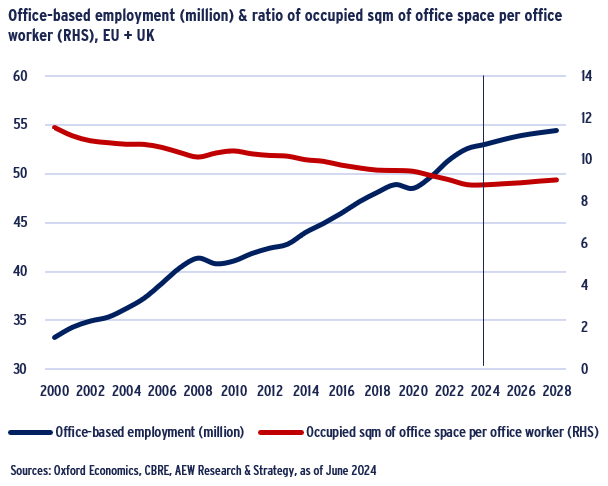

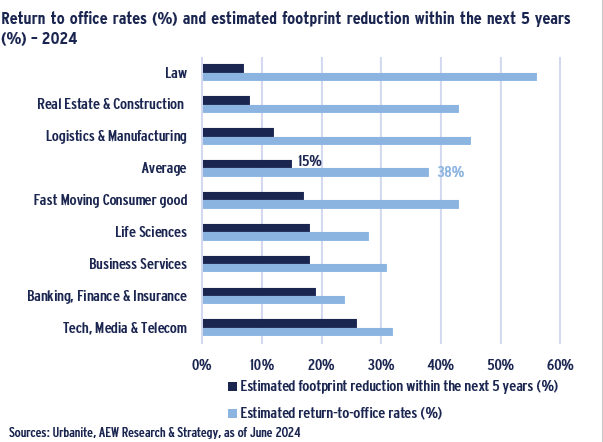

RESIDENTIAL REMAINS DEFENSIVE IN A HIGHER INTEREST RATE ENVIRONMENT

- Rising mortgage interest rates and the post-Covid return to cities increase demand for rental housing and further intensify the long-standing shortage of supply. This, combined with positive household formation growth, offsets the negative impact of weak population growth in Europe.

- Construction and financing costs remain high, reducing supply in already low vacancy markets as developers’ profit margins are weakened.

- EPC rating-led regulations are expected to further tighten supply across markets, and a green premium has started to emerge.

- European rental markets are therefore expected to experience strong market rental growth going forward. Our latest forecast for 2023-27 residential comes in at c.3% p.a., in line with logistics but higher than for office and retail. Recently introduced rental caps to protect tenants against inflation-linked rent indexation are expected to be temporary and not inhibit long term market rental growth.

- Investor demand for residential is expected to remain strong with transactions expected to resume once the expectations of buyers and sellers have aligned. This is particularly true of student and senior housing as they offer the benefits of a single, long and triple-net commercial lease to investors and higher yields on average.

- Due to increased interest rates, refinancings might prove an obstacle for some investors and create a debt funding gap. It is mostly driven by the assumed ICR restriction, due to the low yields in residential.

- In fact, residential REITs have been trading at significant discounts compared to NAV as a result of their above-average leverage levels, which might force some to sell assets in order to rebalance their capital stack regardless of the solid occupier fundamentals.

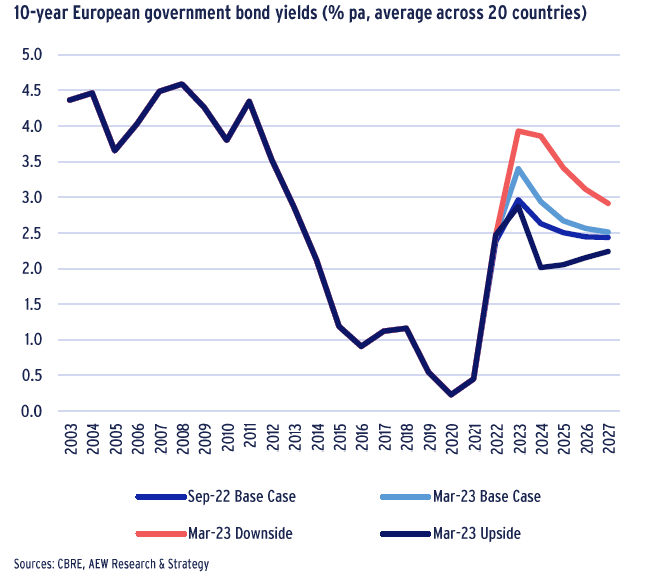

- Bond yields have been impacted by the recent bank-related concerns, but as inflation has started to settle down and further rate hikes might come in less than previously expected.

- Our updated residential yields are forecasted to show further yield expansion of 50 bps followed by yield compression from 2024.

- Due to its strong supply-demand fundamentals and its well diversified and stable cash flows, we expect that residential property will continue to be sought-after as a substitute to bonds by many investors even in today’s higher interest rate environment as it has a defensive role in a diversified property investment portfolio and provides some hedge against inflation.

TIGHTENING MARKETS AS DECREASING SUPPLY OFFSETS WEAK POPULATION GROWTH

SHORT TERM DEMAND BOOST FROM RETURN TO CITIES

- Demand for inner-city residential recovered in 2022 as a result of the gradual return to the office.

- This has been further boosted by the influx of 4.7 million refugees from Ukraine who have registered for temporary protection in the EU in 2022. Germany and Poland welcomed 1 million Ukrainian refugees each. With the conflict expected to drag on, refugees are expected to settle down in their host country and increasingly rent in the private-rented sector.

- Another key driver of demand is household formation which is strong, particularly in cities.

- These are the key demand drivers in a context of weak long term demographic outlook, with negative population growth expected in in Germany, Central and most of Southern Europe.

RISING CONSTRUCTION COSTS HURT PROFITABILTY

- Supply of new rental housing in the long term is driven by developers’ profitability, which is driven by land and building costs and sales prices.

- In that respect, it should be noted that residential construction costs increased by 11% year-on-year in Europe in Q3 2022 and have steadily increased since the beginning of 2020, alongside CPI.

- Most recent evidence suggests however that construction prices growth has slowed down as the end of 2022.

- High construction cost, combined with higher cost of capital, have decreased developers’ margins, limiting future supply. This will support capital value growth of existing assets.

- It also translates into higher residential prices for newly-built apartments (for instance, +5% in France in Q4 2022.

- High construction costs also impact the cost of retrofit capex and therefore net operating income and returns to developers and investors alike.

DECLINING PERMITS & CONSTRUCTION HIT NEW SUPPLY

- As a result of stricter financing conditions and high construction costs, residential buildings’ construction output fell in 2022, particularly in Germany as shown in the chart, but also in Spain and Austria.

- The supply of new dwellings is not expected to recover in the short term. This will make the housing market in supply constrained cities even tighter than before and drive market rental growth.

- The number of residential building permits filed in the EU27 – a leading indicator of future developments - also fell sharply in 2022.

- With developers’ profitability challenged by cost increase, these permits might not even translate into new residential developments.

- The number of residential building permits filed are significantly down in France as illustrated. In Denmark, Ireland, Finland and Sweden the same trend is noted.

INCREASING MORTGAGE RATES DRIVING DEMAND FOR RENTAL UNITS

SURGE IN MORTGAGE RATES PUTS PRESSURE ON PRICES

- Typical bank mortgage rates in the euro area have risen significantly since the beginning of 2022. This comes after central banks started hiking their base rates to try to push recent high inflation back to their 2% targets.

- Mortgage interest rates have risen to just below 3% at the end of 2022 on average in the Eurozone, a level not seen since 2013 and the largest and fastest increase ever recorded.

- UK mortgage rates are standing out as significantly higher than in the Eurozone due in part to the Bank of England’s policy.

- UK rates have risen sharply in the past year with the average quoted rates for a 5-year fixed mortgage at 75% LTV at 5.0% in Dec-22 up from 1.3% in Sep-21.

- As more households will not be able to secure a loan for a house purchase in the current lending environment will push home prices down while at the same time support demand for rental units in the private rented sector.

HOUSE PRICE DECLINE EXPECTED IN 2023

- The rise in interest rates has led to a sharp slowdown in house prices at the end of 2022 after rising by almost 10% in Q1 2022 in the Eurozone.

- There are significant differences between markets due to structural differences in their mortgage markets.

Markets with a higher share of variable mortgage interest rates, such as Sweden, experienced a faster slowdown in prices with a decline of 11% recorded in Q4 2022 and expectations of a 18% y/y decline in early 2023.

Most markets are expected to experience a decline in prices in 2023, ranging from -8% in the UK to -3% in France.

MARKETS WITH VARIABLE RATES OR SHORT LOAN MATURITIES ARE MORE VOLATILE

- The sharp fall in house prices recorded in the UK and Sweden over the past quarters are mostly explained by the large share of variable mortgage interest rates (49% in Sweden) or loans with maturities shorter than 5 years (83% in the UK) in these markets, which increase the volatility in prices.

- Indeed, in the UK, most mortgages have a fixed-rate contract, but the fixed-rate period is mostly below 5 years. This is significantly below the rest of Europe.

- In contrast, only 1.6% of mortgage loans are on floating interest rates in France, while 78% of outstanding loans signed for over 10 years.

- It is also important to note than Interest-only mortgages have a substantial market share in some countries (Sweden, the Netherlands, Germany).

- New loans are increasingly signed with fixed rates and with longer loan maturities.

STRONG MARKET RENTAL GROWTH EXPECTED GOING FORWARD

POST-COVID RETURN TO CITIES DRIVES RENTS UP 10%

- The European market average of 3.3% prime rental growth for 2018-2022 period hides some significant inter-period changes worth noting.

- After falling by 0.8% on average across Europe in 2020 during the Covid lockdown, prime residential rents already started recovering in 2021 (+1.4%).

- But, prime residential rents accelerated sharply post-Covid lockdowns in 2022, increasing by 9.6%.

- This post-Covid rebound was particularly strong where over 20% prime rental growth was recorded in Warsaw (+47%), Berlin, Barcelona and Amsterdam.

- This reflects the return of private tenants to cities after the lockdowns, the long-term supply shortages as well as the recent high levels of inflation recorded in 2022.

INDEXATION LIMITED BY RENTAL CAPS IN SOME MARKETS

- Inflation did not directly translate into market rental growth despite indexation clauses in most European markets due to rental caps introduced by various governments to limit the impact on tenants.

- Spain, Ireland, the Netherlands, France and Denmark all introduced temporary rental caps, ranging from 2% in Spain – the most constraining – to 4% in Denmark.

- England and, more surprisingly, Germany did not introduce a national rental cap, despite inflation reaching 7-8%. New caps were not needed as in Germany, annual rental reviews are already highly regulated.

- Inflation has decreased in the Eurozone to 8.5% in February, but with core inflation reaching a record high of 5.6%. It remains therefore unclear if governments will prolong these temporary rental caps, which were initially set to last one or two years.

2023-27 PRIME RENTAL GROWTH EXPECTED AT 3% PA

- At 2.9% p.a. on average, prime residential rental growth expected between 2023 and 2027 is expected to be above inflation (2.1% p.a.) as the imbalance between demand and supply continues.

- This is in line with the 3.3% p.a. prime rental growth recorded over the past five years across our 24 market coverage, boosted by a strong 2022.

- This also compares favourably against other property types, with prime office and high street rental growth expected at 2.0% p.a. and 1.2% p.a. respectively over the next five years. Prime logistics is slightly ahead at 3.1% p.a.

- Amsterdam and the Dutch markets, London and Madrid are expecting to outperform the European average.

STRONG INVESTOR DEMAND TO CONTINUE FOR DEFENSIVE SECTOR

DROP IN INVESTMENT ACTIVITY AFTER 2021 RECORD

- After reaching an all-time high of €97bn in 2021, European residential volumes totaled 60€bn in 2022, a 40% decrease y/y.

- 2021 was an exceptional year with the acquisitions of Deutsche Wohnen by Vonovia (€27.6bn) and the Lamartine portfolio by French insurer CNP from CDC Habitat (€2.4bn) lifting the sector share of total to a record 28%.

- While H1 2022 volumes were still high, the investment activity collapsed in the second half of the year when interest rate hikes started to bite.

- 2023 transactions have been limited so far as the bid/ask spread remains high, with volumes in the first two months of 2023 down around 50% y/y.

- With more limited activity, investors and valuers struggle to set prime yields.

- Nevertheless, according to INREV 2023 Investment Intentions Survey, residential maintained its second position as preferred investment sector after offices but ahead of logistics.

- This preference can be explained by the relative high stability of cashflows offered and is further confirmed by residential accounting for a solid 21% of the total European investment market in 2022.

OPERATIONAL RESIDENTIAL: THE BENEFITS OF A COMMERCIAL LEASE

- Commercial residential – residential assets supported by a commercial lease to an operator – combine the benefits of a single, long, triple-net commercial lease with the defensiveness of the residential sector.

- On the back of an ageing population, investors’ interest in the senior housing market has been increasing.

- Since 2012, volumes invested in senior housing (independent living only) have more than doubled and reached €3bn in 2022.

- Volumes invested in student housing have also been increasing, driven initially by the UK market, reaching a record high of €17bn in 2022.

- As universities were forced to close, operations have quickly recovered post pandemic as illustrated by Unite’s £5bn portfolio UK reservation rate of 83% (vs 67% at the same time last year).

- Together senior and student housing now represents 30% of the residential volumes invested across Europe, compared to a ten-year average of 20%.

MATERIAL DEBT FUNDING GAP IN RESIDENTIAL

- One headwind for investors is highlighted by the debt funding gap (DFG). This is the potential shortfall between the original secured debt amount originated and the amount available for refinance at the loan maturity.

- Our estimate of the DFG is driven by lower collateral value projections as they drive up loan-to-values (LTVs) at refinancing and by the additional impact from higher interest rates on interest coverage ratios (ICR).

- Compared to offices and retail, residential-secured loans show the lowest combined DFG. This is mostly due to modest acquisition volumes in 2018-20 for this sector relative to the others.

- The residential sector’s combined DFG at ICR 2.0 is estimated at EUR 11bn, which is less than 22% of the all sector combined DFG.

- Residential is the only sector where ICR restrictions are stronger at 2.0, which is a result of low yields in the sector at loan origination in 2018-2020, coupled with solid capital value growth to 2022.

UNDERPERFORMING RESIDENTIAL REIT OFFERS BUYING OPPORTUNITIES

BUYING OPPORTUNITIES FROM DELEVERAGING REITS

When we turn to the REIT markets we can highlight a number of interesting supporting trends.

As a result of higher interest rates, recent negative performance and a relatively high LTV of 44% on average, many residential REITs have been forced to deleverage.

Some residential REITs also have a substantial share of their loans due to refinance before the end of 2024, also in terms of absolute debt quantum.

Regardless of the uncertainty around asset values, in their aim to deleverage their balance sheets and assure shareholders, residential REITs have put large portfolios up for sale, often with a sizeable discount.

This need to deleverage has also led Vonovia and other REITs to announce a freeze in their development ambitions.

Given the size of these REITs development pipelines, this has significant implications on supply in the German residential and construction market.

RESIDENTIAL REITS TRADING AT A SHARP DISCOUNT

- With daily pricing, the REIT market is always quickest to react to changing capital market conditions and sector specific newsflow.

- Residential REITs experienced a correction from Oct-21 to the end of 2022, after outperforming in the past couple of years.

- Their discount to NAV collapsed to reach over 50% in October 2022, when concerns about rising interest rates were the highest.

- While this correction was not confined to residential sector, the above-average leverage of residential REITs and associated refinancing challenges in a context of rising interest rates penalised the sector.

- Residential REIT NAVs partly recovered in the first quarter of 2023 – driven by an improving macro outlook and solid market fundamentals.

- They are still trading at a sector high 35% discount to NAV in mid-March.

- As a result, many residential REITs are now forced to deleverage with asset sales, offering an interesting opportunity for long term private investors.

GREEN STREET CPPI INDEX SUGGESTS MORE RESILIENCE

- In contrast to these unencouraging signals from the REIT market itself, Green Street’s broader CPPI index confirms that the residential sector has proved more price resilient than other property types.

- According to this index, residential prices have fallen by 16% on average since peak, compared to 40% for retail (vs peak going back to 2018 in most markets), 21% for offices and 19% for logistics.

- As a proxy for private market pricing, the CPPI index is unlevered and captures the prices at which commercial real estate transactions are currently being negotiated and contracted.

- Private market valuations might seem high in comparison to the listed market’s implied view of values as stated through the NAV discount.

- It usually takes around 9-12 months for external valuers of unlisted property funds to adjust valuations. Lack of arm’s length transactions proving a typical obstacle for these valuation adjustments.

EPC RULES REDUCE SUPPLY AND DRIVE PRICES

EPC REQUIREMENTS TRIGGER REDUCTION IN STOCK

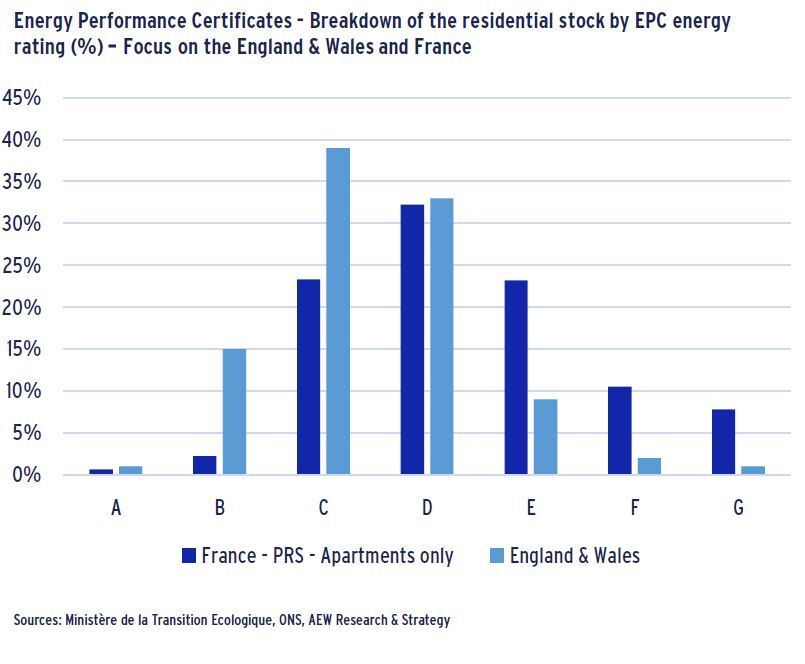

- EPCs provide information on the indicative energy performance of a dwelling, issued when the property is sold or rented. EPCs are the main tool used to implement the EU’s Energy Performance of Buildings Directive (EPBD) in the residential sector and the main source of data on the energy efficiency of the European residential stock.

- Landlords won’t be allowed to let or continue to let residential properties if they have an EPC rating below E, unless exempted. In England & Wales, this Minimum Energy Efficiency Standard has been implemented since April 2020.

- In France, the 2021 Climate and Resilience Act set a deadline in 2025 for properties with an EPC label G and 2028 for properties rated F, with some restrictions already in place on potential rent increase for the worst-performing properties.

- In England and Wales, 45% of the residential dwellings have an EPC below C. In Paris, it is 42% of the apartment stock with an EPC below D which will soon be unlettable unless refurbished.

- The implementation and enforcement of these policies is likely to prove challenging, particularly in the tightest rental markets as tenants are likely to accept to lease non-compliant units. Retrofits to meet EPC requirements might be costly. These regulations could therefore reduce the supply available in the rental market.

EPC METHODOLOGIES VARY ACROSS MARKETS

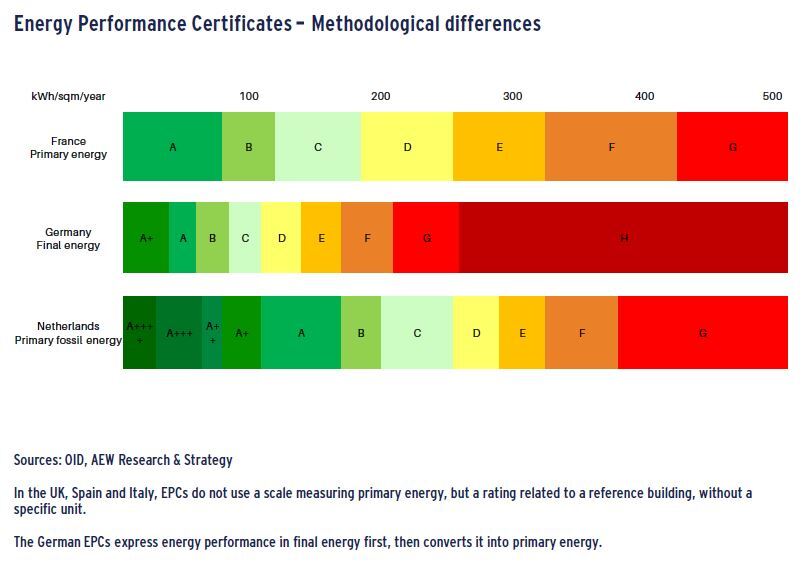

- EPCs have become a major public policy instrument for steering the decarbonisation of the building sector. However, EPC methodologies do vary significantly between countries despite a simple scale from A to G in terms of methods (calculated or based on actual consumption), scope of energy consumption, thresholds and units used.

- These inconsistencies make comparisons across Europe difficult. The European Performance of Building Directive’s (EPBD) recast proposal published in 2021 plans to harmonise EPCs between all Member States and standardise energy bands from 2026.

- These will then be used in the EU Taxonomy, with band A corresponding to zero emission buildings and band G representing the 15% least energy efficient part of the residential stock.

- The extension of the European carbon market to the building sector represent another environmental policy which is not based on EPC. In the context of high inflation, commercial buildings are likely to be integrated first in the ETS market, from 2025, followed by residential buildings from 2029.

FIRST ESTIMATED EPC IMPACTS ON PRICING

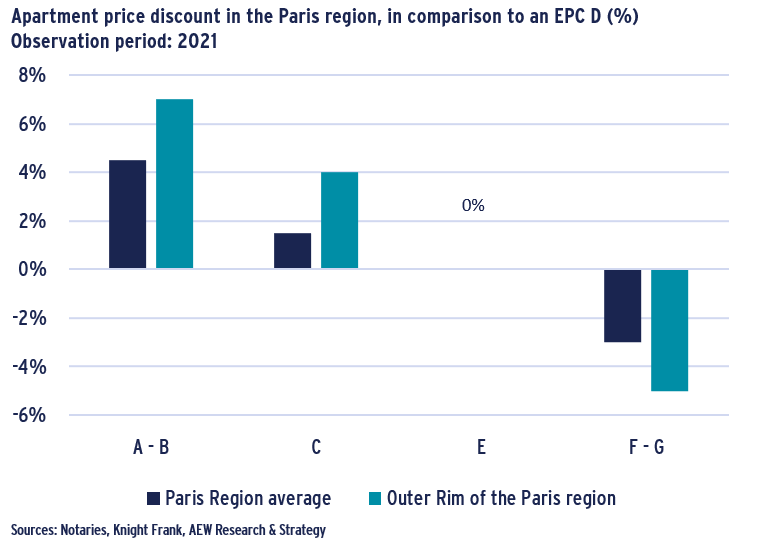

- As investors price in the costs of EPC retrofits, the first evidence of a green premium and of a brown discount in the residential sector emerges.

- Compared to apartments with an EPC rating D, dwellings with an EPC F or G traded at a 3% discount in the Paris region and 5% in the Outer Rim of the region were the market is less tight. There is also a green premium of 5-7% for properties rated A or B.

- While this seems low, the estimated discounts are based on 2021 transactions. It seems highly probable that EPC-driven discounts will be higher in the future given the closer deadline and the impact on liquidity.

- In the UK, evidence from Knight Frank shows that dwellings which saw their EPC improved from D to C experienced an uplift in value of 3%. This UK green premium increased to 9% for a two-notch upgrade from E to C and 20% for a three-notch upgrade from F/G to C.

CRREM EMERGING AS NEXT CARBON BENCHMARK

SECTOR & COUNTRY PARIS-COMPLIANT PATHWAYS

- As local governments and building owners are working to implement the EPC regulations, a new Paris-aligned benchmark has emerged.

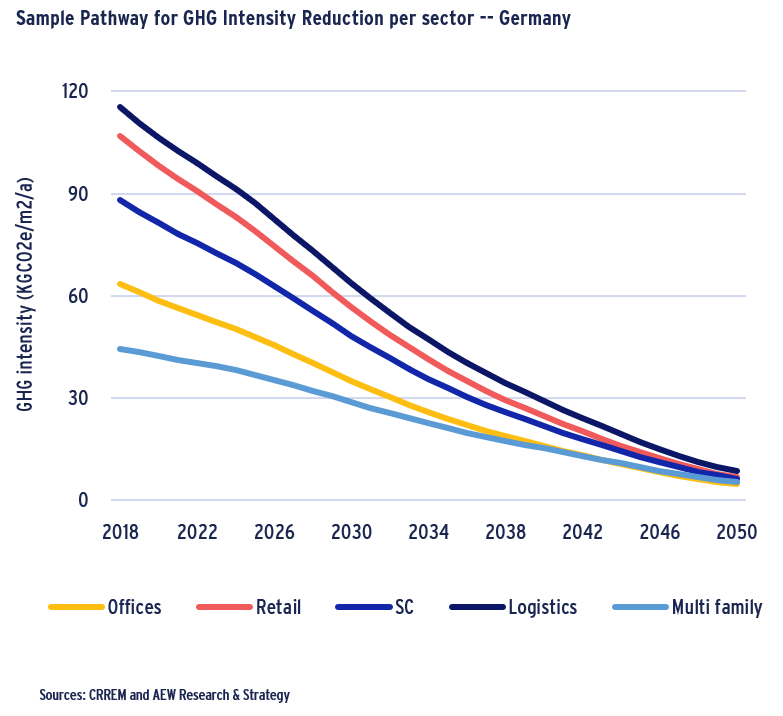

- In previous reports, we highlighted the Carbon Risk Real Estate Monitor (CRREM) which as part of the science-based climate initiative identifies country and property type specific decarbonization pathways.

- These pathways take into account the global carbon budget of GHG that can be emitted until 2050 to not exceed global warming above 2.0 degree Celsius globally by 2100.

- In our illustration we show the pathways for Germany. Due to its relatively high share of traditional carbon-based power generation the German pathways are starting at a relatively higher GHG intensity than in other countries.

- Consistent with other European countries, German residential shows a lower GHG intensity than other property types.

- CRREM has become embedded in GRESB and other leading ESG benchmarks. Also, leading residential operators, like Vonovia, map their portfolios as they progress to meet the CRREM pathway over time.

- Although not yet incorporated in regulations and laws, one could consider CRREM as the next phase in de-carbonisation.

CLIMATE TRANSITION COSTS ESTIMATED IN FIVE STEPS

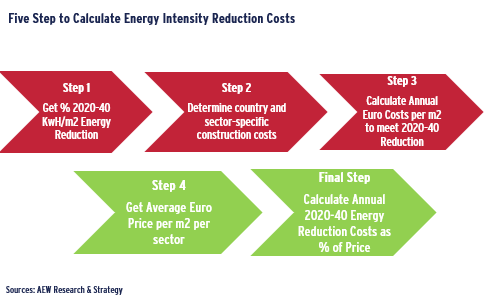

- As shown in the diagram, we apply a five-step approach in order to arrive at a relative cost measure of energy intensity transition:

- Look up the % energy intensity reduction needed in KwH per sqm from the CRREM tool for each country’s three property sectors;

- Determine the country and sector specific construction costs index;

- Calculate the annual costs in euros per sqm to meet the 2020-40 energy intensity reduction (taking into account the % needed (step 1) and the change in costs over time);

- Determine the average sales price per sqm for each country’s property sector

- Calculate the annual energy intensity reduction costs to meet the Paris-accord based CRREM pathways as % of current property price for each country’s three sectors.

RESIDENTIAL ENERGY CAPEX RELATIVELY LOW

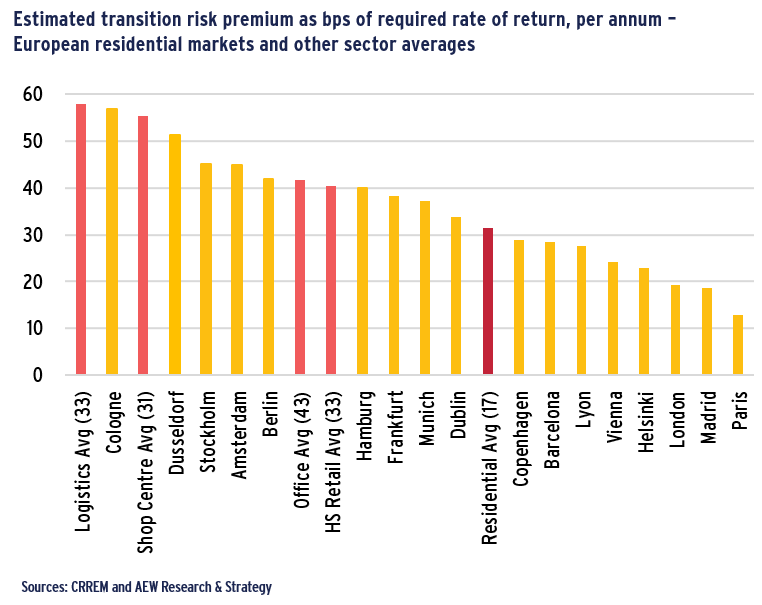

- To integrate the above annual required capex costs to meet the CRREM pathways in our existing relative value analysis, we estimate the capex in bps of each market’s required rate of return and define it as a climate transition risk premium.

- To put these climate transition risk premia for residential markets into a broader context, the chart on the right shows individual markets as well as averages for the other property sectors.

- Our results confirm that the residential sector has the lowest relative costs of meeting the Paris-compliant pathways of energy intensity reduction.

- In fact, Paris, Madrid and London stand out as having the lowest relative costs. This is a clear result of the high capital values of residential properties in these markets relative to more regional markets, like Cologne.

- It should also offer institutional investor some comfort that residential assets have a lighter capex burden in terms of energy savings than other property types.

ONGOING REPRICING & FORECASTS POINTING AT YIELD COMPRESSION

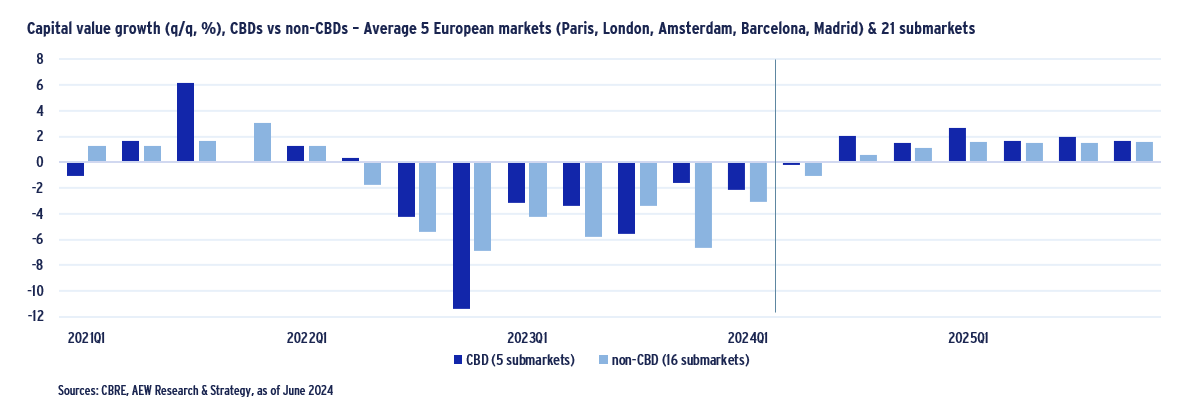

PRIME RESIDENTIAL YIELDS MOVED OUT 60 BPS IN 2022

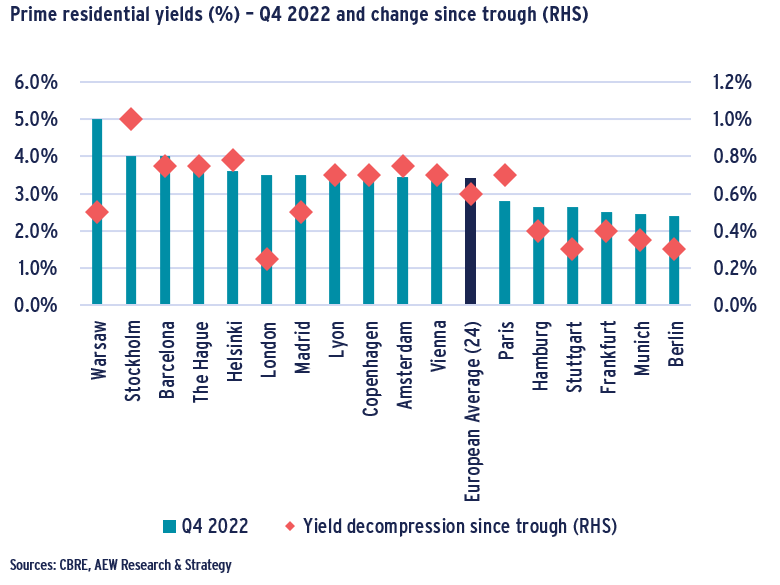

- Prime residential yields in Q4 2022 have moved out by 60 bps on average in Europe since their lowest level at the beginning of 2022.

- Under-average yield decompression has been recorded during this period in London and in the low-yielding German markets.

- In contrast, prime residential yields moved out by 100 bps in Stockholm as a result of falling house prices.

- Prime residential yields stood at 3.4% at the end of 2022 when considering a 24-market European average, ranging from 2.4% in Berlin to 5.0% in Warsaw.

50 BPS ADDITIONAL YIELD SHIFT TO BE EXPECTED

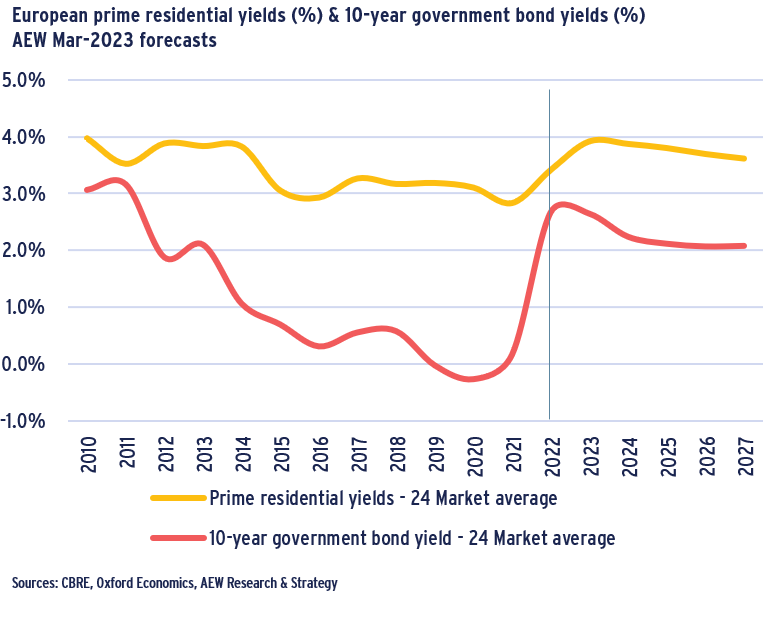

- Our recently updated prime residential forecasts indicate a further yield decompression of 50 bps before prime residential yields peak at 3.9% in 2023-24 to rebuild a risk premium over 10-year government bond yields.

- This comes after the 60 bps yield decompression already recorded in 2022.

- From 2024, prime residential yields are then expected to compress once again to 3.6% by 2027.

- This reflects the financial markets expectations on the stabilisation of government bond yields as central banks are expected to stop hiking their base rates in mid-2023.

- Bond yields have also been impacted by the recent bank-related concerns.

- In contrast, our in-house residential yields forecasts from last November assumed a stabilisation of residential yields at around 4% on average.

- The spread between prime residential yields and government bond yields is expected to average 160 bps over the next five years.

SENIOR & STUDENT HOUSING YIELDS TO STABILISE

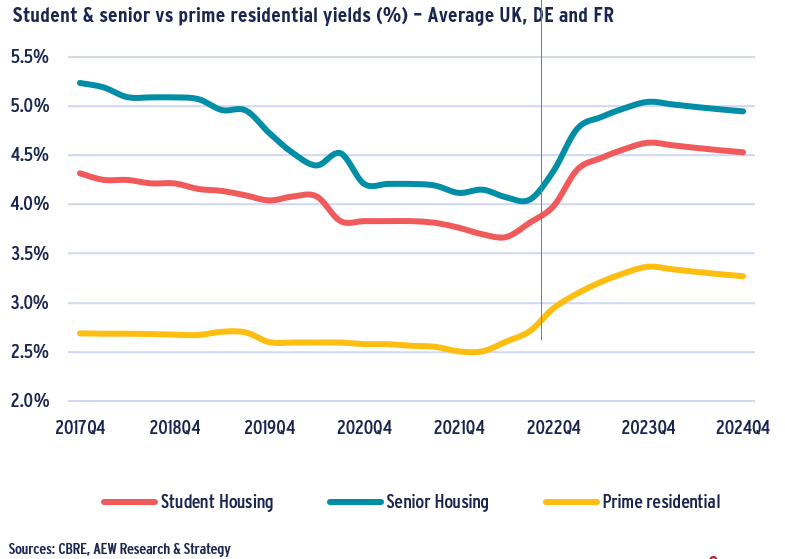

- Senior and student housing yields have been compressing alongside residential yields as these subcategories have become more sought after by institutional investors over the past decade.

- Senior and student housing yields remain higher than prime residential to reflect operational risks and currently stand at 4.3% and 4.0% respectively after decompressing by around 30 bps in 2022 - less than the 60 bps decompression recorded for prime residential yields.

- Based on the interpolation of our residential forecasts, senior housing yields are expected to stabilise at 5.0% and at 4.5% for student housing yields (average of UK, France and Germany).

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW. There is no assurance that any prediction, projection or forecast will be realized.