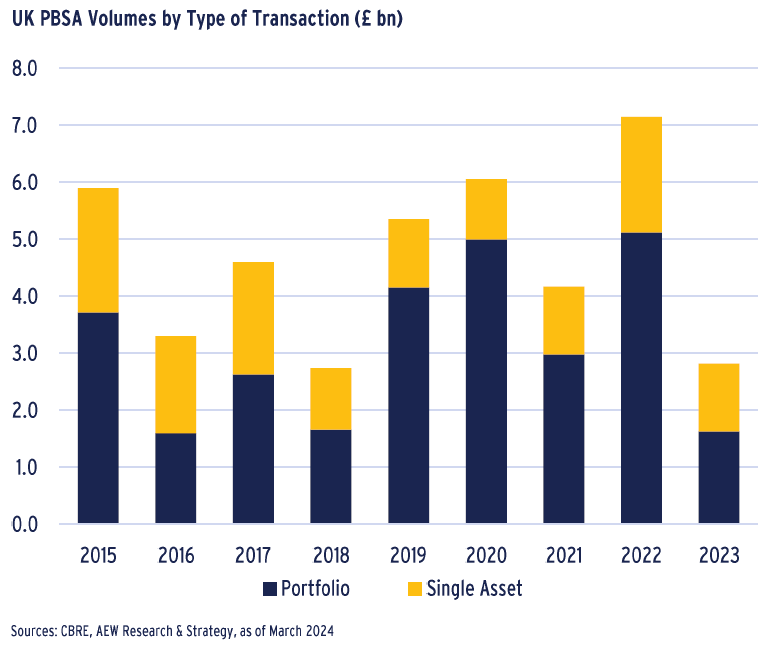

STRONG OCCUPIER FACTORS TO DRIVE INVESTMENT FORWARD

- Annual UK PBSA investment volumes reached a record high in 2022, totaling just over £7bn. This was made up of mostly portfolio deals.

- 2023 total volumes were notably lower relative to this standout performance, reflecting a 60% y/y decline to just £2.8bn. As a result, 2023 was the second lowest year after 2018.

- This decline can unsurprisingly be attributed to the higher Bank of England’s policy rates which increased from 1.75% to 5.25% in just one year. These higher debt costs, limited financing availability and ongoing price discovery resulted in dampened activity.

- Separately, strong demand for PBSA assets was evident as forward funding deals reached their highest level in 2023 since 2016, irrespective of elevated debt and construction costs.

- As a result of the ongoing demand-supply imbalance and continuing yield premium, we would expect investment transaction volumes to rebound in 2024 and beyond.

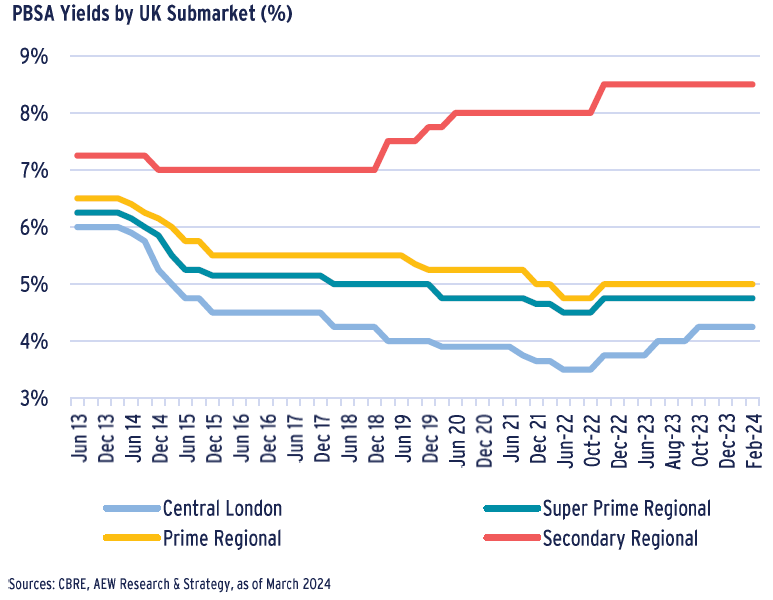

UK REGIONAL PBSA YIELDS PROVED THEIR RESILIENCE

- PBSA yields across all UK submarkets softened by 25-50bps q/q in Q4 2022, in light of the macro-economic situation.

- However, regional PBSA yields have remained stable throughout 2023, into the start of 2024, although limited transaction data means that true pricing may not have fed through. This is largely supported by their stronger rental growth and more acute supply shortage.

- This regional yield stability confirms the confidence in the sector and its long-term income prospects.

- Central London yields continued to shift out further in 2023 by 50bps, increasing to 4.25% in February 2024. Given its ultra low yields, pricing in London has been more impacted by the higher interest rate environment.

- PBSA has proven to be counter-cyclical during downturns, as student numbers increase as people look to upskill or stay in education. This, coupled with attractive returns, reinforces investors’ attraction to PBSA.

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW. There is no assurance that any prediction, projection or forecast will be realized.