- In this publication, we update our analyses for European office markets. Our initial analyses show that GenAI is expected to have a positive impact on office employment as it will automate certain routine tasks, while creating new higher value-add AI-related jobs. London, Paris and Frankfurt are expected to benefit most from future AI adaptation.

- Office vacancy rates continued to increase in Q1 2025, even in CBD markets. CBD vacancies had previously trended down as bifurcation has remained a continuing theme so far. However, with less new supply and an increasing number of office conversions, overall vacancy is projected to come down from its 9% peak mid-year 2025 to 7% by 2029.

- Signs are beginning to emerge that CBD office rental growth since 2020 is pricing out cost-conscious occupiers, with more affordable, non-CBD submarkets looking increasingly attractive in terms of value for money.

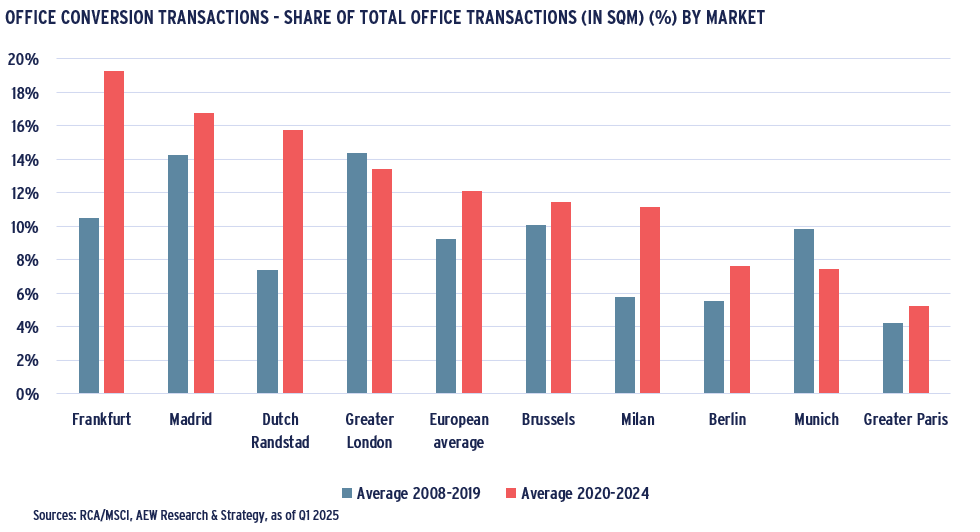

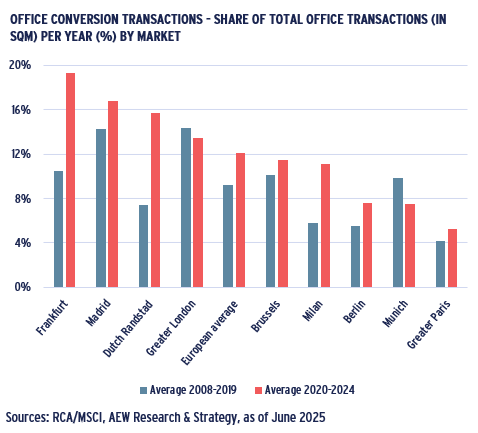

- The increasing post-Covid trend of office conversions is also confirmed at an individual market level, with the highest 2020-24 share of office conversion transactions recorded in Frankfurt & Madrid, as shown in the chart below.

- Average 2025-29 prime rental growth is expected to reach 2.8% p.a. across all 61 covered European office submarkets. Across a sample of five CBD submarkets rental growth is forecast at 3.5% p.a., which is only slightly stronger than 3.3% p.a. for the 14 non-CBD submarkets in the same cities. This might signal a broadening recovery as bifurcation diffuses.

- 2024 office transaction volumes remained muted, down 53% compared to their 15-year historic average. As a share of total volumes, offices represented a record low of 21% in Q1 2025. But liquidity is expected to improve as more managers believe European values will improve in sharp contrast with the US, where office values are still expected to decline.

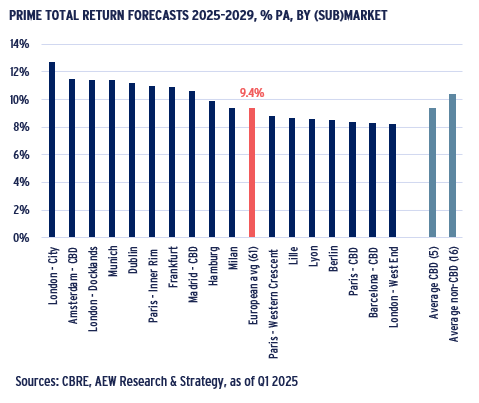

- Our latest prime office forecasts show that average total returns are expected to reach 9.4% p.a. over the next five years across our 61 covered European markets. The 9.4% p.a. cross market average reflects a high of 12.7% p.a. for London City and 8.2% for London West End with no European office market expected to have a sub 8% return.

- In a further signal of a broadening recovery beyond prime, non-CBD submarkets with higher current income yields are expected to have a 10.4% p.a. return and outperform lower yielding CBD markets at 9.4% p.a. over the 2025-29 period.

OFFICE EMPLOYMENT EXPECTED TO GROW WITH ULTIMATELY POSITIVE AI IMPACT

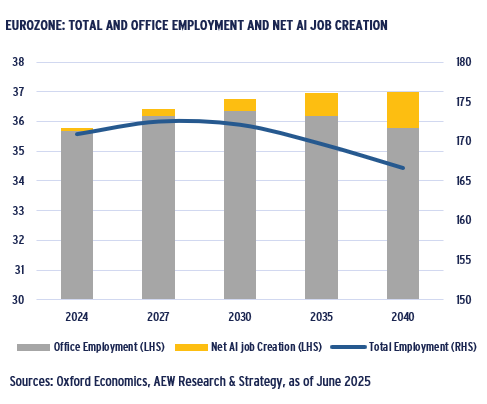

- Due to demographic challenges, overall employment across all sectors in Eurozone is expected to peak at around 172mn in 2027, with a notable decrease to 167mn by 2040.

- If we look more closely at office employment only, this demographic impact is less, meaning that the largest decline is projected in non office-based employment.

- Oxford Economics is projecting GenAI to have a positive impact on office employment.

- It expects that AI will automate many routine tasks, while creating new higher value-add AI-related tasks and jobs.

- The ultimate net effect on office employment from an increasing and broader application of AI tools is expected to be positive, with more jobs created than removed.

- In 2024 the AI-related jobs accounted only for 0.3% of total office employment, while by 2040 it is expected to grow to 3.2% of total office employment, or 1.2mn new jobs.

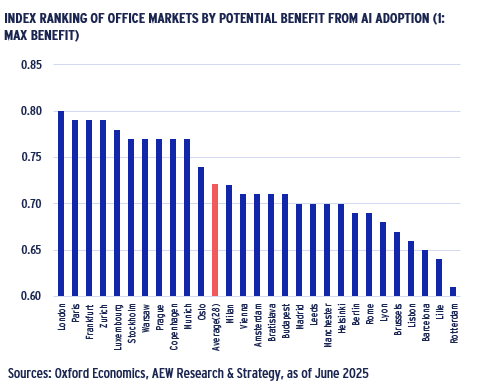

LONDON, PARIS & FRANKFURT OFFICES TO BENEFIT MOST FROM AI

- We rank markets benefiting from AI by combining data on potential sectoral AI benefit in terms of labour productivity gains with city and sector level employment data.

- Based on this, markets with a larger share of finance & insurance, as well as IT and other professional services are projected to benefit more from future AI adoption.

- London & Paris rank first in our AI-index measure, followed by Frankfurt, Zurich, Luxembourg, Stockholm and Warsaw.

- In contrast, markets with more employment in sectors such as administrative & support services and public administration are expected to benefit less from AI.

- Rotterdam, Lille, Barcelona, Lisbon and Brussels are expected to benefit less based on their local dominant industry employment sectors.

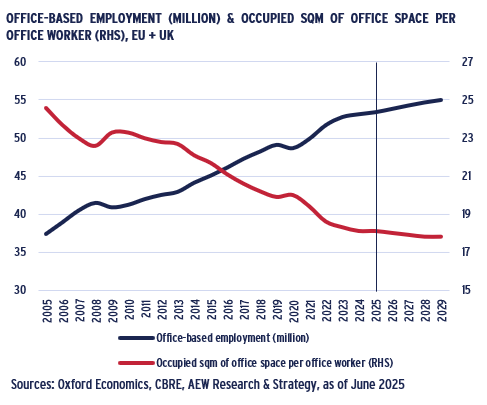

OFFICE-BASED EMPLOYMENT REMAINS A KEY DRIVER

- Office-based employment in Europe (including the UK) has been rising steadily since the 2000s, only interrupted by the Global Financial Crisis and by the Covid pandemic.

- Office employment growth is expected to slow down to an average of 0.7% per year over the next five years, compared to 1.6% over the last five years, but should remain positive.

- The average number of sqm of office space per employee has fallen 28% from 25 sqm in 2005 to 18 sqm in 2024. A stabilisation at this level is expected in the coming years.

- The typical ratio of workstation per employee is now 0.7 after steadily declining since 2000, due to the development of remote working and desk-sharing policies.

- A key challenge for occupiers’ ability to downsize is managing their workers’ usage peaks across weekdays as well as expanding desk-sharing policies.

- We note some recent examples of large tenants (like HSBC) reversing their post-Covid aggressive desk per employee ratios to ensure there are sufficient workstations at peak times.

OFFICE VACANCY RATES PROJECTED TO PEAK IN H1 2025

EVEN CBD MARKETS SEEING RISING VACANCY IN LATEST QUARTERS

- Since Covid, the dominant trend has been the bifurcation between CBD where the demand dynamics remained strong and more peripheral, less attractive office submarkets.

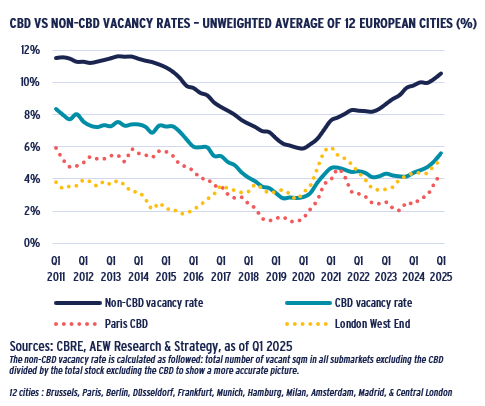

- The average Q1 2025 CBD vacancy rate stands at 5.6% nearly half when compared to the 10.6% vacancy for non-CBD submarkets across 12 different European cities.

- However, over the past year, CBD submarkets – including Paris CBD and London West End - have experienced an increase in vacancy rates of 120 bps as well.

- Even as most occupiers continue to favour central locations to attract and retain staff, expansion plans might be on hold due to the continued macro and geopolitical uncertainties.

- The increase in CBD office rents since 2020 might be starting to deter cost-conscious occupiers. More affordable, non-CBD submarkets are increasingly offering better value for money.

- This reduced bifurcation could be a first sign of a broadening recovery in CBD and non-CBD markets alike.

LIMITED SUPPLY GROWTH KEY TO REDUCING VACANCY

- Concerns regarding offices have mostly focused on future demand, but it is important to consider new supply as well.

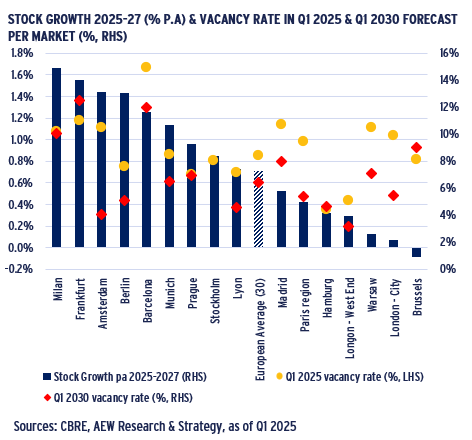

- CBRE projects office stock to grow 0.7% p.a. over the next two years across the 30 markets for which data is available. This is lower than the historical average of 1.3% p.a. (2003-2024).

- Milan, Frankfurt, Amsterdam and Barcelona with their high current vacancy rates will remain vulnerable as they are projected to have a strong increase in stock as well.

- Brussels is expected to see office conversions offset new supply, leading to negative stock growth.

- Beyond 2026, new supply is likely to decrease further as investors seek to diversify away from offices.

- Higher rates and lenders’ risk-averse attitude towards offices also limit the availability of new development debt finance.

- In addition to low new supply, conversion of vacant and older office buildings will help vacancy rates to come down. This conversion potential is only partially captured in our forecasts.

- Vacancy rates are expected to come down over the next five years in most European markets, with the exceptions of Frankfurt, Hamburg and Brussels.

OFFICE VACANCY RATES PROJECTED TO COME DOWN IN EUROPE

- Demand decreased due to more remote working started during Covid. However, many occupiers are still fine-tuning their post-Covid needs as some cut back too much too soon.

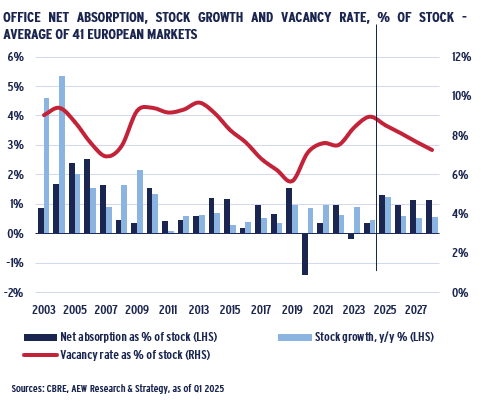

- Net absorption or take-up measures the changes in the occupied stock. In our European 41-market average, net absorption is expected to rebound over the next five years.

- Currently, the average European vacancy rate stands at 9.0%, a sharp increase since the 2019 pre-Covid 5.7% level, but still below the 10% high point of 2013.

- The vacancy rate is expected to peak in H1 2025 as new development deliveries start to slow down.

- This is reflected in the weaker stock growth expected in the coming years (0.7% pa over 2025-2029).

- This projected rebalancing of supply and demand means that the average vacancy rate across 41 European office markets covered is expected to come down to around 7% by 2029.

OFFICE CONVERSIONS ARE INCREASING AS COMMUTES RECOVER TO PRE-COVID LEVELS

LA DÉFENSE & CANARY WHARF METRO USE EXCEEDS PRE-COVID LEVELS

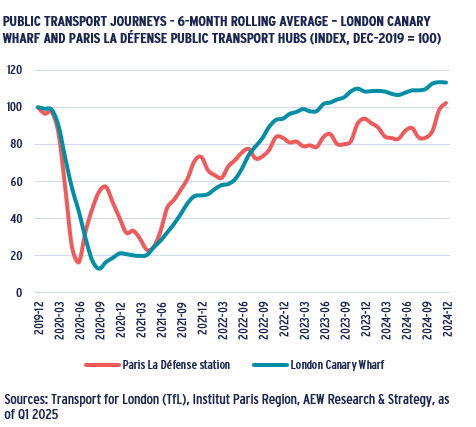

- Since data on exact office usage is patchy in Europe, public transportation journeys offer a proxy to see how return to the office mandates have impacted office occupancy rates.

- Journeys made to and from the leading business districts of La Défense and Canary Wharf now exceed pre-pandemic levels, when considered on a normalised and indexed basis.

- TfL data for Canary Wharf highlight the May-22 opening of the Elizabeth line, which allowed more efficient travel across town pushing journeys nearly 20% above pre-Covid levels.

- Journey data for other London and Paris stations is likely to be dominated more by tourist and shopping and less useful.

- UK office usage data from Remit Consulting reflects a somewhat similar trend, with a Mar-25 post-Covid record high national usage of 38% vs a pre-pandemic level of 60%.

- London usage is at 37%, with a record of 60% recorded for London’s West End. This confirms that differences between local submarkets reflect the ongoing bifurcation.

OFFICE TRANSACTIONS FOR CONVERSION PURPOSES ARE INCREASING

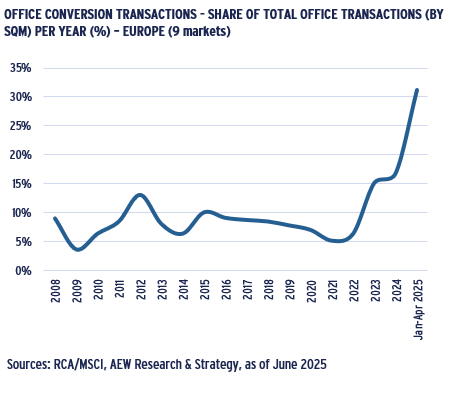

- As shown, acquisitions for purpose of conversion to another use represent an increasing share of total office transactions (by sqm) in nine key European markets.

- In the first four months of 2025, office conversions represented more than 30% of total office transactions, up from 17% in 2024. Both up from the post-GFC average of 8%.

- In the past, many potential conversions proved unprofitable due to technical challenges and high costs.

- Recent value declines, more motivated sales from owners facing difficult re-financings and new more flexible change of use regulations have stimulated office conversions.

- Conversion of offices into other uses (residential, student accommodation, hotels, logistics, self-storage etc) offers owners the opportunity to protect value and liquidity.

- Obsolete offices are offered a second life, a more sustainable solution in terms of lifecycle carbon, when compared to the traditional demolition and new construction.

- With an increased planning and regulatory focus on lifecycle carbon emissions, retrofitting existing buildings is increasingly favoured over demolition and reconstruction.

FRANKFURT AND MADRID LEADING CITY-LEVEL CONVERSION TREND

- At the individual market level, we also note a trend towards more office conversions in recent years.

- Most markets recorded an increase in the share of office conversions from 2008-19 to the post-Covid period of 2020-24, with the notable exceptions of London and Munich.

- Among markets, the highest 2020-24 shares of office conversion transactions have been recorded in Frankfurt & Madrid, with the lowest in Paris and Munich.

- These differences are likely due to local planning regulations as well as local markets conditions such as vacancy levels and office to residential rent differentials.

- Frankfurt and Milan stand out as showing the biggest increase from their average 2008-19 conversion ratio to the more recent 2020-24 period.

- As high vacancy rates in some markets prevail, local planners are more likely to adjust their change of use policies to allow investors and developers more flexibility.

STRONG CBD RENTAL GROWTH PROJECTION STARTING TO LIFT IN NON-CBD MARKETS

AVERAGE RENTS STABILISING WHILE PRIME RENTS ARE STILL RISING

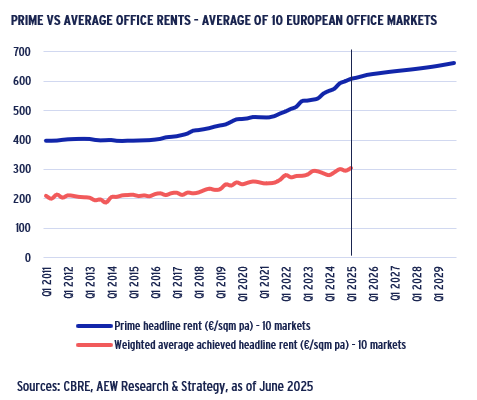

- Most office rents reflect prime quality space, but CBRE also tracks weighted average achieved rents for ten European markets in Germany (5), Italy (2), Paris, Brussels and Warsaw.

- Average rents better reflect the wider occupier market, even if prime and average rents show similar historical trends.

- Since 2020, prime office rents for these same ten markets have increased by 5.0% p.a. while average contracted rents achieved 3.8% p.a. during the same period.

- This data confirms the increasing post-Covid bifurcation between high quality and more average quality offices.

- Higher-quality space in the best locations remains sought-after even at higher rents.

- Since many occupiers reduced their space requirements post-Covid they could afford to pay higher prime rents per sqm/sqft while keeping total occupancy costs stable.

- Apart from prime versus average quality rents, a closer look at CBD vs non-CBD markets can offer some additional perspective.

CBD VS NON-CBD RENTAL GROWTH GAP FORECAST LESS THAN EXPECTED

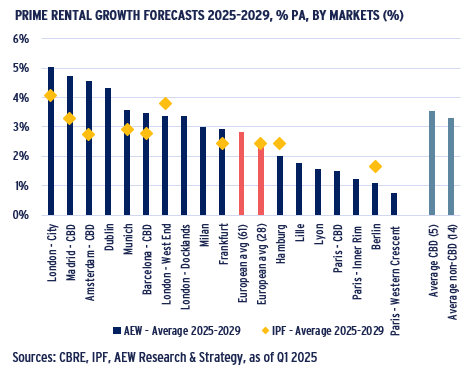

- Average 2025-29 prime rental growth is expected to reach 2.8% p.a. across our 61 covered European office markets.

- Across a sample of five cities, prime rental growth is forecast at 3.5% p.a. in CBD submarkets, which is only slightly stronger than 3.3% p.a. for the 14 non-CBD submarkets.

- This is a surprising result given CBD submarkets have experienced very strong rental growth in recent years resulting in the market bifurcation we highlighted earlier.

- A smaller gap between CBD and non-CBD rental growth could signal a broadening of the office market recovery.

- Prime rental growth is forecast to be stronger in the CBDs of Madrid, Amsterdam and Barcelona. But not in London’s West End and Paris CBD submarkets.

- When we compare our in-house with the IPF consensus forecasts across 28 European markets, our 2025-29 average growth is 2.5% p.a., very similar to the 2.4% p.a. IPF average.

- Our current forecasts are more positive than the IPF consensus for London City, Madrid and Amsterdam and less positive for Berlin, Hamburg and London – West End.

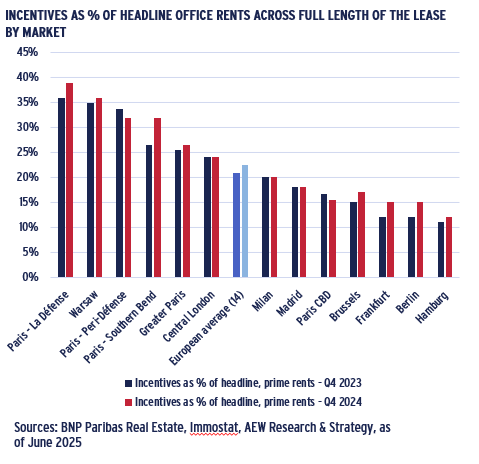

INCENTIVES REFLECT LOCAL CONVENTION & SUBMARKET BIFURCATION

- It is fundamental to also look at lease incentives to better grasp the extent of the bifurcation in the office market.

- These are defined as rent-free periods, step-up rents and other incentives agreed by the landlord to secure the lease.

- These incentives are calculated as a percentage of the total headline rent to be paid during the full length of the lease.

- BNP Paribas Real Estate reports incentives at low levels in Hamburg (12%) and Frankfurt (15%) but higher levels in London (24%), Paris (26%), and Warsaw (36%).

- Within larger markets, incentive levels also vary significantly by submarket. Across Paris, incentives currently range from 17% of headline rents in Paris CBD to 40% in La Défense.

- Net effective rental growth has therefore been weaker than headline rental growth in a many submarkets when incentives are taken into account.

INVESTMENT MARKET : PROJECTED RETURNS DRIVEN BY CURRENT INCOME AND MARKET RENTAL GROWTH

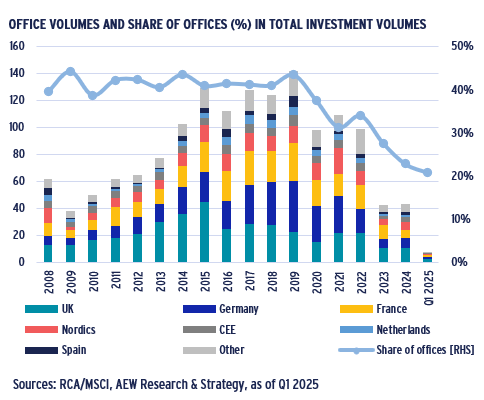

MUTED RECENT OFFICE INVESTMENT ACTIVITY EXPECTED TO IMPROVE

- 2024 European office investment volumes reached €43bn, which represented a marginal 1% increase from 2023.

- However, office transaction volumes remain muted and 2024 volumes were down 53% compared to their 15-year historic average.

- Also, the latest Q1 2025 volumes came in at €8bn, a 10% decrease compared to Q1 2024.

- As a share of total volumes, offices represented a record low of 21% in Q1 2025 due to limited secondary transactions.

- It also reflects that many institutional and retail investors are aiming to reduce their (over-) exposure to the office sector.

- However, some large, core investments were recorded (such as Norges Bank’s recent €800m Central London and Paris deals), further confirming market bifurcation.

- Finally, office liquidity is expected to improve as an increasing number of potential investors believe the market has finally bottomed out and capital values will improve.

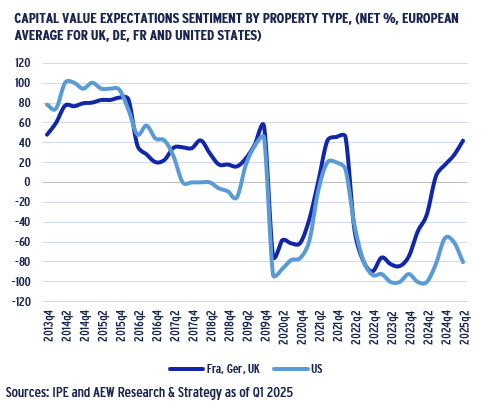

EUROPEAN MANAGERS’ MUCH MORE POSITIVE TOWARDS OFFICES THAN US MANAGERS

- Sentiment among European managers continued to improve based on the latest May/June 2025 IPE Real Assets Expectations Indicator survey.

- The net percentage (%) is calculated as the difference between the share of managers who believe property values would increase vs decrease over the next 12 months.

- Offices have trailed in the overall improvement in managers’ sentiment but now over 40% of respondents expect a positive capital value increase for offices in the next year.

- Past changes in managers sentiment can be tied to actual European transaction volumes. Based on this improved sentiment, we expect office volumes to recover.

- Finally, we note that Europe is well positioned when compared to managers’ sentiment towards US offices, as concerns on refinancings and high vacancy rates prevail.

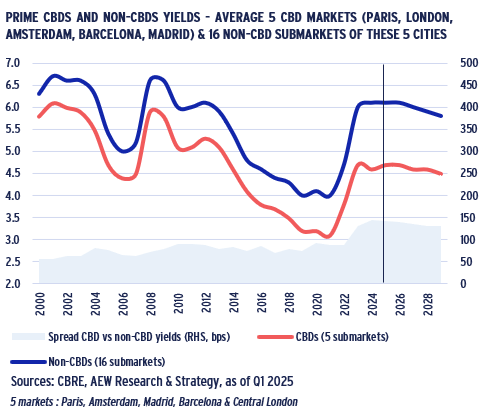

RECORD CBD VS NON-CBD YIELD SPREAD PROJECTED TO TIGHTEN

- Looking again at our selection of five cities, we note that the spread between CBD and non-CBD submarket yields has never been greater than the current 145 bps.

- Across this more limited sample, prime CBD yields are expected to peak at 4.7% in 2025, before compressing by 20 bps over the next five years.

- This compares to 30 bps average yield tightening expected for our full 64 market European coverage.

- In contrast, non-CBD yields are expected to peak at 6.1% also in 2025 before compressing by 30 bps, in line with the full coverage European average.

- This means that the yield spread between CBD and non-CBD markets is likely to reduce and could offer a temporary investment opportunity in select non-CBD markets.

- For both CBD and non-CBD markets, a return to the record low yield levels of 2022 is however unlikely given where government bonds are projected to move to.

INVESTMENT MARKET : PROJECTED RETURNS DRIVEN BY CURRENT INCOME AND MARKET RENTAL GROWTH

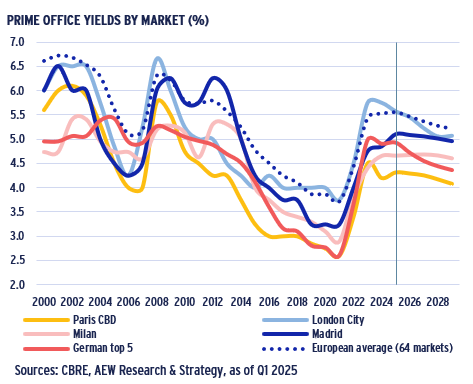

30 BPS OFFICE YIELD COMPRESSION EXPECTED OVER THE NEXT 5 YEARS

- Most European markets are projected to have already fully repriced with only limited yield expansion expected in 2025.

- Our recently updated prime office forecasts indicate a 30 bps yield compression by 2029 across our 64-market average, after prime office yields peak at 5.6% in 2025.

- Our prime office yield forecasts reflect the Oxford Economics forecasts of government bond yields over the five-year forecast period.

- Among the main European markets, London City is expected to experience the strongest compression going forward (70 bps) followed by the German Top 5 markets (55 bps).

- Limited yield compression is expected in Paris CBD (10 bps) with office yields forecast at 4.1% by 2029.

- In contrast, Milan and Madrid office yields are forecast to remain stable.

NON-CBD SUBMARKETS TOTAL RETURNS TO OUTPERFORM CBD

- Our latest prime office forecasts show that average total returns are expected to reach 9.4% p.a. over the next five years across our 61 covered European markets.

- The 9.4% p.a. average reflects a high of 12.7% p.a. for London City and 8.2% for London West End with no European office market expected to have a sub 8% return.

- Non-CBD submarkets with higher current income yields are expected to have a 10.4% p.a. return and outperform lower yielding CBD markets at 9.4% p.a..

- This is confirmed by London City, Southbank, Midtown and Docklands expected to outperform London’s West End CBD total returns which suffer from low initial income yields.

- Similarly, Paris CBD is expected to underperform other Paris non-CBD submarkets.

- This is again a sign that even if bifurcation prevails with vacancy and rents, higher yields should compensate investors for the perceived higher risk in non-CBD markets.

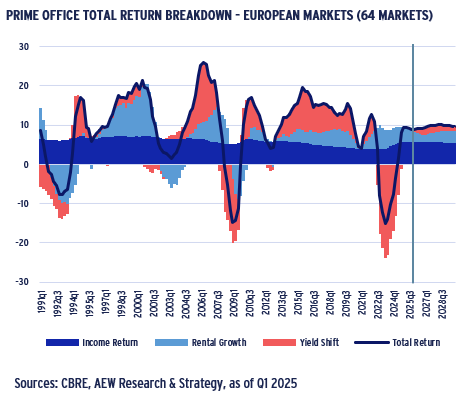

TOTAL RETURNS DRIVERS SHIFT TO CURRENT INCOME & RENTAL GROWTH

- If we look closer at the components driving the 9.4% p.a. prime European office total return, we note that they are mostly driven by current income and rental growth.

- Given the revised outlook for bond and property yields to tighten less going forward, capital value appreciation from yield shift is now projected to be limited across offices.

- However, on top of the 5.6% p.a. income return over the next five years, there is still some capital value growth.

- Capital value growth is expected as a result of market rental growth at 2.8% p.a. over the next five years. This is in line with the long-term average (2.6% p.a.).

- In contrast, the forecasted capital return from future yield shift is projected to be modest at 1.2% p.a.

- This is an improvement from the significant value declines – due to yield shift in the 2022-24 period. These declines were in fact more pronounced than in the post GFC period.

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW. There is no assurance that any prediction, projection or forecast will be realized.