Broad-based Logistics Demand Offers Resilience Against Tariffs

- Despite the most recent reductions and pauses, tariffs triggered a spike in trade policy uncertainty. This is expected to push up supply chain pressures. European logistics occupiers are likely to further deepen their operational focus from just-in-time to just-in-case to ensure continuity. This might trigger a higher demand for logistics space.

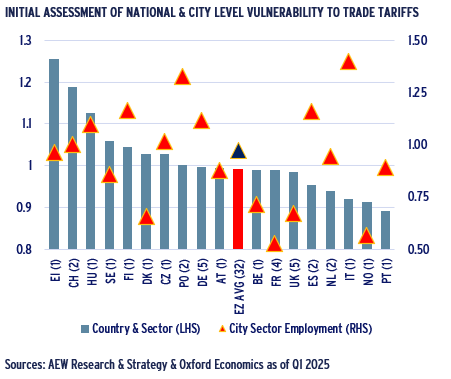

- Vulnerability to new US tariffs is limited for core Europe. Based on the Oxford Economics’ global industry tariff vulnerability index we expect Ireland, Switzerland, CEE and Nordic sub-regions to have above average vulnerability.

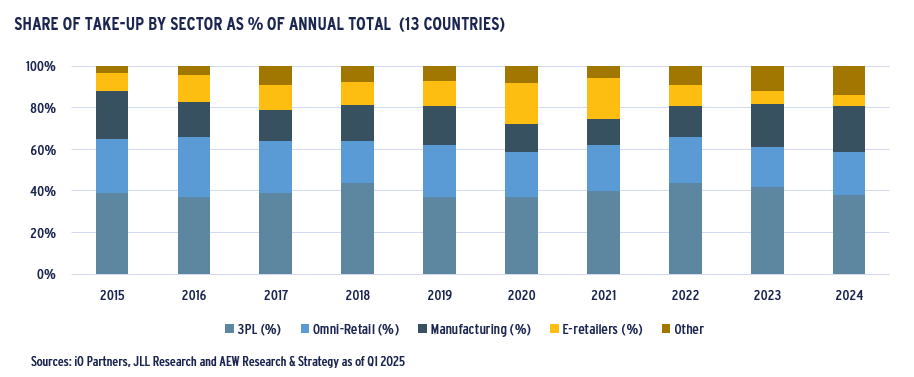

- E-commerce remains a central theme in logistics take-up. However, a closer look at take-up confirms a broader based support for take-up across sectors, as shown below. This diversified base of logistics space users should offer resilience in future take-up regardless of the ultimate impact of tariffs.

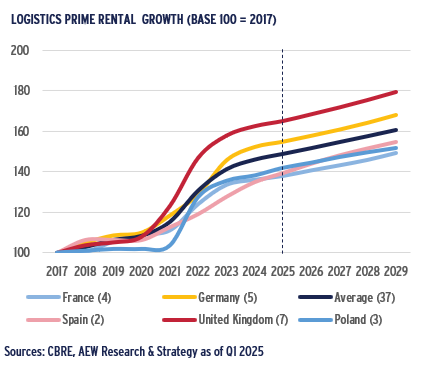

- Our prime 2025-29 rental growth forecasts of 1.9% p.a. across our 37 covered European logistics markets is down due to slower economic growth, weaker take up and higher vacancy rates. As new supply is expected to moderate, year-end 2024 European average vacancy rate of 5.1% is projected to come down gradually to 3.7% by 2029.

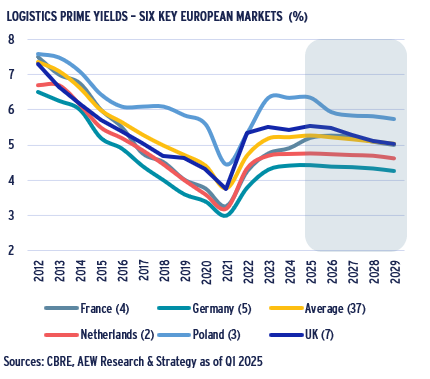

- As in other sectors, higher interest rates pushed prime logistics yields from 3.7% to 5.3%. After the 2022-24 repricings and our revised base case with less bond yield tightening, prime logistics yields across all markets are expected to move in by only 30bps by 2029. This means current income and rental growth will be key for returns.

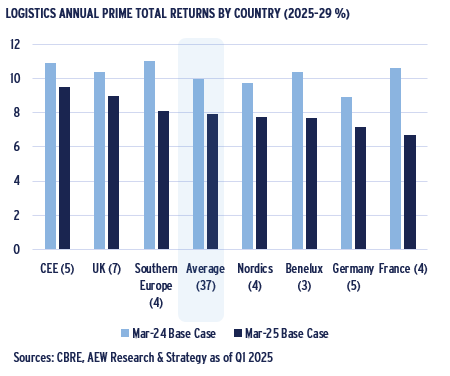

- As a result, total returns across European logistics markets are estimated at 7.9% p.a. for 2025-29 in our Mar-25 base case, making it the second most attractive sector after offices. CEE and UK logistics markets are expected to have the highest total returns at 10.9% p.a. and 10.4% p.a., respectively.

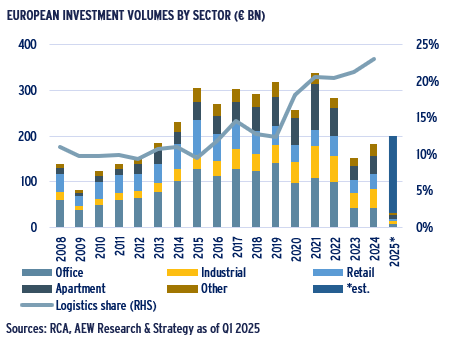

- Despite a recent pause, manager sentiment towards logistics has steadily improved since 2022. Logistics’ volumes are expected to increase to €50bn in 2025, up 19% from 2024 levels. At 23% of cross sector 2024 volumes, logistics realised the highest share of total volumes on record.

MACRO: TARIFFS IMPACT MIGHT BE POSITIVE FOR LOGISTICS SPACE DEMAND

TARIFF UNCERTAINTY TO DEEPEN OCCUPIERS’ JUST-IN-CASE FOCUS

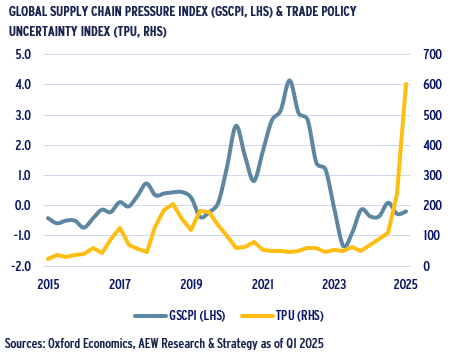

- Despite the most recent reductions and pauses, tariffs triggered a spike in trade policy uncertainty (TPU), which might further disrupt global supply chains (GSCPI).

- So far, the GSCPI does not yet show that supply chain pressures increased due to the news. It seems reasonable that this will come through later as trade flows are redirected.

- Container demand and harbor capacity will shift in short order to facilitate this, triggering supply chain pressures.

- Higher TPU combined with a higher GSCPI might hurt short term confidence of European logistics space users, as they pause expansion plans until uncertainties are resolved.

- Even if tariff uncertainty lingers, European logistics occupiers are likely to further deepen their operational focus from just-in-time to just-in-case to ensure continuity.

- This just-in-case focus on additional inventory might trigger a higher demand for logistics space.

LIMITED TARIFF INITIAL VULNERABILITY FOR CORE EUROPE

- Our initial assessment of vulnerability to recent US trade tariffs announcement shows limited vulnerability for core European countries and cities.

- Oxford Economics’ global tariff vulnerability index for each of 20 manufacturing sectors is used to estimate each country’s vulnerability based on its own sector breakdown.

- Based on this country score, Ireland, Switzerland, CEE and Nordic countries show above average vulnerability.

- On the city (NUTS2) level, we use manufacturing and transport & storage employment for 32 cities to estimate each cities relative share in these vulnerable sectors.

- Inconsistencies with the country level results come in part from having one or two cities in some countries. Milan and Warsaw/Silesia have above national vulnerability.

- High German city level vulnerability comes from Frankfurt’s high score which is only partly offset by Berlin and others. Barcelona’s high score is also only in part offset by Madrid.

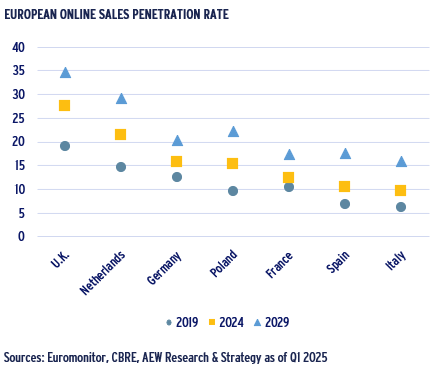

E-COMMERCE TO REMAIN KEY DRIVER FOR LOGISTICS SPACE TAKE-UP

- E-commerce has been a key driver of demand for logistics space as both traditional retailers and supermarkets move to omni-channels to compete with pure on-line platforms.

- This is expected to continue as European online as a share of total retail sales is expected to reach 20% by 2029 confirming its continued growth and up from 16% as of 2024.

- The UK, Germany and the Netherlands accelerated their on-line penetration during the Covid period. Even from these higher start points they are projected to increase further.

- The UK is expected to reach 35% share of ecommerce by 2029, while Netherlands and Germany 29% and 22%, respectively.

- Across other lagging countries, like France and Spain, the online sales penetration growth is expected to accelerate by 2029 to reach 18% and 16%, respectively.

- Surprisingly, the Polish share of e-commerce is expected to reach 22% by 2029 showing a slower increase.

OCCUPIER MARKET: MORE BALANCED ABSORPTION & SUPPLY TO PUSH VACANCY RATES DOWN GOING FORWARD

LOGISTICS TAKE-UP NORMALISED TO PRE-COVID LEVELS

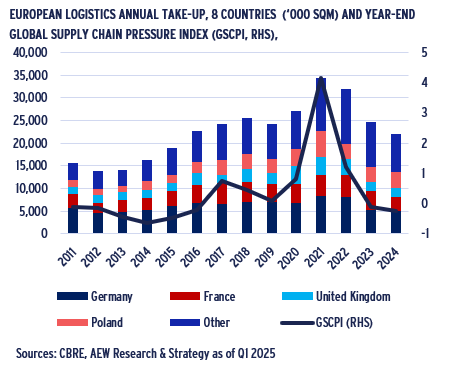

- European logistics take-up was 22.5mn sqm in 2024, a fourth consecutive year of decline from its 2021 peak.

- It seems that there is a positive link between elevated supply chain pressures as shown in the GSCPI during the 2020-22 Covid period and the 2021 record level of take-up.

- Many space users adjusted their operational focus from just-in-time to just-in-case requiring more warehouse space.

- 2021 take-up levels were also driven by a surge of e-commerce activity during the pandemic lockdown periods when consumers were dependent on home deliveries.

- As global supply chains normalized, annual take-up returned to just below pre-Covid levels. This moderating trend on take-up was consistent across main established Northern logistics markets.

- On the other hand, 2024 take-up was higher in Poland than in 2023. Southern European markets, in Italy and Spain, also recorded resilient occupier activity.

BROAD BASED SUPPORT FOR LOGISTICS TAKE-UP

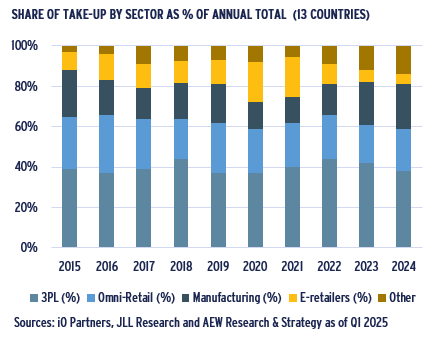

- E-commerce is a central theme when most discuss logistics take-up, but a closer look confirms a broader based support.

- Third-Party logistics (3PL) providers represent 40% of annual take-up on average for the last ten years.

- Many firms outsource to these supply chain expert 3PLs to allow more flexibility on inventories and capital expenses, while offering instant capacity to expand into new markets.

- Due to competition from pure e-retailers, traditional store-based retailers have invested in large, regional omni-channel distribution centres as well as small urban logistics facilities.

- Our data shows clearly that e-retailers benefited from the surge of online sales during the 2020-21 Covid period, as they took a much larger share of take-up in these years.

- With a solid presence in core markets, pure e-retailers are shifting their focus to markets with more remaining potential online penetration, such as CEE and Southern Europe.

LOGISTICS VACANCY PROJECTED TO COME DOWN FROM 2024 LEVEL OF 5%

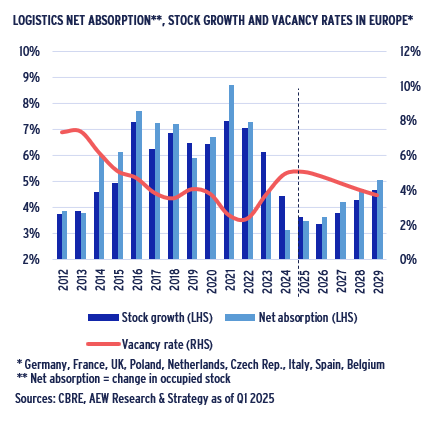

- In the last two years, developers responded to the strong increase in Covid-related demand during 2021-22.

- During 2023-24, this increased supply was met by a declining demand for space pushing vacancy rates up to 5.1% up from its 2022 record low of 2.4%.

- However, new supply is projected to subside as developers’ profitability has been hurt by higher costs and lower capital values like in other sectors.

- Going forward, new supply and demand are projected to be more balanced, which means that logistics vacancy rate is projected to come down gradually to 3.7% by 2029.

- This should prove to be a positive factor for future rental growth across the core European logistics markets.

- Despite the unhelpful news flow on trade tariffs, the main fundamental drivers for logistics space demand such as e-commerce and near-shoring manufacturing remain favorable.

- In fact, new positive factors come from an increased need for European defence and data centre spending.

STEADY RENTAL GROWTH ACROSS MOST LOGISTICS MARKETS

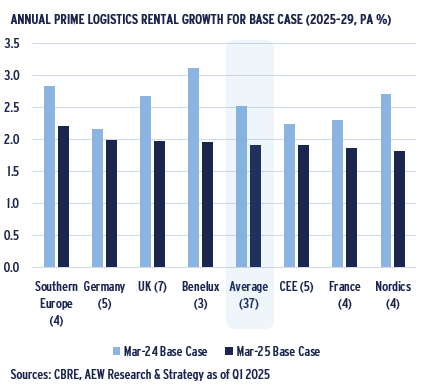

- Our forecasts for prime rental growth have moderated to 1.9% p.a. in 2025-29 across the European logistics markets, down from 2.5% p.a. in last year’s projections.

- Slower economic growth, lower take up and higher vacancy rates are the key drivers for this downside revision.

- Steady growth across major European countries and sub-regions is confirmed by a relatively tight range of 1.8% to 2.2% p.a., at around inflation target level of 2%.

- Southern Europe is ranked top in terms of the projected rental growth, followed by Germany and the UK.

- Benelux, previously the top region is now expected to show rental growth which is at par with European average.

- CEE, France, and the Nordics are expected to show below the average rental growth, however, still very close to the European average.

- These modest growth rates should be able to withstand any short-term impact from tariffs announcements on both the supply and demand side of the occupier market.

PRIME LOGISTICS RENTS PROJECTED TO RESUME PRE-COVID GROWTH

- Prime rental growth trends on an indexed basis highlight the positive effect of the 2020-21 Covid-related lockdowns across most key European logistics markets.

- European prime logistics rents went up nearly 40% over the 2020-23 period, with the UK rents moving up by near 50% over the same period.

- Spanish markets did not benefit from the same level of impact during the period as vacancy rates had become elevated a bit earlier than in other markets.

- As vacancy rates have increased across more European markets in 2023-24, our rental growth forecasts are resuming the pre-Covid growth rates for the majority or markets.

- In fact, the projected growth for Spanish prime logistics rents going forward is slightly above the European average.

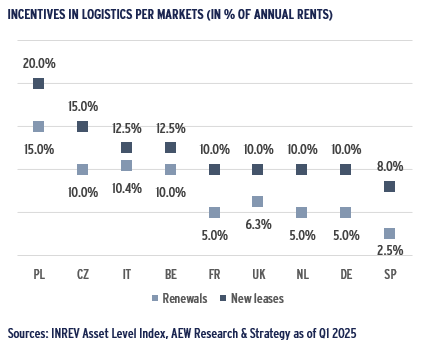

CEE MARKETS PRICE IN MORE NON-RENT INCENTIVES

- Prime rents do not reflect lease incentives, which are common in most European markets as landlords offer tenants incentives on new leases and renewals.

- Incentives are typically a reflection of both current market’s negotiating dynamics and established over the longer-term practices in the local market.

- Central and Eastern European markets offer the highest levels of incentives on new leases: Poland at 20%, and Czech republic at 15% of the annual rent, respectively.

- Italy and Belgium follow with 12.5%, while all of the largest markets, i.e. France, UK, Netherlands and Germany offer 10% incentives on new leases.

- Spain has the lowest incentive for new leases at 8%.

- The variation in incentives is similar for renewals, where in most countries the incentives are 4-6pp lower than for new leases, with the exception of Italy and Belgium.

INVESTMENT MARKET: PROJECTED RETURNS DRIVEN BY CURRENT INCOME AND MARKET RENTAL GROWTH

LOGISTICS AT HIGHEST SHARE OF 2024 EUROPEAN VOLUMES ON RECORD

- Full year 2024 European transaction volumes across all main property types increased by 22% to €183bn from 2023.

- 2024 logistics volumes increased by 31% from 2023 to €42bn, still down 40% from the €70bn record 2021 volumes.

- However, logistics made up 23% of the total 2024 European investment volumes, making it the highest share on record and confirming it as a solid favorite with investors.

- Given the significant 2022-24 repricing and improving investor sentiment, we project €200bn in 2025 investment volumes in Europe.

- As part of this recovery, we anticipate logistics’ volumes to increase further to €45-50bn in 2025, up from €42bn in 2024.

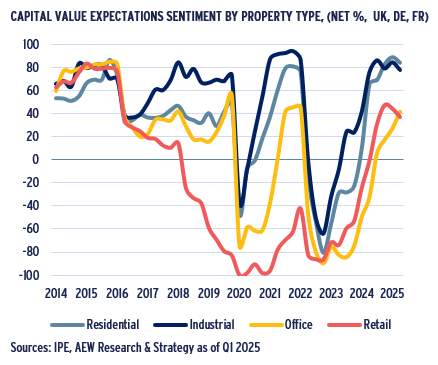

MANAGER SENTIMENT FOR LOGISTICS REMAINS NEAR RECORD HIGH

- Sentiment among European managers slightly worsened based on the latest available May/June 2025 IPE Real Assets Expectations Indicator survey, albeit remained highly positive.

- The net percentage (%) is calculated as the difference between the share of managers who believe property values would increase vs decrease over the next 12 months.

- Investor sentiment towards the logistics sector has steadily improved since Q4 2022 and is currently at 78%.

- Managers sentiment on logistics is significantly more positive than for the retail and office sectors.

- In fact, managers’ logistics sentiment was the fastest to recover and reached a record 92% in 2021 once the Covid-restrictions were lifted and trade flows were able to resume.

- Recent logistics yield tightening and increased vacancy rates have limited a further improvement in sentiment to below the previous record.

- Uncertainty around tariffs has negatively affected sentiment in the most recent survey.

PRIME LOGISTICS YIELD TIGHTENING PROJECTED TO MODERATE

- Like in other sectors, higher interest rates pushed prime logistics yields for all 37 covered markets from 3.7% to 5.3%.

- This 160bps logistics increase over the 2022-24 period is second only to the 190bps office yield widening.

- After the 2022-24 repricings and our revised base case with less bond yield tightening, prime logistics yields across all markets are expected to move in by only 30bps by 2029.

- This is in line with prime yields tightening across other sectors, but less than the 40bps forecasted office tightening.

- Prime logistics yields in Poland and UK are currently above the European average at 6.4% and 5.4%.

- Both the Polish and UK markets are expected to show more than average yield tightening of 60 bps and 40 bps over the next five years, respectively.

- The impact of recent news flow might delay the yield impact of pre-tariff improving sentiment and liquidity, but our base case yield projections remain relevant.

PROJECTED LOGISTICS TOTAL RETURNS COME IN AT 7.9% P.A.

- Total returns across all 37 European logistics markets are estimated at 7.9% p.a. for 2025-29 in our Mar-25 base case, making it the second most attractive sector after offices.

- This is down 210 bps for the same period from our Mar-24 base case as prime logistics yields tightened in 2024 and are projected to tighten less going forward.

- CEE and UK markets are expected to achieve the highest total returns at 10.9% p.a. and 10.4% p.a., respectively.

- The decline is not consistent across all countries with France Southern European and Benelux countries showing a larger adjustment in their return outlook.

- The extent and timing of 2024 yield tightening reset capital values for our projections. Current income and rental growth are now the main total return drivers.

- As bond yields are expected to stay broadly flat, our covered logistics markets are now expected to see little capital growth from yield tightening over the next 5-year period.

TOTAL RETURNS DRIVERS SHIFT TO CURRENT INCOME & RENTAL GROWTH

- Given the revised outlook for government bond and property yields to tighten less going forward, capital value appreciation is now projected to be less than in our previous projections.

- However, we still project capital value growth as a result of market rental growth. Even at a similar yield, capital values improve when rental income increases.

- Combined with the post-correction higher current income yields, our total return projections are less dependent on yield tightening and could be assumed to be less uncertain.

- Unsurprisingly, in a historical context it is clear that the capital value appreciation as a result of yield shifts has been the least stable component of total returns.

- As logistics took its place as a mature investment sector yields tightened consistently since 2013. This was followed by the 2020-21 Covid-related prime rent increases.

- The 2022-24 yield cycle was more severe for logistics than any other European prime sector. Also, the effects of yield widening were more severe than in the post-GFC period.

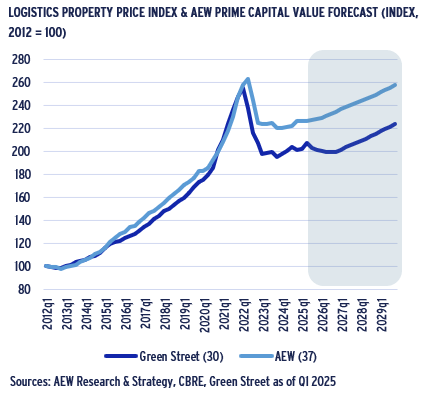

AEW BASE CASE PROJECTS STEADY RECOVERY FROM 2025

- When comparing AEW base case prime capital value forecast across 37 markets with Green Street’s price index for 30 logistics markets, we note some differences.

- Prior to 2022, both indices have shown a similar pattern of growth, more than doubling over the course of 10 years.

- Since 2022, however, AEW index has lost 16% from peak to bottom, while the Green Street index recorded a more severe correction of 24%.

- AEW’s index reflects the changes in the prime rent and prime yield only, i.e. not tracking any specific property or portfolio.

- Green Street’s index, in contrast, tracks market-level changes in values, largely based on portfolios of European REITs.

- AEW expects the index to recover steadily in the 2025-59 period, while Green Street expects the index to decrease further before showing a similar growth rate post 2027.

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW. There is no assurance that any prediction, projection or forecast will be realized.