PRIME EUROPEAN SHOPPING CENTRE REPRICING ALLOWS REBOUND

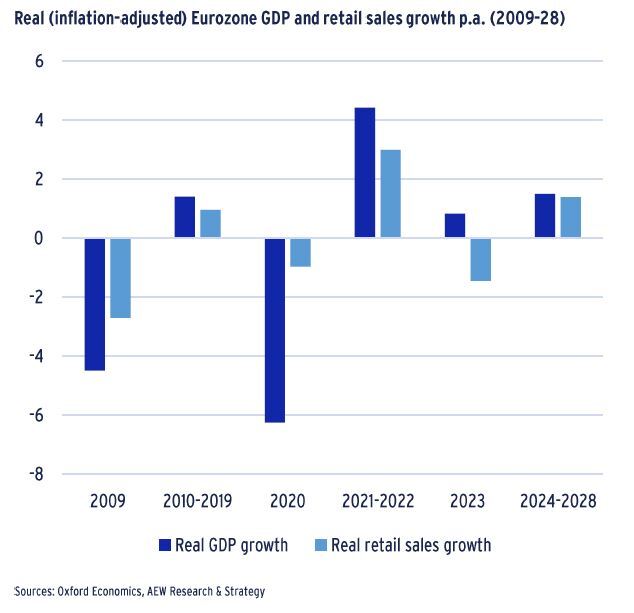

- As a 2023 recession is likely to be avoided in Europe and inflation is expected to normalise, real GDP is forecast to grow at an annual rate of 1.5% and real retail sales at a rate of 1.4%, p.a. between 2024 to 2028. These growth rates surpass the long-term post-GFC trend, reflecting the favorable conditions of low unemployment rates and, therefore consumer purchasing power.

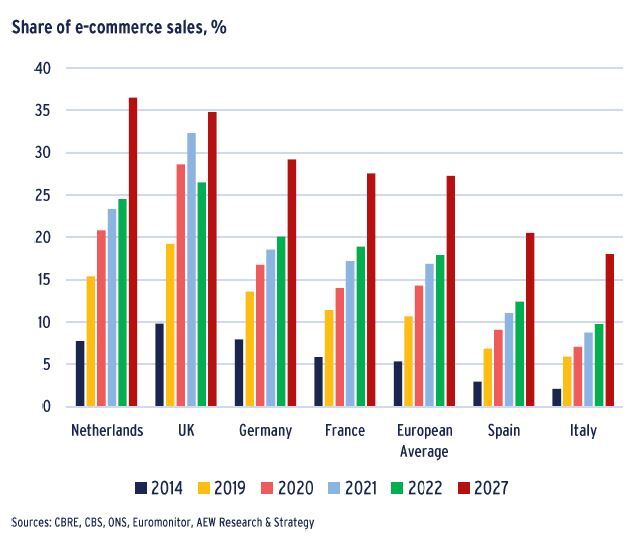

- Although the UK experienced a temporary post-lockdown decline in 2022, the average e-commerce retail share across Europe is expected to rise significantly from 18% in 2022 to 27% by 2027. By 2027, the Netherlands is expected to emerge as the leading European country in terms of the share of e-commerce.

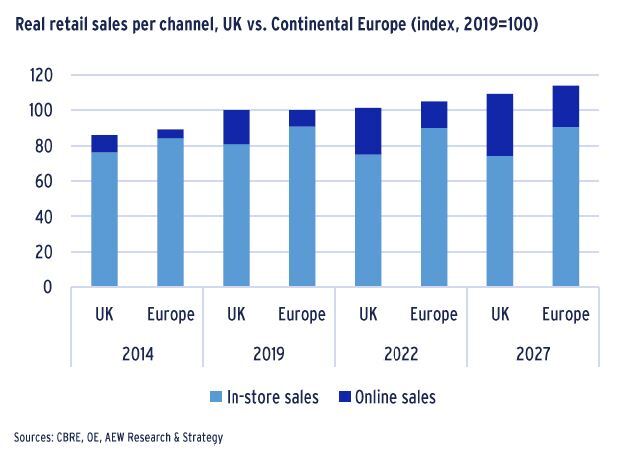

- Continental Europe witnessed a rebound in in-store sales in 2021, with projections indicating stabilisation at pre-pandemic levels by 2027. However, UK store sales are expected to stabilise at a level 8% lower compared to the pre-COVID 2019 level.

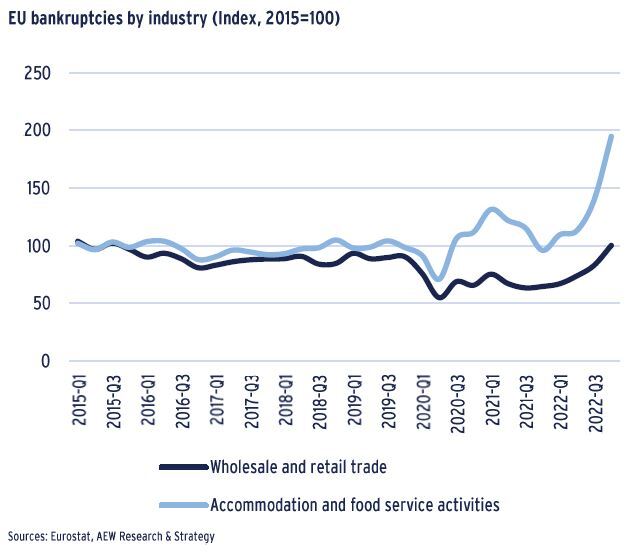

- In relation to retail tenants, the focus has shifted to an increase in corporate failures after the lockdown government supports expired. Eurostat data shows that EU bankruptcies in the retail sector have increased by 55% in 2022 and more than doubled for the F&B and accommodation sector.

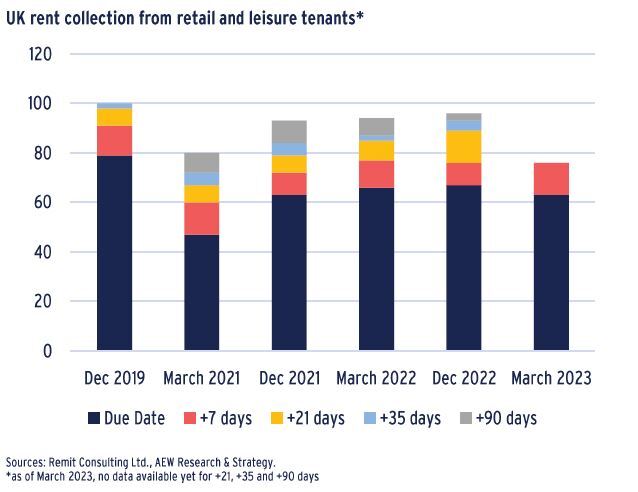

- Although there has been an increase in corporate failures, the collection of UK retail rents has stabilised. While they still remain below the pre-COVID 2019 levels, there has certainly been a recovery from the levels observed during the lockdowns.

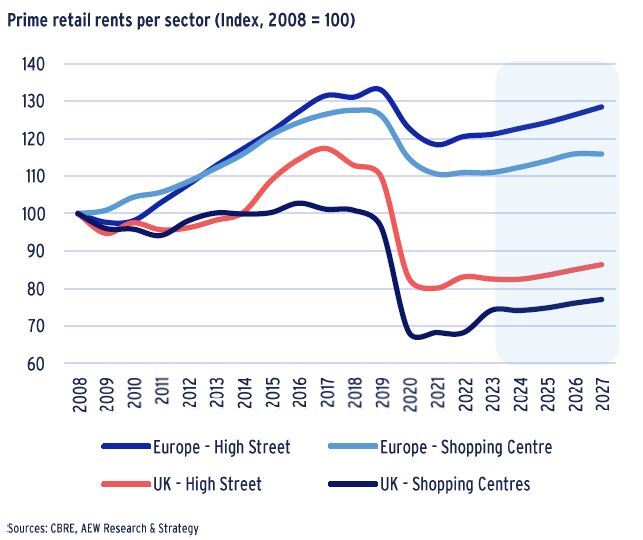

- Based on an improved macro outlook, our predictions indicate a growth of 1.2% p.a. for prime high street retail rents and 1.4% p.a. for prime shopping centre rents over the next five years. This signifies a stabilisation compared to the declines of -9% in the UK and -4% in Continental Europe recorded during 2020-2022.

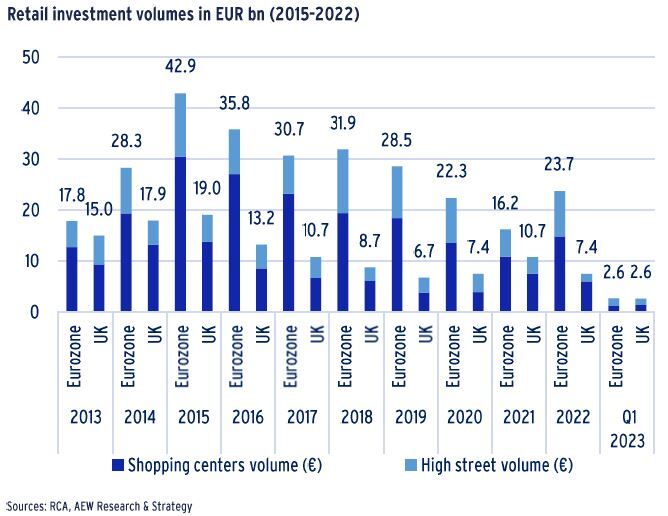

- Investors' concerns about high interest rates were evident in the fall of transactions towards the end of 2022, resulting in pan-European retail investment volumes amounting to EUR 31bn. This figure is only half of the record EUR 62bn achieved in 2015.

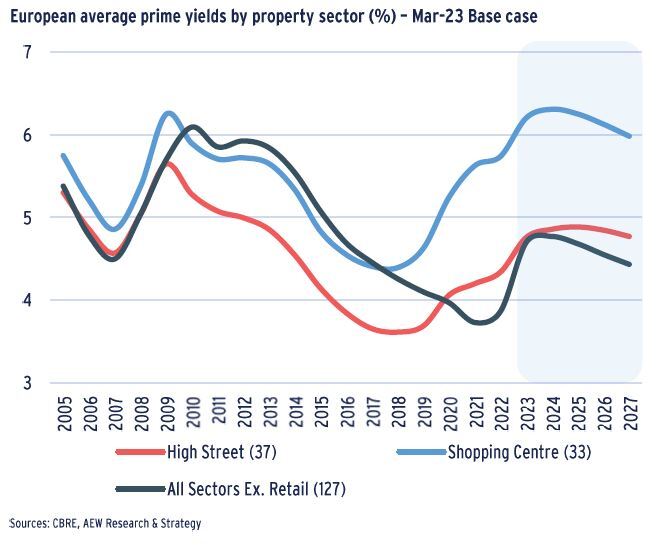

- Prime shopping centre yields are projected to reach 6.0% by the end of 2027 on average across Europe, following a significant re-pricing since 2017. Prime high street yields re-priced to 4.3% in 2022 and are expected to reach 4.8% by the end of 2027 according to our Mar-23 base case scenario forecasts.

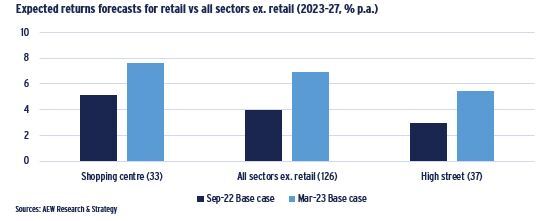

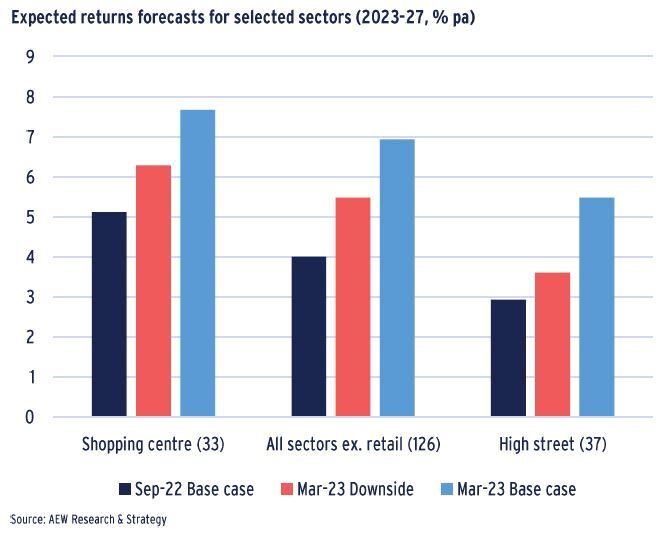

- In our latest base case, the projected returns for prime shopping centres from 2023 to 2027 stand at 6.3% p.a., while prime high street retail returns are expected at 3.6% p.a., a notable improvement compared to our Sep-22 forecasts.

- As retail re-pricing continued in 2022, we updated our estimates for the debt funding gap (DFG) in the retail sector, which now stands at EUR 17bn. The DFG represents the quantified amount of debt that cannot be refinanced due to current negotiable LTVs and adjusted collateral values.

- Based on our risk-adjusted approach, 45% of our shopping centre markets are classified as attractive and 33% of high street markets are deemed less attractive. These figures surpass the remaining sectors’ average (all sectors ex. retail).

- Amongst shopping centre markets, Stockholm, Paris, Dublin and UK regional markets stand out as the most attractive markets, while among high street retail market Dublin, Berlin and Paris rank top. CEE markets remain among the least attractive.

MACROECONOMIC FUNDAMENTALS

STRONG REBOUND OF RETAIL SALES AFTER 2024

- Government support during the pandemic in 2020 and high inflation in 2023 have distorted the typical cyclicality observed between retail sales and GDP growth.

- Following the decline in real GDP and retail sales in 2009, as a result of GFC, a subsequent period from 2010 to 2019 witnessed positive growth in both, reaching 1.4% and 1.0% p.a. respectively.

- Similarly, this cyclical trend can be observed following the COVID-related decrease in real retail sales. In 2020, real GDP growth fell by 6.3%, whilst retail sales experienced a milder decline of -1%. This less pronounced decrease can be attributed to the robust government support schemes put in place.

- However, the post-COVID rebound was brief due to the Russian invasion of Ukraine, which led to a surge in energy and food prices, that triggered a continent-wide cost-of-living crisis.

- Whilst Europe managed to avert a widespread recession, consumers experienced a significant decline in real income, which in turn resulted in negative real retail sales growth in 2023.

- From 2024-2028, real GDP is expected to grow at 1.5% p.a. and real sales by 1.4% p.a., exceeding the long-term post-GFC trend. This return to positive growth also indicates the favourable conditions of the current low unemployment rates.

SHARE OF E-COMMERCE TO RISE FOLLOWING 2022 PAUSE

- The COVID restrictions in 2020 and 2021 propelled the online share of retail sales to reach record levels throughout Europe.

- After the COVID pandemic, the UK, the most mature market, saw a temporary decline in its e-commerce market share in 2022 as consumers returned to physical stores. This drop was not recorded in the countries with lower levels of online sales share.

- Looking ahead, the growth trend is expected to resume until 2027, with the average e-commerce retail share in Europe projected to rise from 18% in 2022 to 27% in 2027.

- Although the e-commerce share continues to grow, it remains uncertain when and at what level it will eventually stabilise.

- The uncertainty regarding the stabilisation of the share of e-commerce sales stems from various factors, including evolving consumer behaviour which is highly sensitive to macroeconomic conditions, retail market dynamics, technological advancements, and regulatory changes.

IN-STORE SALES TO REMAIN STABLE IN EUROPE & UK

- Total real retail sales in the UK remained relatively flat in 2022, growing only 1.3% relative to pre-pandemic levels of 2019, whilst European real retail sales grew by 5% in the same period.

- The emergence of e-commerce initiated a decline in the share of in-store sales, and naturally this trend was further accelerated by the 2020-2021 pandemic.

- After experiencing a decline of 7.3% in the UK and 1% in Europe by 2022 compared to the pre-pandemic levels of 2019, the absolute volumes of in-store sales have reached a point of stabilisation and are expected to remain relatively unchanged in the mid-term.

- The anticipated growth in total retail sales in the future will be primarily attributed to the substantial increase in online sales, expected to rise by 33% in the UK and 54% in Europe by 2027.

RETAIL OCCUPIER MARKET

RETAILERS’ BANKRUPTCIES TICK UP

- In the long-suffering retail sector, investors’ focus has shifted to an increase in tenant failures after the lockdown supports expired.

- Eurostat data shows that EU bankruptcies in the retail sector have increased by 55% in 2022 and have more than doubled for the F&B and accommodation sectors.

- These increased failures are a result of governments ending their COVID support schemes as many businesses now have to pay back their state-backed loans.

- The timing is unfavorable, particularly considering the pressure on profit margins due to high inflation, which has led to a decrease in turnover as costs have risen.

- Retailers in the mass-market fashion industry have been significantly affected, which stands in stark contrast to the impressive performance of luxury retail groups such as LVMH and Kering.

- In the UK, 2,300 stores became vacant in 2022 as a result of bankruptcies, a 23% increase compared to the 10-year average.

UK RETAIL RENT COLLECTIONS IMPROVED

- Despite the uptick in corporate failures during the pandemic, the collection of UK retail rents has overall since stabilised.

- According to Remit Consulting, as at the end of March 2023, the share of rents paid on time decreased by 4 pp. compared to the previous quarter, with 63% of rents being paid on the due date.

- This decline was offset by a 4 pp. increase in the level of rent collections within a week (+7 days) after the due date.

- The lasting negative impact of the pandemic means that current rent collection levels continue to remain well-below their pre-COVID 2019 levels, despite stores reopening.

- Following the reopening of outlets post-lockdown, retailers have been facing difficulties to meet their financial obligations requesting some form of rental relief from their landlords.

- Retail rent collection was improved thanks to negotiations on rental adjustments which in return were compensated with extension of the lease term.

PRIME RETAIL RENTS CONTINUE THEIR SHY RECOVERY

- Prime retail rents, especially in the UK, were already on a downward trajectory, and the pandemic-induced lockdowns in 2020 further accelerated this decline throughout Europe.

- UK shopping centre prime rents are projected to increase by 8.7% in 2023, followed by an average annual growth rate of 1% p.a. from 2024 to 2027.

- In contrast, UK high street retail prime rents are anticipated to remain relatively stable in 2023 and 2024, followed by a renewed positive growth rate of 1.6% p.a. from 2025 to 2027.

- Prime rents for shopping centres in Continental Europe have also passed their lowest point and are expected to grow at an average rate of 1.1% p.a. from 2023 to 2027.

- European prime high street retail rents recorded a rebound of 1.8% in 2022, which is expected to continue at a growth rate of 1.3% p.a. for the period from 2023 to 2027.

- Nevertheless, over the next five years, none of the retail sectors are expected to reach the peak rent levels observed prior to the start of the current retail sector price correction cycle.

RETAIL INVESTMENT MARKET

- Both shopping centre and high street retail investments in Eurozone picked up in 2022, reaching EUR 23.7bn.

- On the other hand, retail investment activity in the UK dropped significantly during the last quarter of 2022, decreasing year totals to EUR 7.4bn.

- Some assets are coming to market as retail owners attempt to shrink their debt obligations or investors are divesting in order to raise capital. Secondary assets with the intention for redevelopment are also traded.

- Although improving from 2021 investment activity, the slow down at the end of the year 2022 illustrates investors’ concerns about interest rates, which led to 2022 pan-European retail investment transactions to come in at EUR 31bn, half their EUR 62bn record of 2015.

- Future retail transaction volumes will likely be impacted by the limited availability and higher costs of debt financing, which we discuss in our debt funding gap analysis.

PRIME RETAIL YIELDS TO STABILISE AT A NEW HIGH LEVEL

- From the onset of the pandemic in 2020 to 2022, both prime European shopping centres and high street yields repriced by 50 bps and 20 bps respectively. These are expected to further widen in 2023 by an additional 50 bps each.

- After this significant re-pricing, prime retail yields are now projected to have mostly peaked out and to narrow over the next five years.

- Prime shopping centres yields are projected to peak at 6.2% in 2023, while prime high street yields will continue to marginally decompress to 4.9% by 2025.

- Since retail yields started to correct earlier, the upward movement is less dramatic than for the average of all the other sectors, as illustrated in the graph, with more brutal correction for logistics.

- Nevertheless, prime shopping centre and high street retail yields should remain above the all-sector average (excl. retail) in the next five years.

SHOPPING CENTRES TO OUTPERFORM

- Across all property sectors (excl. retail), the total annualised average return expected between 2023-2027 increased from our last round of forecasts (Sep-22) from 4.0% to 6.9% p.a.

- Historically, retail sectors have demonstrated a greater sensitivity to macroeconomic conditions, and therefore the sector is expected to benefit from improving macroeconomic drivers by 2024.

- As a result, total annual shopping centre returns have improved from 5.1%, in our Sep-22 forecasts, to 7.7% in our updated Mar-23 base case scenario, while high street returns improved from 2.9% to 5.5% annually for the 2023-2027 period.

- As both central banks and consensus forecasts have struggled to keep up with the 2022 run-away inflation, we maintain our downside scenario with lower growth and higher inflation.

- Our downside scenario further reduced shopping centre and high street retail anticipated returns to 6.3% and 3% over the forecast period.

DEBT FUNDING GAP ANALYSIS

SOME SIGNS OF CAPITAL VALUE REBOUND

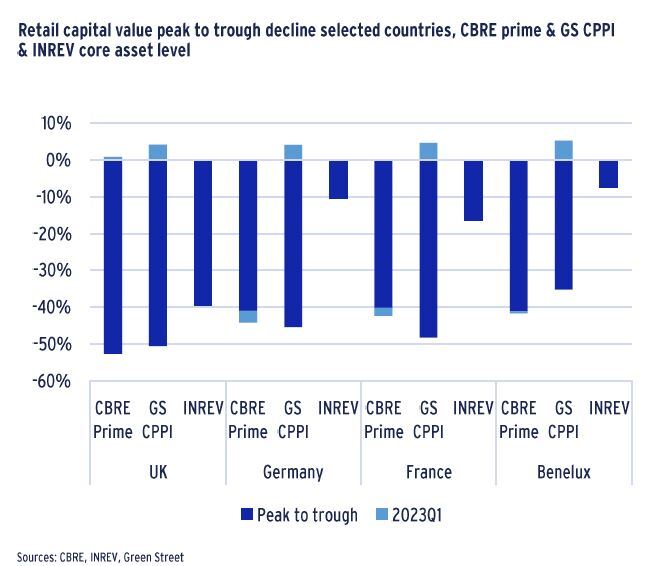

- To compare repricing in the retail sector during the current cycle, we consider CBRE Prime, Green street CPPI index, and INREV core asset data on capital values.

- There are differences between the datasets: INREV reports actual returns on asset valuations from core funds, while CBRE returns are based on prime rents and yields, and the CPPI index is derived from valuation data of publicly-traded companies.

- When considering prime returns and the CPPI index, repricing levels ranged from -35% to -52% across different regions. INREV valuation figures indicated a smaller decline of only -8%. Note that the time periods vary in the peak to trough calculations.

- The CPPI index has reversed the trend with positive Q1 2023 figures in all regions. CBRE data indicates a slight repricing in Germany and France, positive return in the UK, and near-zero return in the Benelux regions.

- INREV figures for Q1 2023 are still not available at the time of this publication.

RETAIL DEBT FUNDING GAP REFLECT VALUE DECLINE

- The decrease in capital values may present difficulties when it comes to refinancing loans that are reaching maturity.

- In addition to the decrease in collateral value, lenders may also be reluctant to refinance at the original loan-to-value (LTV) level.

- According to the CREFC LTV sentiment results, (senior) lenders are likely to lower their actual LTVs to 50%. Based on this, our analysis assumes a refinancing LTV of 50%.

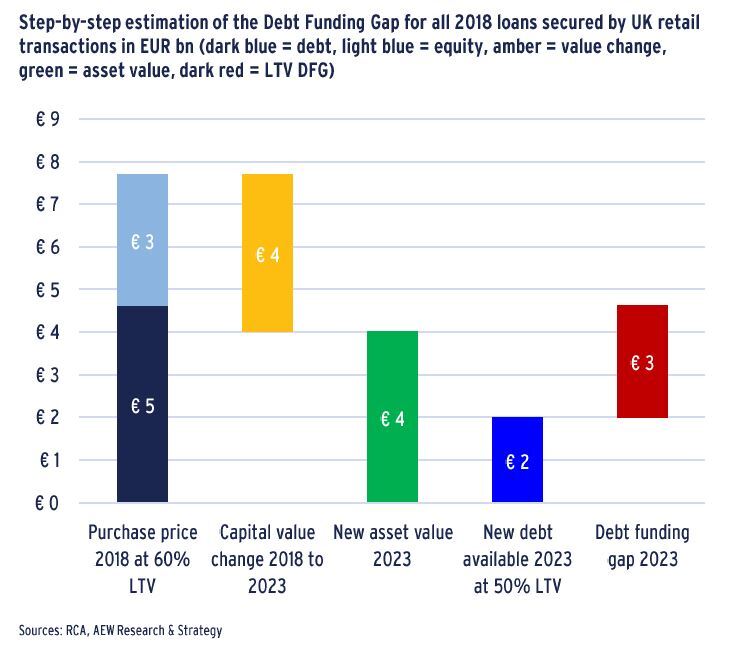

- As an example, we provide our estimate of the debt funding gap (DFG) for all 2018 originated UK loans secured by retail collateral as follows:

- Transaction volumes are adjusted for non-levered deals (17% of 2018 UK retail volume) amount to €7.7bn.

- LTV of 60% is assumed at purchase, resulting in the estimate of total debt volumes secured by UK retail property at €4.6bn.

- 5 year capital value decline for UK retail shows a -48% decline in value between 2018 and 2023, decreasing original collateral value to €4.0bn.

- New available debt volume is estimated at 50% LTV of new value, leaving a debt funding gap of €2.6bn.

- In our overall results, we estimate the DFG for three countries and three vintages from 2018 to 2020.

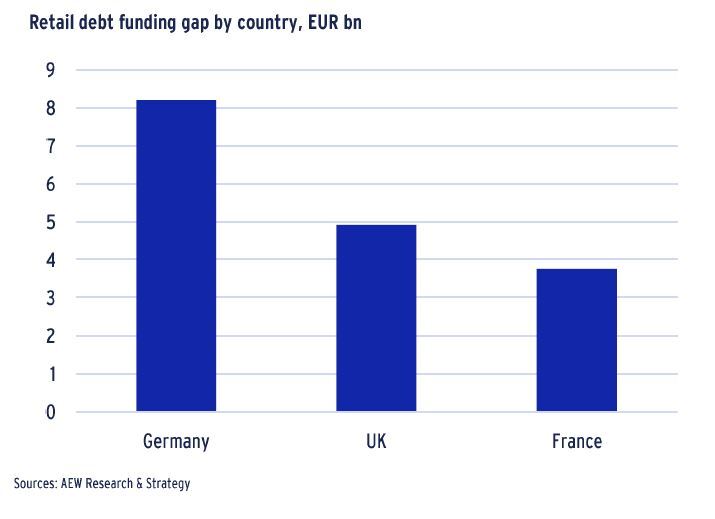

GERMANY’S RETAIL MARKET HAS THE LARGEST DFG

- Germany’s DFG for loans secured by retail properties is estimated at €8.2bn, followed by the UK at €4.9bn, and France at €3.8bn for the period 2023-2025.

- These constitute 15.4% for Germany, 17.1% for the UK, and 15.2% for France, relative to all loan volumes secured by retail assets in these countries in the period 2018-2020.

- The DFG is front-loaded, with the highest share falling for 2023, and the lowest in 2025.

- Most of the DFG is attributable to the price correction in the sector that took place between 2018-2023, and a smaller share to the potentially lower refinancing LTV.

RELATIVE VALUE ANALYSIS: INCREASING OPPORTUNITIES IN RETAIL

BOTH RETAIL SECTORS SHOW INCREASINGLY ATTRACTIVE MARKETS

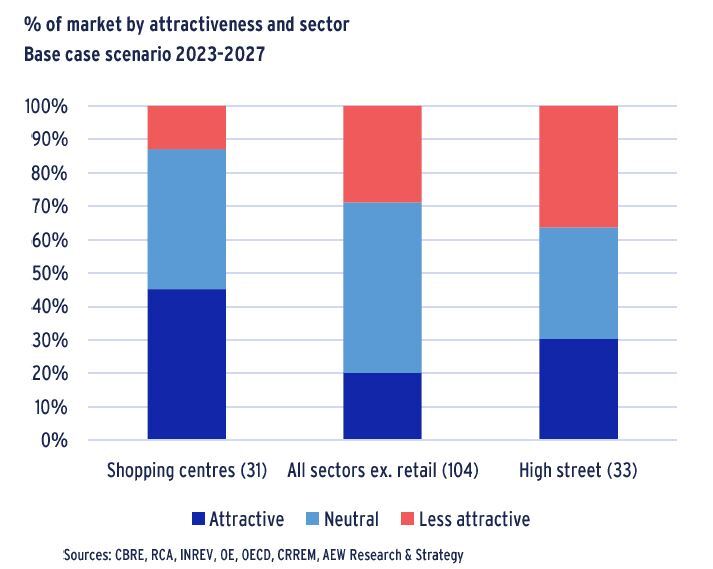

- Our relative value approach classifies markets with Expected Rate of Returns (ERRs) well above Required Rate of Returns (RRRs) as attractive and those with ERRs well below RRRs as less attractive.

- 45% of shopping centre markets are classified as attractive, 45% as neutral, and 10% as less attractive in our updated base case scenario.

- For high street retail, the share of attractive markets stands at 30%, the share of neutral markets at 37%, and less attractive markets represent 33%.

- Shopping centres are expected to perform better than the other sectors average in term of market attractiveness according to the base case scenario, as illustrated in the graph.

- High street retail is also more polarised, showing a higher percentage of both attractive and less attractive markets than the other sectors average.

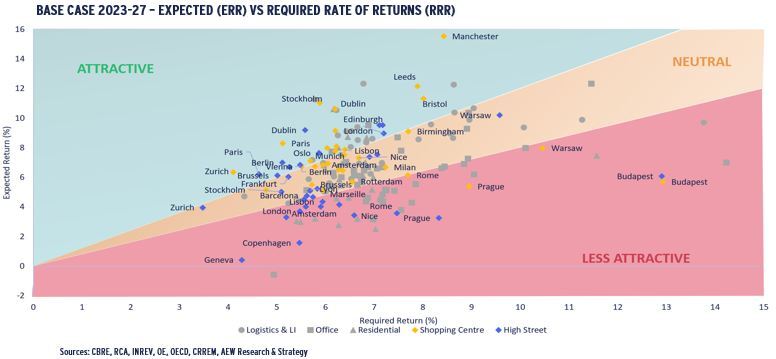

- The below scatter graph can be interpreted as follows: the RRR for the next five years is represented on the horizontal axis and the ERR is represented on the vertical axis.

- Markets in the green area show ERR sufficiently in excess of the RRR as attractive. The red zone markets are classified as less attractive, given their ERR does not meet the RRR.

- The yellow background indicates a range of 20% of the difference between the two, which is deemed an appropriate range where markets are not clearly over- or underpriced. As a result, markets within this middle yellow range are labelled as neutral.

- A majority of shopping centre markets are classified as attractive, while only four markets fall into less attractive category. However, a large number of high street retail markets are classified as either less attractive or neutral.

- On a city level, Stockholm shopping centre is the most attractive market, followed by UK regional, Dublin and Paris shopping centres. Dublin, Berlin and Paris high street are most attractive markets in the high street retail sector.

- Among the less attractive markets are CEE and South European high street and shopping centres markets which, historically, tend to prove more sensitive to economic slowdown than more mature markets.

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW. There is no assurance that any prediction, projection or forecast will be realized.