Investment Vehicles Page

North America

U.S. Core Strategy

Diversified, core real estate strategy with the goal of targeting institutional-quality multifamily, retail, office and industrial properties in well-located markets throughout the U.S. with a goal to provide preservation of capital, stable income and modest appreciation over the long-term.

Learn More

North America

U.S. Core Strategy

Strategy

Core Strategies

Sectors

Industrial,

Multifamily,

Office,

Retail

Inception

2007

The core strategy in the U.S. sources, closes and manages investments in the four primary property types (industrial, multifamily, office and retail) in major U.S. metropolitan markets.

North America

Core Plus/Value-Add Strategy

AEW’s value-add investment strategy focuses on growth and income and seeks to take advantage of the re-balancing of America's demography and the real estate investment opportunities that will follow in its wake.

Learn More

North America

Core Plus/Value-Add Strategy

Strategy

Core Plus & Value-Add Strategies

Sectors

Industrial,

Multifamily,

Office,

Retail

Inception

2004

The core plus & value-add investment strategy is a growth and income strategy that seeks to take advantage of the re-balancing of America's demography and the real estate investment opportunities that will follow in its wake. The core plus & value-add investment strategy seeks to provide investors with an attractive return, comprised of current cash distributions and appreciation potential through re-positioning and other active management strategies.

North America

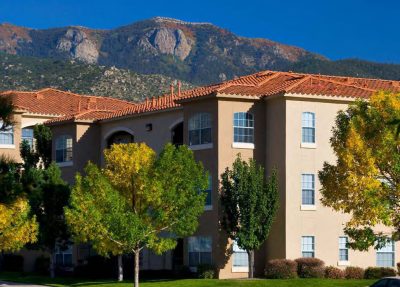

Seniors Housing Strategy

AEW’s core plus/value-add seniors housing real estate strategy involves joint ventures with experienced, operationally-astute seniors housing operators (public and private) in primary and secondary metropolitan markets in the U.S.

Learn More

North America

Seniors Housing Strategy

Strategy

Core Plus & Value-Add Strategies

Sectors

Memory Care,

Assisted Living,

Independent Living,

Age-Restricted

Inception

2007

AEW’s Seniors Housing Strategy targets opportunities for acquisition, development and select repositioning primarily in the memory care, assistant living, independent living and age-restricted sectors of the seniors housing market. The general focus is on assets in major metropolitan markets in the U.S. that exhibit strong underlying income demographics for both seniors and their adult children, as well as favorable supply/demand characteristics.

North America

Opportunistic Strategy

AEW’s opportunistic real estate investment strategy seeks to identify and capitalize on emerging investment trends before they become fully-appreciated by the broader market.

Learn More

North America

Opportunistic Strategy

Strategy

Opportunistic Strategies

Sectors

Industrial,

Multifamily,

Office,

Retail

Inception

1988

AEW’s opportunistic real estate strategy seeks to identify and capitalize on emerging investment trends before they become fully-appreciated by the broader market, and to capitalize on them.

North America

Diversified Strategy

The North America diversified real estate equity securities strategy is designed with the goal to provide exposure to the major sectors of the real estate market from REITS and other publicly-traded real estate companies in North America.

Learn More

North America

Diversified Strategy

Strategy

Real Estate Securities Strategies

Inception

1995

AEW’s North American diversified real estate equity securities strategy is designed with the goal to provide broad exposure to all major sectors of the public real estate market in North America, with the objective of achieving strong risk-adjusted returns. The diversified strategy typically includes 30-35 core positions.

North America

U.S. Income Strategy

Real estate equity securities strategy designed to offer enhanced income and risk-adjusted total returns through a disciplined value approach based on bottom-up security selection of primarily REIT preferred securities.

Learn More

North America

U.S. Income Strategy

Strategy

Real Estate Securities Strategies

The U.S. income REIT strategy is designed to offer enhanced income and risk-adjusted total returns through a disciplined value approach based on bottom-up security selection of primarily REIT preferred securities. Security selection is made with a particular emphasis on balance sheet strength; balance sheet strategy; relative evaluation of each security; and catalysts that will lead to the improvement/deterioration in overall credit metrics.

North America

Debt and Capital Markets

AEW is an active buyer, seller and lender for all types of commercial properties throughout North America and select international markets.

Learn More

North America

Debt and Capital Markets

Strategy

Debt & Capital Markets

AEW’s Debt and Capital Markets team provides borrowers with a variety of full stack lending solutions including whole loans, mezzanine debt, and preferred equity. Flexible capital targets both stabilized and transitional properties, including development, across the risk/return spectrum generally in top 25 metropolitan areas in the U.S.

North America

Separate Accounts & Transferred Asset Management

AEW offers separately managed accounts and transferred asset management capabilities in North America to transition, restructure and ultimately sell assets in a manner that is consistent with each client's goals and objectives.

Learn More

North America

Separate Accounts & Transferred Asset Management

Strategy

Separate Accounts & Transferred Assets

Separate Accounts & Transferred Asset Management typically begin with either a new capital allocation or transferred assets and a capital commitment for new investing. Services include transferred asset management, work-out services and customized solutions. A dedicated team that includes acquisitions, portfolio management, asset management and accounting professionals work exclusively on direct equity portfolios.

Strategy

Sectors

Inception